Innovation continues to drive Vietnam’s growth in November 2024, strengthening its position as a global investment hub. High-tech advancements, enhanced logistics, and sustainable development projects in key regions like Ho Chi Minh City, Dong Nai, and Binh Duong are leading this transformation. Strategic developments, including innovative research hubs and infrastructure expansions such as gateway to Central Vietnam, Da Nang’s Free Trade Zone and Long An Port, are positioning Vietnam as a center for efficiency and connectivity in global trade.

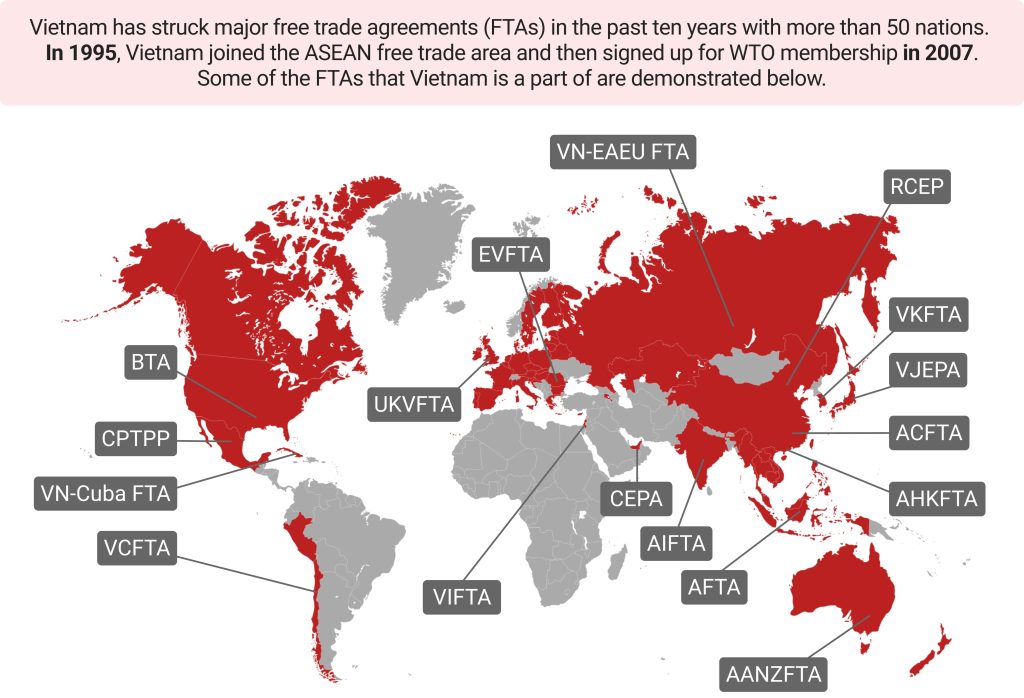

Vietnam’s international trade partnerships are also expanding, highlighted by agreements like the Comprehensive Economic Partnership Agreement (CEPA) with the UAE. These initiatives showcase Vietnam’s commitment to fostering a dynamic investment environment while advancing in high-tech sectors like semiconductors and nuclear energy. For foreign investors, Vietnam presents a compelling opportunity for collaboration and growth, supported by a forward-thinking approach to economic development and sustainability.

Interested in Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services

Southern Vietnam Attracts Strong Foreign Investments

Innovation is shaping Southern provinces and cities in Vietnam as they draw significant foreign investment in 2024. In Dong Nai, German enterprises explored opportunities, while Aeon Mall Group (Japan) invested over US$250 million in Bien Hoa City. US investors revealed plans for high-tech projects in advanced optics and semiconductors. In Binh Duong, innovation continues with Polytex Far Eastern Vietnam committing US$1.54 billion to expansion and Warburg Pincus proposing a logistics center.

Vietnam’s largest city Ho Chi Minh hosted delegations from NVIDIA and Smart Tech Group, proposing projects like an AI research hub and a battery factory with investments up to US$850 million. Meanwhile, Long An strengthened ties with European firms for green transformation and logistics. These efforts showcase southern Vietnam’s growing role in attracting international investors across diverse sectors.

Read Related: 9 Reasons to Choose Ho Chi Minh City in Vietnam to Launch Your Business

Addressing Logistics Costs to Boost E-Commerce

Vietnam’s e-commerce market, projected to reach US$13.9 billion in 2024 and grow 11.21% annually to US$23.65 billion by 2029, is hindered by high logistics costs. At 17% of total costs, significantly above the global average of 10.6%, these expenses challenge local businesses’ competitiveness. Investments from Mitsubishi Estate in Long An and BW Industrial in Dong Nai aim to reduce these inefficiencies through innovation in advanced warehousing facilities.

To enhance competitiveness, Vietnam must adopt AI and IoT for real-time tracking, foster public-private partnerships to improve infrastructure, and streamline last-mile delivery. These strategies could position Vietnam as a leader in regional logistics, supporting its growing digital economy.

Read More: A Look into Business Opportunities in E-commerce Logistics in Vietnam

Vietnam Revives Nuclear Energy for Stability

Vietnam is reviving plans for nuclear energy to address its rising energy demand and net-zero emissions goal by 2050. Power demand is growing by 10% annually, with GDP targets of 6.5-7% by 2025. Currently, coal accounts for over 33% of electricity generation, but no new coal projects are planned beyond 2030 due to environmental concerns. Hydropower and renewable sources also face limitations in meeting peak demands.

The government has approved a proposal to restart nuclear energy as part of its 2025 socioeconomic plan, leveraging innovation in nuclear technology to ensure energy stability and reduce emissions. Experts highlight nuclear power’s low carbon footprint—6g CO₂/kWh compared to coal’s 1,000g—making it a viable solution for balancing emissions reduction and economic growth.

Read Related: Vietnam Renewable Energy: Advantages and Growth in the Green Energy Industry

Vietnam Poised to Lead Global Semiconductor Growth

Vietnam is rapidly positioning itself as a hub in the global semiconductor supply chain. As part of its Semiconductor Industry Development Strategy 2021-2030, the country aims to attract major global players with targeted incentives and ecosystem improvements. SEMIExpo 2024 emphasized Vietnam’s strategic location and the growing demand for supply chain diversification amid US-China trade tensions. With a focus on innovation, the nation’s workforce in semiconductor-related fields has expanded by 50%, now boasting over 460 engineers, with further growth anticipated.

Key investments include semiconductor manufacturing plants by prominent international firms and collaborations with regional and global industry leaders. Vietnam’s young, tech-savvy population and commitment to developing high-tech infrastructure have bolstered its appeal as a semiconductor powerhouse. This focus is not only advancing Vietnam’s economic competitiveness but also integrating the country into one of the most critical global value chains of the future.

Read More: Unlocking Opportunities and Overcoming Challenges in the Global Semiconductor Industry

Ho Chi Minh City Welcomes Fresh US Investments

Ho Chi Minh City is set to attract significant US investments across technology, finance, and healthcare. At the Autumn Forum 2024 in New York, municipal leaders engaged with US investors, fostering discussions on key projects, including a US$850 million battery production plant and a US$305 million data center. By early 2025, over 30 US firms are expected to advance agreements and deepen ties with local businesses.

NVIDIA plans to establish an AI research and training center, while Marvell Technology expands its chip design centers. These initiatives highlight innovation as a core driver of HCM City’s ambition to become a financial hub and reinforce its strategic partnership with the US, fostering economic growth.

Read More: Updates on US Investment in Vietnam: A Surprisingly Fruitful Partnership

Danang Leverages Free Trade Zone for Growth

Danang’s economy grew by 6.47% in the first nine months of 2024, with Q3 GDP rising 8.6% year-on-year. Development investment capital reached nearly US$1 billion, up 7.1% on-year. A landmark initiative to pilot Vietnam’s first Free Trade Zone (FTZ), spanning 700 hectares, is set to boost the city’s competitiveness and attract foreign investment. The FTZ integrates logistics and export-processing facilities, including the US$146 million Lien Chieu seaport project, which is 70% complete and expected to be operational by 2025.

The FTZ will drive innovation in trade, services, and logistics, backed by a planned US$126 million investment for functional areas. Complementary initiatives, such as the US$337 million inland waterway tourism project, support Danang’s vision to become a leading marine economic center and logistics hub in ASEAN by 2030. These efforts, aligning with global FTZ practices, position Danang as a high-quality industrial and service hub.

Long An Port Expands for Global Trade

Long An International Port is set to begin international container transportation by 2025, leveraging its advantageous location and infrastructure to support the Mekong Delta’s exports. Currently, 70-75% of goods from the region rely on ports in Ho Chi Minh City and Ba Ria-Vung Tau. The port’s operations could reduce transportation costs by 10-30% due to the absence of infrastructure fees.

The port recently signed a sister-port agreement with the Port of Long Beach in the US, strengthening international trade ties. As the Mekong Delta lacks large-scale seaports, Long An Port is poised to play a critical role in addressing logistical bottlenecks, reducing costs, and enhancing Vietnam’s export capabilities.

Read Related: Trade Logistics in Vietnam: Top Megaports and Their Impact from Saigon to Hai Phong

Vietnam Strengthens Trade Ties with Middle East

Vietnam and the UAE signed a comprehensive economic partnership agreement (CEPA) in October 2024, aiming to boost bilateral trade to US$20 billion. Trade between the two countries saw 38% growth from 2022-2023, exceeding US$12 billion. The agreement focuses on sectors like oil and gas, renewable energy, and digital transformation.

The UAE is Vietnam’s largest export market in West Asia, with Vietnam’s exports surpassing US$4 billion in 2023. This partnership is expected to expand investments in infrastructure, green transition, and financial services, enhancing Vietnam’s economic growth and global trade network.

Read More: The Definitive Guide to Vietnam’s 17 Active Free Trade Agreements – FTAs

Conclusion

Vietnam’s economic momentum in 2024 underscores its growing appeal to global investors and its strategic role in international trade. With robust foreign direct investment, advanced logistics projects, and strengthened trade agreements, Vietnam is building a foundation for long-term growth and sustainability. From high-tech innovation and logistics modernization to enhanced global partnerships, the country’s proactive approach is solidifying its position as a key player in the global economy. As Vietnam integrates cutting-edge technology and sustainable practices, it continues to unlock its economic potential and create opportunities for international collaboration.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly