Vietnam’s economic performance in 2025 can be summed up in one word: remarkable. Despite global headwinds and tariff challenges, the country’s economy delivered one of the fastest growth rates in Southeast Asia. The year saw robust GDP growth, moderate inflation, record-high trade turnover, and strong inflows of foreign investment – all signs of a vibrant economic rebound.

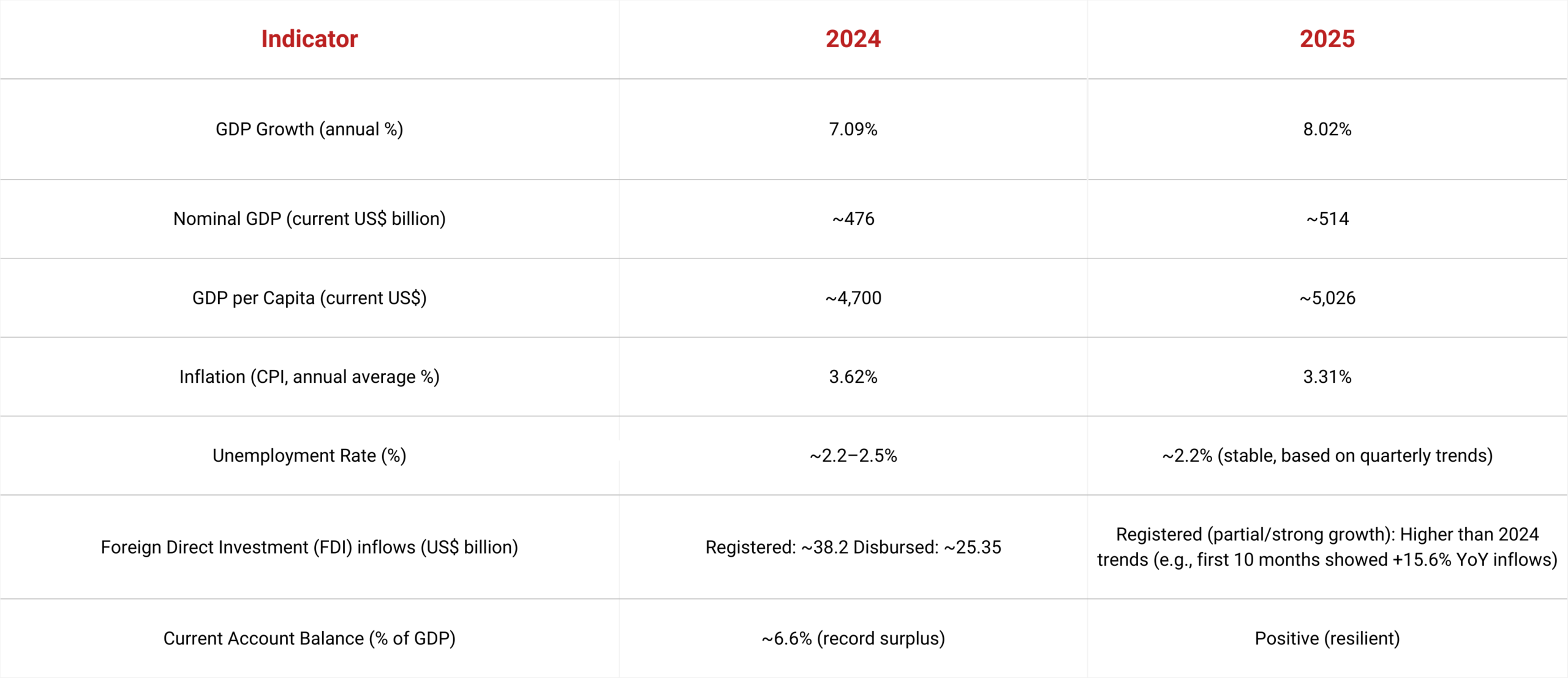

By the Numbers: Vietnam’s economic performance in 2025 was characterized by 8.02% GDP growth, average inflation of just 3.31%, total trade value of $930 billion, an FDI inflow of $38+ billion, and retail sales growth around 9% – all pointing to a broad-based upswing. The sections below break down each of these components in detail, with data-driven insights and context to make the trends understandable for general readers.

Ready to capitalize on Vietnam’s record-breaking GDP growth? Check out InCorp’s expert incorporation services.

GDP Growth Hits Multi-Year Highs

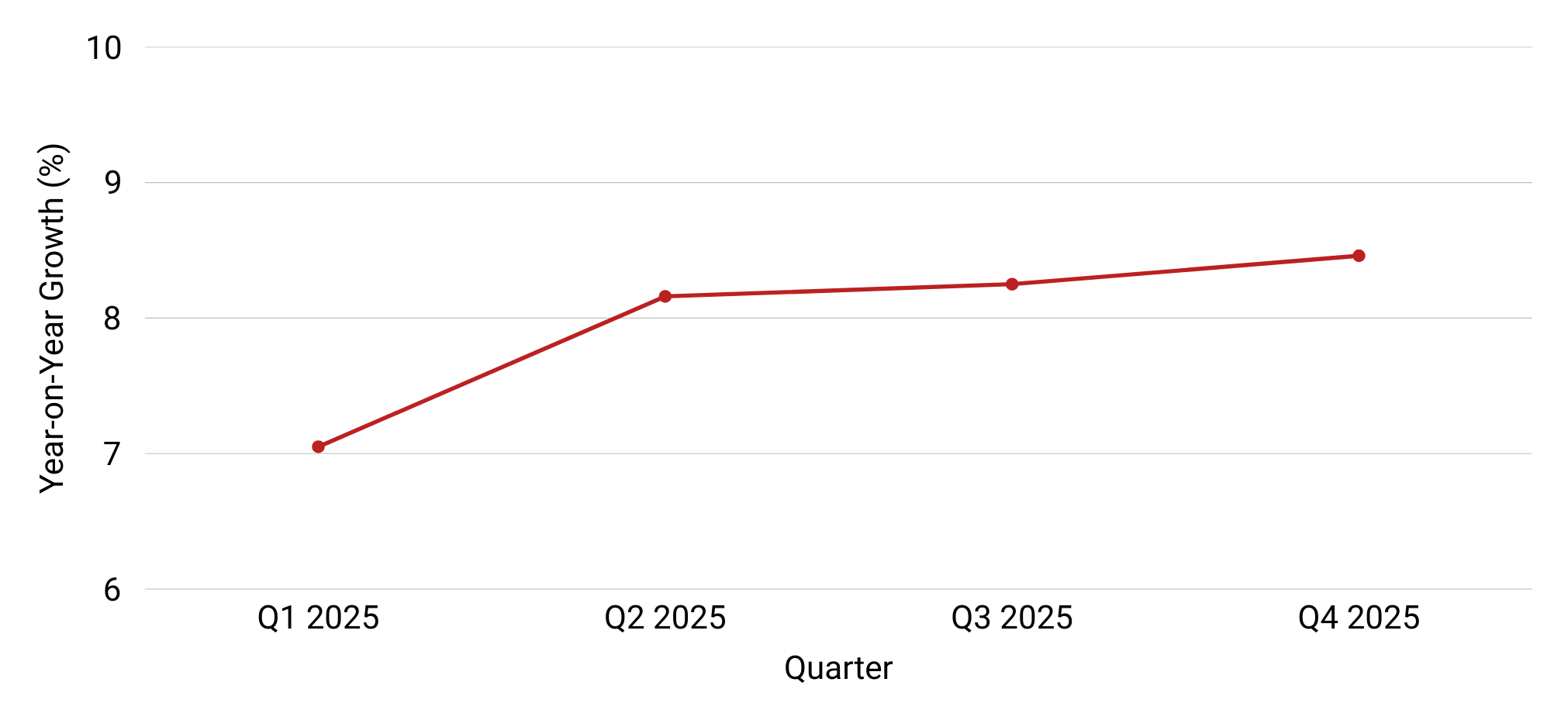

Vietnam’s GDP growth in 2025 soared to 8.02% (year-on-year), the second-highest annual growth rate the country has seen in the 2011–2025 period. This strong expansion placed Vietnam among Southeast Asia’s fastest-growing economies, reinforcing its status as one of the region’s most dynamic performers. Notably, economic growth accelerated each quarter – from 7.05% in Q1 to 8.46% in Q4 – showcasing gathering momentum over the year.

Vietnam’s robust economic performance in 2025 was driven by broad-based growth across all sectors. Industry and construction expanded 8.95%, the strongest result since 2019, contributing 43.6% of total GDP growth. Manufacturing was the main engine, rising 9.97%, with electronics and textiles leading the expansion. Services grew 8.62% on the back of recovering trade and tourism, while agriculture posted steady growth of 3.78% despite weather challenges. Overall, this sectoral mix reflects a well-balanced economic performance between export-oriented manufacturing and domestic services.

GDP growth in 2025 exceeded forecasts and marked a strong rebound from the prior year. The economy added roughly $38 billion, reaching an estimated $514 billion, or about $5,026 per capita, making Vietnam the world’s 32nd largest economy. Notably, this growth came despite external headwinds, including softer global demand and new U.S. tariffs imposed in August 2025. Strong Q4 results highlight Vietnam’s resilience, competitiveness, and ability to sustain economic performance under external pressure.

Inflation Tamed and Monetary Policy Eases

Unlike its rapid GDP growth, Vietnam’s inflation remained well controlled in 2025. The average CPI rose 3.31%, comfortably within the National Assembly’s target, while December inflation eased to 3.48%, signaling cooling price pressures toward year-end. Core inflation averaged just 3.21%, reflecting stable underlying trends. This benign inflation environment was a critical pillar of Vietnam’s economic performance, helping preserve purchasing power and policy flexibility.

Monetary policy supported growth without fueling inflation. The State Bank of Vietnam adopted a pro-growth stance, cutting interest rates and expanding credit as inflation stayed in check. By late 2025, bank lending had grown about 13%, largely flowing into production and business activities. A stable exchange rate further helped limit imported inflation. Overall, prudent and flexible macroeconomic management allowed Vietnam to grow rapidly without overheating — a rare balance that strengthens prospects for sustainable economic performance.

Record Trade Turnover and External Surplus

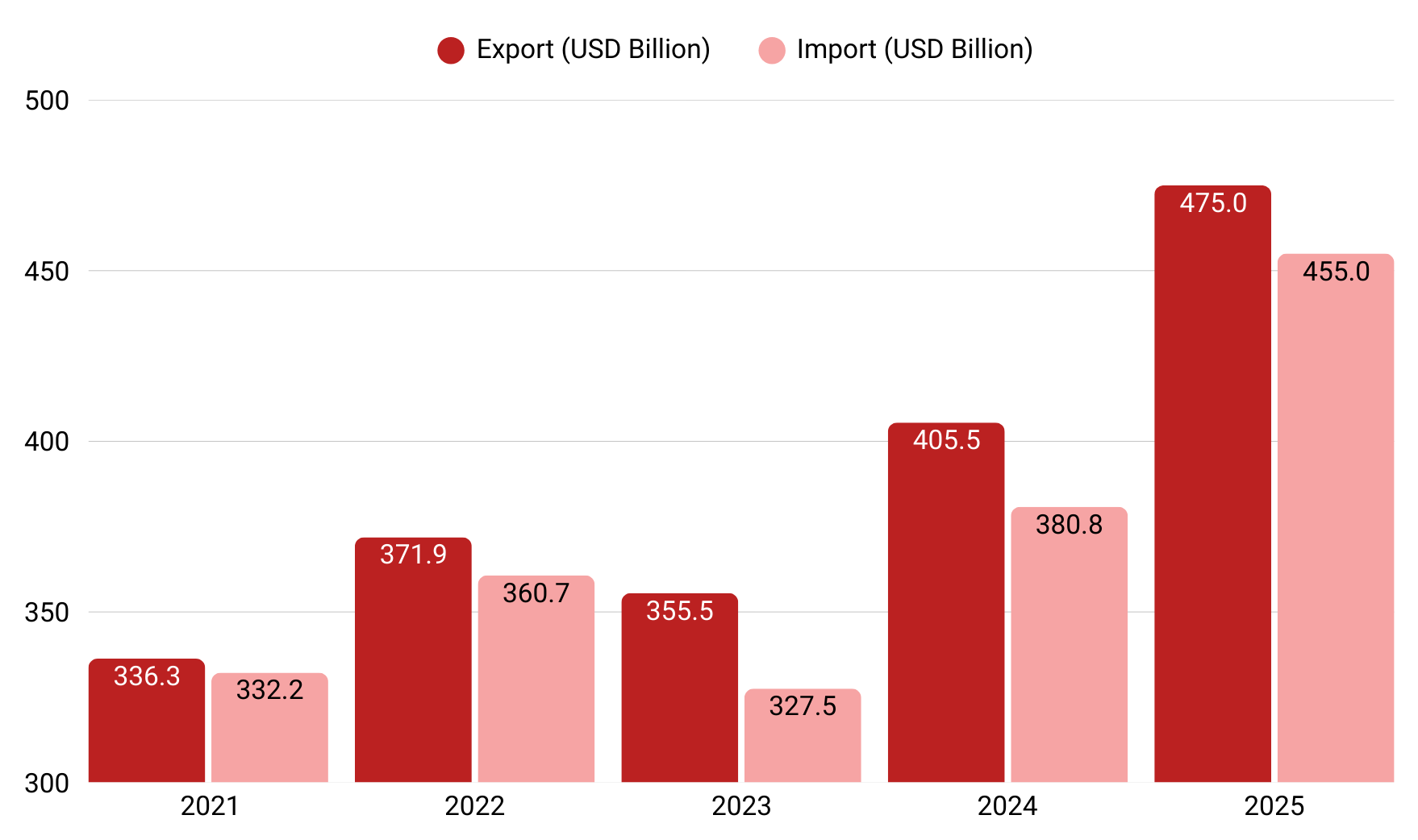

One of the most impressive aspects of Vietnam’s economic performance in 2025 was its booming foreign trade. The country’s total trade turnover (exports + imports) hit a record high of over $930 billion, up 18.2% from the prior year. To put that in perspective, Vietnam’s trade value was roughly 1.8 times its GDP, underscoring an extraordinary level of global integration for a developing economy.

Even more striking, Vietnam achieved a trade surplus of around $20 billion for the year. In simple terms, the nation sold far more to the world than it bought. This robust trade surplus expanded significantly thanks to surging exports, and it provides a cushion for the economy (supporting the currency and foreign reserves) while reflecting strong global demand for Vietnamese products.

Exports

Vietnam’s exports reached approximately USD 475 billion in 2025, up 17% year-on-year. December alone recorded a peak of USD 44 billion, as firms rushed shipments ahead of new U.S. tariffs.

Manufacturing dominated exports, with processed industrial products accounting for nearly 89%. Major categories included electronics (computers and phones), machinery, apparel, and footwear. Notably, seven product groups each exceeded USD 1 billion in a single month, underscoring the scale and diversification of Vietnam’s export base.

Foreign-invested enterprises contributed over three-quarters of total export value, highlighting Vietnam’s role as a key manufacturing hub for multinationals. At the same time, domestic firms saw a late-year rebound, with exports rising nearly 18% in December on strong holiday demand.

Imports

Imports totaled around USD 455 billion in 2025, increasing 19.4% year-on-year and growing faster than exports. This rise was driven mainly by manufacturing demand for components, machinery, and raw materials, alongside recovering consumer activity.

The import structure reflects a production-led economy: 93.6% of imports were production inputs, while consumer goods accounted for only 6.4%. China was the largest import source (USD 186 billion), resulting in a sizeable bilateral deficit, while the United States generated Vietnam’s largest trade surplus, reinforcing Vietnam’s position in global value chains.

Trade resilience and competitiveness

Vietnam’s strong trade performance came despite global volatility and higher tariffs. In August 2025, the U.S. imposed 20% tariffs on selected Vietnamese goods and up to 40% on some transshipped products. Businesses responded by front-loading exports, helping maintain momentum.

Even after tariffs took effect, Q4 exports still grew by about 19% year-on-year, signaling resilience. Analysts described 2025 as “a historic high and a milestone in international integration,” noting improvements in quality, sustainability, and compliance with stricter standards.

For general readers, the takeaway is clear: Vietnam’s trade engine performed strongly in 2025, supporting jobs and incomes. A record-high trade surplus also delivered a net foreign currency inflow, reinforcing financial stability and economic confidence.

Resilient FDI Inflows Underpin Growth

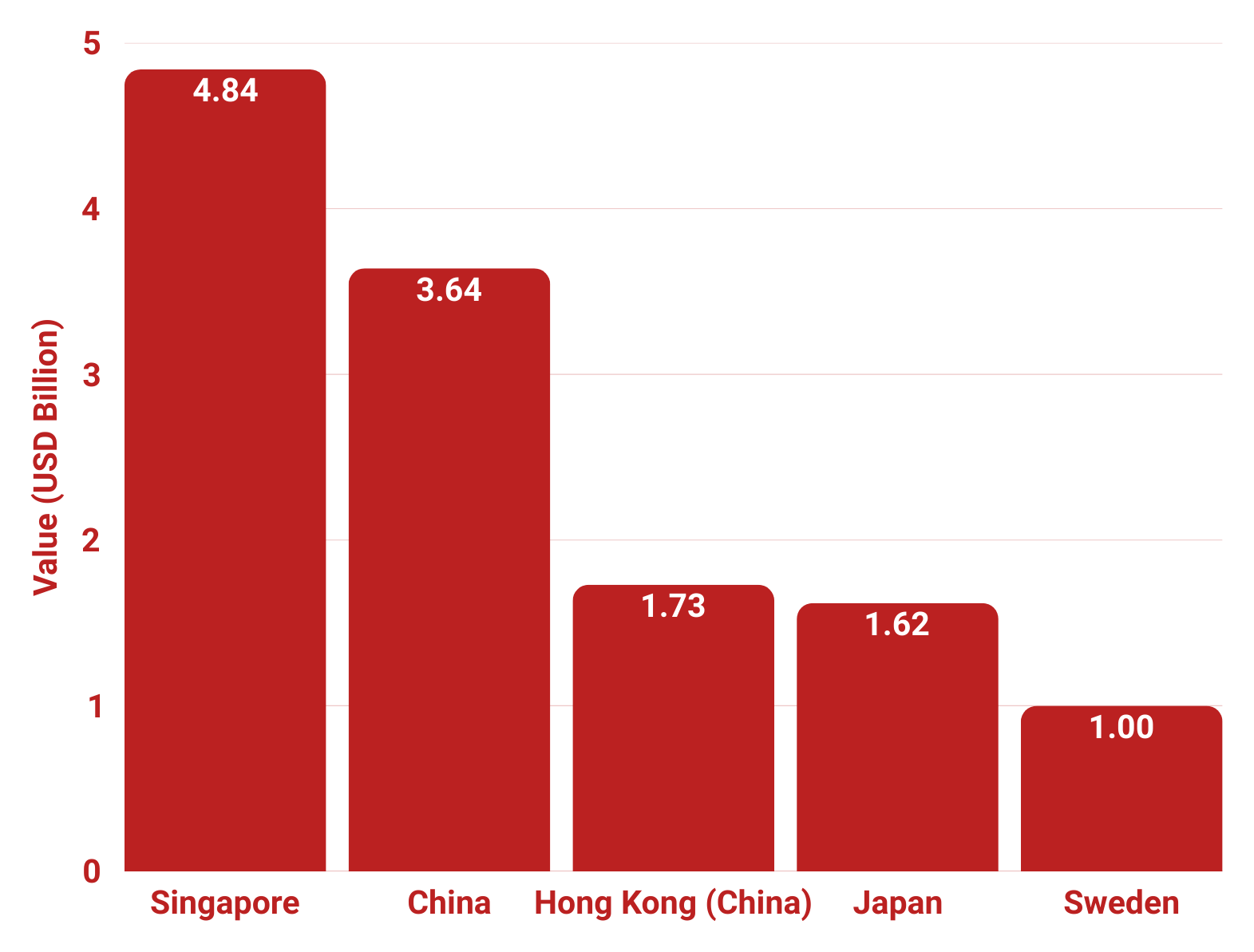

Foreign direct investment remained a core pillar of Vietnam’s economic performance in 2025, showing resilience despite global uncertainty. Newly registered FDI reached over USD 38.4 billion, broadly flat year-on-year (+0.5%). The real standout, however, was FDI disbursement, which climbed to USD 27.6 billion, up 9% from 2024 and the highest level in five years.

This surge in disbursement indicates that investors were not only committing capital but actively implementing projects, building factories, infrastructure, and operations on the ground. Such follow-through reflects strong investor confidence and is a particularly positive signal for Vietnam’s near-term growth prospects.

Manufacturing and processing continued to dominate FDI. These sectors accounted for about 56.5% of newly registered capital (around USD 9.8 billion). Including project expansions, total manufacturing FDI reached roughly USD 18.6 billion, or nearly 59% of all FDI, reinforcing Vietnam’s role as a major industrial and export hub. Real estate ranked second, attracting about USD 3.7 billion (around 21% of new FDI), driven by optimism around urbanization and a growing middle class.

Investor origins were diverse. Singapore led with approximately USD 4.8 billion (28% of new FDI), followed by China (USD 3.6 billion, 21%), Hong Kong (~10%), Japan (~9%), and Sweden (~USD 1 billion). In parallel, M&A activity surged, with 3,587 foreign capital contribution and share purchase deals worth over USD 7 billion, a sharp 54.8% year-on-year increase.

Overall, these trends highlight how FDI continued to fuel Vietnam’s growth in 2025, bringing capital, technology, and deeper integration into global supply chains. The record-high disbursement level underscores Vietnam’s success in maintaining a stable, attractive investment environment, supporting industrial expansion, exports, and long-term economic momentum.

Industrial Output and Sectoral Drivers

Vietnam’s industrial output strengthened markedly in 2025, underscoring its manufacturing-led economic performance. The Index of Industrial Production (IIP) rose 9.2% year-on-year, accelerating from 8.2% in 2024. Momentum built through the year, with December IIP up 10.1%, marking the 11th consecutive month of expansion. In Q4 alone, industrial output surged nearly 10%, driven by a 10.8% increase in manufacturing, confirming factories were operating at high capacity.

Manufacturing and processing remained the main engine, expanding about 9.97%, the fastest post-pandemic pace. Growth was broad-based across electronics, apparel, footwear, machinery, and furniture, supported by strong export demand and FDI-driven capacity expansion. Construction also posted robust growth (~9.62%), reflecting public infrastructure spending and private investment in factories and commercial real estate. Utilities supported this expansion, with electricity up ~6.4% and water supply ~7.8%, while mining lagged at just 0.4%, given Vietnam’s mature resource base.

Services staged a strong recovery in 2025, growing 8.62%, one of the fastest rates in over a decade. High-contact services led the rebound: transport and warehousing jumped 10.99%, fueled by trade and e-commerce, while accommodation and food services rose 10.02% as tourism recovered. Vietnam welcomed a record 21.2 million international visitors, up ~20% year-on-year, supporting hospitality, aviation, and retail. Wholesale and retail trade grew 8.5%, contributing over 10% of GDP growth, while financial services expanded ~7.8% amid rising credit demand.

Overall, the data point to a balanced economic performance. Manufacturing led, services followed closely, and both sectors reinforced each other. Agriculture grew a steady 3.78%, supporting rural incomes and food security despite weather disruptions.

For Vietnam, this broad-based growth model enhances resilience. By relying on multiple growth engines rather than a single sector, the economy created jobs across industries and laid a strong foundation for continued robust economic performance in 2026 and beyond.

Scaling your production to meet global demand? Check out InCorp’s business expansion and compliance services.

Domestic Consumption and Retail Resurgence

Domestic demand emerged as a major growth driver of Vietnam’s economic performance in 2025, alongside exports. After several years of pandemic-related disruption, consumer spending rebounded strongly, pushing total retail sales of goods and services above VND 7 quadrillion (around USD 263 billion). This marked a 9.2% year-on-year increase, the fastest retail growth in at least five years. Even after accounting for inflation, retail volumes rose solidly, pointing to genuine gains in household consumption.

This resurgence was underpinned by improving incomes and employment, as strong economic growth created jobs and supported wage recovery. Macroeconomic stability, including low inflation, helped lift consumer confidence, while supportive government measures such as the 2% VAT reduction, lower fuel taxes, and shopping stimulus programs effectively boosted purchasing power.

Tourism played a powerful supporting role. Vietnam welcomed 21.2 million international visitors in 2025, alongside robust domestic travel. Travel-related revenues increased by over 20%, fueling spending on accommodation, dining, and entertainment. As a result, accommodation and catering revenue rose 14.2%, while travel services revenue surged nearly 20%, reinforcing a virtuous cycle of jobs, income, and consumption.

Meanwhile, e-commerce and digital payments continued to expand, broadening access to goods and amplifying promotional campaigns, particularly toward year-end and the Lunar New Year period. By Q4 2025, retail sales were still growing at around 8–10% year-on-year each month, signaling sustained momentum.

Overall, strong domestic consumption confirmed that Vietnam’s growth in 2025 was not export-dependent alone. With a population nearing 100 million, the domestic market has become an increasingly important stabilizer. In 2025, both exports and local consumption were firing simultaneously, delivering a powerful boost to Vietnam’s economic performance and strengthening the economy’s resilience against external shocks.

Building a team to serve Vietnam’s growing middle class? Check out InCorp’s HR and payroll outsourcing services.

Fiscal Policy and Public Investment Support

Vietnam’s fiscal policy in 2025 focused on supporting growth while maintaining macroeconomic stability. Leveraging its strong fiscal position, the government accelerated public investment and implemented targeted tax cuts to stimulate demand. Infrastructure projects were pushed nationwide, covering transport, energy, and digital infrastructure, helping boost short-term activity while easing long-term bottlenecks. According to the Asian Development Bank, these efforts supported growth while public debt remained below 34% of GDP, well under the 60% statutory ceiling.

A key measure was the extension of the 2% VAT reduction on many goods and services throughout 2025. This policy lowered costs for businesses and increased household purchasing power, directly supporting consumption and overall economic performance. The government also cut environmental taxes on fuel to contain logistics costs and streamlined administrative procedures, including faster investment approvals, to improve the business environment. Although these steps reduced revenue in the short term, they paid off through stronger GDP and retail growth.

Despite this expansionary stance, fiscal discipline was maintained. The budget deficit is estimated at around 3.8% of GDP, a moderate and sustainable level. Vietnam’s debt-to-GDP ratio stayed close to one-third, preserving ample fiscal space for future development needs. Authorities emphasized effective disbursement, ensuring allocated public funds were actually spent on projects to maximize growth impact.

In practice, 2025 saw record public investment disbursement, with many provinces achieving over 90% execution of their annual plans. This injected momentum into construction and related industries and complemented accommodative monetary policy. ADB officials noted that Vietnam’s above-8% growth reflected effective policy coordination, from accelerating public investment to improving the legal and regulatory framework.

Overall, Vietnam used its fiscal tools proactively and prudently. Public investment created jobs and closed infrastructure gaps, while tax relief and supportive measures boosted private spending — all without triggering fiscal or inflationary instability. For everyday observers, the roads, bridges, and power projects built in 2025 not only improved daily life but also laid a strong foundation for sustained economic performance in the years ahead.

Key takeaways and outlook for 2026

2025 marked an exceptional year for Vietnam’s economic performance. Real GDP grew 8.02%, one of the strongest outcomes in recent history, driven by broad-based expansion across manufacturing and services. Inflation stayed low at 3.31%, allowing supportive monetary policy, while fiscal stimulus was deployed prudently with the deficit held near 3.8% of GDP.

Vietnam reinforced its role as a trade and investment hub. Total trade exceeded USD 930 billion, generating a USD 20 billion surplus, despite new U.S. tariffs. FDI disbursement hit a five-year high of USD 27.6 billion, supporting factory construction, infrastructure, and long-term capacity building. At the same time, domestic consumption rebounded strongly, with retail and services spending rising around 9–10%, aided by income growth and a tourism recovery.

The outlook for 2026 remains positive but more moderate. Most forecasts point to growth in the 6–7% range, reflecting a high base in 2025 and softer global conditions. Risks include weaker external demand and financial volatility, but ongoing reforms, strong investment momentum, and a large domestic market provide important buffers.

Overall, Vietnam enters 2026 from a position of strength. If policy discipline and reform momentum are maintained, economic performance should remain robust, consolidating the gains achieved in 2025 and supporting sustainable growth in the years ahead.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Why was Vietnam’s economic performance strong in 2025?

- Vietnam’s economic performance benefited from rapid industrial growth, resilient exports, strong FDI inflows, revived domestic consumption, and stable macro policies.

Did inflation threaten Vietnam’s economic performance?

- No. Inflation remained well controlled, allowing policymakers to support growth without undermining Vietnam’s economic performance or financial stability.

How important was domestic demand to economic performance?

- Domestic demand became a key growth engine, helping Vietnam’s economic performance rely less on exports and more on its nearly 100-million-strong consumer base.

What does 2025’s economic performance mean for 2026?

- The strong economic performance in 2025 provides momentum for 2026, with growth expected to moderate but remain among the strongest in Asia.