The role of a Chief Accountant, in Vietnam, is pivotal and distinct within the organizational framework. While the fundamentals of this position echo its global counterparts, the Vietnamese business environment imbues it with unique characteristics. Beyond the mere oversight of financial records, a Chief Accountant serves as an indispensable component of a company’s core operations, wielding responsibility for the efficient and effective management of financial affairs.

The responsibilities entrusted to the Chief Accountant in Vietnam span a comprehensive spectrum. They bear the mandate of overseeing all facets of accounting, steering financial reporting initiatives, and ensuring strict adherence to the Vietnam Accounting Standards (VAS). This multifaceted role assumes critical significance in upholding the financial integrity and regulatory compliance of the company within the specific framework of Vietnam.

Seeing challenges in Accounting? Check out InCorp Vietnam’s Nominee Chief Accountant Services in Vietnam

What is a Chief Accountant?

As per Clause 1, Article 53 of the Law on Accounting 2015, the Chief Accountant assumes the role of overseeing the accounting apparatus within a unit, serving as its head, and taking charge of the execution of all accounting functions within that domain.

In adherence to the applicable laws, companies are mandated to appoint either an in-house Chief Accountant or engage the services of an outsourced Chief Accountant. This statutory requirement underscores the pivotal role of the Chief Accountant as the leader of a company’s accounting function, tasked with the organization and execution of all accounting responsibilities within the accounting unit.

Crucially, the implementation of financial transactions, as evidenced by payment vouchers and orders, necessitates the dual approval of the Chief Accountant and the authorized person sanctioning expenditures.

The Chief Accountant operates under the guidance of the legal representative of the accounting unit, holding the responsibility of upholding the credibility of a company or corporation’s accounts and aligning them with the standards set by management. In the fulfillment of this role, the Chief Accountant meticulously verifies the tasks executed by the accounting teams, ensuring accuracy and adherence to established standards.

Read Related: Vietnam’s Tax Landscape: Expert Accounting Outsourcing Strategies

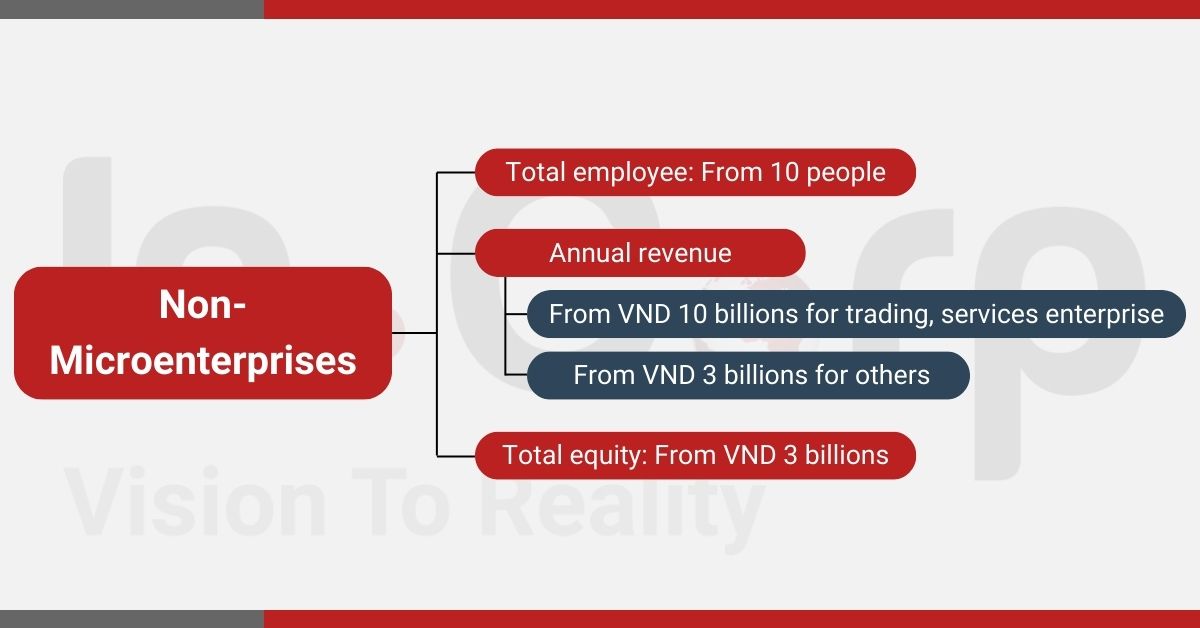

Given the provided definitions concerning the Chief Accountant in Vietnam, it naturally raises the question among investors about which businesses require a Chief Accountant. The straightforward response is that any company not classified as a “micro-enterprise” is mandated to appoint a chief accountant. For a clearer grasp of this criterion, we will delve into the definition of a “micro-enterprise” in the following section.

What is a Micro-Enterprise in Vietnam?

The qualification of a micro-enterprise is determined by a set of criteria including the industry of operation, the aggregate count of employees covered by social insurance, total capital, and the revenue recorded in the preceding year.

- Industry, Construction, Agriculture, Aquaculture, and Forestry: the workforce is fewer than 10 employees and the required capital as well as the total revenue do not exceed VND 3 billion;

- Trade and Services: the workforce is fewer than 10 employees and the required capital does not surpass VND 3 billion. But the total revenue is no more than VND 10 billion.

With this information, we can summarize the characteristics of a non-micro enterprise as follows:

Understanding the Nominee Chief Accountant Role

As outlined in Clause 1, Article 55 of the Law on Accounting 2015, the Chief Accountant in Vietnam shoulders significant obligations, including:

– Ensuring strict adherence to the laws governing accounting and finance within the accounting units.

– Organizing the functioning of the accounting apparatus in alignment with the stipulations of the Law on Accounting.

– The Chief Accountant is tasked with the preparation of financial statements, following prescribed accounting regimes and standards.

– The Chief Accountant is responsible for endorsing bank payment documents and overseeing the signing of salary payments.

– A pivotal duty involves affixing the signature on year-end financial reports and reports from external auditors.

– Working closely with tax authorities and auditors, the Chief Accountant facilitates a seamless exchange of information. This includes providing necessary documents and offering comprehensive explanations for any inquiries posed by tax authorities or auditors during the auditing process.

According to Clauses 2 and 3, Article 55 of the Law on Accounting 2015, the Chief Accountant in Vietnam is endowed with specific rights, including:

– The Chief Accountant has the right to autonomously carry out accounting tasks.

– Chief Accountants of regulatory agencies, state-budget-using organizations, and enterprises with over 50% state-held charter capital, in addition to the general rights, also have the privilege to:

- Offer written opinions on matters such as employment, reassignment, pay raises, commendations, and disciplinary actions concerning accountants, warehouse-keepers, and treasurers.

- Request timely provision of relevant documents from the accounting unit’s departments related to the Chief Accountant’s accounting and financial supervision responsibilities.

- Preserve dissenting opinions in writing if they differ from the decision maker’s stance.

- Submit written reports to the legal representative of the accounting unit regarding discovered violations against finance and accounting regulations within the unit. If compliance is necessary, the report is escalated to the superior authority or a competent entity.

Legal Requirements and Qualifications

Following Vietnam’s Law on Accounting 2015, the role of a Chief Accountant carries distinct qualifications, setting it apart from standard accounting positions. These requirements apply both to individuals seeking the role and those being considered for promotion to Chief Accountant:

– Possess a Bachelor of Accountancy degree, also referred to as a Bachelor of Accounting.

– Accumulate a minimum of 2 years of practical experience either as an accountant or in performing accounting duties.

– Undergo specialized training to obtain a Certificate of Chief Accountant, as detailed in Circular 199/2011/TT-BTC. This certification is a prerequisite for assuming the position of Chief Accountant.

– Exhibit an adequate level of knowledge and skills relevant to the Chief Accountant role, coupled with a commitment to ethical work practices.

– Fulfill the standards established by the government for their specific type of accounting unit, ensuring alignment with regulatory expectations.

According to Clause 1, Article 54 of the Law on Accounting 2015, a Chief Accountant must adhere to the following standards:

– Fulfill the standards specified in Clause 1, Article 51 of the Law on Accounting 2015.

– Demonstrate compliance with professional ethics, emphasizing truthfulness, integrity, and a commitment to legal adherence.

– Possess professional accounting knowledge and skills requisite for the Chief Accountant role.

– For individuals holding a bachelor’s degree in accounting, a minimum of 2 years of practical experience in accounting is required.

– For individuals with an associate degree in accounting, a minimum of 3 years of practical experience in accounting is necessary.

Benefits of Having a Nominee Chief Accountant

The appointment of a chief accountant holds various benefits for businesses, particularly ensuring compliance with legal regulations. The chief accountant assumes a crucial role, in overseeing, supervising, and guaranteeing the quality of work within the company’s accounting department.

For small and medium-sized enterprises (SMEs), hiring a full-time chief accountant can impose a substantial financial burden on the business. Opting for the service of a nominee chief accountant offers a cost-effective solution, minimizing expenses while optimizing the utilization of human resources within the company. This approach proves especially valuable when addressing staff shortages in key roles, such as tax accountants, providing businesses with a seasoned professional to fill vacancies and maintain the seamless functioning of the accounting department.

Engaging a chief accountant through a nominee service reduces costs and provides businesses with an experienced individual responsible for overseeing work and possessing full legal status.

Prohibited Cases and Penalties Related to Chief Accountants

People prohibited from practicing accounting in Vietnam

The Law on Accounting 2015, in Article 52, explicitly outlines the categories of individuals prohibited from practicing accounting in Vietnam. These restrictions encompass:

– Individuals below the legal age;

– Individuals who, either wholly or partially, have their civil capacity revoked by a court;

– Individuals compelled to attend reform schools or rehabilitation centers;

– Individuals barred from practicing accounting based on a valid court judgment or decision;

– Individuals undergoing criminal prosecution;

– Individuals subjected to imprisonment or convicted of economic crimes or other offenses linked to finance and accounting, without having their criminal records expunged;

– Parents, adoptive parents, children, spouses, and siblings of the legal representative, head, Director, General Director, deputies of the head, Deputy Director, Deputy General Director in charge of finance–accounting, and the chief accountant within the same accounting unit. Exceptions apply to private enterprises, single-member limited liability companies owned by individuals, and cases explicitly defined by the Government;

– Individuals assuming positions like managers, executive officers, treasurers, warehouse-keepers, buyers, or sellers of assets within the identical accounting unit. Exemptions are granted for private enterprises, single-member limited liability companies owned by individuals and instances specified by the Government.

Fines you should be aware of

As per Decree 41/2018/ND-CP, companies should take heed of fines ranging from VND 10,000,000 to VND 20,000,000 for specific infringements:

– Failure to appropriately organize the accounting unit’s accounting apparatus leads to fines falling within the specified range.

– Fines are applicable for neglecting to appoint chief accountants, and accountants or for not acquiring accounting services or chief accountant’s services.

– In cases where a company has previously been fined and persists in non-compliance, there exists the possibility of further scrutiny, resulting in higher fines or penalties.

Chief Accountant Outsourcing in Vietnam

The swiftest and most effective approach to expanding into a new market, ensuring tax compliance with local laws, is through the utilization of business process outsourcing providers. These providers offer corporate secretarial services, a valuable resource prevalent in emerging markets, with years of expertise in assisting foreign companies in establishing their foothold. Vietnam, in particular, follows this trend, where the intricacies of constantly evolving local tax regulations necessitate the guidance of a proficient accountant to avoid potential disadvantages.

Regulations governing accounting firms providing the aforementioned services to enterprises tend to be more comprehensive compared to those for in-house accountants. To engage in these services, a service provider must hold a Certificate of Eligibility to provide accounting services, meeting all conditions stipulated in Vietnam’s Law on Accounting. This includes obtaining a Certificate of Chief Accountant training.

The Certificate of Eligibility is conferred upon accounting firms that can demonstrate:

– Possession of an Investment Registration Certificate (IRC), Enterprise Registration Certificate (ERC), or equivalent registration documents.

– Employment of at least two accounting professionals, either as employees or capital contributors.

– The presence of a director, general director, or legal representative who is also an accounting professional.

Still Confused about Accounting? Check out our Accounting & Taxation Services in Vietnam

Conclusion

The Chief Accountant in Vietnam holds a pivotal and multifaceted position, serving as the linchpin for financial integrity and regulatory adherence within a company. Beyond the oversight of Vietnam Accounting Standards (VAS) and local regulations, the Chief Accountant actively contributes to strategic financial planning and decision-making processes.

For companies, whether local or international, a comprehensive understanding of the indispensable role and regulations surrounding the Chief Accountant is imperative. This role extends beyond more financial oversight, delving into the intricate landscape of local financial laws, tax regulations, and international accounting standards. Consequently, the Chief Accountant becomes a critical guide, steering a company through the complexities of the Vietnamese market, ensuring not only compliance but also financial efficiency and robustness.

The effectiveness and competence of the Chief Accountant significantly influence the success of any business in Vietnam. As a role laden with responsibility and expertise, the Chief Accountant becomes indispensable in navigating the challenges and capitalizing on the opportunities inherent in the Vietnamese business environment, ultimately fostering financial stability and growth in an increasingly competitive market.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Is chief accountant higher than Senior Accountant?

- Yes, the Chief Accountant is typically higher than a Senior Accountant in an organizational hierarchy. The Chief Accountant oversees the entire accounting department, ensures compliance with accounting regulations, and is legally responsible for financial reporting, while a Senior Accountant handles complex accounting tasks but reports to the Chief Accountant or Finance Manager.

Is chief accountant the same as CFO?

- No, the chief accountant and CFO (Chief Financial Officer) are not the same, though their roles may overlap. The chief accountant focuses on compliance with local accounting standards, bookkeeping, and financial reporting, especially tax and statutory reports. In contrast, the CFO has a broader strategic role, including financial planning, risk management, funding, and advising company leadership on financial decisions. In Vietnam, appointing a chief accountant is often a legal requirement for companies, while a CFO is optional.

What Are The Four Main Responsibilities Of A Chief Accountant

- The four main responsibilities of a chief accountant are overseeing financial reporting, ensuring compliance with accounting standards and regulations, managing budgeting and forecasting processes, and supervising accounting staff and operations.

What is a chief accountant?

- A chief accountant is the senior accounting professional responsible for overseeing a company's accounting operations, financial reporting, and compliance with tax and financial regulations. In Vietnam, appointing a chief accountant is mandatory for most companies, and the individual must hold a chief accountant certificate and meet specific experience and qualification requirements as defined by law.