Vietnam’s economy in 2026 continues to shine as one of Southeast Asia’s brightest stars, with foreign direct investment (FDI) reaching new highs amid global supply chain shifts and robust trade agreements like CPTPP and EVFTA. Ho Chi Minh City and Hanoi pulse with opportunity, attracting multinational enterprises (MNEs) and startups alike. Yet, beneath the excitement of market entry lies a sobering reality: many foreign investors encounter severe compliance issues shortly after incorporation.

Securing the Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC) often feels like victory, but post-incorporation compliance issues frequently derail operations. These compliance issues arise from Vietnam’s evolving regulatory framework, including the amended Law on Investment (effective March 1, 2026), Global Minimum Tax rules, and the new Personal Data Protection Law (PDPL) enforced from January 1, 2026. Without proactive management, compliance issues can lead to fines, audits, blocked transactions, or even license suspension.

Market entry in Vietnam is more than incorporation — see the full guide on how a one-stop operating partner can support your growth journey.

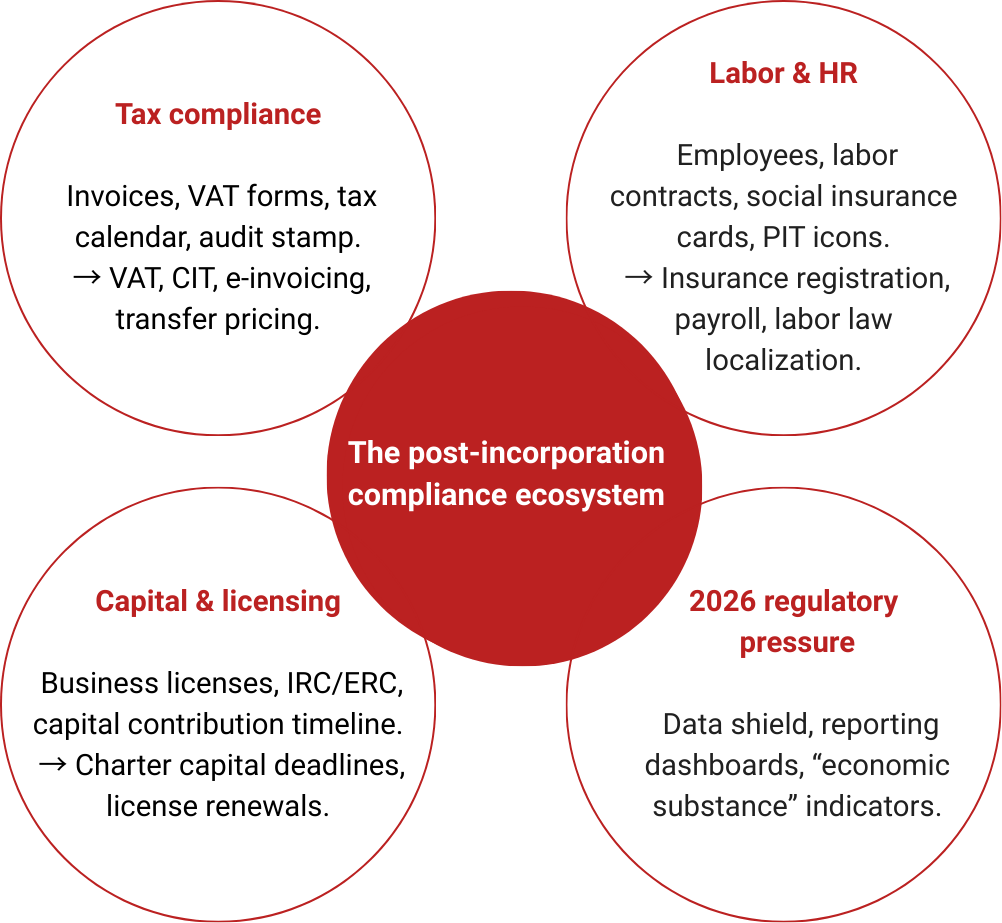

Key compliance issues in post-incorporation in Vietnam

For foreign-owned enterprises, incorporation marks the beginning of regulatory exposure rather than the end. Once operations start, regulatory and compliance risks tend to surface across tax, labor, and governance, particularly when responsibilities are fragmented or managed remotely. In 2026, enforcement trends show that authorities are focusing less on intent and more on accuracy, timeliness, and consistency in execution.

Tax-related risks after incorporation

Tax administration remains the most frequent source of regulatory exposure for foreign investors operating in Vietnam. Monthly VAT declarations and quarterly provisional corporate income tax payments continue to cause problems, especially when filings are late, incomplete, or misaligned with underlying accounting records.

At year-end, annual CIT finalization and audited financial statements due by 31 March often reveal gaps in revenue recognition, expense allocation, or intercompany documentation. These inconsistencies between finance and tax teams commonly trigger audits or follow-up reviews.

The risk environment has intensified in 2026. Decree 310/2025 introduces stricter penalties for e-invoicing errors and invoice violations, while Decree 320/2025 places additional pressure on multinational groups to correctly aggregate taxable income and apply consistent transfer pricing logic across entities.

Labor and HR compliance exposure

Employment-related obligations remain a high-risk area due to Vietnam’s strict enforcement approach and employee-friendly legal framework. A recurring issue is the failure to register employees for social, health, and unemployment insurance within the required 30-day period, which is frequently identified during labor inspections.

Incorrect personal income tax withholding, missing compliant labor contracts, or unclear job scopes also increase exposure, particularly when disputes arise or inspections look beyond formal documentation. These risks are amplified when global HR policies are applied without localization, creating structural misalignment between headquarters practices and mandatory Vietnamese labor requirements.

Capital and licensing obligations

Capital contribution and licensing requirements continue to generate risk long after incorporation. Delays in charter capital contribution beyond the 90-day deadline remain a common violation and may result in administrative penalties or, in more serious cases, license suspension or revocation.

Similarly, failure to renew conditional business licenses or submit updated investment reports often leads to ongoing regulatory friction. These oversights can restrict business activities, delay approvals, and limit expansion plans.

Emerging regulatory pressure points in 2026

New regulatory developments are expanding the scope of post-incorporation obligations for foreign investors. The Personal Data Protection Law, effective from 1 January 2026, introduces additional requirements for organizations handling employee, customer, or partner data in Vietnam.

At the same time, regulators are placing greater emphasis on economic substance. Entities with minimal local presence, limited staffing, or weak decision-making authority are more likely to face scrutiny during inspections. Statistical and investment monitoring reports submitted to the DPI and GSO are also increasingly cited as problem areas when they are overlooked or filed inaccurately.

Root causes: why fragmented advisory models increase risk

One of the most overlooked drivers of recurring post-incorporation problems in Vietnam is reliance on a “setup-only” advisory model. Under this approach, incorporation specialists complete licensing and then disengage, leaving investors to coordinate accountants, lawyers, payroll providers, and HR consultants independently. What appears efficient during market entry often becomes fragile once operations begin.

This fragmentation creates structural risk because no single advisor owns the full regulatory picture. Filing deadlines fall between service providers, responsibilities blur, and critical obligations are missed simply because each party assumes another is handling them. In many cases, issues arise not from regulatory complexity, but from gaps in ownership and coordination.

The challenge becomes more pronounced when regulations change. Without a central point monitoring updates, such as new tax filings or reporting standards, responses are often delayed or inconsistent. For foreign investors managing Vietnam operations remotely, these slow reactions increase exposure, with penalties or corrective filings required before adjustments can be implemented.

Fragmentation also drives up costs in ways investors rarely anticipate. The same data is repeatedly entered, reviewed, and reconciled across multiple providers, inflating fees while still failing to prevent errors. When problems surface, accountability becomes diffuse, advisors focus on defending their scope, and the investor ultimately bears the consequences.

In contrast, integrated operating partners centralize accountability, timelines, and regulatory insight under a single framework. By aligning tax, accounting, HR, and compliance execution, they reduce handover risk and manage regulatory exposure systematically, before it escalates into penalties, disputes, or operational disruption.

Don’t let early efficiency hide long-term risks — read why setup-only services may expose your business to operational challenges.

Practical strategies to prevent and resolve compliance issues

In 2026, successful foreign investors in Vietnam do not try to eliminate compliance issues entirely. Instead, they design operating systems that anticipate regulatory risk, assign ownership clearly, and resolve compliance issues before they escalate into penalties or operational disruption.

Build and maintain a dynamic compliance calendar

Many recurring compliance issues stem from missed or misunderstood deadlines rather than complex regulations. A shared, digital compliance calendar should sit at the center of operations, covering all major obligations and assigning clear owners.

Key items to include:

• Monthly VAT filings due by the 20th.

• Quarterly provisional CIT payments.

• Employee insurance registration within 30 days of hiring.

• Annual global minimum tax calculations, where applicable.

• Ongoing PDPL assessments and updates.

This calendar should be reviewed quarterly to reflect regulatory changes, including Investment Law and tax updates introduced in 2026.

To avoid missed deadlines, check out InCorp Vietnam’s 2026 Compliance Calendar, designed to help foreign investors track all core compliance obligations in one place.

Insist on a thorough post-incorporation handover

A significant number of first-year compliance issues originate during the transition from setup to operations. Investors should require a structured handover that goes beyond licenses and seals and addresses early operational risk.

A proper handover should cover:

• Charter capital contribution evidence and deadlines.

• Initial tax registration and first filings.

• Employee insurance setup and payroll alignment.

• Data mapping and processing inventories under PDPL.

This continuity prevents early gaps from turning into long-term compliance issues.

Partner with full-scope, integrated advisors

Fragmented advisory structures are a key driver of recurring compliance issues. Investors should prioritize partners that provide end-to-end services under one operating framework, rather than coordinating multiple disconnected vendors.

When evaluating advisors, confirm that they:

• Handle incorporation, accounting, tax, payroll, HR, legal, and corporate secretarial work in-house.

• File directly with authorities in Vietnamese.

• Do not outsource compliance execution in ways that reintroduce handover risk and compliance issues.

Leverage local, on-the-ground expertise

Local presence plays a critical role in reducing compliance issues, especially in interpretation-heavy areas. Teams based in Ho Chi Minh City or Hanoi, with fluent Vietnamese speakers, are better positioned to engage directly with tax offices and labor authorities.

This local capability helps:

• Interpret regulatory nuances, including global minimum tax safe harbors.

• Respond quickly to authority queries.

• Avoid translation-related compliance issues that often arise in remote management models.

Proactively address 2026 regulatory shifts

New regulations are expanding the scope of compliance issues for foreign investors. Proactive preparation is essential.

Priority actions include:

• Conducting a global minimum tax applicability assessment if the group qualifies.

• Appointing a data protection officer and completing PDPL inventories ahead of inspections.

• Updating labor contracts to reflect new unemployment insurance and reporting requirements.

Early action converts future compliance issues into controlled implementation projects.

Implement fixed-fee retainers and internal controls

Predictable compliance management reduces both cost and risk. Fixed-fee retainers for routine filings encourage advisors to focus on prevention rather than correction, while internal controls provide an additional safety net.

Best practices include:

• Quarterly mock audits covering VAS reconciliation, insurance contributions, and e-invoice flows.

• Internal training to help teams recognize early warning signs of compliance issues, such as unusual regulator queries.

Plan compliance into operations from day one

High-performing FDIs treat compliance as an operating cost, not an afterthought. Many allocate 10–15 percent of initial setup budgets to ongoing compliance and build regulatory timelines into operational planning.

Key considerations:

• Bank account opening timelines of 2–4 weeks.

• Hiring-to-insurance registration delays.

• Internal approval workflows needed to support economic substance.

Embedding these controls early helps prevent structural compliance issues and supports long-term operational stability.

Final Insights: Mastering Compliance Issues for Sustainable Success

In 2026 Vietnam—with liberalized investment rules but rigorous enforcement—effective management of compliance issues separates thriving enterprises from those firefighting crises. Proactive, integrated approaches not only mitigate risks but build credibility with authorities, unlocking incentives, smoother expansions, and reliable profit repatriation.

Don’t let post-incorporation compliance issues overshadow your Vietnam opportunity. With the right framework and partners, compliance becomes a foundation for long-term competitiveness.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions About Incorporation

What are the most common compliance issues after incorporation in Vietnam?

- Late VAT filings, incorrect PIT withholding, delayed social insurance registration, and overdue charter capital contribution are the most frequent issues.

Why do setup-only market entry services increase compliance risk?

- They stop at licensing, leaving no owner for ongoing tax, labor, and reporting obligations once operations begin.

When do compliance issues usually appear?

- Typically within the first year, especially during the first tax finalization, labor inspection, or audit.

How can foreign investors prevent compliance issues effectively?

- Use an integrated partner, maintain a centralized compliance calendar, and assign clear ownership for every filing and deadline.