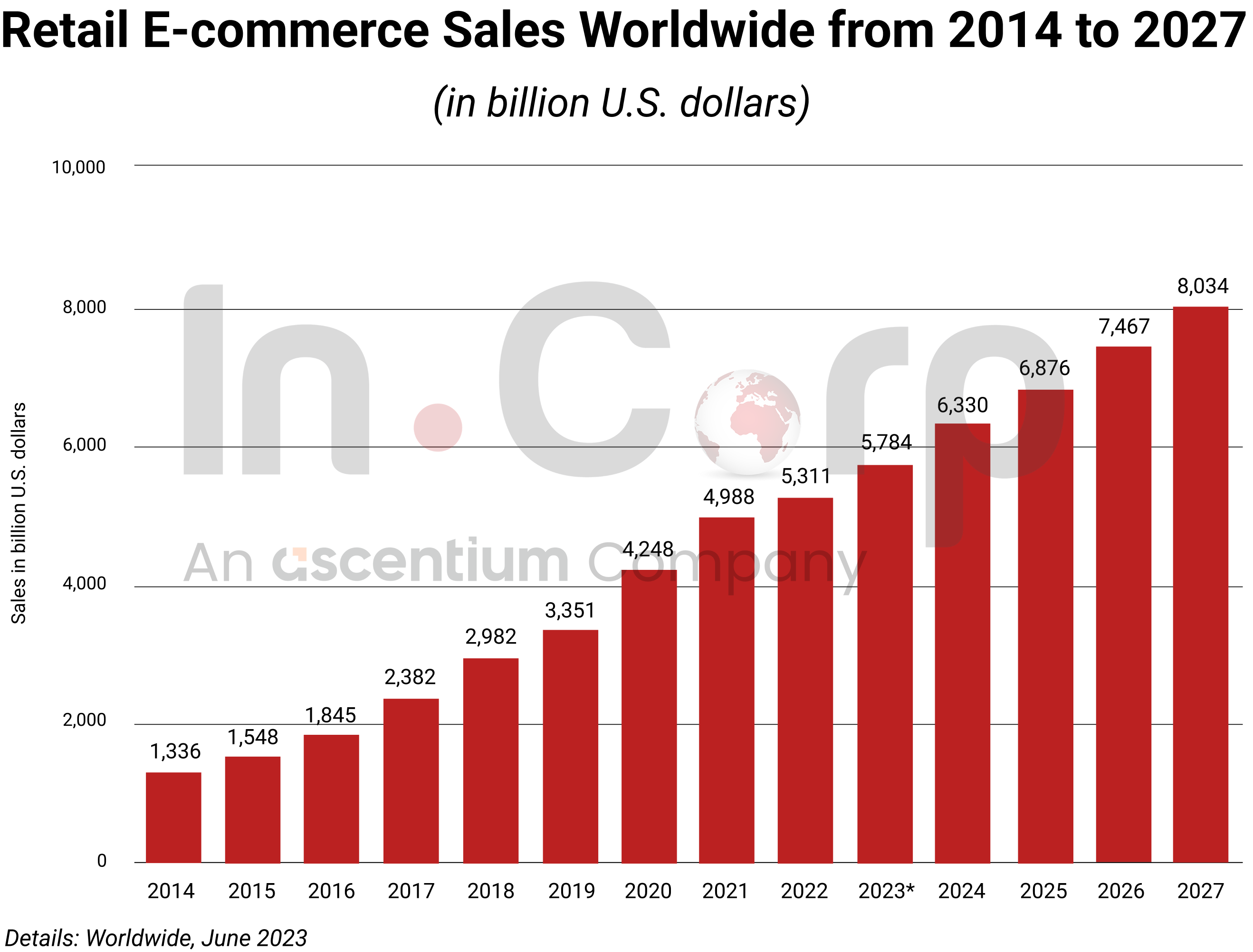

As global retail e-commerce sales are projected to exceed US$6 billion in 2024 and reach US$8 billion by 2025, according to Statista, foreign direct investment (FDI) companies are increasingly looking to establish a digital presence in Vietnam’s rapidly expanding e-commerce market. This shift is fueled by the remarkable evolution of e-commerce in Vietnam, particularly after the COVID-19 pandemic in 2021, which significantly accelerated consumer adoption of online shopping platforms.

E-commerce in Vietnam has become a defining trend, enabling consumers nationwide to access products and services with a single click. This rising trend has gained substantial momentum in Vietnam, where hundreds of e-commerce platforms operate with varying scales and structures. However, not all platforms offer equal value or opportunities for foreign investors. According to Mr. Jack Nguyen, CEO of InCorp Vietnam, for FDI companies considering entry into Vietnam’s e-commerce sector, understanding both the registration process and choosing the right platform are crucial first steps.

Read Related: FDI Company in Vietnam: Setting Up an E-Commerce Business

Creating a proprietary website within the e-commerce in Vietnam landscape provides FDI companies with significant advantages, such as direct access to customers, greater marketing flexibility, and operational autonomy. However, as InCorp Vietnam emphasizes, understanding and complying with local regulations is essential for establishing a legally sound digital presence. Businesses—especially foreign-invested enterprises—must fully understand the legal requirements before registering their websites to avoid potential penalties. At the same time, Vietnam’s rapidly evolving digital landscape, driven by rising smartphone adoption and the influence of social media, has reshaped consumer behavior, with an increasing number of consumers turning to online marketplaces for their purchases.

This comprehensive guide explores the top 16 platforms driving e-commerce in Vietnam, providing essential insights for foreign businesses planning their digital expansion into this dynamic market. Understanding both the regulatory framework for FDI companies and the competitive landscape is fundamental for making informed decisions that will shape long-term success in Vietnam’s rapidly growing e-commerce sector. Whether you are looking to buy, sell, or establish an FDI e-commerce presence in Vietnam, this analysis will help you identify the most trustworthy, effective, and suitable platforms for your specific needs.

Starting Your Business in Vietnam? Check out InCorp Vietnam’s business registration solutions

Overview of E-Commerce Website for an FDI Company in Vietnam

For foreign direct investment (FDI) companies seeking to establish an e-commerce presence in Vietnam, understanding the regulatory framework and available options is essential for successful market entry. The Vietnamese e-commerce landscape offers various pathways for foreign companies to engage in online retail activities, each with distinct requirements and operational considerations.

In Vietnam, e-commerce websites are defined as electronic information platforms established to facilitate partial or complete commercial transactions, encompassing product display, contract execution, service delivery, payment processing, and after-sales support. For FDI companies, it is crucial to note that these platforms must operate within Vietnam’s legal framework and require proper registration or notification with relevant authorities.

The government recognizes four distinct categories of e-commerce websites in Vietnam, each serving specific business purposes: The first category, sales websites, represents the most straightforward option for FDI companies looking to establish their direct online retail presence. These websites focus on promoting and selling the company’s products or services. While they require notification to the Ministry of Industry and Trade (MOIT), they generally face fewer regulatory hurdles compared to other categories.

More complex options include trading floors, which serve as comprehensive e-commerce service providers, online auction websites facilitating competitive bidding processes, and online promotion websites designed for marketing and promotional activities. These three categories require formal registration with MOIT, indicating a higher level of regulatory oversight and compliance requirements.

For FDI companies entering the market, establishing a trading company with appropriate licensing is a prerequisite for operating an e-commerce website in Vietnam. The process typically requires 1-2 months for obtaining a business license, followed by approximately one month for securing a retail license. This timeline may vary based on the scope and nature of products to be registered.

It’s important to note that while physical office space is not mandatory for purely digital operations, compliance with MOIT registration or notification requirements remains essential. This regulatory framework ensures transparency and accountability in Vietnam’s growing e-commerce sector while protecting consumer interests and maintaining market stability.

FDI companies should also consider that the Vietnamese e-commerce ecosystem offers multiple channels for market entry. While establishing an independent e-commerce website provides greater control over brand presentation and customer experience, companies may also consider utilizing existing e-commerce platforms like Lazada, Shopee, or Tiki as complementary sales channels. These platforms offer established infrastructure and market reach, though they require separate seller registration and compliance with platform-specific requirements.

The choice between developing an independent e-commerce website and utilizing existing platforms should align with the company’s long-term strategy, resource capabilities, and market positioning objectives. Successful implementation often requires careful consideration of local market dynamics, consumer preferences, and regulatory compliance requirements unique to Vietnam’s e-commerce landscape.

How to Register an E-Commerce Website for an FDI Company in Vietnam?

This guide outlines the process for foreign direct investment (FDI) companies looking to establish an e-commerce presence in Vietnam, differentiating between setting up a full-fledged e-commerce platform and a single-seller e-commerce website. It also clarifies the legal requirements and procedures involved.

Understanding the Different Types of E-commerce Presence

It’s crucial to distinguish between an “e-commerce platform” and an “e-commerce website.” An e-commerce platform (similar to Amazon) allows multiple sellers to list and sell their products. Establishing such a platform requires a specific E-commerce Platform License, which is a complex process involving approvals from multiple ministries and can take up to a year. Due to these stringent requirements, the number of operating e-commerce platforms in Vietnam is limited. This option is generally not recommended for companies with limited capital or technical resources.

Alternatively, an e-commerce website involves a single seller (the website owner) selling their own products. This model is more akin to a traditional trading company with an online presence. Setting up this type of website is considerably simpler.

Setting Up an E-commerce Website (Single Seller)

For an FDI company wishing to operate a single-seller e-commerce website in Vietnam, the process is similar to registering a trading company, with the added step of Website Notification. This involves notifying the Ministry of Industry and Trade (MOIT) about the website’s establishment.

Legal Framework and Requirements

Vietnamese law distinguishes between two types of e-commerce websites: sales e-commerce websites and websites providing e-commerce services. For a sales e-commerce website (the focus of this guide), the following conditions must be met:

- The entity must be a trader, organization, or individual with a granted personal tax identification number.

- The Ministry of Industry and Trade must be notified about the establishment of the sales e-commerce website.

Since an FDI company legally established in Vietnam and possessing a tax code fulfills the first condition, the primary remaining step is the MOIT notification. This process is governed by Article 52 of Decree 52/2013/ND-CP, as amended and supplemented by Decree 08/2018/ND-CP.

Registration/Notification Process (Step-by-Step)

The process involves using the MOIT’s online portal (http://online.gov.vn/):

- Account Creation: Create an account on the MOIT portal, providing information such as the website owner’s name, business registration number, business lines, address, and contact details.

- Account Confirmation: Within three working days, the MOIT will review the provided information. Upon approval, the account will be confirmed, granting access to the next step.

- Website Category Selection: Log in and select the appropriate category for the e-commerce website.

- Information Verification: The MOIT will review the provided information for eligibility and completeness.

- Confirmation and Code Receipt: Upon successful verification, the website owner will receive a confirmation code via email. This code can be displayed on the website as a logo, indicating legal registration/notification with the MOIT. A red logo signifies registration, while a blue logo indicates notification.

Required Documents

The following documents are typically required for the registration/notification process:

- Enterprise Registration Certificate

- Investment Registration Certificate

- Investment License

- Trading License

- Establishment license (for organizations)

- ID or Passport (for individuals)

Processing Time

The processing time varies:

- E-commerce website registration: 3-5 working days

- E-commerce website notification: 10-15 working days

Key Considerations for Ranking E-commerce Sites

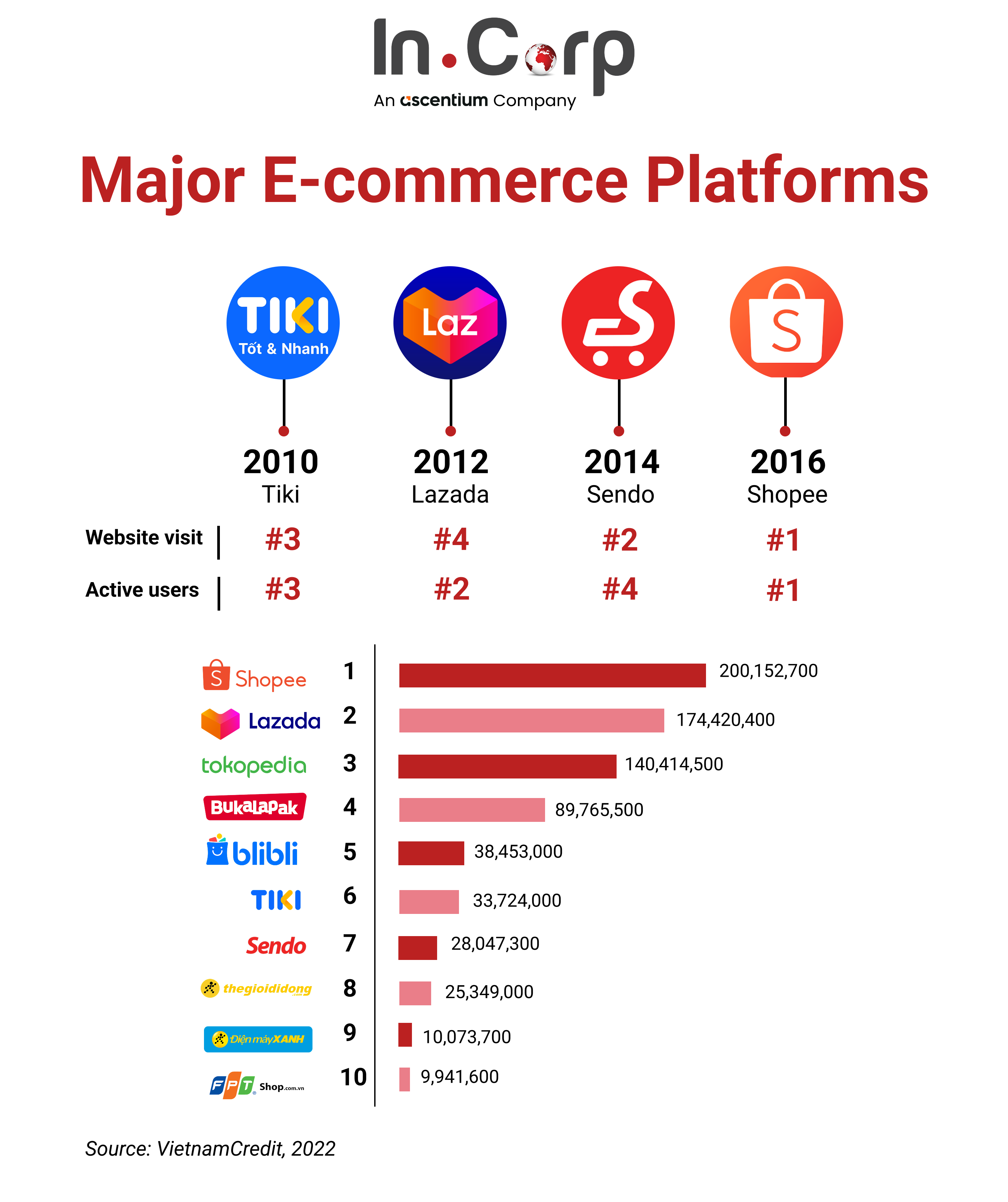

Factors such as monthly visits (Similarweb), app downloads and usage statistics (App Annie), and social media following (specifically Facebook in Vietnam) are key metrics for assessing the performance and reach of e-commerce platforms. These criteria are often used to rank and compare different e-commerce sites. It is important to note that only platforms with substantial traffic (e.g., 100,000 hits) or social media presence (e.g., 100,000 followers) are usually considered in such rankings.

Permitted and Prohibited E-Commerce Activities in Vietnam

Decree 52/2013/ND-CP outlines the legal framework for e-commerce, and Article 4 specifically addresses prohibited activities. Engaging in any of the following can lead to legal consequences:

- Multi-Level Marketing Schemes: Organizing e-commerce marketing and business networks that require participants to pay a fee for service purchases and receive commissions or bonuses for recruiting new members is illegal. This prohibition targets pyramid schemes disguised as e-commerce ventures.

- Counterfeit and Infringing Goods: Selling fake goods or goods and services that violate Intellectual Property Rights is strictly forbidden. This includes any products that infringe on trademarks, copyrights, or patents.

- Banned Goods and Services: Trading goods or services that are generally banned from commerce in Vietnam is also prohibited in the e-commerce space. This encompasses items restricted due to safety, security, or other regulatory reasons.

- Fraudulent Fundraising: Using the name of an e-commerce company to illegally raise funds from other traders, organizations, or individuals is a serious offense. This targets fraudulent activities that exploit the e-commerce platform for illicit financial gain.

- Unregistered/Unlicensed Services: Providing e-commerce services or offering e-commerce monitoring, evaluation, or certification services without proper registration or licensing as required by Decree 52 is illegal. This ensures regulatory oversight of these specialized services.

- Inconsistent Information: The goods or services offered on a website must align with the information registered with the Ministry of Industry and Trade (MOIT). Discrepancies between the registered information and the actual offerings are prohibited.

- Misleading Website Presentation: Creating confusion among consumers regarding an e-commerce website’s relationship with other traders, organizations, or individuals through the use of logos, links, or other technologies is prohibited. This aims to prevent deceptive practices that mislead consumers about affiliations or endorsements.

Vietnam’s Online Shopping Market: Top Websites & E-Commerce Platforms

The top 16 e-commerce sites in Vietnam, based on a combination of web traffic, app rankings, social media presence, and overall market influence.

1. Shopee Vietnam

- Website: https://shopee.vn

- Web Traffic (Monthly): 38,589,400

- App Ranking: Top 1 (iOS & Android)

- Social Media: 172,410 YouTube subscribers, 14,804,320 Facebook followers, 137,160 Instagram followers

- Model: B2C

- Founded: 2015

- Description: Shopee is the most visited e-commerce website in Vietnam. Its user-friendly layout, easy navigation, quick order processing, and strong marketing campaigns have contributed to its top ranking.

2. Thegioididong

- Website: https://www.thegioididong.com/

- Web Traffic (Monthly): 32,349,000

- App Ranking: Top 2 (iOS & Android)

- Social Media: 600,930 YouTube subscribers, 3,377,630 Facebook followers, 2,120 Instagram followers

- Founded: 2004

- Description: Thegioididong is a pioneer e-commerce website in Vietnam, specializing in mobile and digital products. Its extensive network of physical stores across 63 provinces and cities, combined with its online platform, has made it a leader in the electronics market.

3. Dienmayxanh

- Website: https://www.dienmayxanh.com/

- Web Traffic (Monthly): 21,373,700

- App Ranking: Top 3 (iOS), Top 7 (Android)

- Social Media: 367,220 YouTube subscribers, 1,469,130 Facebook followers

- Founded: 2010 (part of Thegioididong)

- Description: Dienmayxanh, owned by Thegioididong, is another popular e-commerce site for electronics. Its widespread supermarket system and strong public relations strategies have boosted its ranking.

4. Lazada

- Website: http://www.lazada.vn/

- Web Traffic (Monthly): 17,606,700

- App Ranking: Top 4 (iOS), Top 3 (Android)

- Social Media: 138,700 YouTube subscribers, 28,413,610 Facebook followers, 71,550 Instagram followers

- Model: B2C and C2C

- Founded: 2012

- Description: Backed by Alibaba, Lazada offers a wide range of products. It acts as a platform for both businesses and individuals to sell online. Lazada invests heavily in marketing and brand building.

5. Tiki

- Website: https://tiki.vn/

- Web Traffic (Monthly): 15,624,000

- App Ranking: Top 3 (iOS), Top 5 (Android)

- Social Media: 365,450 YouTube subscribers, 2,818,460 Facebook followers, 124,000 Instagram followers

- Model: B2C

- Description: Tiki, a Vietnamese-owned e-commerce platform, offers diverse products, focusing on quality and competitive pricing. It is known for its good customer service and delivery.

6. Chotot.com

- Website: https://www.chotot.com/

- Web Traffic (Monthly): 13,324,000

- App Ranking: Top 4 (iOS), Top 6 (Android)

- Social Media: 185,450 YouTube subscribers, 2,404,333 Facebook followers

- Founded: 2012

- Description: Chotot.com is a leading classifieds platform in Vietnam, facilitating C2C transactions across various product categories.

7. Sendo

- Website: https://www.sendo.vn/

- Web Traffic (Monthly): 3,347,300

- App Ranking: Top 4 (iOS), Top 12 (Android)

- Social Media: 93,710 YouTube subscribers, 2,703,250 Facebook followers

- Model: B2C2C

- Founded: 2012

- Description: Sendo, backed by FPT Corporation, connects buyers and sellers nationwide, with a focus on fashion.

8. FPTshop.com

- Website: https://fptshop.com.vn/

- Web Traffic (Monthly): 31,141,600

- Social Media: 186,420 YouTube subscribers, 2,454,720 Facebook followers, 10,050 Instagram followers

- Founded: 2007

- Description: FPT Shop is a retail system specializing in digital products like phones, tablets, and laptops. It is an authorized distributor for several brands, including Apple.

9. Bachhoaxanh.com

- Website: https://www.bachhoaxanh.com/

- Web Traffic (Monthly): 7,372,100

- App Ranking: Top 13 (iOS)

- Social Media: 2,640 YouTube subscribers, 227,590 Facebook followers

- Description: Bachhoaxanh is a mini-grocery chain owned by Thegioididong, focusing on fresh food and everyday essentials.

10. Meta.vn

- Website: https://meta.vn/

- Web Traffic (Monthly): 3,019,000

- App Ranking: Top 20 (iOS), Top 15 (Android)

- Social Media: 19,960 YouTube subscribers, 68,650 Facebook followers, 490 Instagram followers

- Founded: 2007

- Description: Meta.vn is an established e-commerce platform in Vietnam, offering a variety of products.

11. Cellphones

- Website: https://cellphones.com.vn/

- Web Traffic (Monthly): 7,100,900

- Social Media: 2,084,290 YouTube subscribers, 552,670 Facebook followers, 58,880 Instagram followers

- Description: Cellphones specializes in mobile phones and accessories.

12. Phong Vu

- Website: Phongvu.vn

- Web Traffic (Monthly): 1,026,200

- Social Media: 7,770 YouTube subscribers, 212,475 Facebook followers

- Description: Phong Vu is a well-known brand in the technology retail sector.

13. Vatgia

- Website: http://www.vatgia.com

- Web Traffic (Monthly): 56,100

- App Ranking: Top 17 (iOS)

- Social Media: 308,550 Facebook followers

- Description: Vatgia offers a wide range of products, from electronics to fashion.

14. Dien May Cho Lon

- Website: https://dienmaycholon.vn/

- Web Traffic (Monthly): 4,183,600

- Social Media: 70 YouTube subscribers, 562,820 Facebook followers

- Description: Dien May Cho Lon sells electrical goods and furniture.

15. Nguyen Kim

- Website: https://www.nguyenkim.com/

- Web Traffic (Monthly): 2,925,700

- App Ranking: Top 15 (iOS), Top 10 (Android)

- Social Media: 18,770 YouTube subscribers

- Description: Nguyen Kim is a well-established retailer of electronics and appliances in Vietnam. It also maintains a strong online presence.

16. Hoang Ha Mobile

- Website: https://hoanghamobile.com/

- Web Traffic (Monthly): 8,359,200

- Social Media: 57,660 YouTube subscribers, 555,210 Facebook followers

- Description: Hoang Ha Mobile specializes in mobile phones and accessories, known for offering competitive prices.

How Can InCorp Vietnam Assist?

Vietnam’s e-commerce market is experiencing significant growth. Statista reported a market value of approximately $12 billion in 2020, placing Vietnam just behind Indonesia, Thailand, and Singapore in Southeast Asia. This growth trajectory is expected to continue, fueled by Vietnam’s expanding digital population. Data from the Ministry of Information and Communications (MIC) indicates that over 70% of Vietnamese citizens have internet access, with nearly half having made online purchases and over half using e-wallets or online payment methods.

InCorp Vietnam provides comprehensive support for businesses navigating Vietnam’s e-commerce landscape. Our experienced legal team can guide you through every step, from securing necessary certifications and licenses to registering your website and selecting the ideal virtual office for your operations. Contact us today to begin your e-commerce journey in Vietnam!

15,000+

clients worldwide

1,200+

professional staff

20,000+

incorporated entities in 10 years

12,000+

compliance transactions yearly