In Vietnam’s fast-paced market, maintaining financial stability through accurate bookkeeping in Vietnam is crucial. Proper bookkeeping ensures businesses track earnings and expenses, maintain compliance, and avoid common bookkeeping mistakes. To manage these tasks efficiently, many companies rely on professional bookkeeping services that help streamline financial records and ensure compliance with local regulations.

Although bookkeeping and accounting are often used interchangeably, they serve different functions. Bookkeeping categories focus on recording financial transactions, while accounting interprets these records for decision-making. Compliance with Vietnamese Accounting Standards (VAS) and GAAP is essential, particularly for foreign investors. Many businesses face bookkeeping and accounting problems, making it necessary to adopt bookkeeping best practices to ensure accuracy.

Business owners often struggle to balance bookkeeping with daily operations. Many opt for budget bookkeeping, hire a bookkeeping virtual assistant, or explore the benefits of outsourcing bookkeeping to streamline operations. Understanding bookkeeping fees per hour can help businesses choose the right financial management strategy.

Whether you’re a startup or an established foreign enterprise, mastering bookkeeping in Vietnam is vital. Proper execution can mean the difference between surviving and thriving in the country’s competitive business environment.

The Importance of Accurate Bookkeeping in Vietnam

Bookkeeping in Vietnam is a cornerstone of business success, ensuring compliance with Vietnamese regulations while supporting both national and international business operations. It goes beyond simple record-keeping, encompassing financial health, tax compliance, and regulatory reporting.

Foreign-invested businesses must adhere to strict bookkeeping and accounting standards, including annual audits by independent auditors under Vietnam Standards on Auditing (VAS). Decree No. 05/2019/ND-CP further reinforces these norms, requiring compliance from state agencies, public service enterprises, and listed companies. Failure to follow bookkeeping best practices can result in bookkeeping and accounting problems, such as extra tax assessments, VAT refund denials, and the withdrawal of Corporate Income Tax incentives.

Maintaining proper records is essential, with organizations required to operate under a Chief Accountant’s supervision. Financial statements must be signed by both the Chief Accountant and the legal representative before being audited and submitted to tax authorities within 90 days of the financial year’s end. Additionally, foreign investors repatriating profits must notify local tax authorities in advance.

Beyond compliance, bookkeeping in Vietnam plays a crucial role in investor communication. Transparent financial records, profit and loss statements, and performance reports assure stakeholders of a company’s growth potential and fiscal responsibility. Avoiding common bookkeeping mistakes, such as inaccurate record-keeping or delayed reporting, is key to maintaining financial credibility.

Many businesses, particularly SMEs, find it beneficial to leverage the benefits of outsourcing bookkeeping. Whether through budget bookkeeping, hiring a bookkeeping virtual assistant, or understanding bookkeeping fees per hour, outsourcing allows companies to focus on growth while ensuring compliance. Regardless of the approach, proper bookkeeping from day one is vital for long-term success and financial stability.

Discover How InCorp Vietnam’s Bookkeeping Services Improve Your Business’s Bookkeeping in Vietnam

Key Components of Effective Bookkeeping

Effective bookkeeping involves maintaining accurate and up-to-date financial records, crucial for fulfilling tax obligations. Inconsistent record-keeping can lead to errors in financial reporting, affecting tax compliance and potentially resulting in penalties. Understanding the key components of effective bookkeeping is essential for any business in Vietnam.

The specific components of effective bookkeeping include accurate financial statements, proper documentation, and electronic records management.

Accurate Financial Statements

All companies in Vietnam must prepare their financial statements according to the Vietnamese Accounting Standards (VAS) to ensure transparency and consistency. Templates for financial statements are standardized under VAS, which aids in compliance and uniformity across different businesses. This standardization ensures that financial reports are consistent and comparable, facilitating better compliance with tax regulations.

Foreign-invested businesses often maintain dual accounting records: one under VAS for local compliance and another for their home country’s standards. Accounting records and financial statements in Vietnam need to be prepared in Vietnamese, although foreign languages can be included in addition, especially for foreign firms.

The official currency for accounting in Vietnam is the Vietnamese Dong (VND), but foreign-invested companies can choose to use a foreign currency for their accounting records.

Proper Documentation

Maintaining comprehensive documentation, including invoices and receipts, supports tax deductions and compliance. Proper bookkeeping requires various documents, including invoices, receipts, and non-cash payment documents, to ensure compliance with tax regulations. These documents are essential for accurate financial reporting.

Invoices, receipts, and transaction documents must be meticulously maintained to meet Vietnam’s tax record-keeping standards. Comprehensive documentation helps businesses effectively respond to inquiries during tax inspections, facilitating compliance and reducing audit complications.

Electronic Records Management

Electronic records in Vietnam must be encrypted and secure, preventing unauthorized access or modifications during storage. Adhering to security measures like data encryption protects sensitive financial information, ensuring the integrity and confidentiality of financial data.

Electronic records must meet the same requirements as paper documents, and be encrypted, and stored securely to protect data integrity. Implementing robust electronic records management systems ensures compliance with legal standards and enhances bookkeeping efficiency.

Benefits of Outsourcing Bookkeeping in Vietnam

Strategic Budget Management

Correct bookkeeping lays the foundation for accurate financial plans. It is about keeping detailed records of income to help companies analyze their financial resources and costs with accuracy. This systematic approach makes possible the creation of comprehensive budgets that can be put to strategic use in determining future investments and operational expenses rather than relying on guesswork for decisions to be made.

Tax Compliance and Preparation

Proper bookkeeping practices ensure seamless tax compliance. Maintaining meticulous records throughout the year allows businesses to generate accurate financial statements readily requested by HMRC. This proactive approach allows for precise forecasting of tax liability and ensures compliance with regulations.

Systematic Record Management

Professional record-keeping helps minimize all inefficiencies that could arise from disorganized financial documentation. Through the development of structured and consistent bookkeeping practices, businesses can quickly upload important financial information. It will have fewer errors and corresponding risks for missed deadlines that could jeopardize operational efficiency.

Performance Tracking and Goal Setting

Accurate financial records provide quantifiable metrics for assessing business performance. This data-driven approach enables organizations to establish realistic growth targets and monitor progress effectively. Rather than relying on estimates, companies can make informed decisions based on concrete financial indicators.

Regulatory Compliance

The government’s implementation of Making Tax Digital (MTD) requires businesses to manage their finances digitally. Using the right bookkeeping software not only helps meet these regulations but also provides a more affordable option than outsourcing financial management tasks, reducing the chances of penalties.

Risk Mitigation

Keeping financial records organized greatly alleviates operational stress and minimizes risks related to regulatory compliance. By employing professional bookkeeping practices, businesses can ensure that their financial data is accurately maintained and easily accessible for review. This allows management to concentrate on essential business operations without worrying about financial documentation.

Professional Development

Digital bookkeeping offers great chances to improve financial management skills. By using software, attending HMRC workshops, or accessing professional development resources, the insights gained lead to better business decisions and enhanced financial management abilities.

By adopting professional bookkeeping practices, businesses create a strong base for financial management, compliance, and strategic growth. This organized method of keeping financial records is crucial for ensuring efficiency within the organization and reaching long-term business goals.

Bookkeeping Categories in Vietnam

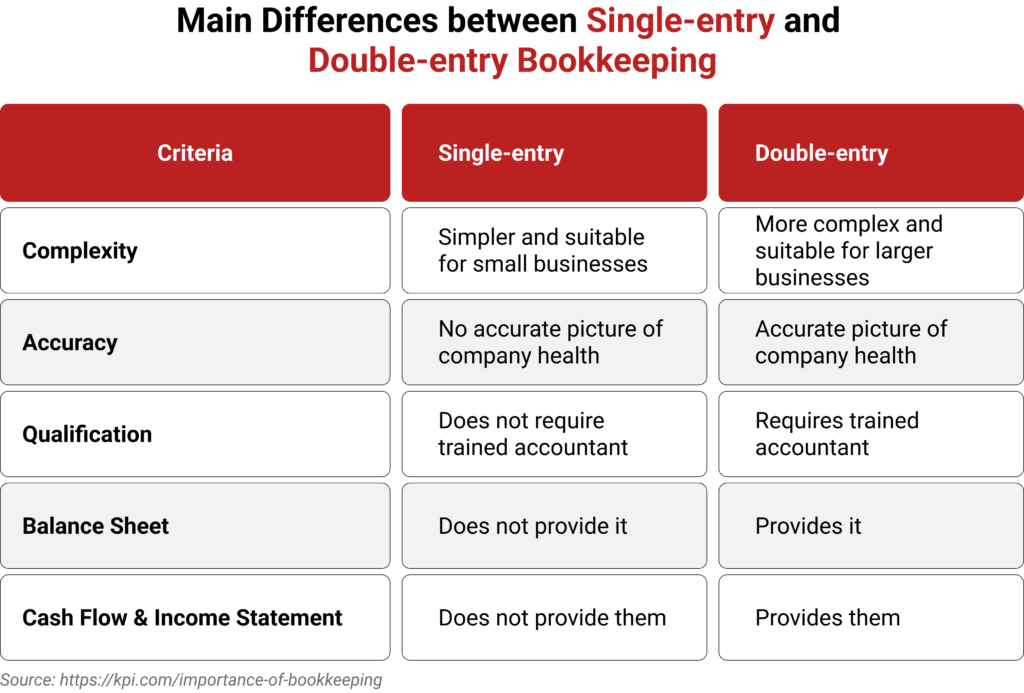

There are two main ways to handle your business bookkeeping: single-entry bookkeeping and double-entry bookkeeping.

Single-Entry Bookkeeping

Single-entry bookkeeping is a straightforward method that is most effective for businesses with a limited number of transactions. In this system, each transaction is recorded just once, either as money received or money spent. It is akin to maintaining a checkbook. However, the drawback of this approach is that it does not account for your assets and liabilities, making it less comprehensive compared to double-entry bookkeeping.

Double-Entry Bookkeeping

Double-entry bookkeeping is a more sophisticated method that most businesses rely on. In this system, each transaction is recorded twice—once as a credit and once as a debit. This approach provides a precise view of your business’s financial health. It monitors all aspects: your assets, liabilities, equity, income, and expenses.

Key Accounting & Tax Obligations for Foreign Companies

Foreign companies operating in Vietnam must follow a detailed accounting and tax framework that complies with Vietnamese Accounting Standards (VAS). These companies are required to keep VAS-based records but can also maintain parallel accounting records for their international headquarters. A common approach among foreign enterprises is to keep accounts that meet VAS requirements and then convert them to International Financial Reporting Standards (IFRS) quarterly for their parent companies.

The accounting records should primarily be in Vietnamese, although companies can use commonly spoken foreign languages as well. While the Vietnamese Dong is the main currency for accounting, foreign companies can choose to use a different currency after informing the tax authorities.

Monthly financial reports need to be printed, signed by the General Director, and officially stamped to ensure compliance with Vietnam’s chart of accounts. The standard accounting period in Vietnam runs from January 1 to December 31, but companies can opt for a different 12-month period if they register it with the tax department.

Foreign companies have extensive reporting obligations, which include company and personal income taxes, as well as annual audit reports that cover balance sheets, income statements, profit and loss statements, and changes in equity statements.

These audited reports must be submitted within 90 days after the end of the fiscal year to three main government authorities:

- The provincial Department of Planning and Investment (or the local Department of Export Processing and Industrial Zone)

- The provincial tax department, and

- The regional statistical offices.

Read More: VAS to IFRS Conversion Guide: Exploring Key Differences

Compliance for Representative Offices in Vietnam

The Vietnamese regulatory framework requires all business entities operating in the country to fully comply with the Accounting Law and Vietnamese Accounting Standards (VAS), regardless of their ownership structure or origin. The VAS framework provides detailed guidelines for financial reporting, bookkeeping practices, and the preparation of financial statements.

Acknowledging the distinct characteristics of various sectors, the standards include specialized accounting rules designed for specific industries, such as securities, insurance, and funds management.

In a significant step towards international alignment, the Vietnamese government has launched a strategic plan to adopt the International Financial Reporting Standards (IFRS) by 2025, representing a major shift in the country’s financial reporting environment. This transition underscores Vietnam’s dedication to aligning with global accounting standards and improving the transparency and comparability of financial reporting internationally.

Read Related: Effortlessly Establishment of a Representative Office Vietnam: A Detailed Guide for Investors

Preparing for Vietnam’s Transition to IFRS by 2025

The Vietnamese government has announced plans to eliminate Value Added Tax (VAT) on Vietnamese Accounting Standards (VAS) by 2025 while also implementing the International Financial Reporting Standards (IFRS). This decision, which has been anticipated by foreign businesses and publicly traded companies, brings Vietnam in line with global standards in corporate governance. The shift to IFRS is expected to improve efficiency and transparency in the corporate sector.

Download the full VAS to IFRS Conversion Guide: Exploring Key Differences from InCorp Vietnam now!

Avoiding Common Bookkeeping Mistakes with Bookkeeping Best Practices

Companies that fail to comply with Vietnam’s tax and accounting regulations may face serious penalties. According to the 2018 Vietnam Penal Code, companies that fail to provide accurate and consistent financial reports may be fined 20% of the under-declared tax amount.

Additionally, Clause 2, Article 59 of Law No. 38/2019/QH14, dated June 13, 2019, on Tax Administration, states that late tax payments will incur an interest rate of 0.03% per day on the unpaid tax amount, starting the day after the tax report submission deadline.

Furthermore, Clauses 4 and 5 of Article 13 in Decree 125/2020/NĐ-CP, dated October 19, 2020, outline fines ranging from US$590.90 to US$984.83 for late tax return submissions. Specifically, a US$590.90 fine applies if the tax return is filed 91 days or more after the deadline without additional tax liabilities, while fines can reach US$984.83 if the delay results in extra tax payments.

Moreover, Article 12 of Decree 41/2018/NĐ-CP, dated March 12, 2018, imposes fines of up to US$1,969.67 for violations such as failing to submit financial statements, not disclosing financial reports, and neglecting mandatory audits required for certain entities.

Read Related: Vietnam Business Accounting & Taxation: Principles of Taxation, Problems & Solutions, and Accounting Department Setup

Outsourcing Solutions with InCorp Vietnam: Tailored Services for Success

InCorp Vietnam’s bookkeeping and accounting services offer a complete solution aimed at enhancing your business’s efficiency and profitability. By entrusting our expert team with these vital functions, you can free yourself from tedious administrative tasks and mitigate the effects of potential employee shortages, allowing you to concentrate on strategic goals like client acquisition and business expansion.

Our dedicated experts manage your financial records meticulously, eliminating the burden of paperwork and enabling you to focus on your primary business activities. InCorp Vietnam adheres to strict policies and upholds the highest industry standards to safeguard your financial data and minimize the risk of fraud.

Opting for InCorp Vietnam for your bookkeeping and accounting needs brings numerous advantages, including quicker turnaround times, a robust support system, enhanced profitability, and access to a highly skilled and experienced team.

Conclusion

Focusing on bookkeeping and accounting is essential for every business. These activities go beyond simple administrative duties; they serve as crucial foundations for financial stability and informed decision-making.

By carefully keeping accurate financial records, businesses obtain the clarity and insights needed to manage the complexities of the financial world, allocate resources wisely, and comply with relevant regulations. Adopting strong accounting practices enables businesses to reach their financial objectives and build a successful future.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What do you mean by bookkeeping?

- Bookkeeping is the process of recording and organizing a company’s financial transactions on a regular basis. It includes tracking income, expenses, assets, liabilities, and equity to ensure accurate financial records for reporting and compliance. Bookkeeping is essential for preparing financial statements, filing taxes, and assessing the financial health of a business.

What exactly does a bookkeeper do?

- A bookkeeper is responsible for recording and organizing a company’s financial transactions, such as sales, purchases, receipts, and payments. They maintain accurate ledgers, reconcile bank statements, and prepare financial records that help accountants and business owners monitor financial health and meet compliance requirements like tax filing.

What is bookkeeping vs. accounting?

- Bookkeeping is the process of recording daily financial transactions such as sales, purchases, receipts, and payments. Accounting, on the other hand, involves interpreting, classifying, analyzing, and summarizing this financial data to prepare financial statements and provide insights for decision-making. Bookkeeping is the foundational step, while accounting builds on this data to assess a company’s financial health and ensure compliance.