Vietnam has embraced economic liberalization with great enthusiasm and invested in human and physical capital, both through public investments as well as opening up the economy to foreign investments. Moreover, the country effectively complemented global liberalization with domestic reforms through ease of doing business and deregulation.

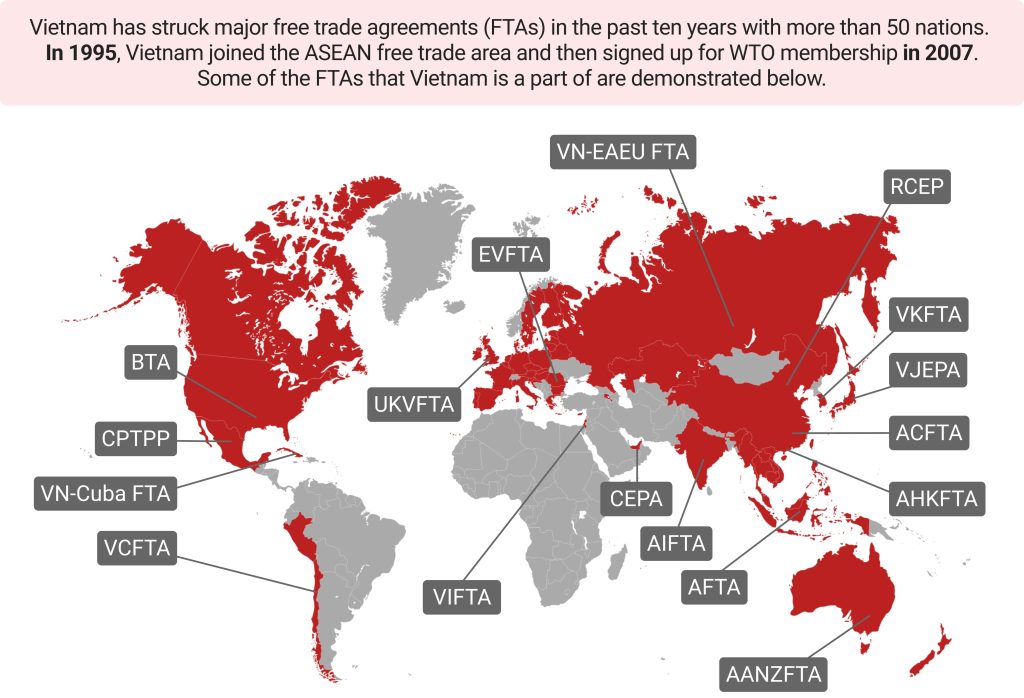

Vietnam has signed significant free trade agreements in the last three decades with over 50 nations, including individual-based agreements as well as those signed via economic blocs. This is impactful considering that before the 1990s Vietnam’s economy was completely insular, similar to that of North Korea. For instance, in 1995, Vietnam became a part of the ASEAN free trade area, and in 2007 it joined the WTO, and later signed a free trade agreement with the US, once Vietnam’s fiercest enemy. This article serves as a comprehensive guide to Vietnam’s free trade agreements.

Investing in Vietnam? See InCorp Vietnam’s Company Incorporation Services

Vietnam’s Trade Evolution: From Isolation to a Key Player in Global Trade

In 1986, Vietnam decided to rescue its economy from the failures of a system setup based on communist central planning and bring profound changes to the country. The government introduced a series of political and economic reform policies known as Doi Moi.

Post-implementation of these reform policies, Vietnam’s economy successfully revived itself and steered to become a “socialist-oriented market economy”. As a result, the country has become an integral part of global trade through increased participation in regional and international institutions and agreements such as the Asia-Pacific Economic Cooperation (APEC) forum, the Association of Southeast Asian Nations (ASEAN), the World Trade Organization (WTO), and the United Nations (UN).

According to the US Trade Commission, Vietnam joined the WTO as its 150th member in 2007 and pledged to completely abide by the accords set out by the organization on customs valuation, technical trade barriers (TBT), and sanitary and phytosanitary measures (SPS).

Read More: Doing Business in Vietnam as a Foreigner: What, Where, Why, How?

Including trading blocs and one-on-one agreements Vietnam is a signatory to the following trade agreements:

EU – Vietnam Free Trade Agreement (EVFTA)

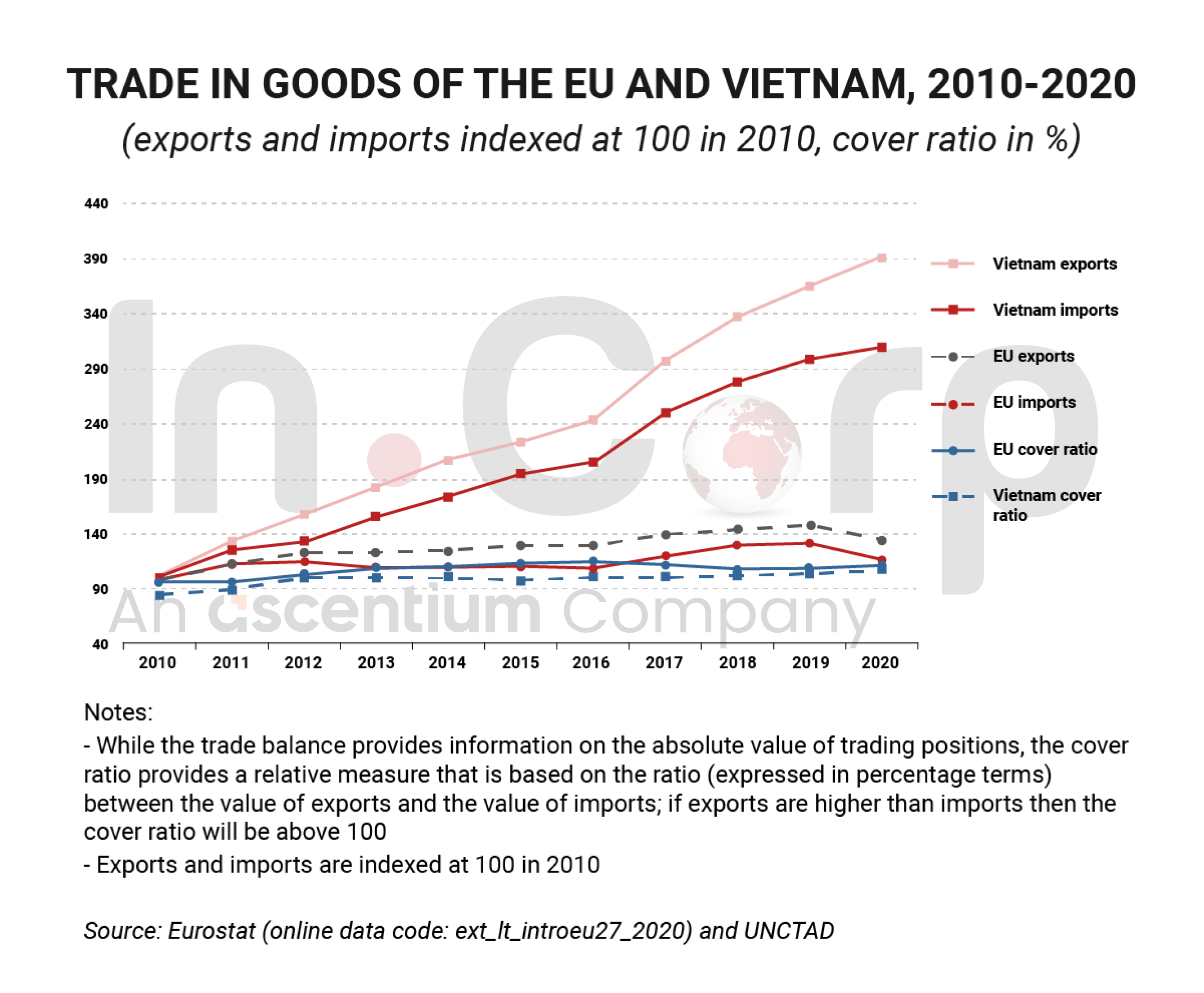

With a motive to bolster trade relations and deepen international integration, a free trade agreement between the European Union and the Socialist Republic of Vietnam was signed in July 2018.

The EU- Vietnam Free Trade Agreement (EVFTA) is aimed at providing opportunities to shore up the trade volumes, boost the job market, and foster economic growth on both sides, through

- Removal of up to 99% of import taxes

- Protecting the interest of investors

- Elimination of bureaucracy and repeating red tapes

- Reduction of trade barriers

- Encourage the use of public procurement markets and services

- Low-risk and safe trade with Vietnam through the enforced agreement

As a direct result of the EVFTA, Vietnam’s export surplus to Europe has reached an all-time high of US$13.4 billion in the first five months of 2022.

Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

One of the world’s largest free-trade areas, the Comprehensive & Progressive Agreement for Trans-Pacific Partnership (CPTPP), consists of 11 signatories representing 13.4% of the global GDP (approximately US$13.5 trillion). The CPTPP was created after the United States refused to sign the original TPP trade agreement under President Donald Trump (which Vietnam would also have been a member of). The CPTPP includes most of the original member nations excluding the US. The countries participating in the new agreement are:

With the agreement in force, taxes on 43% of Vietnam’s garment exports to Canada will be eliminated with immediate effect, and after four years, they will be slashed by 100%. The agreement also focuses on Vietnam’s labor reforms and improving the work environment. This agreement came into force on the 14th of January 2019 for Vietnam.

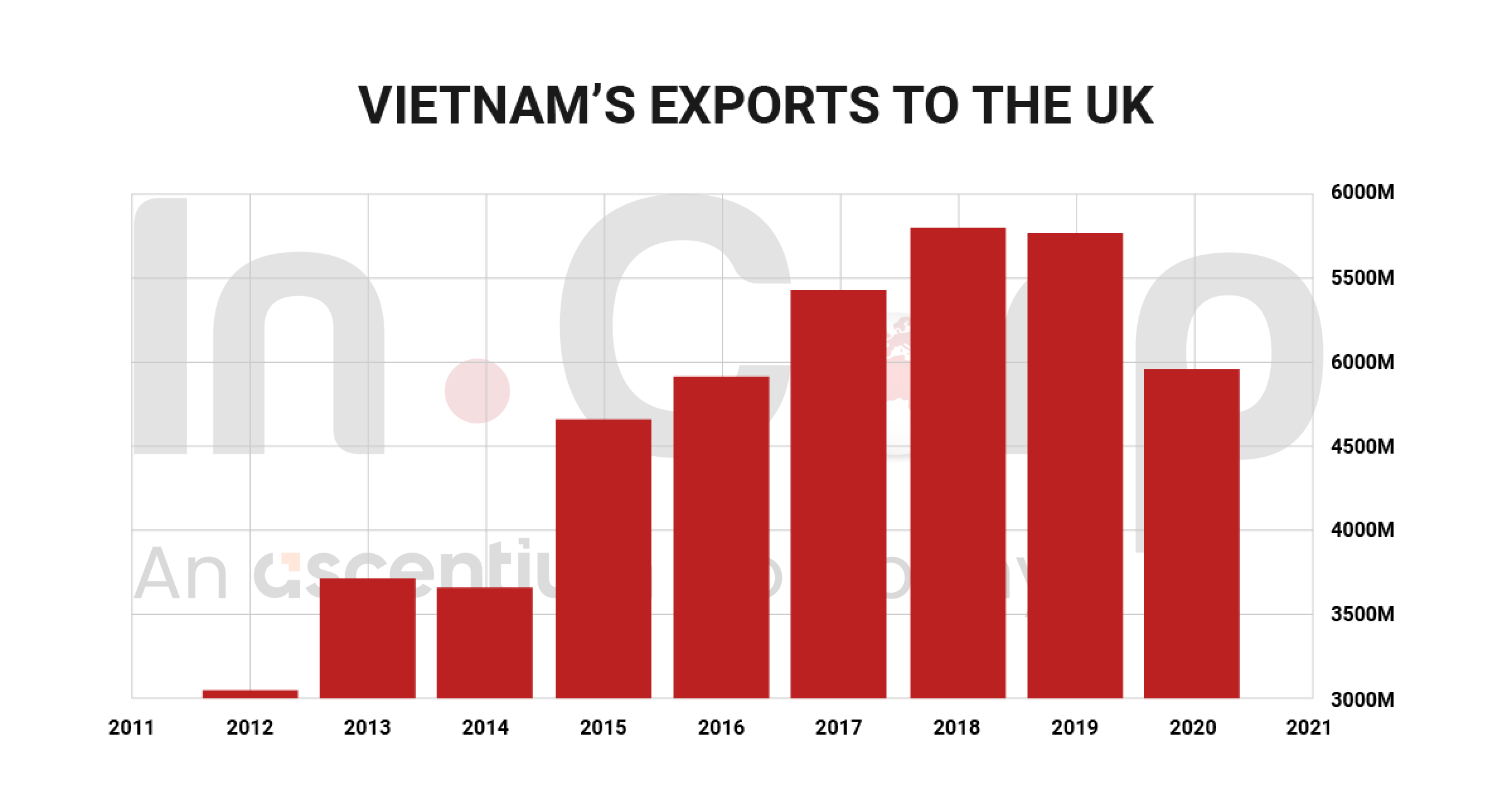

UK – Vietnam Free Trade Agreement (UKVFTA)

Between 2011 and 2020, commerce between the UK and Vietnam increased twofold, illustrating a strong bilateral economic partnership and a strategic commitment to international trade. The UK-Vietnam FTA (UKVFTA) not only aims at fostering exchange between the countries but also contains chapters on government procurement, state-owned enterprises, and market competition.

For goods exported by the UK to Vietnam:

- 48.5% of tariff lines were removed on 01 January 2021;

- 91.8% of tariff lines will be removed by 01 January 2027;

- 98.3% of tariff lines will be removed on 01 January 2029;

- 1.7% of tariff lines are partially liberalized through tariff-rate quotas or not entitled to special treatment

For goods imported from Vietnam into the UK:

- 85.6% of tariff lines were removed on 01 January 2021;

- 99.2% of tariff lines will be removed by 01 January 2027;

- 0.8% of tariff lines are partially liberalized through tariff-rate quotas

The agreement also put adequate focus on market liberalization for goods, services, and investments. Moreover, there are commitments relating to sustainable development, labor welfare, and social responsibility.

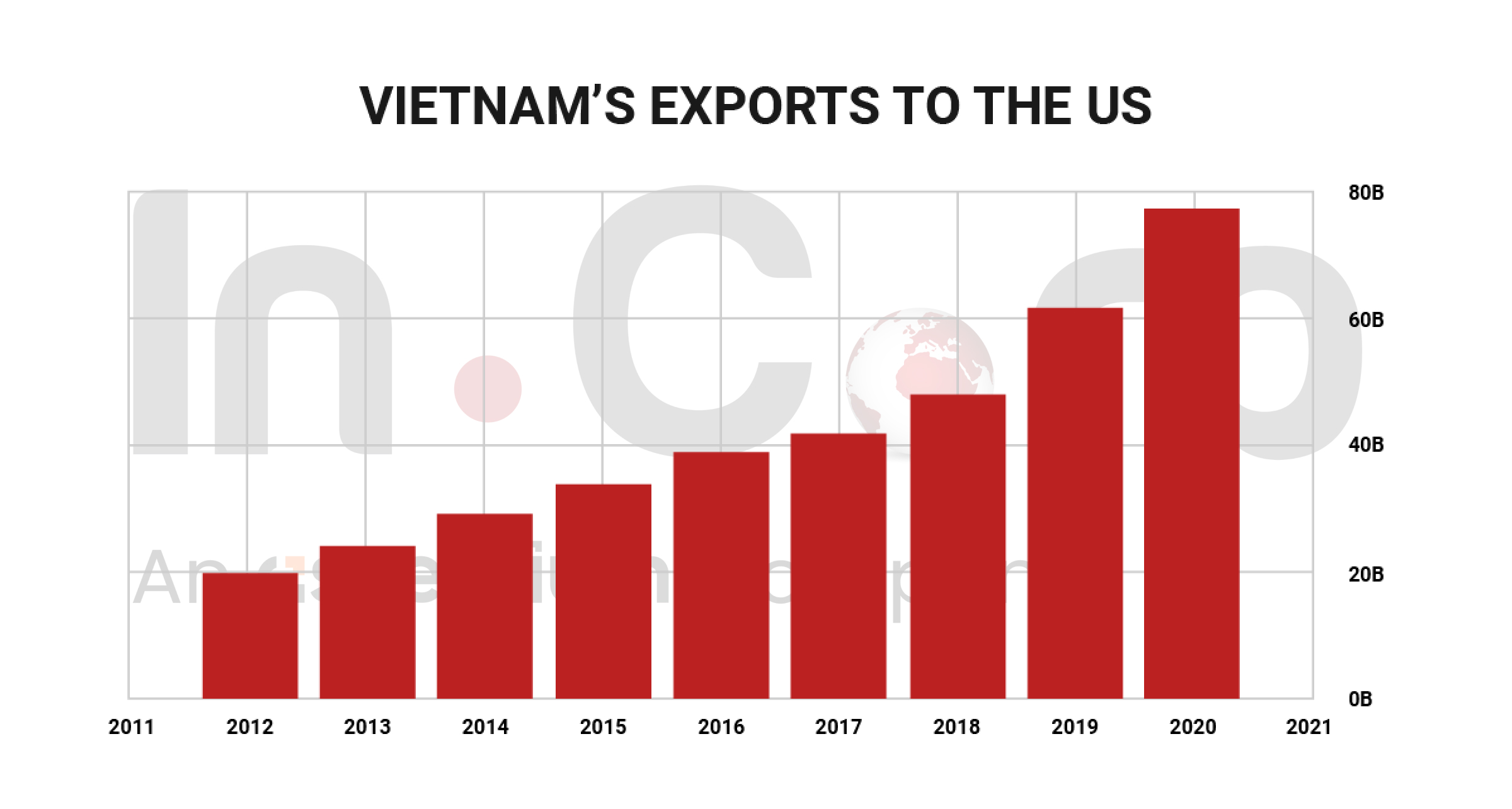

U.S. – Vietnam Bilateral Trade Agreement (BTA)

In 2020, the trade of goods and services between the US and Vietnam registered US$92.2 billion (estimated), out of which US exports to Vietnam clocked US$12.1 billion, whereas imports to the US accounted for US$80.1 billion.

The U.S.-Vietnam Bilateral Trade Agreement (BTA) was put into effect to promote freedom to do business and develop across the two countries. The FTA is a thorough pact that addresses issues including commerce in products and services, security of investments, copyright compliance for intellectual property, and incentivization for doing business.

Read Related: Vietnam has Some of the Lowest Operating Costs in Asia

When Vietnam became a member of the World Trade Organization (WTO) in 2007, the tariff rates significantly dropped and continued to decrease steadily over the years. Hence, the majority of the exports to the US are only liable for tariffs of 15% or less.

ASEAN Free Trade Area (AFTA)

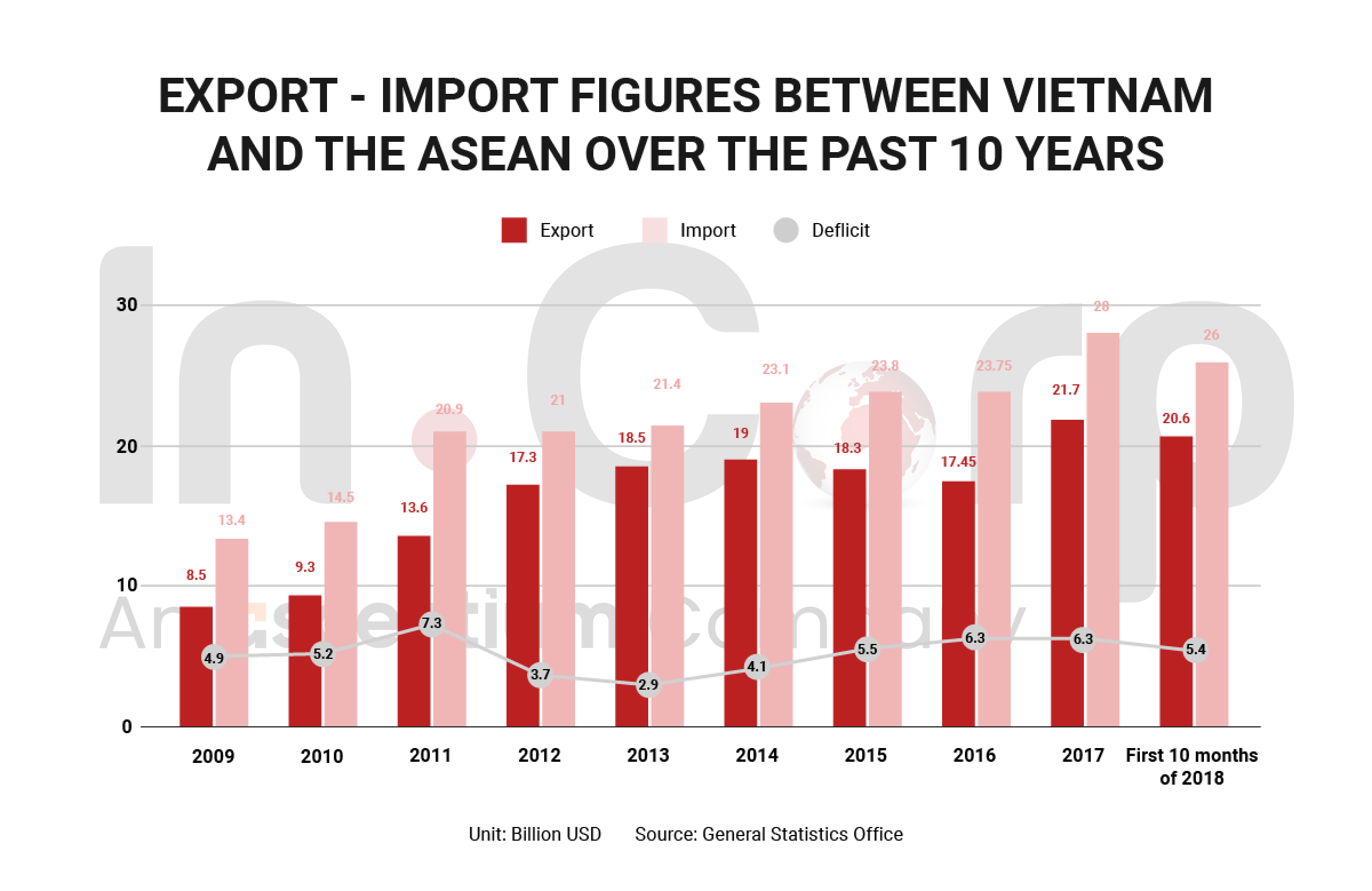

Incepted to boost local trade and manufacturing in all ASEAN countries, the ASEAN Free Trade Area (AFTA) is recognized as one of the world’s most significant free trade areas. Moreover, it influenced some of the world’s largest trade forums and blocs, including the Regional Comprehensive Economic Partnership, Asia-Pacific Economic Cooperation, and East Asia Summit.

AFTA currently consists of the following ten countries:

- Brunei

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand.

- Vietnam

- Laos

- Myanmar

- Cambodia

AFTA is committed to transforming ASEAN into an international production hub by eliminating tariffs and non-tariff barriers. For instance:

- The removal of import tariffs on at least 80% of tariff lines;

- The e-ASEAN Framework Agreement defines all information and communications technology (ICT) items as exempt from import taxes.

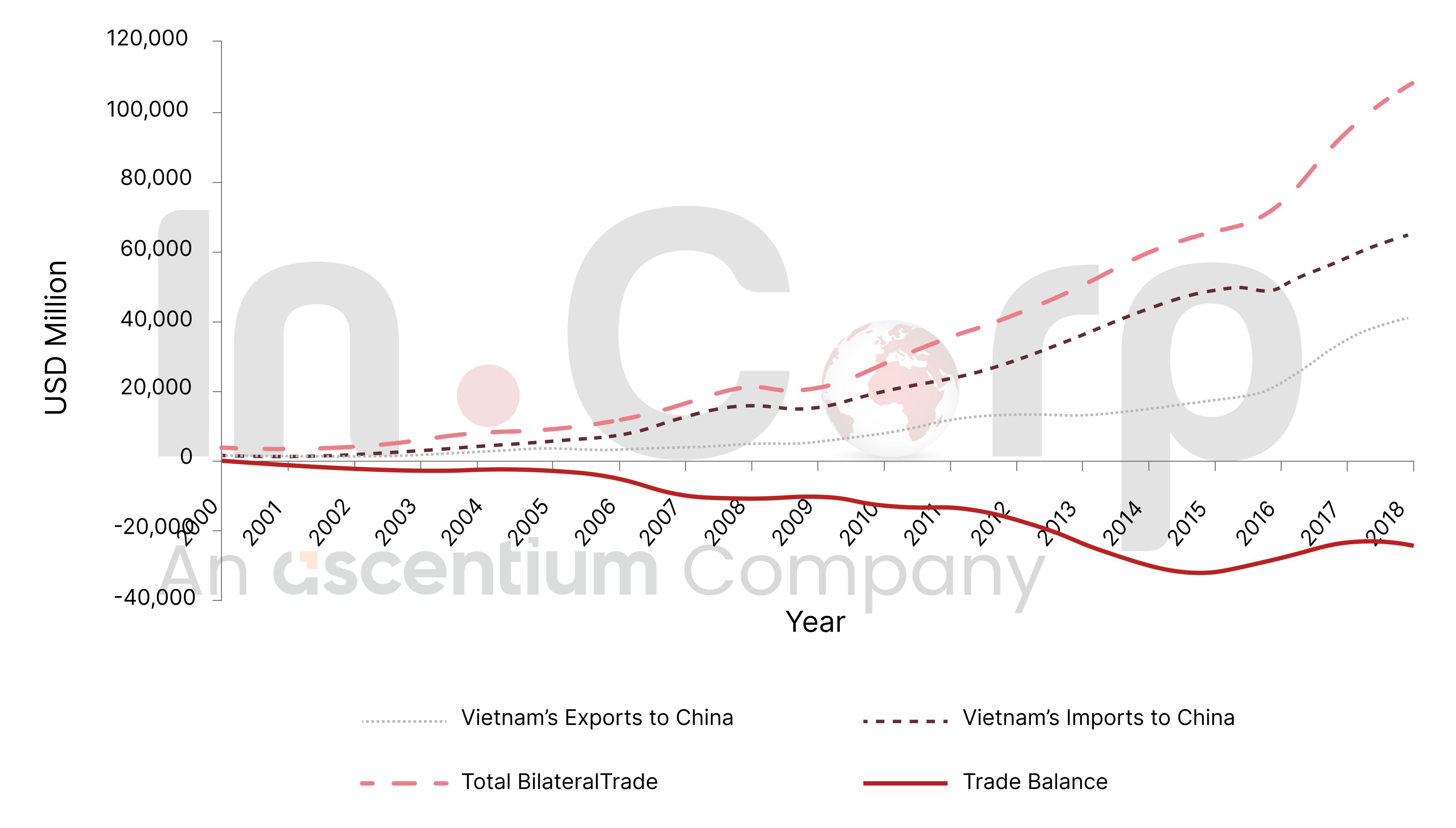

ASEAN – China Free Trade Area (ACFTA)

China exported US$104 billion worth of products to Vietnam in 2020, which consisted primarily of telephones, integrated circuits, and pure cotton yarn. Vietnam imported US$49.4 billion worth of products from China in 2020.

In the year 2000, Leaders of ASEAN and China came together to explore the possibilities of facilitating deeper economic integration within the regions. In the following year, the idea of establishing the ASEAN–China Free Trade Area was endorsed.

Between 2003 and 2008, China experienced a significant increase in trade with ASEAN countries, with trade volume growing from US$59.6 billion to US$192.5 billion. Additionally, in 2008, the collective nominal gross GDP of China and ASEAN countries totaled around US$6 trillion. Two years later, in 2010, Chinese goods sold in ASEAN countries saw their average tariff rates drop from 12.8% to 0.6%, and simultaneously, the tariffs on ASEAN goods sold in China decreased from 9.8% to 0.1%.

Eventually, the ASEAN–China Free Trade Area transformed into the largest free trade area in terms of population covered and 3rd largest in terms of nominal GDP. In 2015, ASEAN’s total merchandise trade with China registered an impressive US$346.5 billion.

ASEAN – Australia – New Zealand Free Trade Area (AANZFTA)

Envisaged to create new opportunities for investors in ASEAN, Australia, and New Zealand, AANZFTA was formed. It is a comprehensive free trade agreement that aims for sustainable economic growth between the two blocks by adopting a transparent and facilitative investment regime. Vietnamese exports to Australia reached US$3.62 billion before the onset of the COVID-19 pandemic, according to United Nations figures. On the other hand, exports from Australia to Vietnam clocked US$6.23 billion in the first seven months of 2022.

As a consequence of the AANZFTA, one can anticipate the following:

- Tariffs will progressively decrease and eventually be eliminated for a minimum of 90% of all tariff lines;

- Enable seamless movement of goods using advanced and flexible rules of origin, streamlined procedures, and more transparent mechanisms;

- Gradually remove barriers to service trade, thus granting service providers in the region improved market access;

- Protecting the interest of investors.

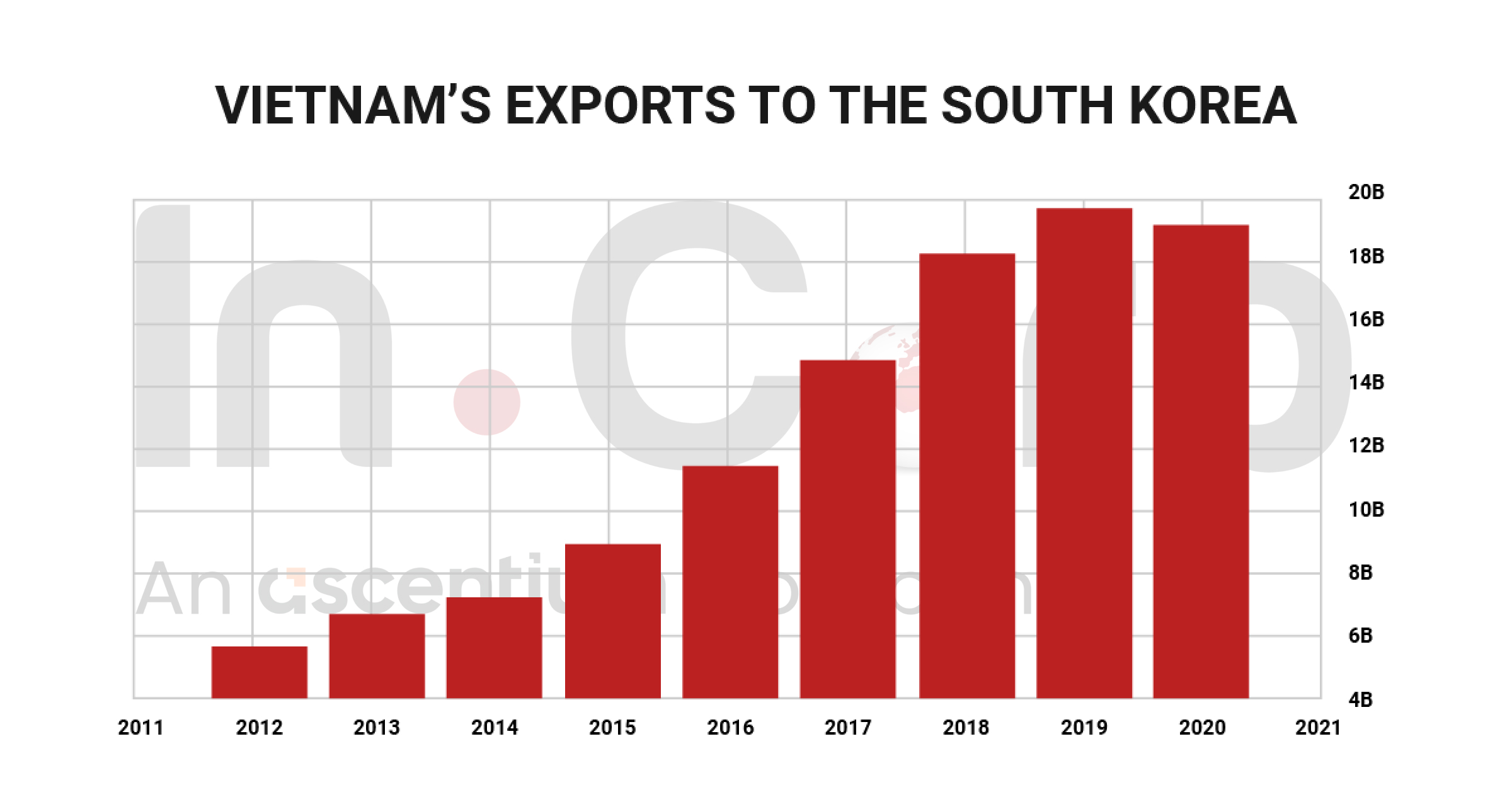

Vietnam – South Korea Free Trade Agreement (VKFTA)

The Vietnam-Korea Free Trade Agreement (VKFTA), established to boost bilateral commerce, expanding investment options, and encouraging economic growth, came into force in 2015. Korea has since swiftly risen to the top of foreign investors in Vietnam.

According to the deal, Vietnam will remove 90% of the tariff lines on items imported from South Korea, and South Korea will remove 95% of the tariff lines for Vietnam. The agreement also addresses matters including the two nations’ respective approaches to competition law, intellectual property rights, and environmental regulations.

South Korea agreed to import around 500 extra products from Vietnam after the agreement went into force. Additionally, it would lower import taxes on goods including tropical fruits, shrimp, fish, crab, clothing and textiles, and timber goods.

Furthermore, as Vietnam currently hosts close to 3,000 Korean enterprises, the implementation of the VKFTA would contribute to the creation of 400,000+ employment prospects in the nation.

Vietnam – Japan Economic Partnership Agreement (VJEPA)

Before the pandemic, Japan’s exports to Vietnam stood at US$19.11 billion, whereas exports from Vietnam to Japan were US$21.2 billion. Exports to Vietnam mainly consisted of insulated wire, broadcasting equipment, and fuelwood.

To further strengthen the trading sector and enhance the business environment within the regions, both parties activated the Vietnam-Japan Economic Partnership Agreement (VJEPA) in 2009. As per the agreement, Vietnam will strive to eliminate 90.64% of the tariff lines.

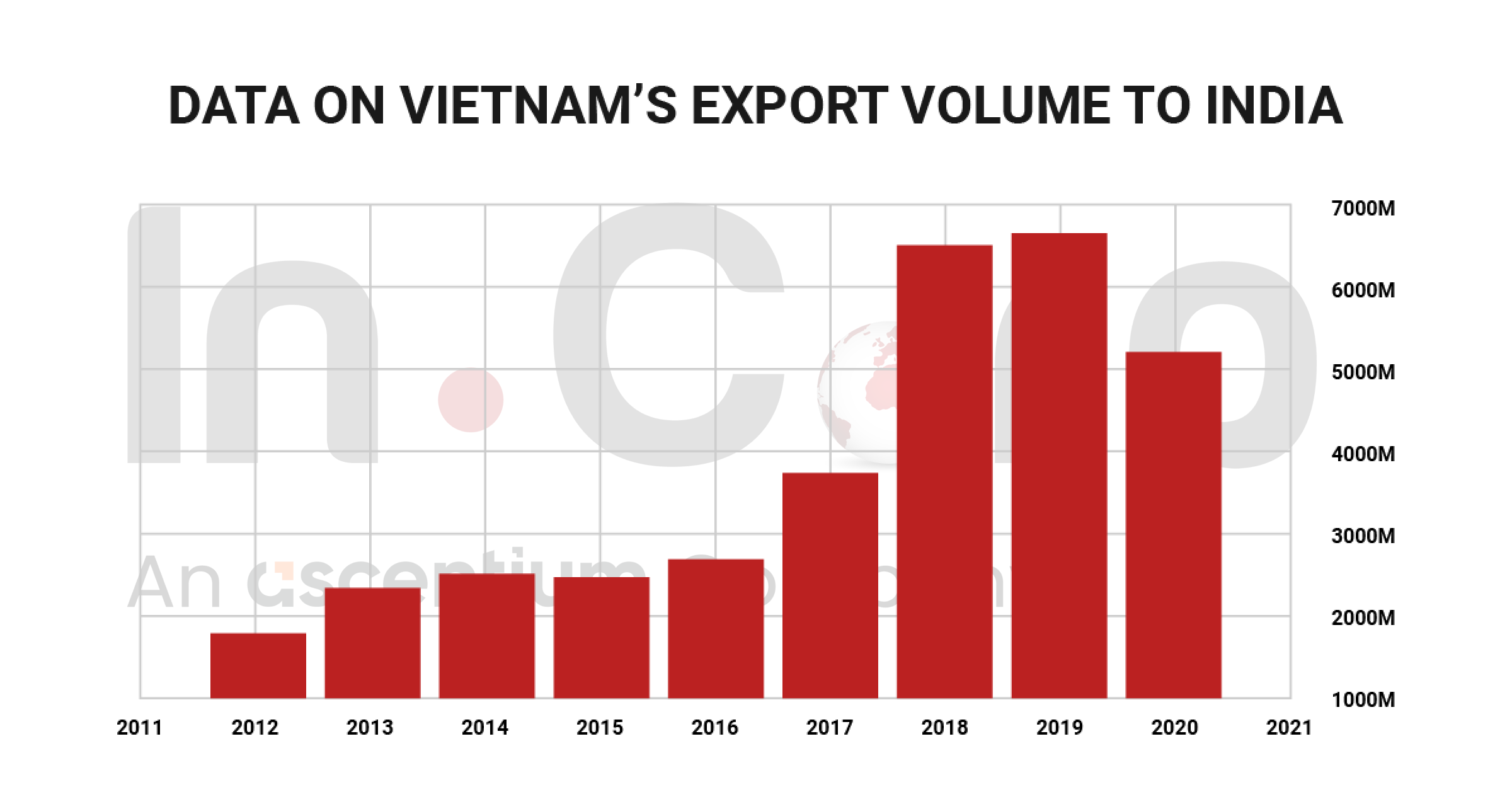

Vietnam – India under ASEAN (AIFTA)

In 2003, the Leaders of ASEAN and India signed the ASEAN-India Framework Agreement on Comprehensive Economic Cooperation. The agreement also laid a solid foundation for establishing the ASEAN-India Regional Trade and Investment Area (RTIA).

According to WTO center, ASEAN and India signed the ASEAN-India Trade in Goods (TIG) Agreement in 2009, which paved the way for creating one of the world’s largest FTAs. The agreement covers approximately 1.8 billion people with a combined GDP of US$2.8 trillion. With the agreement in effect, both trading blocks shall agree to deliver on the following terms:

- Tariff liberalization of over 90% of products traded between the two Asian nations

- Elimination of tariffs on over 4,000 product lines

Vietnam – Eurasian Economic Union (VN-EAEU FTA)

Vietnamese enterprises now have access to a market of 181,000,000 new customers in Eurasia due to the ratification of the Free Trade Agreement between Vietnam and the Eurasian Economic Union (EAEU), which consists of Russia, Armenia, Belarus, Kazakhstan, and Kyrgyzstan.

According to data from the General Department of Customs, Vietnam exported US$323.26 million worth of agricultural, forestry, and fishery products to the Russian market in the first seven months of 2021, an increase of 34.2% over last year. Additionally, according to the WTO, the export turnover for aquatic products, as well as agricultural products, grew by more than 50% over the same period last year.

On the other hand, in 2020, Russia exported coal briquettes, hot-rolled iron, and pork meat worth US$1.78 billion to Vietnam.

Vietnam intends to open the market for around 90% of its total tariff lines as part of its 10-year reduction plan. The VN-EAEU FTA requires both trading blocs to agree to the following conditions for delivery:

- After three to five years since the EIF, the EAEU has eliminated tariffs on goods that it prioritized upon their entry into force, such as agricultural commodities.

- Processed meat and fish, electrical equipment, and agricultural machinery have all seen the removal of tariffs within three to five years since the EIF.

- On the other hand, they eliminated chicken and pork tariffs five years after the EIF.

- Elimination of tariffs on automobiles and alcoholic beverages ten years after the EIF

Regional Comprehensive Economic Partnership (RCEP)

The Regional Comprehensive Economic Partnership (RCEP) is the name of a recently established free trade agreement that involves countries such as Australia, Brunei, Cambodia, China, Indonesia, Japan, South Korea, Laos, Malaysia, Myanmar, New Zealand, the Philippines, Singapore, Thailand, and Vietnam. China had a major role in negotiating this deal, which went into force on January 1st, 2022. It is regarded as the largest FTA in the world because it includes approximately 30% of the world’s population.

Concerning Vietnam, experts anticipate that RCEP will substantially boost the agricultural industry by simplifying access to the Chinese market, one of the world’s largest consumer markets, and reducing tariffs. However, because this agreement became effective just three months before the publication of this article, we currently have limited data to evaluate the actual outcomes of the FTA.

Vietnam – Cuba Trade Agreement

Vietnam and Cuba have had close relations for some time now as old communist partners. Signed in 2018, the Vietnam-Cuba Trade Agreement includes a big focus on regulations on rules of origin, trade in goods, trade defense, and technical regulations.

According to the agreement, both sides have initiated the process of eliminating or reducing taxes for all products imported from each other’s respective markets.

Vietnam – Chile Free Trade Agreement (VCFTA)

Vietnam and Chile signed a Free Trade Agreement (FTA) in 2011 under the auspices of the Asia-Pacific Economic Cooperation (APEC) conference.

The two nations will gain the following advantages from the deal.

- While the remaining products will profit from the FTA, 73% of Chilean exports will gain from tariff-free access to Vietnam. Only 4% of products will be exempt, though.

- Additionally, 75% of Vietnam’s exports would be able to enter Chile duty-free, and the remaining 25% would receive tax breaks for a period of 6 to 11 years.

ASEAN – Hong Kong, China Free Trade Agreement (AHKFTA)

The ASEAN – Hong Kong – China Free Trade Agreement (AHKFTA) took effect on June 11, 2019, for Vietnam, Laos, Myanmar, Singapore, and Thailand. The main goal is to encourage the development of the economy, boost trade and investment, and create stronger economic connections between Hong Kong and the ASEAN nations.

The agreement, signed to lower taxation, improve economic collaboration, and increase investment between Hong Kong and the regional markets in the ASEAN zones, builds upon the already solid economic foundation between the two parties. The aim of Hong Kong to increase its business possibilities in Vietnam will also help compensate for the escalating US-China trade war.

Vietnam–Israel Free Trade Agreement (VIFTA)

The Vietnam-Israel Free Trade Agreement (VIFTA), initiated in December 2015 and officially signed on July 25, 2023, is a significant development in the economic relationship between Vietnam and Israel. VIFTA aims to boost bilateral trade by reducing or eliminating tariffs on a wide range of goods, offering businesses improved market access. It fosters economic growth, job creation, and stability in both countries. The agreement also includes provisions for intellectual property protection and investment promotion. VIFTA reflects the growing strategic partnership between the two nations, signifies Israel’s interest in Southeast Asia, and highlights the value of regional cooperation and global supply chain integration.

Vietnam – UAE under the Comprehensive Economic Partnership Agreement (CEPA)

On October 28, 2024, Vietnam and the UAE formalized a landmark trade deal with Prime Minister Pham Minh Chinh and UAE Vice President and Prime Minister Sheikh Mohammed bin Rashid Al Maktoum presiding over the signing of the Comprehensive Economic Partnership Agreement (CEPA). This historic agreement represents Vietnam’s first Free Trade Agreement (FTA) with an Arab country, creating a foundation for substantial bilateral collaboration in trade, investment, and economic growth. The CEPA is expected to open new avenues for Vietnam to access and expand within the dynamic Middle Eastern market, fostering mutual economic development.

Under the CEPA, the UAE has committed to immediately eliminating tariffs on a wide array of Vietnamese exports as soon as the agreement comes into effect. This key provision will support Vietnam’s export growth in sectors where it holds a competitive advantage, easing market entry to the UAE and facilitating subsequent expansion across other Middle Eastern markets. Nearly all of Vietnam’s export-advantaged products will benefit from improved market access, thus strengthening the country’s trade position in the region and creating promising growth opportunities for Vietnamese enterprises.

Upcoming Free Trade Agreements

As of October 2024, Vietnam has signed and implemented 17 FTAs and is negotiating two additional agreements, demonstrating its dedication to global integration. Through ASEAN, Vietnam has been part of discussions for three active FTAs and has proposed eight more for future negotiation, including with Israel, Pakistan, and Ukraine. Should these plans proceed, Vietnam will have a total of 27 FTAs, significantly boosting its engagement in global value chains, expanding export potential, supporting GDP growth, and reinforcing its regulatory framework.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly