As healthcare spending in Vietnam increased over the years, the need for medical devices compliance has grown. By 2030, Vietnam’s healthcare expenditure will reach US$33.8 billion, up from US$16.1 billion in 2017. In 2025 itself, the forecasted spending is US$23.3 billion. Earlier, the World Bank had predicted that the Vietnamese healthcare market will increase threefold in the 2010–2020 decade, which is visible in the way it has outperformed countries like Thailand and Malaysia.

However, the healthcare scene in the country is plagued by a lack of adequate medical tools, a fact most medical equipment distribution companies acknowledge. This is especially true for outdated surgical equipment. Although the health-related issues of the Vietnamese population have boosted medical spending, still a lot of investment is needed, especially in importing new equipment.

In this article, we have given a thorough insight on how medical device compliance is done in the country, including the classification and registration of the devices. On top of that, we will update with you the most important key considerations when investors need to pay attention when importing their medical devices into Vietnam. InCorp Vietnam helps medical equipment manufacturers acquire the necessary registration for their devices as per Vietnamese regulations.

Need Assistance? Learn About InCorp Vietnam’s Medical Device Registration Services

Definition of Medical Equipment

As per Vietnamese government circulars, medical equipment or medical device is defined as software, diagnostic chemicals, materials, and tools that can be used in combination or separately for the purposes such as supporting or modifying surgical or physiological processes, checking or replacing surgical processes, disinfection of equipment, and etc.

In Vietnamese medical devices compliance, the term “medical equipment/device” has a broad application. It can be any tool that is used to diagnose, treat, prevent or mitigate disease or abnormal health conditions. This differentiates medicines from medical devices. This is in line with how the World Health Organization’s Global Harmonization Task Force (GHTF) defines medical devices. As such, medical equipment distribution companies in Vietnam supply three types of devices:

- Simple devices like stethoscopes, thermometers, and bandages.

- Intermediate devices like nebulisers, blood glucose meters, and hearing aids.

- Complex devices like surgical robots, pacemakers, and MRI scanners.

Some of the most well-known medical equipments in Vietnam are Vinamed JSC, Ho Chi Minh City Medical Technical Services JSC, J&V Medical Instrument JSC.

Medical Equipment Classification

The ASEAN Medical Device Directive (AMBDD) and the Global Harmonization Task Force of WHO classify medical equipment in the following categories, which are also followed by the Vietnamese government.

- Class A: These are low-risk medical equipment like hospital beds, surgical gloves, cotton, bandages, etc. Medical equipment manufacturers need not bother about licenses to supply these.

- Class B: Low-moderate-risk medical devices like electronic thermometers, pregnancy kits, breathing masks, etc. fall under this category.

- Class C: This includes high-moderate-risk medical equipment like implants, electric scalpels, condoms, etc.

- Class D: This category is reserved for high-risk medical devices like artificial bones, surgical kits, antibacterial gauze, etc. Medical equipment distribution companies need to have a license to manufacture and sell these products, as they require quality control and precision along with highly trained personnel diligently following certified processes.

In Vietnam, medical devices are also classified as per the Food and Drug Administration (FDA) guidelines. This includes the following three categories of medical equipment:

- Class I : These are common, low-risk, and low-complexity equipment like hand-held surgical instruments, examination gloves, elastic bandages, dental floss, etc.

- Class II: This category includes partially implanted more risk to patients complex devices like powered wheelchairs, infusion pumps, syringes, computed tomography scanners, etc.

- Class III: Fully implanted, greater-risk medical devices like blood sampling monitors, breast implants, defibrillators, and pacemakers come under this category.

The Vietnam Medical Equipment Association recommends that foreign investors looking to set up medical companies follow Annex 1 of Circular 30/2015/TT-BYT in addition to the above classification system.

While Class A and B medical devices are approved immediately, the review time for Class C and D equipment takes more than a year at times. Foreign companies also need to keep in mind the license fee for each class of medical devices.

- VND 1 million or US$40 for Class A instruments

- VND 3 million or US$120 for Class B instruments

- VND 6 million or US$240 for Class C instruments

- VND 6 million or US$240 for Class D instruments

Read More: Mastering Medical Device Registration: Your Key to Success in Vietnam

Medical Equipment Registration in Vietnam

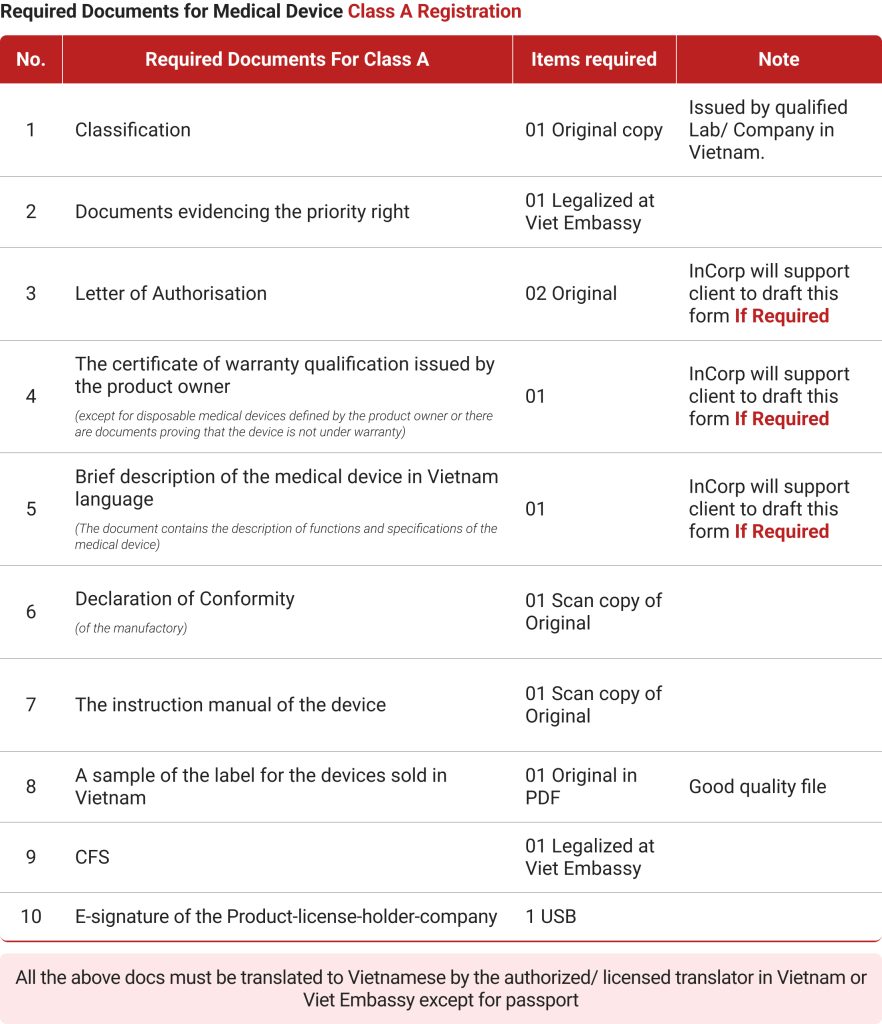

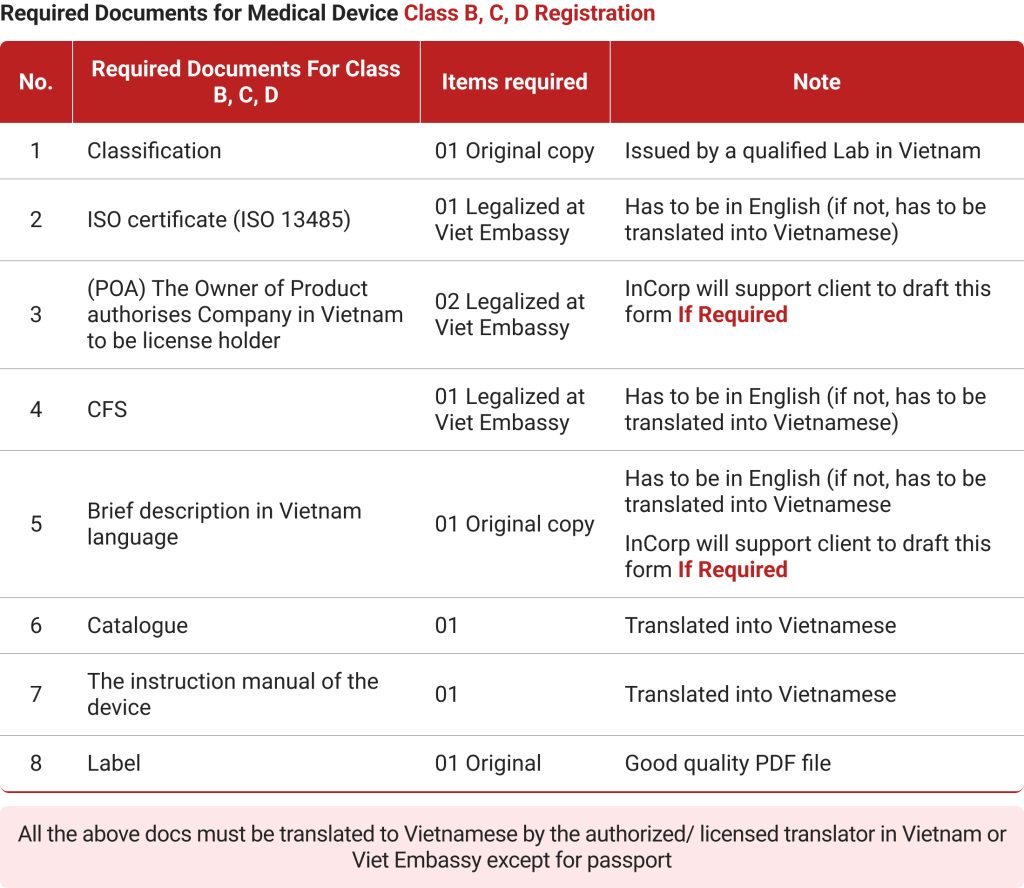

Vietnamese regulations mandate that medical devices compliance follow different registration procedures for different classes of equipment. As per the Ministry of Health’s Department of Medical Equipment and Health Works (DMEHW), all medical equipment distribution companies need to abide by strict criteria to get a license to sell their products.

For Class A and B instruments, medical equipment manufacturers must submit the “Declaration of Applied Standard” to the nearest branch of the Health Department, which will authorize them to sell the product for 1-3 months by providing a marketing authorization code (MAC). Meanwhile, for Class C and D instruments, a Declaration of Applied Standard should be submitted at the local health department, which will grant you a MAC code to sell the products for 6–12 months, with a provision to extend it to 18 months.

Foreign companies should take note of the quick registration and emergency registration procedure of Class C and D medical devices, which grants you approval in 10 days instead of the regular 45-day wait. The quick method applies to equipment with authorization from the US FDA, Medical Devices Agency of Japan, Health Canada, Therapeutic Goods Administration of Australia, UK or Chinese state agency, etc., along with a license to import to Vietnam. Meanwhile, the emergency method is applicable for products meant for epidemic prevention or those used to contain disease outbreaks in natural disasters as authorized by the WHO or EU Health Security Committee.

7 Key Considerations When Importing Medical Devices in Vietnam

1. Timeline Matters When Importing Different Types of Medical Devices

Investors planning to enter Vietnam’s medical device market must factor in regulatory timelines as a critical consideration. While Type A and B devices like blood pressure or glucose monitors can be self-declared and approved in as little as one month, Type C and D devices involve a far more complex and prolonged process. These higher-risk products require full registration and government approval, which can take up to 2 years.

Costs are also significantly higher often double that of Type A and B devices, excluding government fees. Extended delays are common due to the need for supplemental documentation and opaque rejection reasons. Understanding these timelines early is essential for planning market entry and managing investor expectations.

Download Now: The Medical Devices Infographic For Further Understanding.

2. Certificate of Free Sale(CFS) As A Key Paper To Obtain Before Importing

One of the most critical documents in the registration process is the Certificate of Free Sale (CFS). For Vietnam’s authorities, the CFS not only confirms that the medical device is legally marketed in the country of origin but also demonstrates the product’s safety and quality. A valid CFS enhances the credibility of the device by proving that it has undergone regulatory evaluation and is in active use in its home market. For investors, securing a CFS is not just a procedural requirement.

Instead, it is a mandatory condition for import approval and a key foundation for product classification. Without it, or with discrepancies in the stated purpose, businesses risk rejection or even recall of imported goods. Understanding the role of the CFS is essential to ensuring smooth market access and avoiding regulatory pitfalls.

3. Importers Bear Full Responsibility for Medical Device Classification

Under Decree 98/2021, the responsibility for classifying medical devices now lies directly with the importing company. While this gives businesses more autonomy, it also introduces substantial risk—many companies lack the technical expertise to accurately determine the correct classification, which in Vietnam is primarily based on the intended use of the product and supported by documents like the Certificate of Free Sale (CFS). Incorrect classification can lead to serious consequences, including the revocation of all imported goods. As such, it is crucial that importing companies thoroughly understand their products and seek guidance from regulatory experts to ensure compliance from the outset.

4. The Exact Match between information of the product on the product label and when product is disclosed

Importers must ensure that the information on the medical device label matches exactly what was disclosed during product registration. According to Decree 98/2021, once a product is declared, the imported product must reflect that identical information. Any inconsistency between the label and the registered details can lead to regulatory issues unless the change has been properly re-declared. This includes changes in product classification, intended use, manufacturing site, or even the product code listed in the Certificate of Free Sale (CFS).

In such cases, the importer must undergo a new product declaration process, which may significantly delay import timelines. To avoid disruption, businesses should verify that labeling and registration data are fully aligned before importing.

5. Local Presence and Licensing Are Necessary for Import and Distribution

One of the most critical concerns for foreign medical device manufacturers is meeting Vietnam’s strict import and distribution requirements. To comply with local regulations, companies must first secure a Marketing Authorization (MA) license, either through a Representative Office (RO) or by partnering with a licensed Vietnamese distributor. Without a local legal presence, foreign firms cannot import or sell devices independently. Furthermore, Decree 98 mandates that any medical device without a registration number must obtain an import license, covering everything from diagnostic tools to devices used in training, research, and even exhibitions.

Read Related: Required Documents of Representative Office in Vietnam

6. Stricter Product Audit and Inspection

In Vietnam, the audit and inspection of products are primarily conducted by several government agencies, depending on the type of product and industry. Key authorities include:

1. Ministry of Health (MOH)/Department of Health in Ho Chi Minh City: Responsible for food safety and health-related products, conducting inspections to ensure public health standards.

2. General Department of Quality Supervision: Engages in quality control and market surveillance.

How the audit mechanism works?

- Risk-Based Approach: Inspections are often based on risk assessments, focusing on products with higher potential for non-compliance + double check legal documents of the products.

- Regular Inspections: Routine audits may occur annually or biannually, depending on the product category and previous compliance records.

- Surprise Inspections: Authorities can conduct unannounced inspections to ensure ongoing compliance.

- Sampling and Testing: Products may be sampled for quality and safety testing, especially in the food and health sectors.

The frequency of audits varies by product type. High-risk products may be inspected more frequently (e.g., quarterly), while lower-risk items might only be audited once a year.

In June 2025, due to hot issues in non-compliance and fake products in the market, the inspection may happen more often and serious than its usual. In this situation, please make sure that the VN company keeps sufficient documents and records of the registered products.

Medical Equipment Purchasers

Foreign medical equipment manufacturers should keep in mind the following categories of buyers to avoid any medical device compliance issues. In Vietnam, there are essentially four types of medical equipment purchasers:

- Government hospitals, clinics and health centers: Around 70% of the medical equipment used in Vietnam is purchased by public hospitals and healthcare facilities. Foreign companies can sell their products in these centers if they tie up with a local partner.

- Private hospitals.

- Foreign-owned hospitals and clinics.

- Research institutes.

Common Risks for Medical Devices Investors

One recurring issue faced by our clients entering the Vietnamese medical device market is incomplete or improperly prepared documentation during product classification. Many foreign investors overlook the importance of aligning document preparation with both Vietnamese regulatory requirements and the appropriate risk classification (A, B, C, or D). Even minor errors such as missing details or outdated certificates can result in lengthy delays in the authorization process.

A common pitfall is the submission of documents where ISO certifications have expired in the home country, leading to compliance rejections. Furthermore, high-risk devices (Class C and D) are subject to stricter scrutiny and may require clinical trials on humans to validate safety before approval. If documentation is not properly legalized or translated, it can extend the registration process by up to a year. These challenges highlight the need for thorough preparation and consultation before attempting product registration in Vietnam.

Download Now: The Full PDF Guide For The Medical Devices Registration in Vietnam

How can InCorp Vietnam Assist?

Looking to launch your medical devices in Vietnam? InCorp Vietnam is your trusted partner for seamless market entry and compliance. Our team of seasoned legal professionals stays abreast of the country’s evolving medical device regulations, ensuring your products meet all compliance requirements. We handle everything from device classification to securing marketing authorizations, allowing you to focus on your core business.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What are the most common compliance issues faced by foreign medical device companies entering Vietnam?

- Foreign companies often face challenges in documentation, such as incorrect product classification, missing legalizations, or expired certificates (e.g., ISO). These errors can delay or reject applications for product registration or import licenses, especially for high-risk Class C and D devices that may require clinical trials in Vietnam.

How are medical devices regulated in Vietnam?

- Medical Device regulation in Vietnam is administered by the IMDA (Infrastructure and Medical Device Administration) (in January 2025 the MOH changed the name from DMEC to IMDA) under the Ministry of Health (MOH). Medical Device registration requirements in Vietnam are currently in a state of transition.

Do all medical devices require import licenses or registration?

- No, not all devices require import licenses. Vietnam classifies medical devices into Classes A to D based on risk. While Class A and some Class B products may enjoy simplified procedures, Class C and D devices typically require full registration, product dossiers, and sometimes clinical evaluation.