Vietnam’s economy and strategic location have made Mergers and Acquisitions in Vietnam increasingly attractive. After surging through 2020–2021, deal values dipped in 2022–2023 but are rebounding as supply-chain shifts and trade tensions drive foreign interest. According to KPMG, 2021 saw a record USD 10.8 billion in deal value, while 2022 was projected at about $6.8 billion.

The first 10 months of 2023 recorded 265 transactions totaling $4.4 billion, and the first 10 months of 2025 saw 218 deals worth $2.3 billion. Despite a regional slowdown, Vietnam’s Mergers and Acquisitions market has been a bright spot – deal value in 9M2024 was up nearly 46% year-on-year. Notably, large domestic megadeals have driven recent growth: e.g. two Vingroup transactions (~$1.4B combined) accounted for about half of disclosed deal value in 9M2024.

- Deal flow and value trends: Mergers and Acquisitions in Vietnam saw peak activity in 2021, a correction in 2022, then mixed results through 2023–24. KPMG analysis shows a jump in deal value in early 2024 (+45.9% YoY in 9M) despite slightly fewer transactions. Average disclosed deal size has fluctuated (about $32M in 2023 vs $56M in 9M2024).

- Sector breakdown: Key sectors have included real estate, finance, and industry. For example, in early 2023 real estate & construction had 18 deals (USD 564M) and financial services 10 deals (USD 1.8B). Healthcare Mergers and Acquisitions jumped (6 deals, USD 468M, +1460% YoY). Energy and consumer sectors also saw activity, with renewable power projects and retail assets attracting investors.

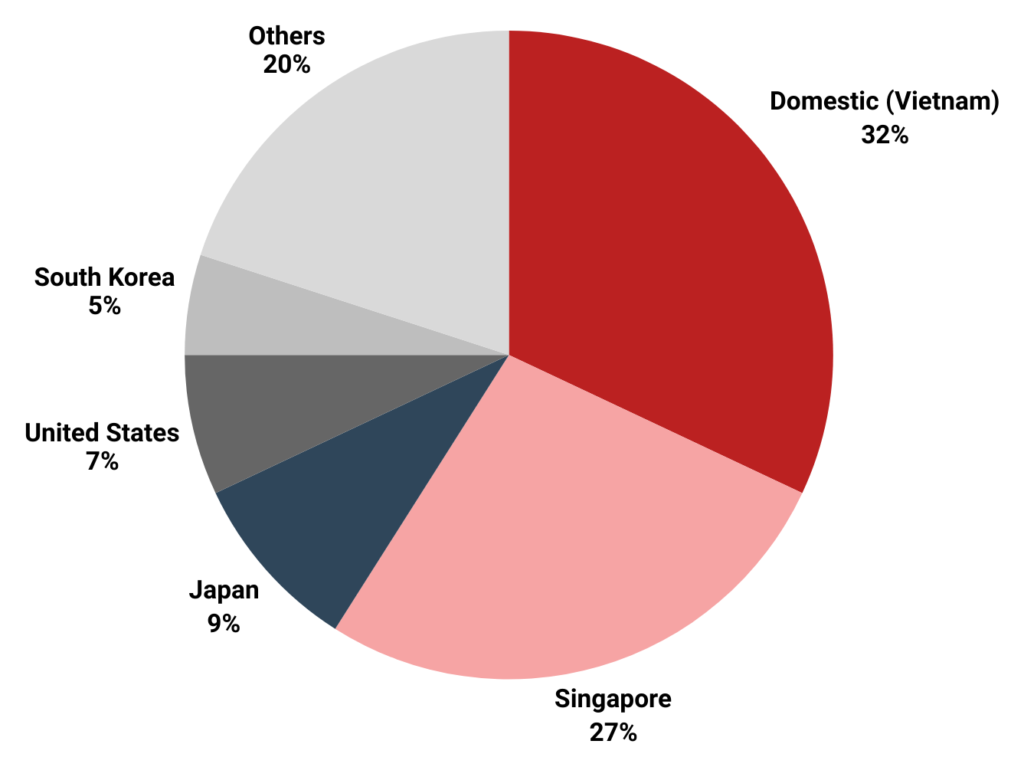

- Foreign vs. domestic: Foreign investors have often led major deals. In 2023, Japan, Singapore and the U.S. topped the list of foreign acquirers. In 2025 domestic and regional players both stayed active: Singapore (27%), Japan (9%), the U.S. (7%) and Korea (5%) accounted for large portions of disclosed deal value. Overall, Vietnam’s Mergers and Acquisitions landscape is characterized by both local consolidation and cross-border interest, as companies seek growth and supply-chain resilience.

Notable Recent Transactions

Several high-profile Mergers and Acquisitions in Vietnam deals in 2023–2025 illustrate market dynamics:

- Residential Property: Japan’s Birch Real Estate acquired Eastern Real Estate (a Masterise subsidiary) in 2025 for $365 million. Other deals include Gateway Thu Thiem’s purchase of land in Ho Chi Minh City (42% stake for ~$99M) and UOA Vietnam’s $67.7M purchase of an office project.

- Banking & Finance: Siam Commercial Bank (Thailand) paid $851 million in 2024 for Home Credit Vietnam, a major consumer finance platform. Aeon (Japan) agreed to buy the Post & Telecommunication Finance arm from SeABank for $162 million. (CVC sold its 5% stake in Asia Commercial Bank for $220M in 2024, reflecting active financing around banks.)

- Consumer & Retail: U.S. private equity firm Bain Capital acquired a stake in Masan Group’s consumer unit for about $255 million. South Korea’s SK Investment bought Masan’s VinCommerce (retail arm) for $200M. In non-food retail, Singapore’s CDH fund bought a minority interest in Bach Hoa Xanh supermarkets.

- Industrial & Technology: Vietnam’s VinFast (automaker) purchased VinES Energy Solutions (battery storage) in 2024 for $440 million. Hyosung of Korea restructured its 49% stake in Hyosung Vina Chemicals for ~$277M. In tech R&D, Qualcomm acquired the AI research arm of VinAI in 2025 (extending chipmaker ties in Vietnam) and NVIDIA announced a major new AI R&D center in Ho Chi Minh City.

- Healthcare: U.S. firm Ares Management took a $150 million stake in Medlatec, Vietnam’s largest private healthcare system. KKR (USA) bought a majority stake in Medical Saigon (a leading eye hospital chain).

- Infrastructure: Swire Pacific (Hong Kong) completed its acquisition of Coca-Cola Beverages Vietnam’s bottling business (adding 3 plants and 6 distribution centers). Four investors (including real estate firms) bought 55% of the holding company behind Vincom Retail (shopping malls) in 2024.

These examples highlight that foreign capital (from Asia, Europe, and the U.S.) targets asset-backed sectors – real estate, industrial, healthcare – as well as consumer and tech platforms. The following table summarizes select large deals:e summarizes select large deals:

Table: Examples of notable M&A in Vietnam transactions (2024–2025).

Sector Highlights

Several sectors have seen major foreign-led deals:

- Real Estate & Construction: Vietnam’s booming housing and industrial land markets draw global investors. From 2014 onward, foreign developers (CapitaLand, Keppel, Mapletree, etc.) have acquired stakes in landmark projects. In 2022 the real estate Mergers and Acquisitions market hit record levels, with investors from Singapore, the U.S., Japan and Korea in the lead. In late 2025, real estate deals (like Birch/Eastern) accounted for over 25% of total deal value.

- Manufacturing & Industrials: As Vietnam becomes a supply-chain hub, strategic acquisitions have picked up. Auto-maker VinFast’s $440M purchase of its battery unit is a key example. Korean buyers remain active: e.g. Hyosung’s Vietnamese chemical JV restructuring (US$277M) and Hana Micron’s ownership moves in chip packaging. Industrial real estate (factories/warehouses) also attracts investors relocating from higher-cost countries.

- Financial Services and Fintech: Vietnam’s underbanked and fast-growing consumer credit market has drawn Asian banks and fintech firms. SCB’s takeover of Home Credit (second-largest consumer finance firm) for $851M underscores this trend. Regional acquirers like Aeon (for SeABank’s finance arm) and insurance groups (DB Insurance taking 75% stakes in local insurers) signal consolidation in financial services. Fintech is on the rise too, as digital banking and e-payments expand under supportive regulation.

- Healthcare: An aging population and rising income levels are driving foreign interest in Vietnam’s healthcare. Major private hospital chains and biotech ventures have seen inbound capital (KKR in eye hospitals, Ares in Medlatec, etc.). The government is gradually liberalizing for pharmaceuticals and clinics to improve capacity, making healthcare a key Mergers and Acquisitions focus.

- Technology & Services: High-tech sectors (AI, semiconductors, software) are emerging. Tech giants are engaging via R&D (NVIDIA center) and acquisitions (Qualcomm/VinAI). Additionally, consumer tech platforms (e-commerce, fintech) are likely Mergers and Acquisitions targets as domestic startups seek scale and foreign expertise.

Across these sectors, asset-backed and high-growth businesses command attention. After the COVID-19 slump, investors are particularly selective, favoring deals with clear value and exit paths. As of late 2025, real estate, materials (chemicals, packaging) and healthcare together made up over half of deal value, reflecting this focus.

Regulatory Environment for Foreign Mergers and Acquisitions

The legal framework for Mergers and Acquisitions in Vietnam is defined by the Enterprise Law, Investment Law, Competition Law and Securities Law. Foreign investors can acquire stakes or establish entities, but must observe various rules:

- Foreign Ownership Limits: In most industries, foreigners can buy up to 49% of a Vietnamese company’s charter capital. Exceptions include banks (30% cap per foreign entity, 20–30% total), finance companies (max 5% per investor, 15% total unless strategic investor), telecom, transportation (typically 49–51%) and other conditional sectors. These limits mean buyers often structure deals to stay below thresholds or obtain approvals.

- Approvals and Licensing: Any acquisition that gives foreign investors over 50% ownership of a company (or control in a “restricted” sector/area) requires an Investment Registration Certificate (IRC) from the Department of Planning and Investment. Previously a 50% market-share trigger required Competition Authority clearance; this “50% rule” was removed in recent reforms. Now, only transactions that create “significant competition-restraining impacts” face anti-trust review. General corporate law requires notifying authorities and updating registration after a merger or share transfer.

- Transaction Process: Mergers and Acquisitions deals typically involve due diligence on legal, financial and tax matters. Key steps include negotiating a Share Purchase or Merger Agreement, obtaining board/shareholder approvals, and fulfilling post-completion filings. Public company takeovers must also comply with Securities Law (e.g. compulsory bids above certain thresholds). Overall, Vietnam has been streamlining approvals: recent laws decentralize certain approvals to local authorities and emphasize post-registration oversight.

- Special Considerations: Foreigners cannot directly own land (they lease land use rights for projects). The 2024 Land Law (effective 2025) has modernized rules on real estate transfers and project ownership, which will affect property Mergers and Acquisitions. On taxation, capital gains from share sales are usually taxable but can be mitigated by structuring or double-tax treaties. Profit and dividend repatriation is generally permitted with an IRC; currency controls are moderate, reflecting Vietnam’s open trade policies.

Regulators are actively encouraging foreign participation in strategic growth sectors. For example, the Investment Law 2020 (amended 2025) lists incentives for sectors like digital infrastructure, semiconductors, AI, and advanced training. Deputy officials have noted that Vietnam remains a “safe, attractive, and highly promising destination for foreign investors”, reflecting government support for Mergers and Acquisitions and FDI. However, foreign buyers are advised to work with local legal and financial advisors to navigate industry-specific limits (e.g. insurance, education, media) and ensure compliance.

Deal-making Outlook and Considerations

For foreign investors eyeing Mergers and Acquisitions in Vietnam, the market offers growth but also requires discipline. Recent analyses note more cautious deal-making: investors are performing stricter due diligence and favoring transparency and scalability. The average deal size has moderated (from $50.7M in 2024 to ~$29.4M in early 2025), meaning more mid-market activity.

Key considerations for foreign buyers include:

- Economic and sector trends: Target industries with strong fundamentals (e.g. export manufacturing, IT services, renewable energy) and rising domestic demand (consumer finance, healthcare). The government’s push on innovation and infrastructure bodes well for tech and green energy deals.

- Valuation and funding: Be prepared for competitive pricing on quality assets. Vietnam’s capital markets are developing (e.g. bonds, IPOs), but Mergers and Acquisitions is often funded by strategic investors, PE funds, or seller financing. Use caution: following the recent surge in valuations, some buyers are waiting for more attractive entries.

- Regulatory change and reform: Watch legislative updates. The government is improving legal frameworks – for example, a draft decree on fintech sandboxes and revisions to land and investment laws. These reforms should enhance market access and may unlock new Mergers and Acquisitions channels (e.g. broader data rights, 5G/AI projects). Continuing entry of multinationals is expected: 2026–27 could see a “strong boost” in Mergers and Acquisitions as policy clarity increases.

- Integration and local expertise: Post-merger integration can be challenging in Vietnam. Cultural and operational differences require careful planning. Engaging local management, understanding corporate governance norms, and anticipating regulatory oversight (e.g. labor laws, environmental permits) are crucial steps. Foreign investors often succeed by partnering with established local players or retained founders.

Looking ahead, Mergers and Acquisitions in Vietnam is poised for continued growth. The country’s strong GDP (over 5% per year) and status as a manufacturing hub attract international capital. According to experts at the Vietnam Mergers and Acquisitions Forum, Vietnam will remain a high-potential market, especially as ongoing trade realignments and domestic reforms create new opportunities. In sum, foreign investors exploring Mergers and Acquisitions in Vietnam will find a maturing, if still evolving, environment: one with real risks but also significant rewards for the well-prepared. M&A in Vietnam will find a maturing, if still evolving, environment: one with real risks but also significant rewards for the well-prepared.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Is Mergers and Acquisitions in Vietnam still attractive for foreign investors?

- Yes. Mergers and Acquisitions in Vietnam offers stable growth, supply-chain resilience, and policy support in priority sectors, with valuations now more rational than during the 2021 peak.

2. Which sectors are most compelling for Mergers and Acquisitions in Vietnam today?

- Manufacturing, industrial real estate, healthcare, consumer finance, and technology remain the strongest drivers of Mergers and Acquisitions in Vietnam.

3. What is the main risk foreign buyers underestimate?

- Not pricing assets, but regulatory structuring and post-deal compliance. Foreign ownership limits and licensing still shape deal feasibility.

4. What separates successful Mergers and Acquisitions in Vietnam from failed deals?

- Early integration planning. Deals succeed when foreign investors align with local management, governance norms, and operational realities from day one.