Overview of Tax Reporting Requirements

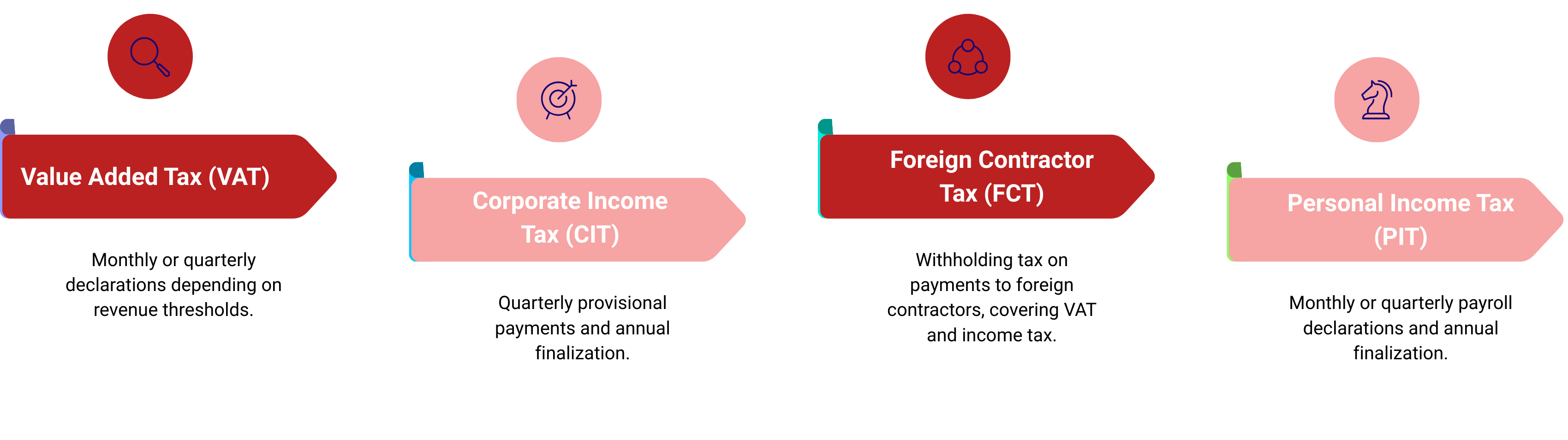

Foreign Direct Investment (FDI) enterprises in Vietnam are subject to multiple tax reporting obligations and must regularly declare and pay taxes to remain compliant and avoid penalties. Key required reports include Value Added Tax (VAT), Corporate Income Tax (CIT), Foreign Contractor Tax (FCT), and Personal Income Tax (PIT) for employees. Understanding these obligations is essential for effective compliance management.

Key tax reports include:

FDI enterprises should embed these requirements into their compliance processes. Accurate and timely tax reporting not only reduces the risk of penalties but also supports tax refunds, profit remittance, and good standing with tax authorities. The following sections outline each mandatory report, key deadlines, and practical compliance guidance.

Types of Mandatory Tax Reports

1. Value Added Tax (VAT) Reports

VAT is a major indirect tax that FDI enterprises must report regularly. The filing frequency depends on prior-year revenue. Enterprises with revenue above VND 50 billion must file monthly VAT returns, while those with revenue of VND 50 billion or less may choose quarterly filing. Newly established companies may also opt for quarterly reporting if they expect lower revenue. Selecting the correct filing cycle is essential to avoid non-compliance.

VAT reporting methods in Vietnam include:

Credit method (deduction method):

This is the most common method for FDI enterprises. Output VAT is offset against input VAT, and only the net amount is payable. VAT returns are filed using Form 01/GTGT under Circular 80/2021/TT-BTC, either monthly or quarterly. Enterprises operating in multiple provinces must submit allocation appendices, such as Forms 01-2/GTGT, 01-3/GTGT, or 01-6/GTGT, to distribute VAT to relevant localities.

Direct method on revenue:

VAT is calculated as a percentage of gross revenue and reported using Form 04/GTGT. This method mainly applies to small businesses or entities not eligible for the credit method and is uncommon for FDI enterprises.

Direct method on value-added:

Applicable mainly to gold, silver, and precious stone trading, VAT is calculated on the value-added amount and reported using Form 03/GTGT.

Read Related: A Comprehensive Guide to Corporate Tax and Compliance Obligations in Vietnam

2. Corporate Income Tax (CIT) Reports

Corporate Income Tax (CIT) is levied on corporate profits, and FDI enterprises must comply with both provisional and annual reporting requirements.

Quarterly provisional CIT payments:

FDI enterprises must estimate profits and pay provisional CIT quarterly, with payment due by the 30th day of the first month of the following quarter, such as April 30 for Q1. Although no quarterly return is usually required, timely payment is mandatory and helps spread tax obligations over the year.

A key rule is the 80% requirement. By the end of Q3, total provisional CIT paid must equal at least 80% of the final annual liability. Underpayment may result in interest charges, so enterprises should regularly review profit forecasts and adjust payments as needed.

Annual CIT finalization:

After year-end, enterprises must finalize taxable income and CIT payable using Form 03/TNDN under Circular 80/2021/TT-BTC. The filing and payment deadline is the last day of the third month after year-end, typically March 31 for calendar-year companies. Finalization reconciles accounting and taxable profit, offsets provisional payments, and determines any additional tax due or overpayment. Late or inaccurate filing can trigger penalties and audit scrutiny.

3. Foreign Contractor Tax (FCT) Reporting

FDI enterprises often engage foreign contractors for services such as consulting, licensing, or equipment supply. In these cases, Foreign Contractor Tax (FCT) may apply. FCT is a withholding mechanism under which the Vietnamese payer withholds and pays VAT and income tax on behalf of foreign contractors without a permanent establishment in Vietnam.

Key points on FCT reporting:

Taxes covered:

FCT includes VAT and income tax. For foreign companies, income tax is CIT; for individuals, it is PIT. VAT is typically 5 percent for services, while income tax rates vary by transaction type under Circular 103/2014/TT-BTC.

Withholding method:

The direct withholding method is most common. The Vietnamese payer withholds VAT and CIT or PIT from payments and remits the tax to the local tax authority, regardless of whether the contract is net or gross.

Declaration and deadlines:

FCT is usually declared per payment, with filing and payment due within 10 days from the payment date. For frequent payments, monthly filing by the 20th of the following month is allowed, using forms such as Form 01/NTNN.

Compliance tip:

Enterprises must assess FCT applicability for each payment, as some transactions may be exempt. Since the local payer bears full liability, accurate calculation and timely filing are essential, and professional advice may help manage risks and apply tax treaty relief.

4. Personal Income Tax (PIT) for Employees

FDI enterprises employing staff in Vietnam must withhold, declare, and finalize personal income tax on salaries, wages, and other taxable benefits.

Periodic PIT declarations:

PIT is filed monthly or quarterly, generally in line with the company’s VAT filing cycle. Enterprises with prior-year revenue of VND 50 billion or less may file quarterly, while larger FDI companies typically file monthly. Monthly PIT is due by the 20th of the following month, while quarterly PIT is due by the last day of the first month of the next quarter, such as April 30 for Q1. Quarterly filing reduces reporting frequency but requires settling three months of PIT at once.

PIT withholding on employment income is mainly reported using Form 05/KK-TNCN, with Form 05-1/PBT-KK-TNCN used when allocating PIT across different localities.

Annual PIT finalization:

Employers must perform annual PIT finalization for employees using Form 05/QTT-TNCN, due by March 31 of the following year. The return summarizes total income, tax withheld, and any tax payable or refundable for each employee. Any shortfall must be paid by the deadline, while overpaid tax may be refunded or carried forward. Annual finalization is mandatory even if PIT is filed quarterly during the year.

Tax Declaration Deadlines

FDI enterprises should closely track tax filing and payment timelines to avoid penalties and late payment interest:

Key deadlines

- Monthly filings: Due by the 20th of the following month (e.g., January filings due February 20). If the 20th falls on a weekend or public holiday, the deadline moves to the next working day. This typically applies to monthly VAT and monthly PIT.

- Quarterly filings: Due by the last day of the first month of the next quarter (e.g., Q1 due April 30). This covers quarterly VAT, quarterly PIT, and the provisional quarterly CIT payment (even though a quarterly CIT return is usually not required).

- Annual finalization: Due by the last day of the third month after year-end. For calendar-year companies, the deadline is March 31 for CIT finalization, PIT finalization, and typically audited financial statements. Some annual compliance items (e.g., transfer pricing-related submissions) also follow this 90-day timeline.

- Foreign Contractor Tax (FCT): Generally within 10 days from each payment to the foreign contractor, or by the 20th of the next month if the company registers to declare monthly for frequent payments.

Payment timing matters

Tax payment deadlines generally align with the filing deadlines. Even if the return is submitted on time, late payment can trigger late payment interest (commonly 0.03% per day on the overdue amount).

Practical tip

Maintain a compliance calendar and set reminders 7–10 days in advance. Late filing can lead to fixed monetary penalties, and late payment accrues daily interest, so treat even a one-day delay as a compliance risk.

Documentation Requirements for Tax Reports

Accurate documentation is the backbone of effective tax reporting. FDI enterprises should maintain organized records and prepare the required documents for each tax report type:

Corporate Income Tax Finalization Documents

When finalizing Corporate Income Tax, FDI enterprises must prepare a complete dossier to support the figures in the CIT return.

The core document is the CIT finalization return (Form 03/TNDN under Circular 80/2021/TT-BTC), summarizing annual taxable income and CIT payable. This must be accompanied by audited annual financial statements prepared in accordance with Vietnamese Accounting Standards and submitted within 90 days of the fiscal year-end. Tax authorities will reconcile accounting and taxable profit during review.

Where applicable, enterprises should attach supporting schedules for tax incentives, preferential rates, and carried-forward losses. Companies with related-party transactions must submit transfer pricing disclosure forms, while detailed documentation such as the Local File is kept on file for inspection.

Enterprises should also retain proof of provisional CIT payments and provide a power of attorney if the return is filed by an authorized representative. A complete and accurate dossier helps minimize follow-up queries, resubmissions, and compliance risks.

Value-Added Tax Reporting Documents

Documentation requirements for VAT declarations depend on the VAT calculation method applied.

Under the credit method, enterprises must retain sales, purchase, and VAT invoices to support declared input and output VAT. Invoices are not submitted with the VAT return (Form 01/GTGT) but must be properly issued and kept for inspection. Where a VAT refund is claimed, a separate refund dossier is required, typically including invoice lists, contracts, payment records, and export documents.

Under the direct method on revenue, VAT is calculated as a percentage of gross revenue. Enterprises should retain sales records, contracts, and payment evidence supporting the reported revenue.

Under the direct method on value-added, mainly used for gold, silver, and precious stone trading, enterprises must keep documentation of total sales, purchase costs, and the value-added amount, supported by accounting records and invoices.

For multi-provincial operations, VAT allocation appendices must be submitted with the return, together with documentation explaining the allocation basis. In all cases, VAT payable should be reconciled with VAT paid, and any adjustments must be supported by proper documentation.

Electronic Tax Filing System in Vietnam

Most FDI enterprises are now required, or strongly encouraged, to file tax declarations and make tax payments electronically through Vietnam’s e-tax system.

Online Portal for Filing: The General Department of Taxation e-Tax portal allows enterprises to submit VAT, CIT, PIT, FCT, and other tax filings online without visiting the tax office. After submission, the system issues an electronic receipt, which serves as official proof of timely filing.

Digital Signature Authentication: All online filings must be authenticated using a digital signature issued by a licensed certification authority. This ensures legal validity, verifies the taxpayer’s identity, and protects documents from alteration. Each tax return is digitally signed by the legal representative or an authorized person.

Real-Time Error Checks: The system includes real-time validation checks, flagging missing information or calculation errors before submission. This helps enterprises correct issues immediately and reduces the need for later amendments. For certain forms, automated calculations are also available, saving time and minimizing arithmetic errors, though figures should still be reviewed carefully.

Payment Integration: The e-tax platform is integrated with banks, enabling electronic tax payments directly after filing. Payment status is updated in real time, helping enterprises track compliance and meet deadlines efficiently.

Transparency and Tracking: Each filing is assigned a transaction code, allowing companies to monitor submission status and access historical records. This transparency is useful for internal control and dispute resolution.

Overall, electronic tax filing improves efficiency, reduces paperwork, and limits in-person interactions. FDI enterprises should ensure staff are familiar with the system and keep backup records of submissions in case of technical issues near deadlines.

Common Tax Reporting Challenges and Solutions

Despite established systems, FDI enterprises often face practical challenges when preparing and submitting tax reports in Vietnam. Common issues and solutions include:

Language barriers:

Tax laws, forms, and e-filing systems are in Vietnamese, which can be difficult for foreign-managed companies. Misinterpretation may lead to reporting errors.

Solution: Use bilingual accountants or local tax consultants. Many FDI firms prepare reports in Vietnamese but review them internally in English to ensure both accuracy and management understanding.

Complex and frequently changing regulations:

Vietnam’s tax rules are detailed and regularly updated through new decrees and circulars, making compliance challenging.

Solution: Stay connected with tax advisors, subscribe to regulatory updates, and regularly update internal tax checklists and templates. Ongoing staff training helps ensure new rules are applied correctly.

E-filing technical issues:

System downtime, login problems, or digital signature errors can occur close to deadlines.

Solution: File early rather than waiting until the deadline. If issues arise, contact tax authority support immediately and document errors with screenshots. Keeping offline records ready provides an additional safeguard.

Group reporting coordination:

FDI enterprises within multinational groups must align local tax reporting with group-level requirements, such as transfer pricing or global tax reporting.

Solution: Reconcile tax and management accounts regularly throughout the year and use accounting systems that support tax tagging. Align local and group reporting formats where possible to reduce duplication.

By anticipating these challenges and applying practical solutions, FDI enterprises can manage tax compliance in Vietnam more smoothly and reduce the risk of errors or penalties.

Conclusion

Navigating Vietnam’s tax reporting requirements may seem daunting, but with proper understanding and preparation, FDI enterprises can manage it effectively. This 2026 tax report guide has outlined the essential obligations – from VAT, CIT, FCT to PIT – along with their deadlines and documentation. The key takeaways for every foreign-invested business are: stay informed of current regulations, organize your financial data, and never miss a deadline. Implementing robust internal processes, leveraging Vietnam’s electronic filing systems, and seeking professional advice when needed will go a long way in ensuring full compliance.

In summary, successful tax compliance in Vietnam is about being proactive and detail-oriented. Every monthly or quarterly tax report submission and every year-end finalization contribute to your company’s compliance track record. By following the guidelines and best practices discussed above, FDI enterprises can confidently meet their tax obligations in Vietnam – accurately, on time, and with minimal hassle. This not only avoids penalties but also demonstrates good corporate citizenship, building trust with authorities and stakeholders. As regulations evolve, continue to treat tax compliance as a priority in 2026 and beyond, and your business will reap the benefits of operating smoothly within Vietnam’s regulatory framework.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Can an FDI enterprise change from quarterly to monthly tax reporting?

- Yes. If revenue exceeds VND 50 billion or the enterprise chooses to switch, the change applies from the following calendar year and should be consistently applied.

Is quarterly CIT filing required in Vietnam?

- No formal quarterly CIT return is required in most cases, but provisional CIT payments must still be made quarterly and meet the 80% rule by Q3.

Are tax reports accepted in English?

- No. All official tax reports must be submitted in Vietnamese. Internal English versions may be used for management purposes only.

Who is liable if Foreign Contractor Tax is underpaid?

- The Vietnamese paying entity is fully liable for any underpayment, penalties, and interest, even if the error relates to the foreign contractor’s income.