Introduction: A New Era of Transparency in Vietnam

Vietnam’s Amended Law on Enterprises 2025 (Law No. 76/2025/QH15), effective July 1, 2025, introduces mandatory Ultimate Beneficial Owner (UBO) disclosure for the first time. The change follows the FATF’s 2023 decision to place Vietnam on its grey list for deficiencies in its anti-money laundering (AML) regime, urging the country to establish timely, accurate UBO records and enforce penalties for non-compliance.

An Ultimate Beneficial Owner is the individual who ultimately owns or controls a company, even if not officially recorded as a shareholder — for example, through nominees, proxies, or intermediary entities. By requiring UBO transparency, the law enables authorities to pierce complex ownership structures, deter misuse of shell companies, and align Vietnam with global AML standards, which often set ownership thresholds between 10% and 25%.

Legal Definition of a Ultimate Beneficial Owner in Vietnam

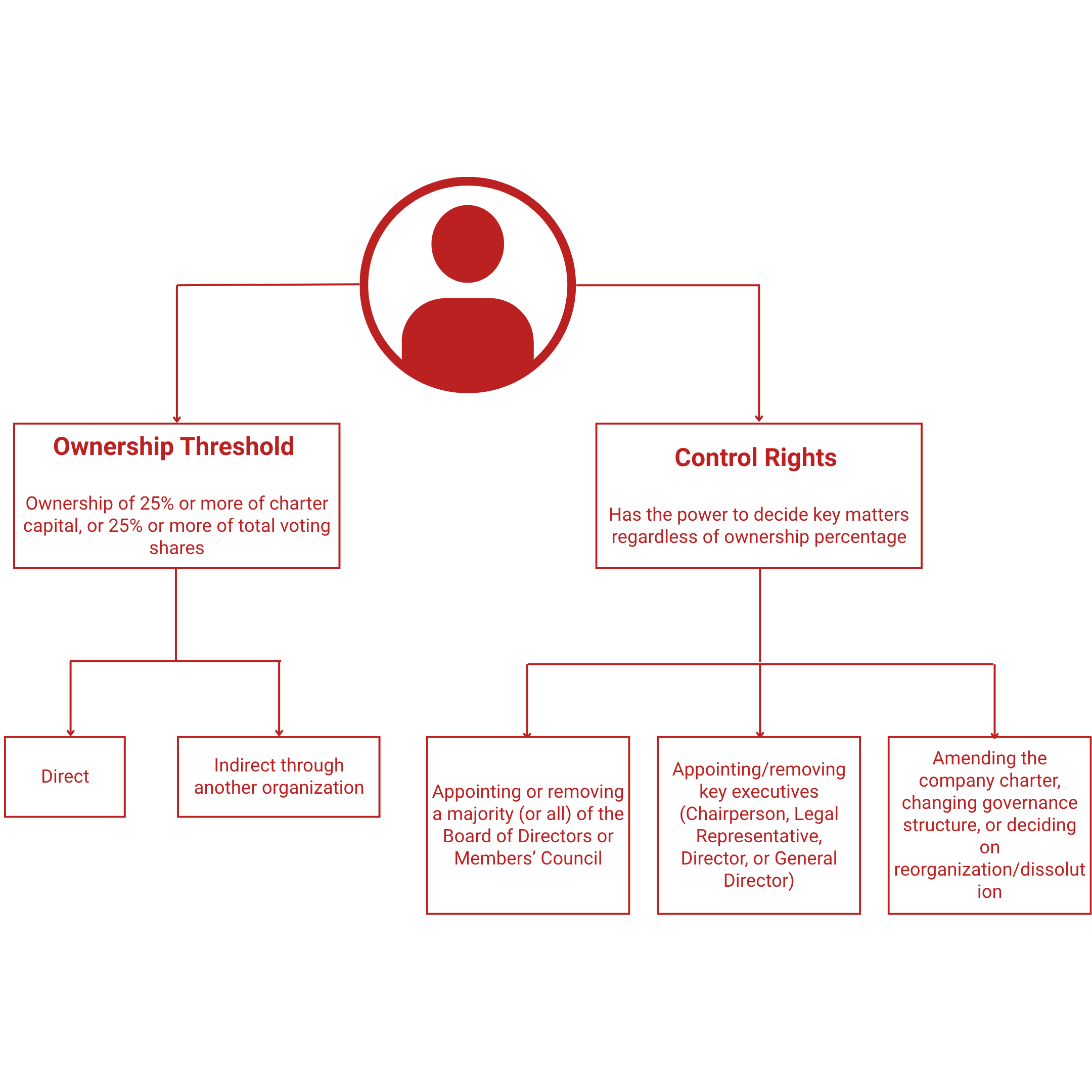

Under Article 17 of Decree 168/2025, an individual is considered a UBO if they meet either of the following:

- Ownership Threshold – Directly or indirectly owns 25% or more of charter capital, or holds 25% or more of voting shares. Indirect ownership includes holdings through intermediary entities.

Example: If Person A owns 100% of Company X, which owns 30% of Company Y, Person A is an indirect 30% owner of Company Y and therefore its UBO. This 25% benchmark aligns with international AML standards and Vietnam’s AML Law 2022, though Decree 168 also captures voting rights as a form of control.

- Control Rights – Has the power to decide key matters regardless of ownership percentage, including:

- Appointing or removing a majority (or all) of the Board of Directors or Members’ Council

- Appointing/removing key executives (Chairperson, Legal Representative, Director, or General Director)

- Amending the company charter, changing governance structure, or deciding on reorganization/dissolution

In short, if a person can unilaterally make or block fundamental corporate decisions, they qualify as a UBO through control rights — even without significant shareholding.

Exceptions – Individuals representing state ownership in wholly state-owned enterprises, or managing state capital in joint-stock or multi-member LLCs, are not treated as UBOs. In those cases, the state is the ultimate owner, and the individual acts only as a representative.

Ultimate Beneficial Owner Information to be Declared

Once a person is identified as a Ultimate Beneficial Owner, companies must collect and report key personal details, including:

- Full name, date of birth, nationality, ethnicity, gender, and contact address

- Type and number of legal ID (ID card or passport)

- Details of ownership percentage or specific control rights held

For indirect ownership via another organization, the company must also declare information on that intermediary entity — its name, registration number, head office address, and shareholding in the company. This allows regulators to trace the full ownership chain to the ultimate individual.

All UBO data is stored in the National Business Registration Database, ensuring authorities can verify and access it when required.

hello

Ultimate Beneficial Owner Compliance Requirements for Enterprises

The new regulations impose ongoing compliance obligations on businesses to ensure UBO information remains up-to-date and accessible. Vietnamese startups, SMEs, and all companies need to be proactive in integrating these requirements into their incorporation and governance processes. Key obligations include:

1. At the Time of Business Registration

Under the new rules, startups, SMEs, and all companies must declare UBO information right from incorporation. This applies to partnerships, LLCs, and joint-stock companies.

Key requirements:

- UBO List in Registration Dossier – A “List of Ultimate Beneficial Owners” must be prepared and submitted with the enterprise registration application. This includes indirect owners — for example, if a shareholder is another company, the natural person owning ≥25% of that parent company must be disclosed.

- Charter & Application Forms – UBO details must also be declared in the company charter and standardized forms (Forms 10 & 11 under Circular 68/2025/TT-BTC). All information is stored in the National Business Registration Database managed by the provincial Business Registration Office.

Special case: If no individual meets the ownership/control threshold (rare), the company should declare that no UBO exists — though in practice, most businesses will have at least one qualifying person.

Read More: Business Entities Options in Vietnam for Foreign Investors

2. During Ongoing Business Operations

Ultimate Beneficial Owner compliance isn’t a one-off step at incorporation — it’s a continuous duty for the life of your business.

1. Maintain Accurate UBO Records

Companies must keep an accurate and up-to-date internal registry of all Ultimate Beneficial Owners (UBOs), detailing their ownership or control percentages and full personal information. These records may be stored physically or electronically at the head office (or another location specified in the charter) and must be retained even after dissolution, in line with the retention rules.

2. Report Changes Within 10 Days

Any change in Ultimate Beneficial Owner information must be reported to the Business Registration Authority within 10 days. This includes:

- A new person qualifying as a UBO

- An existing UBO’s ownership/control falling below 25%

- Changes in personal details or control rights

- An organizational shareholder crossing the 25% threshold (disclose the ultimate individual)

Reports must be filed using the prescribed form and include an updated Ultimate Beneficial Owner list. Publicly listed companies and licensed securities traders are exempt, as they report under securities laws.

3. Provide UBO Data on Demand

Companies must be prepared to supply current UBO information to competent authorities at any time, especially during anti-money laundering (AML) investigations, audits, or inspections.

4. Retain UBO Information After Closure

UBO data must be retained for at least five years after dissolution or bankruptcy by both the company (or liquidator) and the Business Registration Authority.

5. Compliance for Existing Companies

For businesses established before July 1, 2025, UBO details must be submitted at the first business registration update after the law takes effect. Proactive submission is encouraged to avoid delays and demonstrate compliance.

6. Ensure Accuracy and Truthfulness

All UBO information must be accurate and truthful. Providing false, incomplete, or misleading details is prohibited and can result in penalties for both the company and its legal representative.

State Authorities’ Roles in Managing Ultimate Beneficial Owner Data

1. Business Registration Authority (BRA)

- Provincial Business Registration Offices (under the Ministry of Planning and Investment) act as the central custodian of Ultimate Beneficial Owner data.

- All UBO details from incorporation or change filings are stored in the National Business Registration Database and kept at least 5 years after company termination.

- On request from other state agencies, BRA must provide UBO records free of charge — ensuring fast, coordinated responses to AML or law enforcement needs.

- BRA also safeguards the integrity and confidentiality of this sensitive information.

2. Other Competent State Authorities

- Any agency with AML, tax, anti-corruption, or corporate supervision duties can request UBO data from BRA.

- This includes the State Bank’s Financial Intelligence Unit, Ministry of Public Security, tax authorities, and inspectors.

- Access is streamlined and free, allowing quick verification if a company is suspected of being a front for illicit actors.

3. The Government (Regulators)

- Responsible for issuing detailed UBO regulations — including criteria, declaration procedures, data fields, and update mechanisms.

- Decree 168/2025/NĐ-CP provides the core framework, with further guidance via ministerial Circulars (e.g., Ministry of Finance’s standard UBO forms).

- Can adjust thresholds or processes as global AML standards evolve.

Why this matters for startups & SMEs:

This coordinated framework makes it much harder to hide behind shell companies. Even small businesses are now part of a transparent, cross-agency system that international partners and FATF can trust — meaning compliance isn’t just a legal box-tick, it’s part of building credibility.

Compliance Tips: How SMEs and Startups Can Adapt

New Ultimate Beneficial Owner obligations may feel overwhelming, especially for small businesses unused to tracking indirect ownership. But with early preparation and a clear process, compliance becomes routine. Here’s what you should do now:

1. Map Your Ownership Structure

Start by reviewing your company’s shareholders, control rights, and any indirect holdings. Identify anyone who owns 25% or more of the charter capital or voting shares—whether directly or indirectly—or holds special rights to appoint management or veto major decisions. For more complex setups involving parent companies or investment funds, trace the ownership chain all the way up to the ultimate individuals in control.

2. Gather the Required Data

Once you’ve identified your UBOs, collect their personal details, including full name, date of birth, nationality, address, and ID or passport information. Obtain their consent for disclosure and ensure this information is reflected in your company charter and registration forms. For new incorporations, failure to provide a complete UBO list can delay or even block business registration.

3. Set Up Internal Tracking

Treat UBO information as a living record that needs continuous attention. Maintain an internal UBO register and assign a responsible person—whether it’s a founder, legal officer, or compliance officer—to keep it updated whenever there are changes in ownership or control. Before notifying authorities, review any updates to your cap table or board composition to see if they trigger a change in UBO status.

4. Meet the 10-Day Notification Rule

If there’s any change to your UBOs or their details, you must notify the Business Registration Office within 10 days. This strict timeline means businesses should act quickly to prepare the necessary forms. Where possible, combine UBO updates with other corporate filings to streamline the process and reduce administrative work.

5. Educate Your Team & Advisors

Make sure that everyone involved in corporate administration—including lawyers, accountants, and corporate secretaries—understands the UBO regulations. Update internal bylaws or shareholder agreements to require shareholders to report any changes in control arrangements. This ensures that your company stays informed and compliant.

6. Act Now for Existing Companies

If your company was established before July 1, 2025, compile your UBO information now, even if you don’t currently need to file it. Being proactive helps you avoid delays when you later need to make business registration changes. Some companies are choosing to submit their UBO details early to demonstrate good governance.

7. Balance Transparency & Confidentiality

While UBO information is shared among state agencies, it is not made public. However, non-compliance carries real risks, including fines of VND 20–30 million and possible delays in transactions such as capital increases, mergers and acquisitions, or registration changes. The safest route is to comply fully and on time.

8. Turn Compliance into a Benefit

UBO compliance can also work in your favor. Having complete, accurate UBO documentation ready can make it easier to open bank accounts, pass investor due diligence, and close business deals quickly. It also signals to partners and regulators that your company operates with transparency and good governance.

To make sure your UBO details are captured properly from Day One, consider using our company formation services when incorporating.

To make sure your UBO details are captured properly from Day One, consider using our company formation services when incorporating.

How InCorp Vietnam Can Help

Meeting Vietnam’s new Ultimate Beneficial Owner disclosure requirements can be challenging, especially for startups and SMEs with limited compliance resources. InCorp Vietnam streamlines the process by helping you identify and verify Ultimate Beneficial Owner, map complex ownership chains, and ensure all information meets the standards set under Decree 168/2025/NĐ-CP. We prepare and file your UBO declarations, handle change notifications within the 10-day deadline, and maintain ongoing compliance monitoring to avoid penalties or transaction delays.

Our corporate advisory team also helps you structure ownership for transparency while protecting legitimate confidentiality, and we integrate UBO compliance with our incorporation, corporate secretarial, accounting, payroll, and HR advisory services so governance is built into your daily operations. With over 20 years of regional expertise and bilingual legal, tax, and corporate professionals, we enable your business to stay compliant, credible, and investor-ready in Vietnam’s evolving regulatory environment.

Conclusion

Vietnam’s new Ultimate Beneficial Owner disclosure mandate marks a major step toward greater corporate transparency, aligning the country with global AML standards and supporting its efforts to exit FATF’s grey list. While the rules add compliance steps for startups and SMEs, they also strengthen credibility by making ownership structures clear and reducing risks of money laundering, tax evasion, and other illicit activities. The message is simple: if you run a company in Vietnam, you must “know your owners” and be ready to report them.

Acting early—by mapping ownership, keeping records updated, and meeting reporting deadlines—will help businesses avoid fines, reputational damage, and lost opportunities. Beyond compliance, embracing UBO transparency signals good governance, builds investor trust, and positions Vietnamese companies to compete on a level playing field in a market that increasingly values ESG principles.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What is an Ultimate Beneficial Owner (UBO) in Vietnam?

- A UBO is the individual who ultimately owns or controls a company, either by owning 25% or more of capital or voting rights, or by having the power to make key decisions such as appointing directors or approving major corporate actions.

When does UBO disclosure become mandatory?

- UBO disclosure is mandatory from 1 July 2025 under Vietnam’s Amended Law on Enterprises and Decree 168/2025/NĐ-CP.

Do existing companies need to file UBO information?

- Yes. Companies established before 1 July 2025 must submit UBO information at their next business registration update, even if no ownership change occurs.

How quickly must UBO changes be reported?

- Any change to UBO information must be reported to the Business Registration Authority within 10 days, including ownership changes, control rights, or personal detail updates.