Vietnam is host to over 100 fintech startups that offer a broad range of services such as wealth management, digital payments, alternative lending, and blockchain-based technologies. In addition, the country has improved its internet infrastructure & tech-based education ecosystem creating a foundation for developing effective financial technologies. As fintech startups continue to expand, many investors are also exploring company incorporation in Vietnam to establish a formal business presence in this rapidly growing sector.

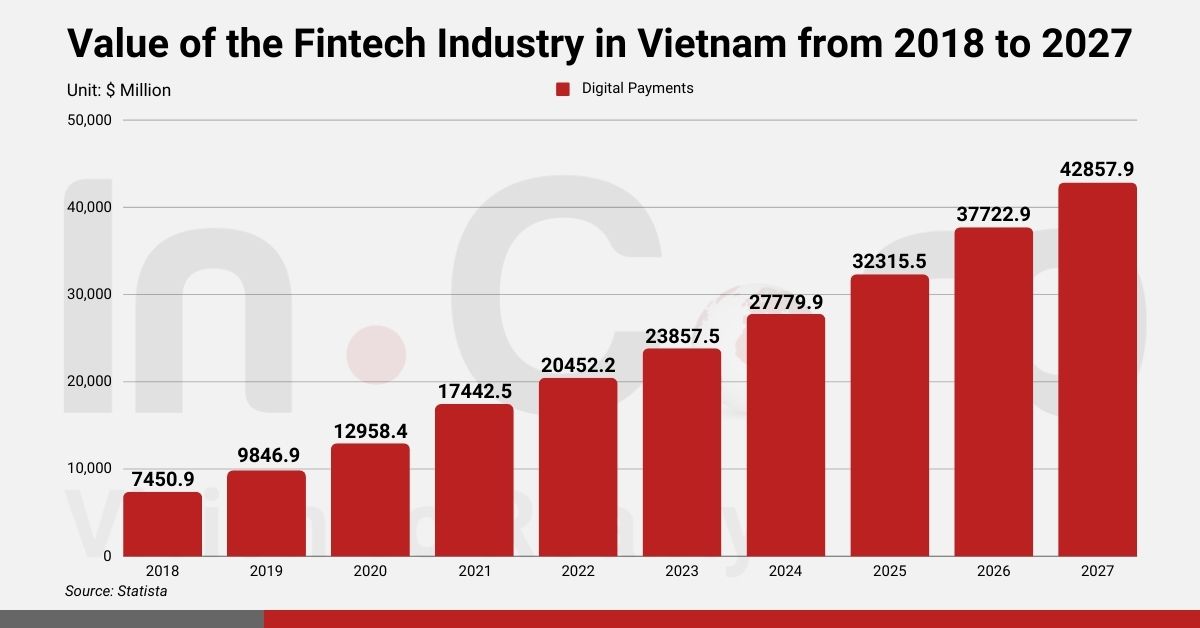

The fintech industry’s current value stands at US$11 Billion and its transaction value in Vietnam is expected to reach US$26,738 million by 2025, with 70.9 million users.

What Did Fintech Vietnam Learn from 2021?

The pandemic’s effects on trade and business tactics

E-wallet providers including MoMo, VNPay, Moca, ViettelPay, and ZaloPay have gained prominence as a result of the new interest in mobile payments, which can be directly attributed to the pandemic and related lockdowns that the country faced. In the first quarter of 2021, about 395 million transactions were made using mobile devices, showing a huge rise of 78% from the prior year, according to Microsave.

Moreover, the digital payment solutions came as a savior for new users who found themselves isolated at home due to COVID restrictions and had to use services like MoMo, Grab, Now, and ZaloPay for their daily needs. It is also noteworthy that various mobile wallet apps have also started providing financial services, like loan applications and non-life insurance products accompanied by discount vouchers and cashback offers.

Fintech’s rise encouraged cooperation with new markets and industry participants. For example, the COVID-19 epidemic has accelerated the development of microinsurance solutions between fintech businesses and insurance companies. For instance, PVI and MoMo introduced the Corona++ nano insurance product to help clients of LMI (Lender Mortgage Insurance) who were at risk.

Acceptance of mobile money in Vietnam

This new year, Vietnam registered a significant milestone of having more than 463,000 people using Mobile Money. Mobile payment technologies are evolving at an unprecedented rate, and Vietnam can now be considered an opportune marketplace for new players looking to invest in this attractive new market.

Latest Fintech Vietnam Startups

1. Infina: The Robinhood of Vietnam

Launched in January 2021, Infina is a leading retail investing app developed with the mission to make investing seamless and secure. Recently, the company received seed funding of US$4 million and previously raised US$2 million as well. Moreover, Infina was part of Y Combinator’s Summer 2021 cohort and is striving to become the “Robinhood of Vietnam.”

The app allows its users to choose from a range of asset classes, including fixed-income products, mutual funds, and equities. Infina’s exponential growth can also be attributed to its successful integration with third-party apps like Tiki.

2. Nano Fintech Vietnam

Nano Technologies was founded in 2020 and received a whopping US$3 million in seed funding. The company has developed an app called VUI that enables workers in Vietnam to access their earned wages immediately.

According to Techcrunch, VUI has registered around 20,000 employees from big corporations like GS25, LanChi Mart & Annam Gourmet. Moreover, the company claims that about 60% of employees sign up for the app as soon as their employer offers it. Therefore, the app has drawn attention from sectors like retail, food and beverage, manufacturing, textiles, garments, and shoes.

3. Anfin: Accessible stock investment

Garnering over a million downloads since its establishment in October 2021, Anfin is already set to receive its Series A funding this year. The fintech app startup hopes to expand beyond Vietnam as a big player in social investment products.

Anfin’s app features fractional trading, stock profiling, and risk assessment, alongside social characteristics such as live audio rooms where users can communicate with each other. Its angel investor, Clement Benoit, said that adding a social aspect to a user-centered stock trading product can be the key to unlocking the Asian market’s potential.

Cryptocurrency in Vietnam – Awareness & Sentiment

Despite being the 53rd largest economy based on GDP, Vietnam is ranked 13th in terms of realizing gains from trading cryptocurrency, according to Cointelegraph.

According to a U.S.-based financial consultancy survey, 20% of Vietnamese admitted that they had bought Bitcoin. The figures happen to be the highest among the 27 countries polled.

The country has the 2nd highest rate of cryptocurrency adoption among 74 surveyed economies, as indicated in data reported by Statista. One of the most crucial factors driving the growth of cryptocurrencies in Vietnam is remittance payments.

In the past years, Crypto has been making a strong presence in Vietnam. According to Finder, 41% of people who own cryptocurrencies are Vietnamese. Because of its significant growth, Vietnam is working on a legal framework for cryptocurrency. It will be built following the provisions of Decision 1255, which approves the idea of a legal framework for the management and handling of “virtual assets, digital currencies, and virtual currencies”.

For this project, Vietnamese Deputy Prime Minister Le Minh Khai has asked three ministries: Finance, Justice, and Information & Communications to collaborate with the central bank, the State Bank of Vietnam, and other relevant bodies to develop the legal framework. Besides, he also has given the Ministry of Finance the responsibility to establish an agreement with other regulatory authorities and the central bank to specify pieces of legislation that need to be modified, supplemented, and promulgated. A clear timeline for implementation is also required.

Investing in Vietnam’s Fintech Industry? Check out InCorp Vietnam’s business registration solutions

Alternative Lending Options

The Alternative Lending market segment includes a wide range of loan options outside of conventional bank loans. It is majorly focused on fulfilling the capital requirements of Small & Medium Enterprises (SMEs) and personal loans (such as Marketplace Lending or Peer-to-Peer lending).

Currently, Vietnam’s total transaction value in the Alternative Lending segment is forecasted to register US$1.1 million and shall demonstrate an annual growth rate (CAGR 2022-2026) of 1.07% by 2026, according to a report by FintechNews. Moreover, the market’s largest share is attributed to crowdlending with a projected total transaction value of US$1 million.

P2P Lending Players in Vietnam

Also mentioned in the report, Vaymuon.vn happens to be one of the country’s largest peer-to-peer (P2P) lending players with over 2 million customer users and 400,000 investors. Currently, the company is seeking to raise US$10 million to expand into countries such as the Philippines, Myanmar, Thailand, Cambodia, and Indonesia.

Several new companies are also entering the market, including Robocash, Interloan, Mofin, Growth Wealth, Fiin, MegaLend, eLoan.vn, and BaBang.

What is in Store for Fintech Vietnam?

As per a survey conducted by Statista and reported by Kapronasia, on average, a Vietnamese consumer spends only US$74 using payment apps, whereas China and South Korea spend US$2,300 and US$2,031, respectively. However, the survey also indicates that the country’s online transaction value will spike from US$11.6 billion in 2020 to US$26.4 billion by 2025.

The survey also indicated that 93% of the fintech investments were made in the payments segment. An e-wallet and payments app called Momo raised US$200 million in its Series E round, with Japanese bank Mizuho contributing a whopping US$170 million. In return, the bank was entitled to 7.5% equity in the company, therefore boosting MoMo’s valuation to US$2.27 billion.

Moreover, other fintech companies in Vietnam are trying to tap into market segments that are not highly competitive. For instance, F88, a lender and insurance distributor, borrowed US$10 million and planned to use it to gain access to untapped market segments.

According to Deal Street Asia, 1.3 million Vietnamese opened up new stock trading accounts in 2021, three times the number in 2020. It is also estimated that the country is home to about 6 million crypto and Non-Fungible Token (NFT) investors.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Is PayPal a fintech?

- Yes, PayPal is a fintech company. It provides digital payment solutions and financial services, enabling users to make online payments, transfer money, and manage transactions electronically.

What is an example of fintech?

- An example of fintech is a mobile payment app like Momo or ZaloPay in Vietnam, which allows users to send money, pay bills, and make purchases digitally. These platforms integrate banking services with mobile technology to enhance convenience and accessibility for consumers.