Vietnam’s Ministry of Finance has issued Circular 99/2025/TT-BTC (effective 1 Jan 2026), a sweeping update of the country’s corporate accounting regime. Circular 99 formally supersedes the previous Circular 200/2014/TT-BTC and its amendments. It applies to all enterprises (across all sectors and ownership) and even extends to credit institutions (for non-banking operations). Authorities describe it as “the most comprehensive changes to Vietnam’s accounting framework in more than a decade”. In practice, this means Vietnamese businesses – including SMEs and startups – must review and update their accounting systems, policies, and disclosures to comply with the new rules. The goals are modernization and transparency: Circular 99 aligns more closely with international standards (IFRS principles) and promotes digitalization and corporate governance.

For small companies, Circular 99’s mix of flexibility and new requirements is important. On one hand, firms can tailor their chart of accounts and use electronic records as they wish, which can simplify bookkeeping. On the other hand, companies must now document internal controls and accounting choices that were previously implicit. In short, Circular 99 shifts from “prescribing every step” to expecting enterprises to self-govern their accounting processes. SMEs will need to take ownership of this shift: updating internal policies, possibly investing in software, and training staff. But the changes also offer advantages – for example, faster recordkeeping and clearer financial reporting that could help attract investors or lenders.

Download the detailed guide about Taxation & Compliance Deadlines in Vietnam now!

Scope and objectives of the 2026 accounting regime

Circular 99/2025/TT-BTC was promulgated on 27 October 2025 and applies to all financial years starting on or after 1 January 2026. It replaces the old corporate accounting circular (No.200/2014) and a number of its amendments, marking a full reset of Vietnam’s accounting rules. The reform’s stated objectives are to modernize the accounting system after a decade of piecemeal changes, bring Vietnamese standards closer to IFRS and other global norms, and foster transparency and digitization in business reporting.

Key points about the scope include: Circular 99 covers all enterprises regardless of size or sector. (Special banking operations still follow State Bank regulations, but general accounting rules now apply even to credit institutions.) The circular mandates that companies establish clear internal governance – firms must develop and document their own accounting regulations and internal control procedures. In other words, businesses are responsible for defining who does what in accounting and how approvals work, rather than simply filling in government forms. Auditors and regulators will expect firms to have written policies on transaction approval, recordkeeping and review responsibilities.

The effective date and timeline are straightforward: Circular 99 takes effect on 1 January 2026. It applies to annual accounting periods beginning on or after that date. Companies should plan now to make the switch in time. (If no guidance is given for a specific matter, transitional provisions say to follow Vietnam Accounting Standard 29 on changing accounting policies.)

Main differences between Circular 99 and the previous accounting regime (Circular 200/2014)

In practical terms, Circular 99 brings numerous changes across all areas of accounting. Below are some of the most important differences from the old Circular 200/2014 regime, with a focus on how they affect SMEs and startups:

Internal Governance and Controls

Under Circular 99, firms must create detailed internal policies for accounting processes. For example, businesses have to “clearly define the powers, obligations, and responsibilities of each department or individual involved in economic transactions”. This is a big shift: Circular 200 did not require companies to write down their own accounting rules in this way. Now, SMEs should put in place (or update) an accounting policy manual or internal regulations that spell out who approves purchases, who records entries, how reconciliations are done, etc. Management must be ready for auditors or inspectors to review those documents. In short, accountability is emphasized: the company itself, not the regulator, sets the details of its accounting controls.

Accounting Currency

Circular 99 clarifies how enterprises use foreign currencies. By default, the Vietnamese dong (VND) is still the accounting currency. However, if a company’s main operations (pricing, revenues, or costs) are in a foreign currency, it may choose that currency as its functional currency. In practice, this means an exporter paid mostly in USD, for instance, can keep books in USD.

Regardless, reports to authorities must still be in VND: companies convert foreign-currency statements using the average exchange rate from their primary bank. When a firm selects or changes its currency, it must explain the reason and the conversion method in the notes, and show the impact on results. Once chosen, a functional currency can only change at the start of a year and only for significant business reasons. For most small local businesses, this change may simply mean explicit notes on currency choice; but for startups with foreign investment or exports, it offers more flexibility in reporting.

Branches and Consolidation

For companies with branches, subsidiaries or affiliates, Circular 99 tightens the consolidation rules. Notably, head offices are no longer required (or even allowed) to publish separate financial statements for branches. Instead, the company’s consolidated financial statements must include all branch data and eliminate any inter-company transactions.

In practical terms, there is no concept of “combined” branch statements as before – everything rolls up into the parent company’s results. Also, any enterprise (parent) with subsidiaries, dependent units or affiliates must prepare consolidated financial statements, eliminating related-party transactions. These provisions strengthen transparency but mean that even SMEs with small branches need accounting systems capable of consolidation. (Very small businesses without affiliates may be unaffected, aside from clearly showing that all operations are in one report.)

Voucher and Book Flexibility

One of the biggest practical changes is that Circular 99 no longer prescribes rigid voucher or book formats. Whereas Circular 200/2014 laid out specific forms (and even rules like ink color or number of copies), the new circular lets enterprises design their own vouchers and accounting books, provided they follow the general requirements of the Law on Accounting. For example, a company can now create an electronic invoice or digital journal entry format tailored to its business – it just must include all necessary data (date, accounts, amounts, description, etc.).

Detailed technical rules (such as “use black ink” or “each voucher has 3 carbon copies”) are eliminated. This flexibility encourages digital accounting: electronic vouchers, e-books and digital signatures are now explicitly allowed. (A signed PDF or an e-invoice can replace a printed paper). For an SME, this means it can streamline recordkeeping using modern software or cloud tools. The trade-off is that the company must ensure authenticity and traceability itself – for example, by keeping audit trails and digital backups – since it can’t simply rely on prescribed paper forms.

Chart of Accounts (CoA) Customization

Circular 99 gives enterprises much more control over their Chart of Accounts. Under the old rules, companies were generally required to use a fixed set of accounts with only limited detail. Now, firms may add, rename or supplement accounts as needed for their business (so long as the overall financial results remain comparable). For instance, the new regulations allow opening extra sub-accounts under main headings to track costs or revenues by project, location, etc. At the same time, Circular 99 updates the official CoA to reflect new economic realities.

New accounts have been introduced – for example, Account 215 for “Biological Assets” (separating crops/livestock from fixed assets) and Account 332 for “Dividends and Profit Payable”. It also adds accounts related to new taxes (e.g. 82112 for Global Minimum Tax top-up). Conversely, some old accounts are abolished. For example, Account 611 (used under the old periodic inventory method) and 1562 (for small purchase costs) have been removed. In summary, companies must document any COA changes in an internal accounting policy, but they gain the flexibility to align account codes with how they actually operate.

Financial Statement Changes

Circular 99 keeps the standard set of financial statements but with updates. The “Balance Sheet” is officially renamed “Statement of Financial Position” to match global usage. The templates themselves have changed (so companies must adopt the new forms verbatim); however, firms may only add extra line items or notes – they cannot delete or re-label the required fields. Annual financial statements remain mandatory, and must be submitted within 90 days of year-end.

One important difference is that a company’s statement now must include all its branches and related units (with inter-company eliminations) as mentioned above. Separate branch statements are dropped. Circular 99 also clarifies the treatment of transitional periods: if a company changes its fiscal year or has a short/long first year, it must disclose comparative figures and explain the change to maintain comparability. Finally, the concept of retrospective adjustments is tightened: only material prior-period errors trigger restatement, and events after year-end cannot be used to alter the prepared statements.

Accounting Policy Updates

Beyond formats, the circular changes some core accounting methods:

- Inventory costing: The standard cost method is newly authorized, and firms can apply different costing methods (FIFO, LIFO, weighted-average, standard cost, etc.) to different inventory items as appropriate. (Under Circular 200, a company had to use one method across the board.) The old dichotomy of “perpetual” vs. “periodic” inventory systems is removed. These changes help manufacturers and trading firms get earlier cost information and reflect actual usage.

- Repairs and Maintenance: Routine repair and maintenance expenses must now be amortized (expensed) as incurred. The previous rule that allowed setting aside a major repairs reserve is abolished. In practice, this simplifies accounting: an SME no longer needs a separate “major repair” provision on its balance sheet.

- Biological Assets: New guidance addresses farms and similar businesses. Biological assets (like livestock or crops) must be classified, capitalized at historical cost, and evaluated for impairment, with related accumulated depreciation accounts for mature livestock. Firms in agriculture should ensure their ledgers have accounts (215 and 2295) for these items and follow the new impairment rules.

- Joint Ventures (BCCs): Circular 99 provides detailed rules for “Business Cooperation Contracts” (a form of joint operation common in Vietnam). Accounting must reflect the economic substance of the arrangement. (This is largely the existing VAS 25 guidance, now reiterated.)

- Doubtful Debts: The circular standardizes how to set aside provisions for bad debts. Defined aging thresholds are given for when receivables become doubtful, though companies can justify alternative methods if needed. SMEs should review their allowance policies and update aging schedules accordingly.

- Other items: Circular 99 also clarifies treatment of deferred expenses, bond issuance costs, preference shares (classified as liability), and introduces new accounts (e.g. 6275 and 82112) for tax-expense tracking under new global minimum tax rules. In essence, the circular refines many technical policies, giving more guidance but also more strict disclosure requirements.

Enhanced Disclosures

A recurring theme is transparency. Companies must provide much more information in the notes to their financial statements. For instance, firms are now explicitly required to disclose:

- The basis of preparation, including the functional currency chosen, revenue recognition policies, and expense classifications (by nature or function).

- The impacts of currency selection/changes, including the method used for translation.

- Any internal (related-party) transactions and balances, and how they affect the results.

- Consolidation methods if the company has subsidiaries or affiliates.

- For special items: detailed notes on cash/cash equivalents (including any restrictions), biological assets, employee benefit obligations, BCCs, dividends/payables, issued bonds, and any single balance sheet or income statement item exceeding 10% of total.

- Key assumptions or estimation uncertainties behind valuations.

- New tax-related disclosures, such as top-up corporate income tax under global tax rules.

In other words, stakeholders (investors, banks, regulators) will expect companies – even SMEs – to explain the story behind the numbers.

Practical Implications for SMEs and Startups

For many Vietnamese SMEs and entrepreneurial startups, Circular 99/2025 offers both opportunities and challenges. The increased flexibility can simplify daily accounting: for example, the ability to use tailored accounts and electronic records means an SME can streamline its bookkeeping to match its business model. A small e-commerce startup could create sub-accounts to track sales channels, or a micro-manufacturer could use standard-cost accounting to speed up inventory valuation. Likewise, eliminating paperwork formalities (like fixed voucher forms or branch reports) reduces some bureaucratic burdens.

However, the greater emphasis on control and disclosure means small companies cannot be lax. Founders and financial officers should use this moment to formalize procedures. For instance, a family-run business should now clearly document who in the family/finance team has authority to approve expenses, rather than rely on informal practice. They should also invest time in understanding and applying new accounting treatments (e.g. how to amortize maintenance, or track biological assets if relevant).

Importantly, improving financial transparency can pay off. Cleaner books and robust disclosures make it easier to get bank loans or outside investment, as lenders and investors see trustworthy data. Startups seeking funding or grants may find the IFRS-like disclosures under Circular 99 actually work in their favor. In this sense, embracing the new rules can strengthen the company’s financial management.

Steps to Get Ready

Here are some practical steps and tips to prepare for Circular 99, especially aimed at SMEs and startups:

- Gap Analysis: Begin by comparing your existing accounting system (chart of accounts, vouchers, book templates, policies, etc.) against the requirements of Circular 99. Identify what must change: Do you need to add new accounts (e.g. Biological Assets), drop old ones (e.g. Account 611), or rename anything? Which processes (like currency translation) need new documentation?

- Update Internal Regulations: Draft or update your internal accounting policy manual. It should cover: the decision on functional currency (and justification), any special revenue recognition rules, the list of any new accounts and their use, procedures for internal transactions, and who can do what. Remember that any customization (like adding accounts) must be backed by a written regulation.

- Redesign Chart of Accounts and Vouchers: Modify your COA in the accounting software to include any new accounts and remove obsolete ones. You may add extra levels or sub-accounts as needed. Also update your voucher templates (even if electronic) to reflect new reporting lines or disclosures. Ensure that each voucher still contains all required information and is approved as per your new policies.

- Upgrade Accounting Systems: Check that your accounting or ERP software can handle the changes. For example, ensure it can use the average bank exchange rate for currency conversion (if needed), allow multiple costing methods, and incorporate any new financial statement templates. Software should have audit trails and data integrity features – Circular 99 explicitly requires strict data accuracy for accounting software. If the current system can’t accommodate the new chart of accounts or if you want better digital workflow (e.g. e-voucher approval), this may be a good time to upgrade.

- Train Your Team: Invest in training or workshops for your finance, audit, and even operational teams. Everyone should understand the new account structure, the reasons behind changes, and the stronger approval/sign-off processes. Make sure staff know how to handle foreign currency (if used) and new disclosure requirements.

- Mock Closing / Dry Run: Before the first fiscal year under Circular 99 begins, do a test closing. Prepare draft financial statements with the new templates and disclosures, including opening balances re-stated if you change currency. This will reveal any errors or missing information ahead of time. For example, reconcile your trial balance with the revised chart of accounts to catch any mapping mistakes.

- Consolidation if Needed: If your company has subsidiaries or multiple branches, start setting up a consolidation framework now. Decide which entity is the parent, collect branch data, and plan how to eliminate inter-company items. Create consolidation templates and consider using automated tools if possible.

- Currency Transition: If you decide to use a foreign functional currency (unlikely for most small domestic SMEs), do it at the start of a fiscal year. Compute opening balances and comparative figures as required by the retroactive principle. Prepare the necessary notes to explain this change for auditors and regulators.

- Monitor Further Guidance: Keep an eye on any additional guidance from the Ministry of Finance or professional bodies. The implementing regulations may be followed by FAQs or circulars clarifying details. Coordinate with your auditor or accounting advisor to ensure your interpretations are correct.

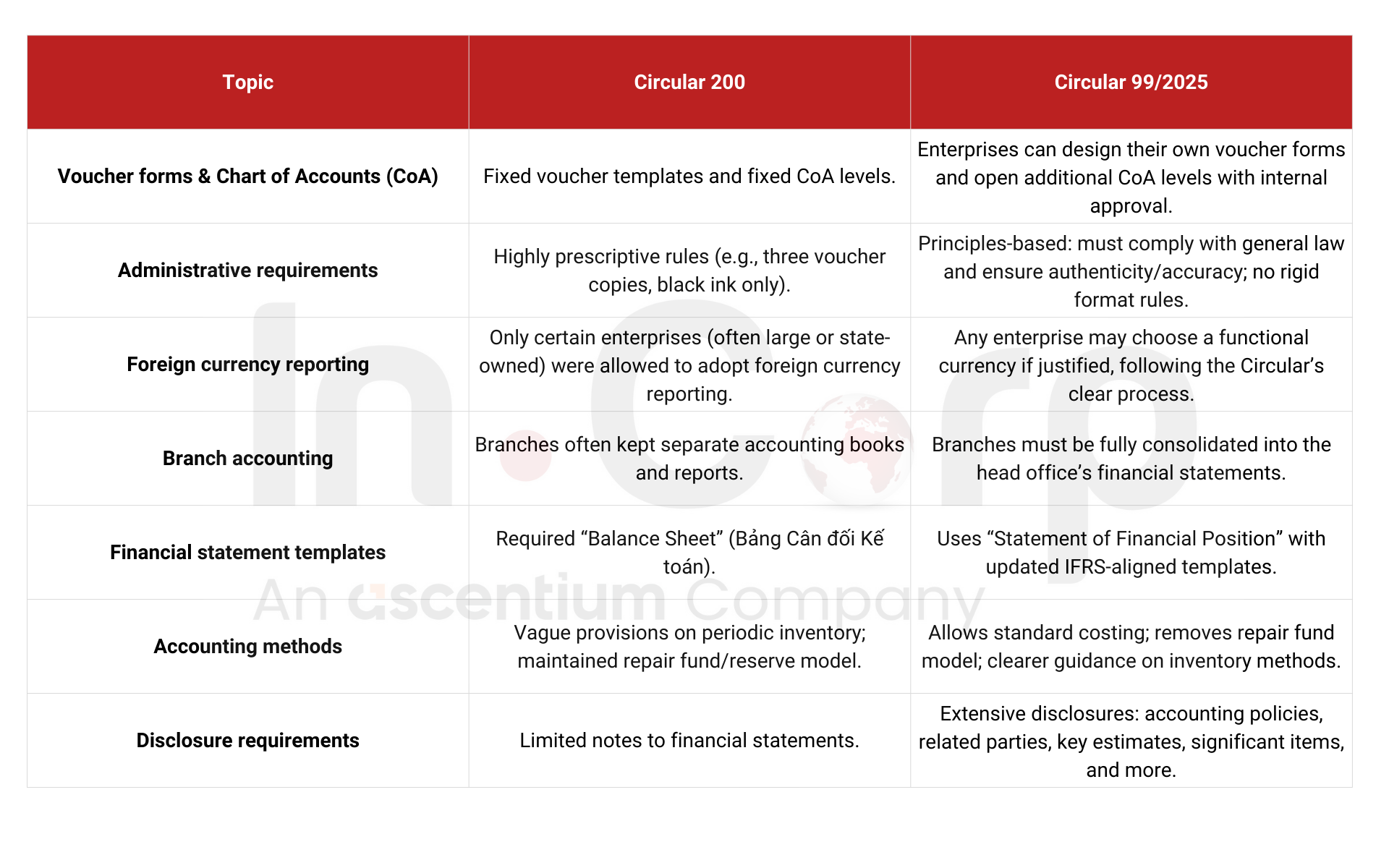

Comparison Highlights: Circular 99 vs. Circular 200/2014

To emphasize the shift, here are side-by-side contrasts (with reference to the new rules) that are especially relevant for SMEs:

In summary, Circular 99 gives businesses more autonomy in how they maintain records, but it also raises the bar for accountability and transparency. It moves Vietnam from a heavily-rulebook system to a more principle-based system in line with international practice.