In recent decades, China has been considered the manufacturing hub of the world, attracting countless businesses seeking cost-effective production and access to a vast consumer market. As firms reassess their footprints, many also scope the company incorporation pathway in Vietnam to align site selection with licensing, tax, and hiring timelines. China accounted for a significant portion of global manufacturing output, producing around 28.7% of the world’s total manufacturing value-added in 2019.

The China +1 strategy boosts manufacturing resilience and efficiency by adding a new production base outside China. Vietnam, a prime choice among options, offers benefits that empower manufacturers to excel in a dynamic global market.

Following US-China Trade War

In July 2018, President Donald Trump of the United States claimed China’s unfair trade practices and started imposing shocking tariffs on China imports. So far, tariffs incurred on Chinese products have reached a whopping US$250 billion. As a result, companies of all sizes are shifting their production centers out of China to countries with matching infrastructure, technology, and human resources like Vietnam.

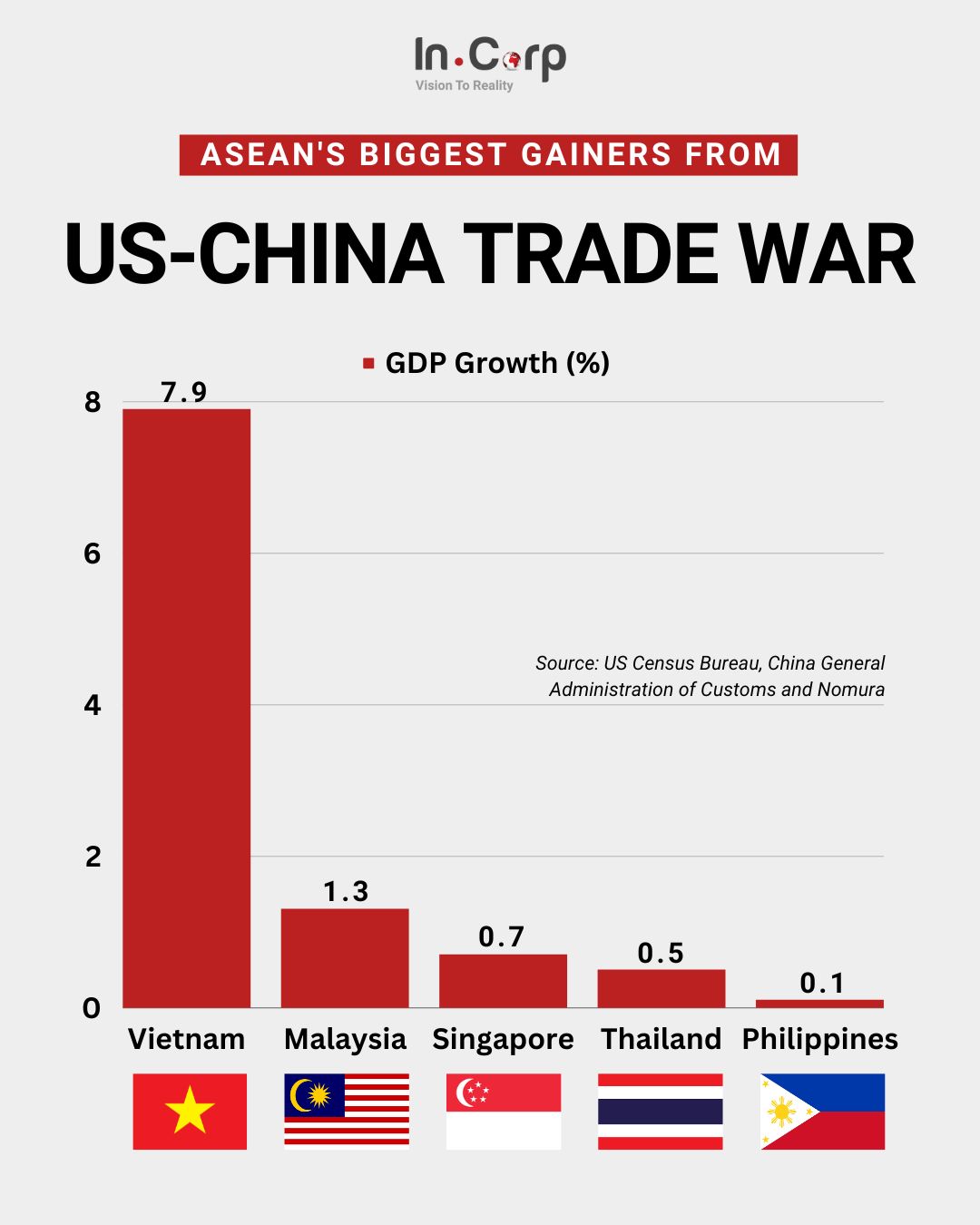

Many trade experts stated that this US-China trade war has shown no sign of improving anytime soon, and has been affecting economies around the world. However, for Vietnam, the US-China war has brought a positive effect on the country’s economy. According to Japanese investment bank Nomura, Vietnam is the biggest benefactor in this dispute with its economy rising by 7.9%. Vietnam’s GDP has also surged by 6.79% in the Q1 of 2019.

Since China is not able to export its products to the U.S., many foreign investors, especially Chinese have flocked to Vietnam and increased their manufacturing capacity to export goods to the U.S.

Moving Your Business to Vietnam: Why Do Chinese Should?

Vietnam has become the favorite destination for investors switching their production from China due to China’s tariff threats and continuously increasing labor costs. Owing to the additional gain of imported goods caused by U.S. tariffs on Chinese products, especially electronics, this multinational shift of production to Vietnam is inevitable.

The apparel industry in Vietnam has the best performance due to the moving operations of textile companies to Vietnam from China. Though the global economy has significantly slowed down, the relocation of China companies to Vietnam will not stop anytime soon.

Investing in Vietnam? Check out InCorp’s Incorporation Services in Vietnam

Positive Relationship between Vietnam and the US

According to a forecast done by Bloomberg, Vietnam’s exports to the US are expected to hike further to US$69 billion in 2019 – a significant growth as compared to US$62 billion in 2018 after signing the total bilateral trade.

Therefore, Vietnam and the U.S. are maintaining a positive economic relationship. In the last ten years, Vietnam’s trade surplus with the United States has experienced significant growth, surging from US$39 billion in 2012 to an impressive US$94.9 billion by 2022. With the underway trade war that is speeding up, more and more Chinese factories (particularly light and manufacturing industries) see this as the best time to move out of the more expensive China.

Not long ago, American company Cooper Tire and Rubber Co and Sailun Vietnam Co Ltd built a tire factory close to Ho Chi Minh City in the form of a joint venture; and the US company Key Tronic Corporations also rented a manufacturing facility around Da Nang.

Favorable Trade Agreements between Vietnam and China

In 2010, Vietnam was a significant participant in the ASEAN-China Free Trade Agreement (ACFTA) because it is an Association of Southeast Asian Nations (ASEAN) member. It has drastically lowered tariffs on a variety of products, fostering more seamless international trade and economic integration.

China-Vietnam economic and commercial cooperation has maintained strong momentum despite the weak global economy. China invested US$2.92 billion in Vietnam’s manufacturing sector in the first nine months of 2023, highlighting Vietnam’s crucial role in the global supply chain with 24.6% of its total trade involving China.

A free trade agreement (FTA) involving 15 countries from the Asia-Pacific region and five of ASEAN’s main economic partners is known as the Regional Comprehensive Economic Partnership (RCEP). The RCEP aims to lower trade restrictions, encourage economic cooperation, and ease the movement of products, services, investments, and technology between China and Vietnam.

Related Read: Guide to Vietnam’s 16 Active Free Trade Agreements (Updated August 2023)

Vietnam’s Unceasing Infrastructure Development

The Vietnamese government makes infrastructure development in the country their very first priority to keep up with its economic growth.

Close to 99% of the Vietnamese population have electricity access and many real estate, ports, bridges, roads, and highways, as well as airports are currently underway to being built.

Stable Government and Cheap Wages

Compared to many neighboring countries in the Asian region, Vietnam’s advantages are perceived as having a relatively stable government and inexpensive labor.

This is especially important for the labor-intensive manufacturing sector, which is why many China businesses have relocated their production to Vietnam. In 2010, Vietnam became the leading manufacturing country for Nike shoes, surpassing China for the first time.

Understanding the China +1 Strategy

The concept of a China +1 strategy involves extending manufacturing operations beyond China to incorporate an additional location, often in a neighboring country. This strategic approach aims to decrease reliance on China and safeguard business operations amidst uncertainties. The core goal is not to supplant China entirely, but rather to mitigate supply chain vulnerabilities and boost operational flexibility. With an alternate production base established, manufacturing enterprises are better equipped to navigate potential disruptions arising from geopolitics, economics, and logistics, thereby mitigating supply chain disruptions and cost escalations.

Manufacturing Companies and China +1

Manufacturing companies across the globe are the primary beneficiaries of a China +1 strategy. Vietnam businesses in industries such as electronics, textiles, automobiles, and consumer goods have long relied on China for their production needs.

However, as China’s competitive edge wanes and businesses become increasingly aware of the importance of supply chain resilience, adopting a China +1 strategy becomes a prudent move. By doing so, manufacturing companies can shield themselves from the repercussions of geopolitical tensions, changes in trade policies, and other unexpected events that may affect their production capabilities and profitability.

The Benefits of Vietnam as a Key Location for the China +1 Strategy

Strategic Geographical Location

Vietnam’s strategic geographical location in Southeast Asia provides a favorable position for companies looking to diversify their manufacturing footprint. Its proximity to China facilitates easy access to raw materials, components, and intermediate goods from the mainland. Additionally, Vietnam’s strategic location allows companies to tap into growing consumer markets in the ASEAN region, which presents ample opportunities for expansion and market penetration.

Read More: Doing Business in Vietnam as a Foreigner: What, Where, Why, How?

Favorable Investment Climate

Vietnam has made significant strides in improving its investment climate by attracting foreign direct investment through various reforms and incentives. Furthermore, the Vietnamese government has actively promoted foreign investment, especially in the manufacturing sector. This is achieved by offering a range of benefits, including tax breaks, streamlined bureaucratic procedures, and simplified customs processes. As a result, this business-friendly environment allows companies to establish operations quickly and efficiently, thus minimizing entry barriers.

Abundant and Skilled Labor Force

As reported in a recent article, among the overall population of 99 million individuals, approximately 51.6 million are classified as part of the skilled and available workforce. Within this segment, an average of 58% falls within the age bracket of under 35 years. This demographic advantage translates into a readily available pool of skilled and trainable workers for manufacturing companies. The Vietnamese labor force is known for its dedication, adaptability, and strong work ethic, making it an ideal choice for companies seeking to maintain high-quality production standards.

Read More: Vietnam’s Workforce: High Demand Skills and Advice for Business in 2024

Competitive Production Costs

While China’s labor costs have been steadily rising over the years, Vietnam continues to offer a competitive edge in terms of production costs. As of 2020, the average monthly manufacturing wage in China was around US$769, while in Vietnam, it was approximately US$278.

Manufacturing companies can benefit from cost savings in labor, utilities, and land, contributing to improved profit margins. This cost advantage, combined with Vietnam’s improving infrastructure and logistics capabilities, makes it an attractive option for businesses looking to optimize their supply chains.

Free Trade Agreements and Market Access

Vietnam’s participation in various free trade agreements (FTAs) significantly enhances its attractiveness as a manufacturing base. The country is a signatory to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA), among others. These agreements grant Vietnamese goods preferential access to numerous markets, opening up opportunities for manufacturing companies to export their products with reduced tariffs and trade barriers.

Related Read: Guide to Vietnam’s 16 Active Free Trade Agreements (Updated August 2023)

Political Stability and Economic Growth

Vietnam has demonstrated remarkable political stability and consistent economic growth in recent years. The government’s commitment to economic reform and international integration has fostered an environment of confidence and predictability for investors. Therefore, this stability and growth trajectory further strengthen Vietnam’s appeal as a reliable location for long-term manufacturing investments.

Conclusion

In general, the China +1 strategy reduces supply chain risks while optimizing production. Vietnam, with its strategic location, investment appeal, skilled workforce, cost competitiveness, trade pacts, and stability, emerges as ideal for diversifying beyond China. Adopting this strategy and choosing Vietnam with InCorp’s expertise unlocks growth in a changing global market.

InCorp Vietnam partners for success, guiding setup, and company type selection. Our insights empower confident China +1 moves, ensuring long-term resilience. With us, navigate expansion complexities, realizing Vietnam’s potential.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What Is China + 1

- China + 1 is a business strategy where companies diversify their manufacturing operations by adding at least one other country alongside China. This approach helps reduce reliance on China and mitigate risks such as supply chain disruptions or geopolitical tensions.

What Is China + 1 Strategy

- The China +1 strategy is a business approach where companies diversify their manufacturing operations by adding production in another country besides China. This reduces reliance on China and mitigates risks related to supply chain disruptions, tariffs, or geopolitical tensions.

What is China +1 strategy Vietnam?

- The "China +1" strategy refers to the business approach where companies diversify their manufacturing operations by maintaining a presence in China while expanding into another country—Vietnam being a top choice. This strategy reduces dependence on China, mitigates risks such as tariffs or supply chain disruptions, and leverages Vietnam's lower labor costs, favorable trade agreements, and improving infrastructure.

What Is China 1 Strategy

- China's "1 strategy" typically refers to the "One China" policy, which asserts that there is only one sovereign state under the name China, encompassing both mainland China and Taiwan. This policy is central to China's foreign relations and national sovereignty stance.