Vietnam’s 2025 Corporate Income Tax (CIT) reform represents a landmark shift in the country’s tax incentive landscape, reflecting a deliberate government strategy to modernize tax administration, prioritize innovation and sustainability, and tighten compliance in the digital economy. As a result, many businesses are turning to professional accounting services to ensure compliance with the new regulations and optimize their tax strategies under the updated framework.

This detailed analysis unpacks the core elements of the new tax regime—anchored primarily in the Law on Corporate Income Tax No. 67/2025/QH15, effective October 1, 2025—and related regulations such as Decree No. 218/2013/ND-CP, Decision 29/2021/QD-TTg, and the Law on Investment 2020. It also integrates insights from Vietnam’s tax circulars and government directives to provide foreign investors with a nuanced understanding of how to maximize tax incentives while ensuring compliance.

1. Strategic Shift in Vietnam’s Tax Incentive Framework

Vietnam has traditionally offered tax incentives based on geographic location, including industrial zones and socioeconomically disadvantaged regions. However, the 2025 amendment signals a paradigm shift toward sector-and scale-based incentives that align with national priorities such as digital transformation, green growth, and industrial upgrading.

Under Articles 13 and 14 of the amended law, tax incentives are now focused on:

- High-tech and digital industries

- Renewable energy and environmental protection

- R&D and supporting industries (e.g., automotive, energy-saving)

This shift moves Vietnam away from low-cost manufacturing toward a technology-driven economy, optimizing tax incentives to attract quality foreign investment and drive innovation.

2. Corporate Income Tax Rates and Thresholds: A Tiered Approach

Vietnam retains its standard CIT rate of 20%, but the new law introduces a graduated CIT structure that supports small and medium-sized enterprises (SMEs), as stipulated in Article 10 of the amended CIT Law:

- 15% CIT for enterprises with annual revenue up to VND 3 billion (~USD 125,000)

- 17% CIT for revenue over VND 3 billion and up to VND 50 billion (~USD 2.1 million)

- 20% CIT standard rate for revenue exceeding VND 50 billion

This graduated rate system aims to alleviate the tax burden on SMEs, encouraging their growth while maintaining fiscal fairness for larger enterprises.

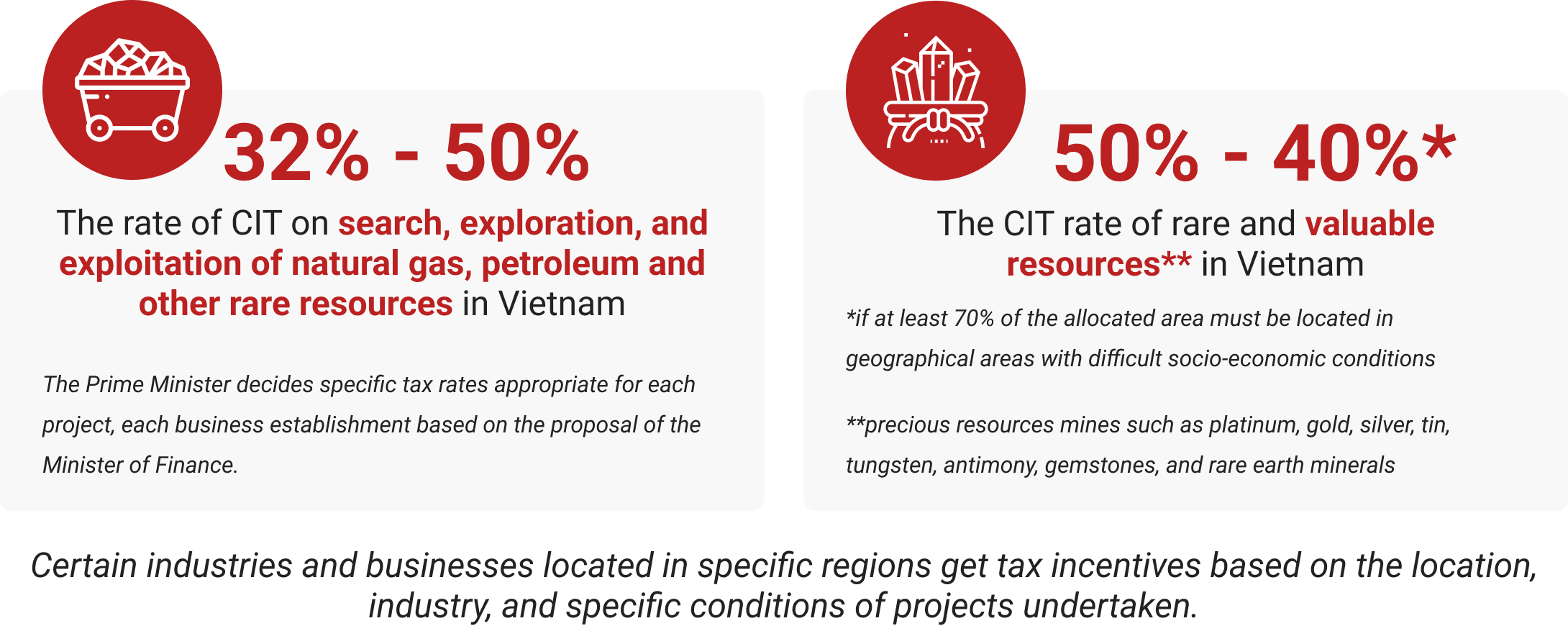

Certain resource-intensive sectors face elevated CIT rates reflecting their strategic importance and environmental impact. For instance, oil and gas exploration is taxed between 25% and 50%, with the exact rate determined by the Prime Minister per contract, while exploitation of precious and rare natural resources such as gold, silver, and rare earths is subject to a 50% tax rate, reducible to 40% if the project is located in especially difficult socio-economic areas.

| Enterprise Type | Annual Revenue | CIT Rate |

| Standard enterprises | 20% (unchanged) | |

| Small enterprises | VND 3–50 billion | 17% |

| Micro enterprises | ≤ VND 3 billion | 15% |

| Special Industries (e.g., oil, gas, rare minerals) | N/A | 25–50% (previously it’s 32% to 50%) |

Revenue is calculated based on the previous tax period’s figures or according to specific provisions applicable to newly established businesses.

Learn how to optimize your tax position with InCorp Vietnam’s expert guidance: Corporate Income Tax Vietnam

3. Sectoral and Location-Based Tax Incentives: Focused and Conditional

3.1 Sector-Based Incentives

The amended CIT Law (Article 13) explicitly enumerates sectors eligible for preferential tax incentives, focusing on those that contribute to Vietnam’s digital economy and green growth agenda. These include:

- High-tech industries: Artificial Intelligence (AI), software development, semiconductor manufacturing

- Renewable and clean energy projects

- Research and Development (R&D) centers

- Eco-industries and environmental protection projects

- Digital technology products, cybersecurity, SME incubators, and co-working spaces supporting startups

- Supporting industries: Automotive manufacturing, energy-saving technologies, and supply chain industries

This sectoral prioritization is further reinforced by Decision 29/2021/QD-TTg, which sets out specific criteria for investment projects to qualify for special tax incentives, emphasizing substantial investment capital, deployment of advanced technology, and active participation in Vietnam’s enterprise value chain.

3.2 Location-Based Incentives

Unlike prior regimes, the 2025 law abolishes tax incentives for investments in industrial parks and broadly defined disadvantaged areas. Incentives now apply only to projects located in:

- Areas with especially difficult socio-economic conditions

- Special economic zones, high-tech parks, and centralized IT zones designated by the Prime Minister

This geographic tightening ensures that tax incentives are targeted toward regions with genuine developmental needs, avoiding blanket subsidies and encouraging more strategic investment decisions.

3.3 Large-Scale Manufacturing Projects

The threshold for large-scale manufacturing projects eligible for tax incentives has been raised from VND 6,000 billion to VND 12,000 billion (~USD 475 million), and such projects must meet technology standards prescribed by the Ministry of Science and Technology (Article 13). This change reflects a more selective approach, prioritizing capital-intensive, technologically advanced investments that can drive industrial upgrading

Investing in Vietnam? Explore InCorp Vietnam’s Accounting and Taxation Services

4. Tax Holidays and Preferential Rates: How They Work

Vietnam offers generous tax holidays and preferential CIT rates to incentivize investment in priority sectors, as detailed in Article 14 of the amended CIT Law and Decree No. 218/2013/ND-CP.

For projects qualifying for the 10% preferential CIT rate, typically in high-tech, renewable energy, and R&D sectors, the tax holiday structure is:

- 4 years full exemption

- Followed by 9 years at 50% CIT reduction

- Total preferential period of 13 years, with the 10% rate applied for 15 years

For projects qualifying for the 17% CIT rate, such as domestic manufacturing and energy-saving industries, the holiday is:

- 2 years full exemption

- Followed by 4 years at 50% CIT reduction

- Total preferential period of 6 years, with the 17% rate applied for 10 years

A practical example for a high-tech enterprise would be paying no CIT during years 1–4, then 5% CIT (half of 10%) during years 5–13, 10% CIT in years 14–15, and reverting to the standard 20% CIT from year 16 onward.

These front-loaded tax holidays are designed to improve early-stage cash flow, which is critical for capital-intensive projects, while the extended preferential period encourages long-term investment and reinvestment.

Read Related: Accounting Services & Tax Reporting Outsourcing in Vietnam

5. Expansion of Taxpayer Scope and Digital Economy Compliance

The 2025 CIT Law significantly expands the tax base by including foreign e-commerce and digital technology platforms as permanent establishments (PEs) if they generate income sourced from Vietnam (Article 3). This means foreign digital enterprises providing goods and services via platforms such as e-commerce, cloud computing, or digital advertising are now subject to CIT and VAT obligations, closing previous loopholes that allowed tax avoidance.

Complementing this, the VAT rate for foreign digital service providers was increased from 5% to 10% effective July 1, 2025, with mandatory tax registration and e-invoicing requirements imposed to ensure compliance.

Additionally, capital gains tax now applies to indirect foreign transfers of shares in Vietnamese companies, addressing tax avoidance through offshore structures and ensuring that gains from foreign investment exits are properly taxed.

6. Non-Tax Incentives: Customs Duty and Land Rental Benefits

Beyond CIT, Vietnam offers important non-tax incentives to support foreign investment, codified in the Law on Investment 2020 and related decrees.

6.1 Customs Duty Exemptions

Foreign investors can benefit from exemptions on import duties for:

- Raw materials and supplies for software production that are not domestically available

- Goods imported for scientific research and technological development

- Goods imported under export processing contracts

These exemptions reduce input costs for innovative and export-oriented projects, fostering competitiveness.

6.2 Land Rental Incentives

Vietnam offers tiered land rental exemptions based on sector and location, as regulated under the Land Law and Decree No. 46/2014/ND-CP:

- Full exemption during the entire operational period for projects in especially encouraged sectors located in socioeconomically difficult regions

- 15-year exemption for projects in special encouragement sectors in difficult areas

- 11-year exemption for projects in special investment encouragement sectors

- 7-year exemption for projects in extremely difficult socio-economic areas

- 3-year exemption for urban and environmental projects needing relocation

Additionally, a 30% reduction in land sublease payments is available for high-tech and innovative startups for the first five years.

7. Additional Incentives and Support for Innovation and SMEs

Vietnam encourages R&D and technology transfer through provisions allowing enterprises to allocate up to 20% of taxable income to science and technology development funds, with a 200% deduction on R&D expenses under Circular 96/2015/TT-BTC. This incentivizes continuous innovation investment.

Startups and SMEs benefit from specific incentives, including a 2-year CIT exemption and 4-year 50% reduction for innovative startups, and a 3-year CIT exemption for SMEs under Resolution 198/2025/QH15. These are complemented by land rent reductions and interest subsidies (e.g., a 2% interest subsidy for green projects), facilitating growth and sustainability.

8. Compliance and Reporting: Navigating the New Landscape

The 2025 reforms also emphasize compliance modernization:

- E-invoicing is mandatory for all businesses, with strict issuance and validation timelines enforced by the General Department of Taxation. AI and big data analytics are used to detect tax evasion and irregularities.

- Tax audits are limited to once per year for compliant taxpayers under Resolution 198/2025/QH15, but non-compliance triggers more frequent inspections and penalties.

- Anti-abuse rules deny incentives if enterprises engage in artificial transactions to replicate benefits or manipulate related-party dealings, reflecting Vietnam’s commitment to OECD-aligned transfer pricing and anti-base erosion standards

Investing in Vietnam? Find out about InCorp Vietnam’s Accounting & Taxation Services

Conclusion

Vietnam’s 2025 tax incentive regime embodies a strategic recalibration, focusing public incentives on sectors and projects that drive innovation, sustainability, and industrial upgrading. For foreign investors, this means:

- Prioritizing investments in high-tech, renewable energy, digital, and supporting industries to access preferential rates and tax holidays.

- Aligning projects with designated special economic zones and socioeconomically challenged areas to leverage location-based incentives.

- Preparing for enhanced digital economy compliance including PE determination, VAT registration, and e-invoicing.

- Utilizing non-tax incentives such as customs duty exemptions and land rental reductions to improve project economics.

- Engaging expert local advisors to navigate certification, application procedures, and ongoing compliance obligations.

By understanding and strategically applying these provisions—rooted in the amended CIT Law No. 67/2025/QH15, Decree No. 218/2013/ND-CP, Decision 29/2021/QD-TTg, and related legislation—foreign companies can maximize their tax benefits and secure a competitive foothold in Vietnam’s rapidly evolving economy.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What Are Tax Incentives

- Tax incentives are financial benefits provided by governments to encourage specific economic activities or behaviors, such as investment, job creation, or energy efficiency. They can include deductions, credits, exemptions, or reduced tax rates.

What do you mean by incentives?

- In the context of Vietnam company formation and taxation, "incentives" refer to preferential policies offered by the government to encourage investment in certain sectors or locations. These can include reduced corporate income tax rates, tax holidays, exemptions from import duties, or land use incentives, especially in high-tech, export-oriented, or underdeveloped areas.

What is the meaning of tax concessions?

- Tax concessions refer to reductions, exemptions, or allowances granted by the government to reduce a taxpayer's liability. These concessions are typically offered to encourage specific economic activities, such as investment in certain industries or regions, or to support social goals like education or environmental protection.

What is the meaning of tax incentivized?

- "Tax incentivized" refers to specific activities, investments, or business operations that are encouraged by a government through reduced tax rates, exemptions, or deductions. In Vietnam, tax incentives are often offered to companies operating in priority sectors (like high-tech or education) or in designated economic zones to attract foreign investment and stimulate economic development.