The recent Global M&A Partners (GMAP) conference, hosted for the first time in our vibrant nation, has placed Vietnam firmly on the map as a prime investment destination for mergers and acquisitions (M&A). This prestigious event, graced by international representatives, highlighted Vietnam’s unique strengths: a stable political climate, a highly skilled workforce, and competitive labor costs, making it an irresistible choice for multinational companies and investors.

Investing in Vietnam? Check out our Talk to our Company Registration Experts

Our nation’s appeal to foreign investors is unmistakable, with a history of attracting over 38,600 projects from 143 countries, totaling an impressive US$460 billion. The year 2023 has been particularly remarkable, with foreign direct investment reaching US$18 billion in just the first ten months – the highest in a five-year span. These figures are a testament to Vietnam’s dynamic potential in M&A activities and its growing stature as a globally attractive investment destination. We invite you to explore the myriad opportunities that Vietnam offers, promising not just growth but also innovation and partnership in a thriving economic landscape.

Read More: Why Should Foreign Investors Consider Doing Business in Vietnam?

Three Major Transport Projects in 2023

Vietnam is set to complete three major transport projects this year: My Thuan 2 Bridge, My Thuan-Can Tho Expressway, and Tuyen Quang-Phu Tho Expressway. These projects will significantly reduce travel times and enhance connectivity in key regions.

The completion of these projects reflects Vietnam’s commitment to improving its infrastructure, offering promising opportunities for foreign investors, especially in logistics and related industries. This development is expected to boost economic growth and regional integration.

Steel Production Boost and Industrial Growing Confidence

Vietnam’s steel industry is proactively adapting to greener production methods to comply with EU emission standards, affecting its significant steel exports to the EU. Major producers like VAS Group and Hoa Phat Group are transitioning to eco-friendly manufacturing, leveraging advanced technologies to reduce emissions, ensuring competitiveness in stringent markets.

Simultaneously, Vietnam is experiencing a revival in industrial production and corporate confidence, with a notable increase in the industrial production index and growth across various sectors. This upswing, marked by rising business confidence and increased export contracts, indicates a strong recovery and favorable opportunities for foreign investment in Vietnam.

Apple Supplier’s Big Boost to Bac Giang ICT

Apple supplier Luxshare-ICT is investing an additional US$330 million in its electronic component manufacturing project in Bac Giang, Vietnam. This expansion, making Luxshare the second-largest foreign investor in Bac Giang, will create thousands of jobs and boost industrial production in the region.

This move reflects a broader trend of Apple suppliers strengthening their presence in Vietnam, aligning with the country’s growing role in global electronics manufacturing. With 26 suppliers operating 28 factories across Vietnam, the country is becoming a key hub for Apple’s production network.

Vietnam – A Hotspot for Blockchain Development

Vietnam is gaining prominence in Southeast Asia’s blockchain sector, driven by high crypto adoption, a skilled IT workforce, and a young, tech-savvy population. The success of startups like Sky Mavis, behind Axie Infinity, highlights this potential. The region, led by Vietnam and including countries like the Philippines and Thailand, is becoming notable for blockchain adoption.

Vietnam’s robust tech talent and demographics enhance its blockchain potential. The Vietnam Blockchain Association emphasizes sector-wide blockchain education, while Ninety Eight’s US$25 million fund supports startups, fostering a dynamic blockchain environment.

SLP Drives Expansion in Vietnam’s Logistics Sector

SEA Logistics Vietnam, under GLP, is expanding its logistics network in Vietnam with the construction of SLP Bac Ninh Logistics in Thuan Thanh II Industrial Park. This project, the third in Bac Ninh province, will provide 93,000 sq.m of modern logistics facilities, enhancing the region’s industrial and logistics infrastructure.

SLP’s growth in Vietnam, with nine logistics infrastructures totaling nearly 1 million sq.m, reflects the country’s increasing appeal to global investors in manufacturing, e-commerce, and logistics. Bac Ninh, a high-tech hub, is attracting significant foreign investment, with over 2,040 projects and a total capital of US$24.6 billion.

Read More: A Look into Business Opportunities in E-commerce Logistics in Vietnam

Expanding International Trade and Partnerships

Vietnam is actively expanding its international trade and partnerships. The country is working with Mongolia to double its trade volume, already having increased it to US$85 million in 2022, with a focus on agriculture, mining, and tourism. Vietnam’s green strategic partnership with Denmark spans 10 sectors, aiming to deepen their Comprehensive Partnership and promote sustainable investments. This collaboration has led to nearly US$900 million in bilateral trade.

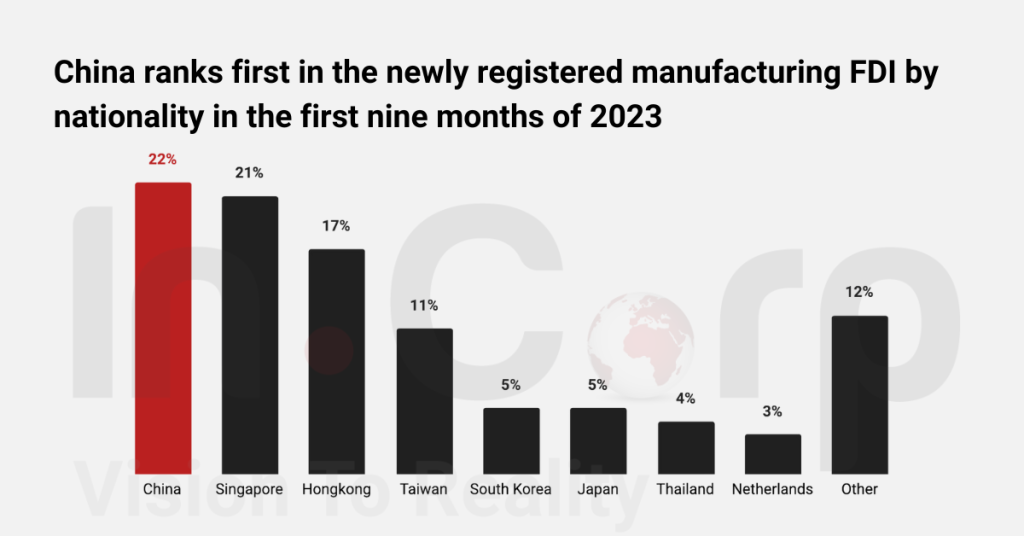

China remains a significant investor in Vietnam, particularly in the manufacturing sector, with investments reaching US$2.92 billion in the first nine months of 2023. The robust trade between Vietnam and China, accounting for 24.6% of Vietnam’s total trade, emphasizes Vietnam’s key role in the global supply chain.

Read Related: China +1 Strategy in Vietnam: An Overview for Chinese Investors

German investments are also notable, with the Suedwolle Group investing US$27 million in a textile plant in Ninh Thuan and Harting launching a US$5 million plant in Hai Duong. These investments highlight Vietnam’s attractiveness in terms of strategic location, competitive pricing, and potential for industrial growth.

Ba Ria-Vung Tau’s FDI Skyrockets by 278%

Ba Ria-Vung Tau province in southern Vietnam has seen a significant increase in foreign direct investment (FDI), attracting 20 new projects worth US$751 million this year, a 2.78-fold increase from last year. Additionally, 25 existing projects increased their capital by US$503 million, indicating a robust growth in foreign investment.

The province now hosts 457 FDI projects with a total capital of US$31.4 billion, including 284 industrial parks. The local government’s efforts to attract more domestic and foreign investors and resolve investment challenges are contributing to this positive trend, presenting lucrative opportunities for foreign investors.

Read More: Choosing the Ideal Business Location in Vietnam: The First Step of Success

Sojitz Launches Industrial Park Project in Dong Nai

Sojitz Corporation is developing Long Duc 3 Industrial Park in Dong Nai, Vietnam, to meet the growing manufacturing demand. This project, a collaboration with GLT, aims to support the expansion of the manufacturing industry and respond to the increasing domestic consumer market.

Dong Nai, with its strategic location near Long Thanh International Airport and robust transportation infrastructure, is emerging as a new manufacturing hub. Sojitz, with over 20 years of experience in industrial park operations, plans to make Long Duc 3 a next-generation industrial park, contributing to Vietnam’s economic growth and a decarbonized society.

Read Related: Vietnam’s Industrial Zones: A Key Player in Global Manufacturing

Hung Yen’s Socio-Economic Growth Spotlight

Hung Yen province, excelling in socioeconomic development, ranks among Vietnam’s top 10 for foreign investment attraction. With a regional GDP growth of 8.61%, it focuses on high-tech and supporting industries, enhancing its appeal to investors.

The province’s strategic initiatives in infrastructure and social welfare, coupled with its strong performance in the Provincial Competitiveness Index, make it an attractive destination for foreign investment. Hung Yen’s commitment to sustainable, smart urban development positions it as a promising location for business and economic growth.

Dong Thap Ramps Up Investment in Industrial Zones

Dong Thap province is enhancing investment in its industrial zones to spur socioeconomic growth. Prioritizing sectors like agricultural product processing and electronics, it plans to develop 11 new industrial zones, adding to its current four zones.

These zones, strategically located near major transport routes and equipped with modern facilities, have attracted significant foreign investment. Dong Thap’s focus on high-tech and sustainable development makes it an appealing destination for investors, with a high occupancy rate in existing zones.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Is $1000 USD a good salary in Vietnam?

- Yes, $1,000 USD per month is considered a good salary in Vietnam, especially in smaller cities or rural areas where the cost of living is lower. In major cities like Ho Chi Minh City or Hanoi, it provides a comfortable middle-class lifestyle, covering housing, food, transportation, and personal expenses.

Is Vietnam a good investment?

- Yes, Vietnam is considered a good investment destination due to its stable economic growth, young workforce, and strategic location in Southeast Asia. The government supports foreign investment through various incentives, especially in manufacturing, tech, and renewable energy. Additionally, Vietnam has signed numerous free trade agreements, improving market access and reducing tariffs. However, investors should be mindful of regulatory challenges and local compliance requirements.

What is the best investment in Vietnam?

- The best investment in Vietnam depends on the investor’s goals, but key sectors include manufacturing (especially electronics and textiles), renewable energy, real estate, and technology. Vietnam’s stable economic growth, young workforce, and integration into global trade agreements make these industries particularly attractive to both foreign and local investors.