Vietnam has become a top economic hub in Asia, leveraging its strategic location, low labor costs, and government reforms that lower operating expenses. The retail sector, in particular, has attracted international brands aiming to cut costs. With labor costs more affordable than in other countries, many of these companies are setting up factories in Vietnam to maximize their investments.

Among 9 Asian countries, Vietnam has the second-lowest average cost of running a business. With monthly expenses of US$79,280, Vietnam’s manufacturing cost is only slightly higher than Cambodia’s, at US$65,313. In comparison, Thailand and Singapore have higher monthly manufacturing costs of US$142,344 and US$366,561, respectively. However, updated data for 2025 shows Vietnam’s labor costs offer approximately 50% savings compared to China.

Vietnam’s low operating costs result from investment-friendly policies, a supportive business environment, and low wages. Recent government initiatives aim to reduce business costs by at least 30% in 2025. This article explores how Vietnam’s labor costs attract global investors, covering operating expenses, labor trends, and tax incentives for manufacturers.

Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services

Operating Cost for Business in Vietnam

By definition, operating costs are all the expenses incurred by companies daily to run a business. However, the cost of running a business varies based on your daily activities. While companies involved in buying and selling properties have to include real estate agents and marketing fees in the operating cost, a plumbing company would have to deal with storage and equipment costs.

Moreover, business owners must be aware of the differences between operating expenses and operating costs. Both might sound the same but they are not. Operating costs include all kinds of expenditures, even operating expenses like rent, utility bills, raw materials, and product delivery charges. Contrary to that, operating expenses are business spending not directly linked with manufacturing the product or delivering the service. It is merely a part of the operating cost.

It is calculated as:

Operating costs = Cost of goods sold (COGS) + Operating expenses (OPEX)

While COGs include direct labor costs, wages, raw material costs, repairs, utilities, tax, and rents, OPEX includes advertising, administrative, R&D, insurance, and office supply expenses.

Read Related: Setting Up a Manufacturing Company in Vietnam: Industries & Procedure

Operating costs for a business fall into three categories: fixed, variable, and semi-variable. Fixed costs, such as wages and rent, remain constant each month. Variable costs, however, fluctuate based on market conditions—such as increased manufacturing expenses when production scales up or higher marketing costs during festive seasons.

Semi-variable costs are typically fixed expenses with occasional fluctuations. For instance, a business might have a set budget for office cleaning, but an occasional deep cleaning will increase costs. Similarly, a software subscription might cover a set number of users, but adding a new team member could push the business into a higher pricing tier. Fixed costs can be direct, such as rent and leases, or indirect, like salaries and office supplies. Variable costs include raw materials, utilities, packaging, payroll, and sales commissions, while semi-variable costs often cover overtime pay, extra internet bandwidth, and additional electricity charges.

Overall, operating costs are essential for maintaining balance sheets and setting budgets. It can lead to better compliance and reduce your tax burden. Companies can save money if they are able to determine the operating cost accurately, as it takes into account base expenses like tools, utilities, rent, wages, maintenance needs, equipment, etc. It also provides important information about the financial condition of the business to investors, helping them make crucial investment decisions.

Cost of Doing Business: Understanding Vietnam Labor Costs

The place is still one of the cheapest places in Asia to do business. In 2025, despite rising costs across Southeast Asia, Vietnam maintains its competitive advantage with labor costs approximately 50% lower than China and significantly below Singapore and Malaysia. The cost structure remains attractive for labor, utilities, rent, and taxes in the country, making it an attractive alternative, especially for the higher-priced economies of Asia, including China and Malaysia.

Labor Costs: Still a Key Advantage

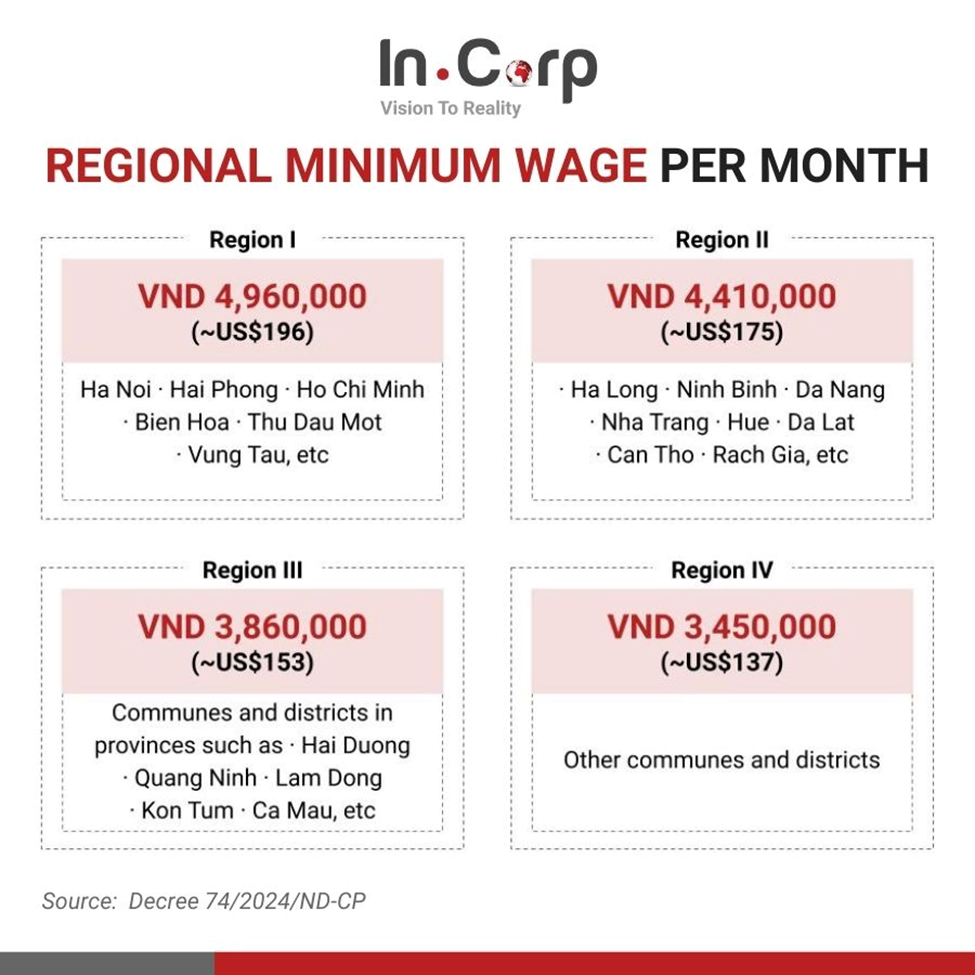

Labor cost is often the first metric investors evaluate, and Vietnam delivers. Updated 2025 data shows Vietnam’s hourly minimum wage ranges from $0.69 to $0.99 across regions. Let’s briefly compare Vietnam’s labor cost competitiveness:

| Country | Average Gross Annual Income at Minimum Wages | Hourly Minimum Wage (USD) |

| Vietnam | ~$1,591 | $0.76 |

| Indonesia | ~$2,449 | $1.18 |

| Thailand | ~$3,733 | $1.50 |

| Philippines | ~$3,405 | $1.64 |

| Malaysia | ~$4,348 | $1.86 |

Source: https://worldpopulationreview.com/country-rankings/minimum-wage-by-country

Vietnam remains highly cost-effective, especially in manufacturing, textiles, electronics, and back-office outsourcing. Recent surveys indicate Vietnamese factory workers earn approximately $250-400 monthly on average, maintaining significant cost advantages over regional competitors.

Updated Monthly & Hourly Minimum Wages (2025)

Vietnam’s government continues to adjust minimum wage levels annually to reflect inflation, labor market demands, and economic development goals. Below are the official minimum wage rates applicable across Vietnam in 2025:

Vietnam’s labor federation has proposed a 9.2% minimum wage increase from July 2025, citing the country’s goal of becoming a high-income developed nation by 2045. This proposal aims to support the national vision of reaching USD $15,000 per capita annual income from the current USD $4,700.

These rates represent a 6% increase over the previous year, aimed at improving workers’ living conditions while maintaining investor appeal.

Average Salaries by Sector in Vietnam (2025)

As of early 2025, the average monthly salary in Vietnam is approximately VND 8.3 million (equivalent to USD 321). However, this overall figure is significantly skewed by the lower wages in agricultural jobs and rural areas. This can be misleading for businesses when hiring highly skilled positions in major urban centers.

In reality, the cost of attracting talent in Vietnam varies considerably depending on location, specific industry, and the required level of expertise.

High-paying sectors

- Information Technology (IT): 25–40 million VND/month

- Finance and Banking: 20–35 million VND/month

- Manufacturing Engineering: 18–30 million VND/month

Mid-range sectors

- Healthcare and Pharmaceuticals: 15–25 million VND/month

- Marketing and Communications: 12–22 million VND/month

- Education (private sector): 12–20 million VND/month

Entry-level and service roles

- Retail and Hospitality: 8–15 million VND/month

- Customer Support/Call Centers: 8–12 million VND/month

- Factory workers: 6–10 million VND/month

Salaries in major cities like Hanoi, Ho Chi Minh City, and Da Nang are significantly higher compared to rural or smaller provinces, with urban centers paying 39% more than rural areas. According to the General Statistics Office under the Ministry of Finance, the average monthly income in Vietnam during Q1 2025 was VND 10.1 million in urban areas and VND 7.2 million in rural areas.

Read More: Minimum Wage in Vietnam: Increase Keeps Vietnam Among the Most Affordable for Business

Mandatory cost and Employee Benefits in Vietnam

Compulsory cost

Wages are not the only consideration when hiring someone in Vietnam. Employers must contribute to Vietnam’s social security system, known as SHUI: Social Insurance, Health Insurance, and Unemployment Insurance.

SHUI Contribution Rates (2025)

When hiring employees in Vietnam, businesses must account for mandatory contributions beyond basic salaries. Below are the official contribution rates for 2025:

| Category | Employer Contribution | Employee Contribution |

| Social Insurance (SI) | 17.5% | 8% |

| Health Insurance (HI) | 3% | 1.5% |

| Unemployment Insurance | 1% | 1% |

This raises the employer’s overall expenses by roughly 21.5% above the gross wage. These figures are essential when calculating the true cost of employment.

There are also salary caps used for calculating these contributions:

- For Social and Health Insurance: Capped at 20 times the base wage (now 46.8 million VND/month)

- For Unemployment Insurance: Limited at 20 times the regional minimum wage

Read Related: Vietnam Social Insurance: Social, Health & Unemployment Insurance (SHUI)

Monthly Direct cost

Monthly Direct Cost refers to variable workforce expenses such as Overtime Payments and Business Travel or Expense Claims, which can fluctuate based on the employee’s workload, seasonal projects, or changing operational requirements.

For instance, Overtime pay ranges from 130% to 300% of the regular hourly wage, depending on the type of extra work performed, including weekday overtime, weekend overtime, night shifts, and work on public holidays or paid leave. Employees working overtime at night receive an additional 20% on top of their overtime pay.

Monthly Indirect cost

Monthly Indirect Cost covers benefits that enhance employee well-being and satisfaction, this includes:

- Annual Health Check (required by law)

- Depends on the company policy.

- On average, this cost may vary from US$20 to US$200 per person.

- 13th Month Salary (common practice in Vietnam)

- Equal to 1 month of gross salary/year

- Example: For VND 30.000.000/month (~ US$1.139)=> Monthly equivalent: VND 2.500.000 (~ US$94).

- Performance Bonus

- Typically varies by company policy and industry.

- Some companies budget 1–3 months of base salary annually as a bonus.

- Social Activities

- Often includes team building, year-end parties, workshops, etc.

- Typical budget: VND 1.600.000 (~US$60/person/year).

While these mandatory costs form the bulk of labor expenses, businesses may also offer other optional benefits such as KPI-based incentives, training or transportation allowances, or premium healthcare insurance to attract and retain talent in Vietnam’s competitive labor market.

To better understand workforce cost, here is a step-by-step example of breaking down the cost components and calculating the total salary and mandatory cost.

| No | Description | Rate | Monthly Cost (USD) | Monthly Cost (VND) |

| 1 | Salary and Allowance | | 1139.38 | 30,000,000 |

| | Monthly Gross Basic Salary | | 1139.38 | 30,000,000 |

| | Other Allowances | | – | - |

| 2 | Mandatory Cost and Employee Benefits | | 282.28 | 7,432,500 |

| 2.1. | Compulsory Cost | | 267.76 | 7,050,000 |

| | Employer’s Social Insurance | 17,5% | 199.39 | 5,250,000 |

| | Employer’s Health Insurance | 3% | 34.18 | 900,000 |

| | Employer’s Unemployment Insurance | 1% | 11.39 | 300,000 |

| | Trade Union | 2% | 22.79 | 600,000 |

| 2.2. | Monthly Direct Cost | | 0.00 | 0 |

| | Overtime Payment | | – | – |

| | Business Travel and Expense Claim | | – | – |

| 2.3. | Monthly Indirect Cost | | 14.53 | 382,500 |

| | Performance Bonus | | – | – |

| | 13th Month Salary | | – | – |

| | Annual Health Check | ~US$120/person/year | 9.68 | 255,000 |

| | Social Activities | ~US$60/person/year | 4.84 | 127,500 |

| | 24/7 Accident & Medical Insurance | Depends on salary bracket | – | – |

| | Total Workforce Cost (1 + 2) | | 1421.67 | 37,432,500 |

Trade Union Law Reform (Effective July 2025)

Foreign workers with 12-month contracts are permitted to join or form trade unions under Vietnam’s recently passed Law on Trade Unions. This aligns with international labor standards and increases workers’ bargaining power. *Note: USD to VND exchange rate stands at 26,330 (updated July 2025)

Economic Outlook and Future Projections

Vietnam’s economy demonstrated strong recovery in 2024, expanding by an impressive 7.09%, with the Industrial Production Index surging 8.4% year-on-year—the highest growth in four years. The government has set an ambitious 8% GDP growth target for 2025.

Key economic indicators for 2025:

- Manufacturing accounts for over 20% of Vietnam’s GDP

- Wage increases averaging 9.5% annually across sectors

- 82% of Vietnamese companies planning salary increases in 2025

- Vietnam aims to attract 40-50 billion USD in FDI annually during 2026-2030

Tax Incentives for Reducing Average Cost in Vietnam

Global investors looking to set up a company in Vietnam are often worried about how to reduce costs in business. For them, knowing about tax incentives like Corporate Income Tax (CIT) incentives is essential. CIT incentives can considerably reduce the average cost of doing business in Vietnam, as it has preferential tax rates and tax holidays.

Read More: Unlocking Corporate Income Tax Secrets in Vietnam: A Comprehensive Overview

While the standard CIT rate is 20%, it can increase up to 50% based on the nature of the project. Also, there are specific provisions for providing 10%, 15%, and 17% preferential tax rates to foreign investors, which can be available either for a specific period or the full tenure of the project.

On the contrary, companies are granted provisions to pay 50% of their taxes or refrain from paying CIT for a certain period if they fulfill certain conditions. It is usually available for 4 years, starting from the first profit-earning year or the 4th revenue-generation year. The Vietnamese government also provides land rental exemptions and customs duty tax incentives.

Read More: Maximize Benefits: A Complete Guide to Tax Incentives in Vietnam for Foreign Companies

Final Words

For investors evaluating Vietnam as a manufacturing or service delivery location, the combination of competitive labor costs, favorable tax policies, and strong economic fundamentals continues to provide significant advantages over regional alternatives. However, success requires understanding the evolving regulatory landscape, including new trade union requirements and potential wage adjustments, while leveraging available incentives to optimize operational costs.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How do you calculate labor cost?

- To calculate labor cost, add all direct and indirect employee-related expenses. This includes gross wages or salaries, overtime pay, bonuses, employer-paid taxes (such as social insurance, health insurance, and unemployment insurance in Vietnam), and any other benefits like allowances or training. The formula is: **Labor Cost = Gross Salary + Employer Contributions + Benefits + Other Related Costs** In Vietnam, employer contributions typically add approximately 21.5% to the gross salary.