Vietnam’s coffee market is experiencing a surge in growth and evolving consumer preferences, backed by record export revenues and rising domestic demand. In 2025, the Vietnam coffee market achieved historic highs in export turnover thanks to soaring global coffee prices and robust demand. At the same time, local coffee consumption is on the rise, with new café chains and consumer trends reshaping the landscape. This blog takes a deep dive into the Vietnam coffee market, examining the latest data on exports, key market trends, consumer behavior, and opportunities for foreign investors.

Record Export Surge in the Vietnam Coffee Market (2024–2025)

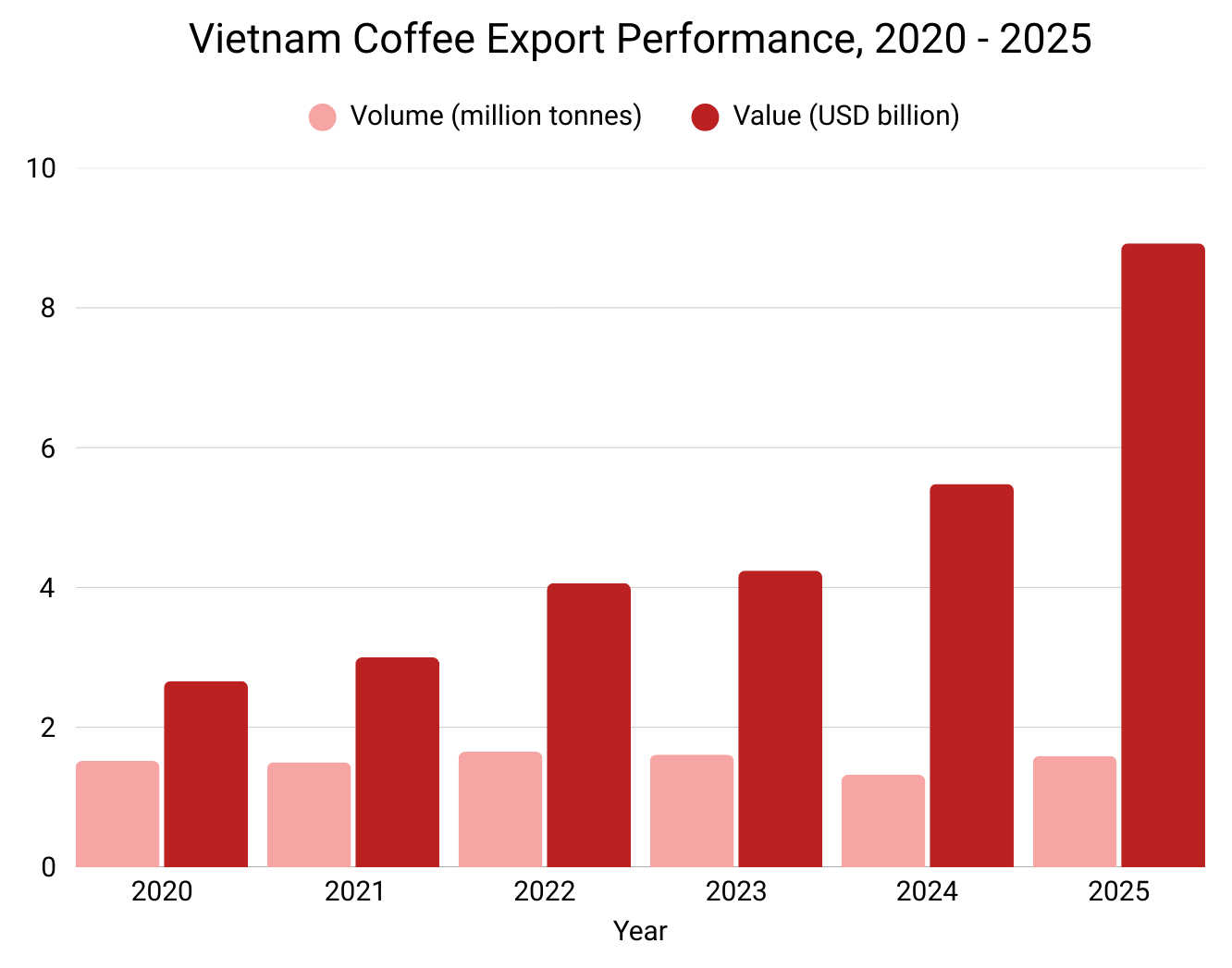

The Vietnam coffee market has seen unprecedented export success in the past two years. In 2024, Vietnam exported 1.32 million tonnes of coffee, which was 18.8% lower in volume than 2023, yet export value jumped 29% to reach US$5.48 billion. This paradox of lower output but higher earnings was driven by a sharp rise in global coffee prices, with Vietnam’s average export price in 2024 soaring 57% year-on-year to about US$4,151 per ton.

2025 broke all previous records for Vietnam’s coffee exports. By the end of the calendar year 2025, Vietnam exported approximately 1.59 million tonnes of coffee, generating a record export revenue of over US$8.92 billion – representing sharp increases of about 18.3% in volume and 58.8% in value compared to 2024. This performance smashed earlier projections and achieved (or exceeded) the US$8–9 billion milestone years ahead of the original 2030 target.

Several factors fueled Vietnam’s coffee export boom in 2025. Global supply shortages—caused by droughts in Brazil and weather impacts in key regions—tightened worldwide availability, driving prices to multi-decade highs. As the world’s top Robusta producer and second-largest overall exporter, Vietnam benefited enormously from these elevated prices, even with modest production growth.

Export prices averaged around US$5,642–5,700 per tonne (USDA: $5,642/tonne for MY 2024/25), with London Robusta futures peaking above US$5,800 early in the year. Domestically, farm-gate prices soared—for example, in early November 2025, Dak Lak province beans reached ₫119,000 per kg (≈US$4.52/kg), significantly boosting farmer incomes and export revenues.

Improved value-add and quality also played a key role. Investments in sustainable practices, better processing, and “deep processing” (e.g., instant and specialty coffee) helped Vietnam move up the value chain, as noted by VICOFA. These efforts, combined with tight global supply and strong demand, delivered record earnings of approximately US$8.3–8.4 billion (USDA MY 2024/25: ~$8.3 billion; crop year consensus often ~$8.4 billion).

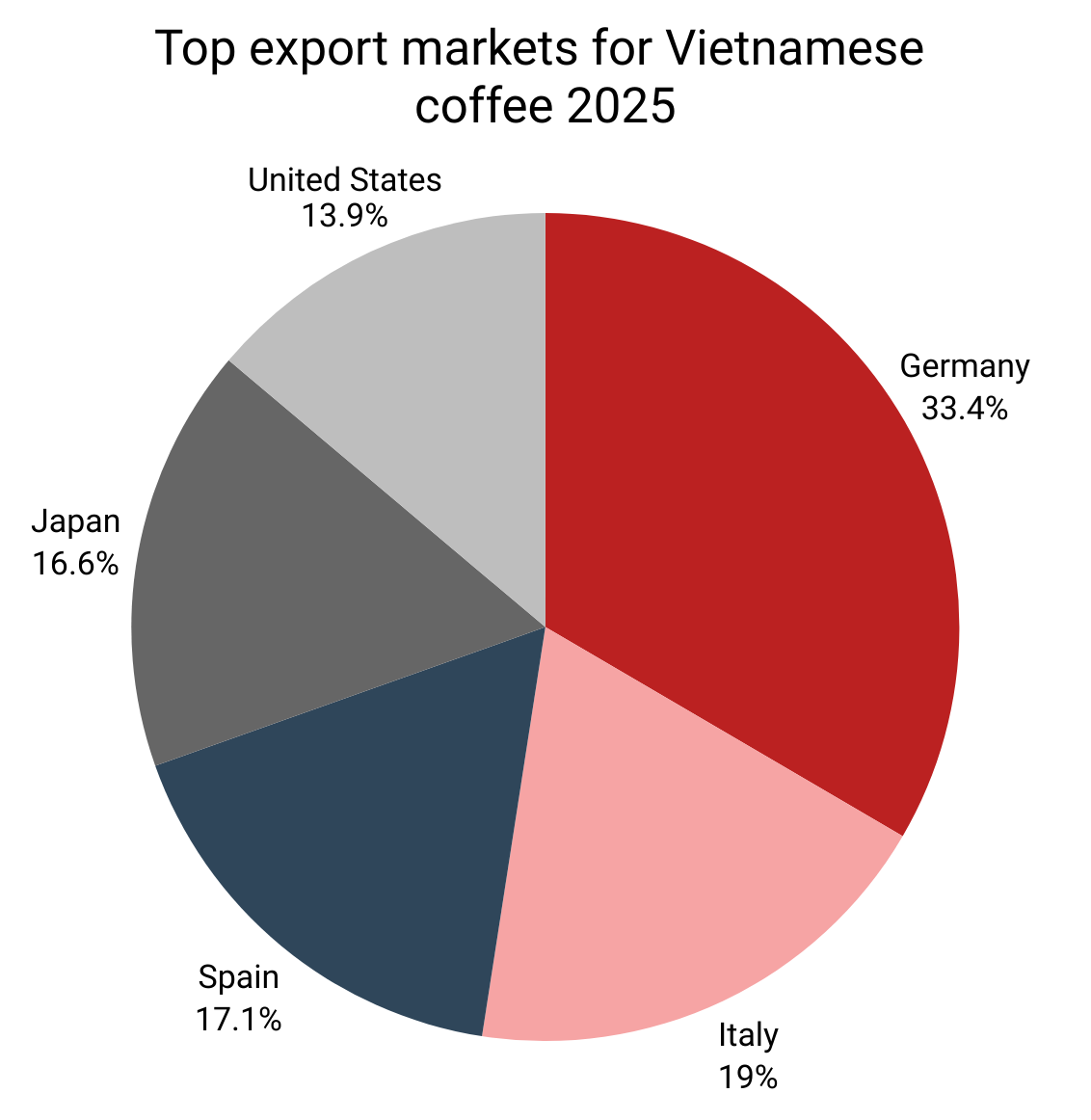

Growth was broad-based, with most top markets up in value. The EU dominated (~47–60% share, led by Germany at ~3.2 million 60-kg bags / ~US$1.23 billion equivalent in key reports), followed by Italy and Spain. Explosive gains occurred in emerging markets—exports to Mexico surged dramatically (up to 1,244% in value per USDA, or ~34–35 times in some early reports, driven by U.S. roasters blending Vietnamese Robusta amid supply shifts).

By diversifying markets and capitalizing on high prices, Vietnam’s coffee sector has strong momentum into 2026, with production forecasts up ~6–10% if conditions remain favorable.

Several global trends converged to drive Vietnam’s record-breaking coffee exports in 2025, primarily through elevated prices rather than massive volume gains.

Expand into Vietnam with confidence. Explore InCorp Vietnam’s one-stop corporate services to simplify market entry, incorporation, and compliance.

Global Trends Boosting the Vietnam Coffee Market

Several global coffee market trends have converged to Vietnam’s advantage. The most impactful is the global supply squeeze from adverse weather: droughts and frosts in Brazil (the top Arabica producer) and heavy rains/typhoons in Vietnam and Indonesia curbed output, tightening worldwide availability amid recovering post-pandemic demand.

This pushed coffee prices to multi-decade highs early in 2025—London Robusta futures peaked at a record US$5,821 per tonne in February, while New York Arabica hit 425.10 cents/lb (around US$9+/kg equivalent). Vietnam, the world’s largest Robusta producer, benefited hugely as prices remained elevated (average export ~US$5,642/tonne per USDA for MY 2024/25, a 143% YoY surge), fueling export earnings of ~US$8.3 billion (USDA MY 2024/25) to US$8.4–8.9 billion (calendar year consensus from VICOFA/Customs), despite modest production (~1.51–1.59 million tonnes).

A key shift was rising Robusta preference in blends and instant coffee, driven by Arabica shortages and Robusta’s strength/cost edge. Tight Arabica supplies narrowed the traditional premium over Robusta, with Vietnamese Robusta occasionally trading at premiums or close parity in periods (e.g., export averages showed Robusta outpacing some Arabica grades amid the crunch). This bolstered Vietnam’s position, as Robusta dominates its output.

On trade policy, U.S. actions under President Trump created openings: In October 2025, a framework trade deal with Vietnam exempted coffee from proposed tariffs (e.g., avoiding a 20% headline rate on most goods). By November 2025, an executive order exempted coffee (and other ag products) from reciprocal tariffs broadly, including reductions for Vietnam-linked imports. (Note: While Brazil saw partial relief—e.g., 40% duties removed in some reports—the U.S. market shift favored diversified sourcing, including more Vietnamese Robusta for blending amid supply dynamics.)

These factors—supply constraints, Robusta’s rising appeal, and favorable U.S. access—underpinned Vietnam’s windfall, with exports hitting historic highs and momentum carrying into 2026 (forecast production up ~6–10%). Prices eased later in 2025 as supplies recovered, but the year marked a pivotal boom for Vietnam’s sector.

Domestic Market: Vietnam’s Rising Second Engine

Beyond its export dominance, Vietnam’s domestic coffee market has emerged as a robust growth driver, fueled by a vibrant café culture, rising incomes, urbanization, and a young population (median age ~32). With over 100 million people, per capita coffee consumption has climbed steadily—reaching around 3 kg annually in recent years (USDA projects ~3 kg for 2025, up from ~1.7 kg in 2015 and nearing 2.5–3 kg in earlier estimates), though still below Europe’s 6–8 kg.

Total domestic consumption hit ~4.8 million 60-kg bags in MY 2024/25, with forecasts rising to 4.9 million bags in MY 2025/26 (USDA FAS Dec 2025 report), driven by booming café visits, instant coffee demand (projected CAGR ~12% to $731 million by 2028), and tourism recovery (17.2+ million international visitors in first 10 months of 2025, up 22% YoY).

This shift positions Vietnam as not just a top producer but a significant consumer market. The domestic scene serves as a key testing ground for products, brands, and models, with rapid chain expansion reflecting strong demand for socializing, work, and leisure in cafés rather than grab-and-go habits. Traditional phin-filtered robusta—often enjoyed as cà phê sữa đá—remains iconic, giving local brands a cultural edge, while urban youth increasingly embrace espresso-based drinks, flavored lattes, cold brews, and specialty options.

Major chains have scaled aggressively:

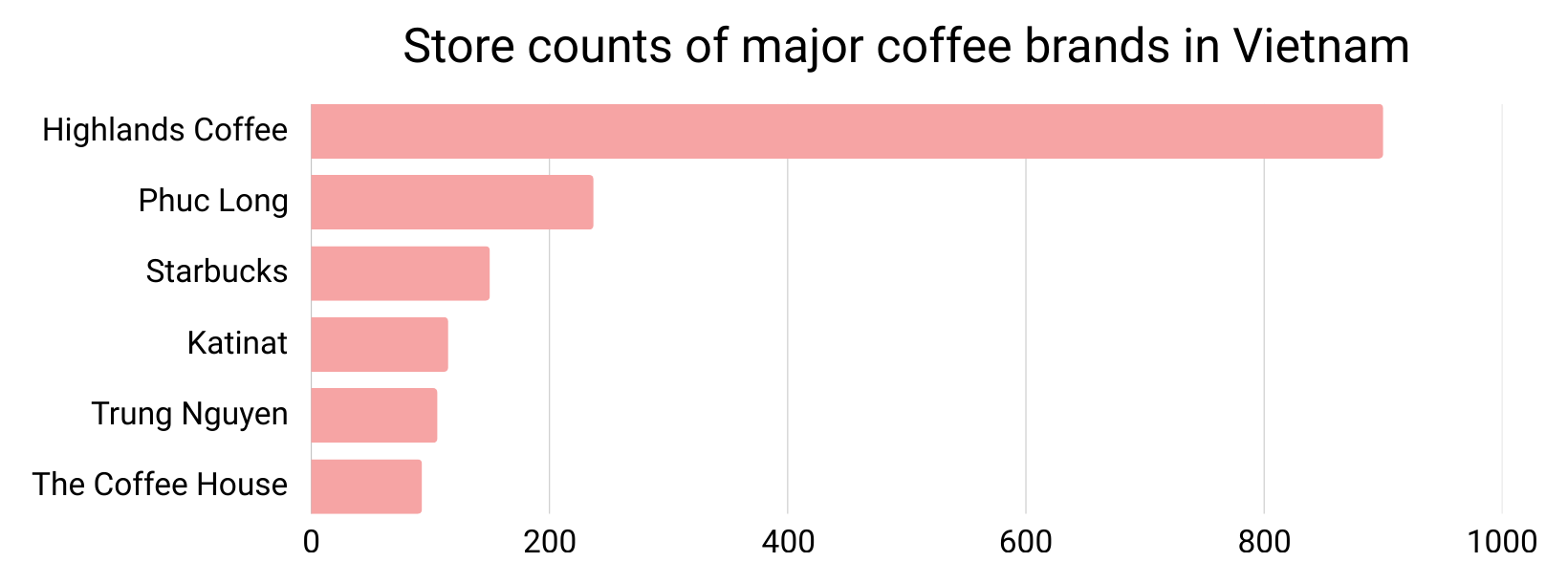

- Highlands Coffee leads with ~855–900 outlets (strong revenue growth and market dominance).

- Phúc Long expanded to ~237 outlets (rapid additions, including digital sales).

- Trung Nguyên Legend maintains a strong presence (hundreds of stores, plus franchising models).

- The Coffee House restructured to ~93 outlets after challenges.

- Starbucks grew to 150 stores (premium positioning, new Reserve locations in HCMC).

Vietnam boasts an estimated 500,000+ coffee-selling spots (from street carts to modern cafés), offering abundant choice at affordable prices and creating a virtuous cycle of demand. Vertical integration shines: chains like Highlands not only retail but also export raw/processed coffee, building scale and stability.

This resilient local demand—less volatile than exports—provides farmers, roasters, and retailers a stable outlet amid global price swings. With favorable prices, specialty coffee growth (CAGR ~7%), sustainability focus, and a young, affluent demographic, the domestic market is poised for continued expansion (projected ~6–6.6% annual growth in consumption to 2030). It forms a powerful “second engine” complementing exports, enhancing resilience and value creation for the entire sector heading into 2026.

Leading Coffee Exporters and Producers

Vietnam is the world’s No. 2 coffee exporter (after Brazil) and the top exporter of robusta beans. The industry is quite fragmented, with numerous exporters competing. In the 2023-2024 coffee crop year (October 2023 to September 2024), Vietnam’s coffee export sector remained highly competitive and fragmented, with 48 enterprises each surpassing $10 million in revenue and collectively accounting for 96% of the industry’s record $5.43 billion total, according to VICOFA.

Leading the pack was Công ty TNHH Vĩnh Hiệp (Vinh Hiep Co. Ltd., based in Gia Lai), which surged to the top position with over $520 million—more than doubling its previous year’s $244 million and overtaking longtime frontrunners through aggressive positioning amid sky-high global prices.

Close behind came Công ty cổ phần Tập đoàn Intimex (Intimex Group JSC) at around $407 million (down from its prior lead), while the broader Intimex family—including affiliates like Intimex Mỹ Phước (~$214 million), Intimex Buôn Mê Thuột (~$34 million), Intimex Đắk Nông (~$26 million), and Intimex Bảo Lộc (~$23 million)—collectively exceeded $716 million, underscoring their enduring dominance.

Other major players exceeding $200 million in export revenue included multinational giants like Louis Dreyfus Company Vietnam, Nestlé Vietnam, and domestic heavyweights such as Tuấn Lộc Commodities, Simexco Đắk Lắk, and Intimex Mỹ Phước.

Further down the rankings, Trung Nguyên Legend achieved about $114 million, reflecting its emphasis on processed and branded products over raw exports. This lineup highlights a mix of agile local firms capitalizing on price volatility and established international traders connecting Vietnam’s robusta supply to global buyers.

On the production side, Vietnam mainly grows Robusta (over 90% of output) with some Arabica in the highlands. It also produces smaller quantities of Excelsa (Chari) and Liberica, and is famous for rarer types like Weasel coffee. Vietnam’s coffee farms are mostly smallholdings in the Central Highlands (Đắk Lắk, Lâm Đồng, Gia Lai provinces). Despite having a smaller planted area than some countries, Vietnam’s yield per hectare is the highest in the world, thanks to intensive farming methods. This high productivity has been a key to Vietnam’s export dominance, though it also raises sustainability challenges (e.g. soil health, climate vulnerability) that the industry is now addressing through replanting and training programs.

Stay compliant while focusing on growth. Discover InCorp Vietnam’s accounting and tax solutions designed to manage filings, reporting, and regulatory requirements for foreign businesses.

Challenges for Foreign Coffee Brands in Vietnam

Vietnam’s domestic coffee market is highly attractive but notoriously difficult for international players to crack. The following barriers explain why many foreign brands struggle despite strong growth potential:

- Local Taste Dominance Vietnamese consumers prefer bold, intense Robusta-based brews — dark-roasted, often with condensed milk (cà phê sữa đá) — delivering a strong, slightly bitter kick. Foreign chains, typically built around smoother, fruitier Arabica drinks, are frequently perceived as “too weak” or lacking depth. Successful entrants must adapt menus with stronger roasts and local classics.

- Leisure-Driven Coffee Culture Coffee in Vietnam is a social ritual, not a quick caffeine hit. People linger for hours chatting, working, or relaxing. Western “grab-and-go” models feel out of place. Foreign brands must create spacious, comfortable, air-conditioned spaces that encourage long stays to match local expectations.

- Extreme Price Sensitivity Most consumers expect to pay only ₫40,000–70,000 ($1.60–$2.80) per cup. Prices above ₫100,000 ($4) are seen as luxury items, with only ~1–2% of the market willing to pay that much. Foreign chains charging ₫70,000–100,000+ (e.g., Starbucks) remain niche, appealing mainly to affluent urbanites and expats, while local outlets offer quality coffee at half the price.

- Declining Visit Frequency Economic pressures and busier lifestyles have reduced café visits. In 2024, 42% of consumers went to a café only 1–2 times per month, while only 32% visited weekly. This trend hits premium brands hardest, as consumers reserve them for occasional treats rather than daily consumption.

- Fierce Competition & Market Saturation With ~500,000 coffee-selling outlets nationwide — from street carts to modern chains — competition is brutal. Local giants (Trung Nguyên, Highlands Coffee, Phúc Long) dominate with deep brand loyalty and lower prices. Foreign brands also compete with trendy milk tea shops popular among youth, making it hard to stand out.

- High Operating Costs Prime retail rents in Ho Chi Minh City (~US$270–280/m²/month) and Hanoi (~US$170–180/m²/month) rank among Southeast Asia’s highest. Combined with staffing, training, and supply chain localization expenses, margins are squeezed — especially when sales volumes are limited by price sensitivity and lower visit frequency.

Bottom Line

Foreign coffee brands succeed in Vietnam only when they deeply localize: adapt to bold Robusta tastes, create lingering-friendly spaces, offer competitive pricing or clear premium justification, and build loyalty programs to drive repeat visits. Those that fail to adjust — even well-known global names — often remain niche players or exit entirely. For new entrants, thorough cultural and pricing research is not optional — it’s essential for survival in one of the world’s most competitive coffee markets.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Why is the Vietnam coffee market growing so rapidly?

- The Vietnam coffee market is expanding due to strong export prices, increasing domestic consumption, and shifting global demand toward Robusta beans.

Is the Vietnam coffee market attractive for foreign investors?

- Yes. The Vietnam coffee market offers opportunities across retail chains, specialty coffee, processing, and value-added products, but success requires deep localization.

What challenges do foreign brands face in the Vietnam coffee market?

- Major challenges include price sensitivity, strong local competitors, high retail rents, and consumer preference for bold Robusta flavors.

What is the future outlook for the Vietnam coffee market?

- The Vietnam coffee market is expected to maintain steady growth as exports remain strong and the domestic café ecosystem continues expanding, supporting long-term investment potential.