Introduction

In 2025, increasingly severe natural disasters, institutional restructuring in the agriculture and environment sector, and heightened volatility in global export markets created significant headwinds for Vietnam’s agro-forestry-fishery exports. Despite disruptions to production, logistics, and rising compliance standards, the sector still recorded positive growth, with key products maintaining momentum and expanding market share, reinforcing agriculture’s role as both an economic stabilizer and a driver of sustainable growth.

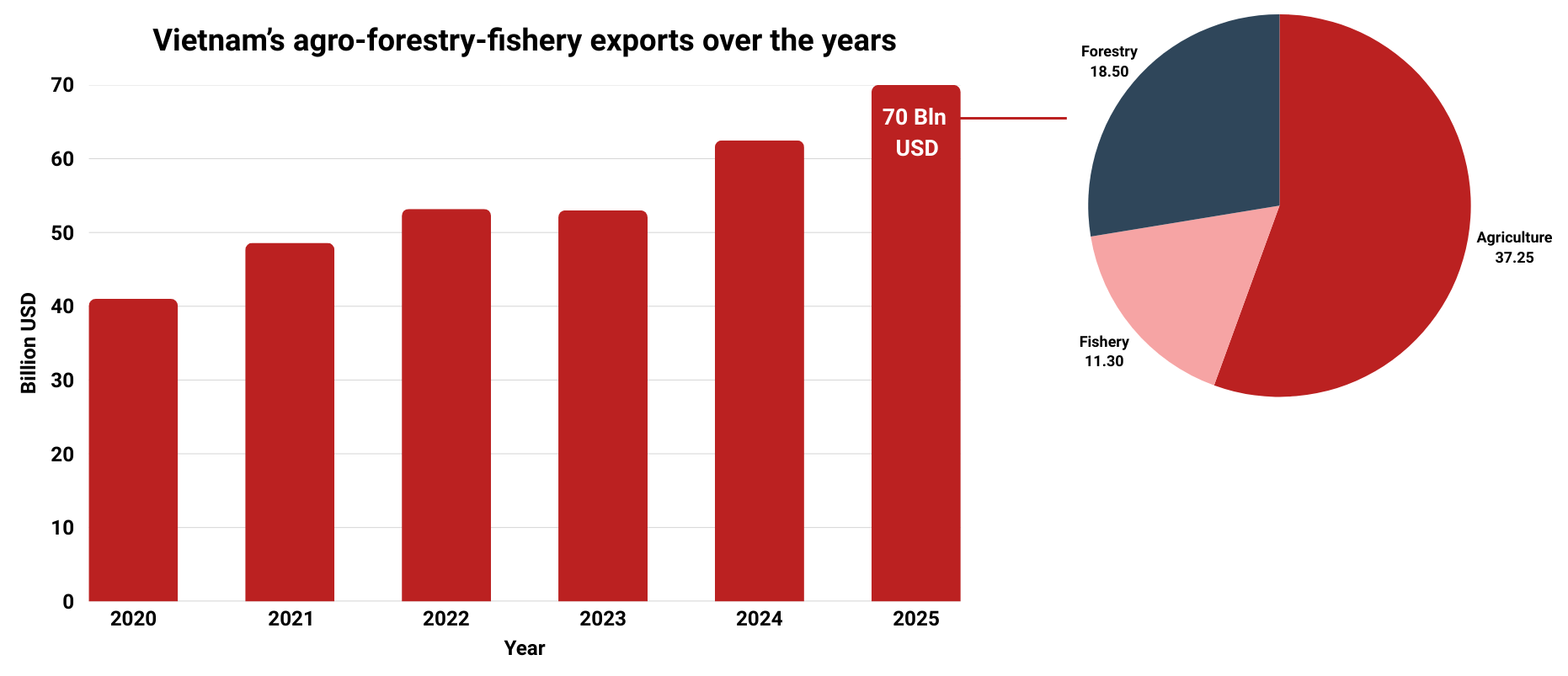

Vietnam’s agro-forestry-fishery sector is a cornerstone of the economy and a rising magnet for investors. Despite accounting for only around 12% of GDP, it employs one-third of the workforce, reflecting immense social and economic importance. In 2025, the sector achieved record-breaking export revenue of over $70 billion (up 12% year-on-year) and a trade surplus exceeding $20 billion.

Market Trends and Demand in Agro-Forestry-Fishery

Vietnam’s agro-forestry-fishery sector has rebounded strongly, with export turnover rising to USD 62.4 billion in 2024 and reaching a record USD 70.09 billion in 2025. In 2025, t he sector recorded value-added growth of approximately 3.78%, higher than in 2024, and remained a net exporter with a diversified portfolio spanning rice, coffee, seafood, wood products, and fruits.

Within the sector, agriculture grew by about 3.48%, forestry by 5.70%, and fisheries by 4.41%. Overall, agro-forestry-fishery activities contributed more than 5% to national GDP growth, reinforcing the sector’s continued role in supporting macroeconomic stability and social welfare.

Agricultural products made the largest contribution, generating approximately USD 37.25 billion, up nearly 14% year on year. Seafood exports rebounded sharply to USD 11.3 billion, maintaining Vietnam’s position as the world’s third-largest seafood exporter. Forestry products reached a new record of USD 18.5 billion, driven by deep-processed wood products and sustainability-certified materials.

Agriculture

In 2025, total grain output reached approximately 47.9 million tons, of which rice production accounted for nearly 43 million tons, despite continued reductions in cultivated area to improve efficiency. The adoption of new crop varieties, mechanization, and advanced farming techniques helped raise average rice yields to about 6.1 tons per hectare, higher than in the previous year.

Other key crops also recorded positive results. Vegetable output exceeded 18 million tons, while fruit production reached around 13 million tons, effectively meeting both domestic consumption and export demand. Concentrated production zones continued to expand, increasingly aligned with VietGAP, GlobalGAP, and traceability standards.

Forestry

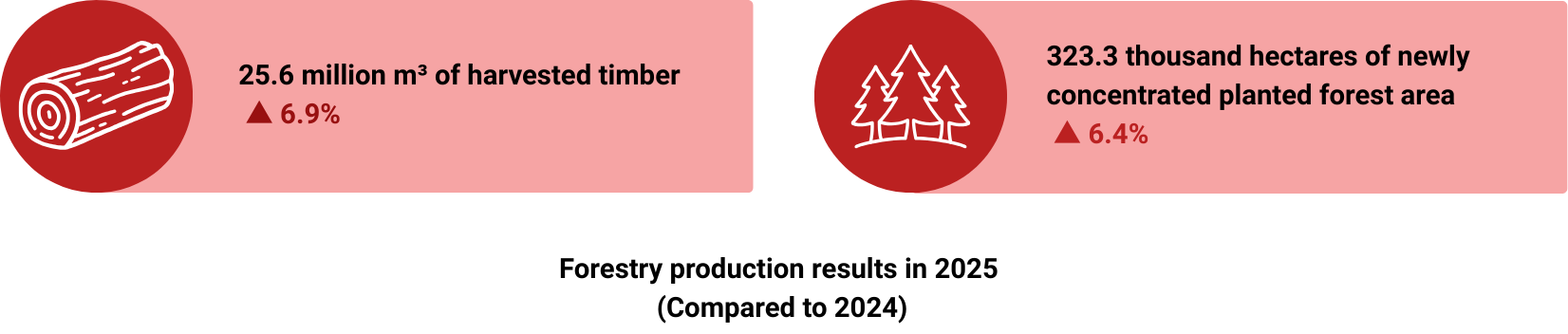

The forestry sector remained a bright spot, with timber harvest output reaching approximately 25.6 million cubic meters in 2025, up nearly 7% year on year. The area of planted forests certified under sustainable forest management standards continued to expand, supporting higher export value for wood and wood products.

Forestry production value grew by around 5.7%, with wood and wood product exports maintaining their position in the USD 15+ billion export group, reinforcing Vietnam’s standing among the world’s leading furniture and wood-product exporters.

Fisheries

In 2025, Vietnam’s fisheries sector maintained solid growth, driven mainly by aquaculture, while capture fisheries were more tightly managed under sustainability requirements.

Seafood export value reached approximately USD 11.3 billion, up 12.4% year on year, despite ongoing global trade uncertainties.

Aquaculture production continued to expand, accounting for a growing share of total fisheries output. Full-year aquaculture output was estimated at 6.12 million tons, up 5.1% compared to 2024, including 4.04 million tons of fish (+4.9%) and 1.38 million tons of shrimp (+6.1%).

In contrast, capture fisheries output declined slightly as a result of adverse weather conditions and stricter enforcement of sustainable fishing regulations linked to IUU compliance. Total capture output in 2025 was estimated at 3.83 million tons, down 0.2% year on year, with marine capture accounting for 3.64 million tons.

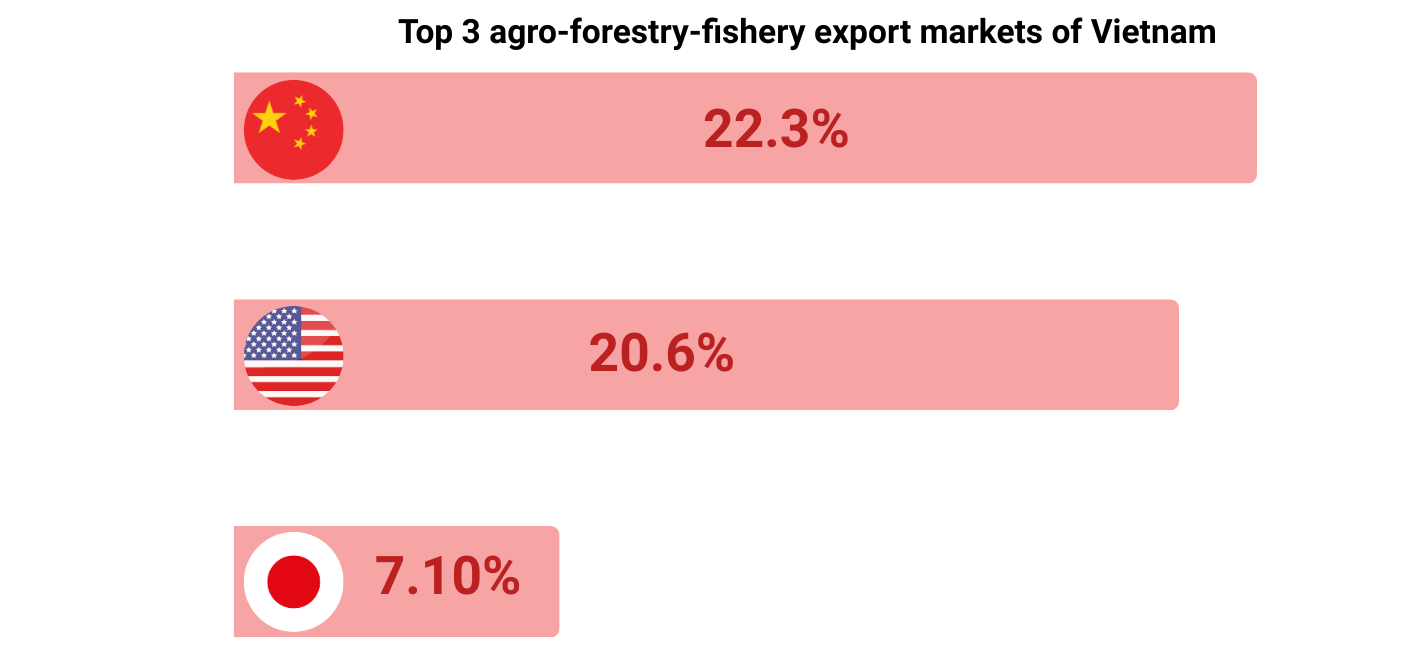

China, the United States, and Japan were the largest markets, accounting for roughly 50% of total export value combined. Exports to China posted the strongest growth, surging 66.1% year on year, while exports to the United States and Japan rose 21.6% and 19.6%, respectively. Looking ahead, the government projects annual growth of 3.5–4% over the next five years, supported by higher-value and export-driven production.

Domestic demand is shifting toward safer and higher-quality food. Nearly 80% of Vietnamese consumers are willing to pay more for clean and traceable products, encouraging producers to move up the value chain. This shift is visible in coffee, rice, and specialty crops, where lower volumes have been offset by higher export value through premium and organic positioning.

Global demand also favors Vietnam’s agro-forestry-fishery industry. Fruit and vegetable exports reached USD 8.6 billion in 2025, driven largely by durian exports to China, alongside growing shipments of bananas, mangoes, and coconuts. Stricter import standards have pushed exporters to improve traceability and compliance, turning regulatory pressure into a competitive advantage.

Overall, demand remains strong both at home and abroad. Early 2026 data is encouraging, with January exports up nearly 30% year on year to around USD 6.5 billion, reinforcing a positive outlook for quality- and sustainability-focused agribusinesses.

Entering Vietnam’s agro-forestry-fishery sector? InCorp Vietnam supports market entry, licensing, and investment structuring.

Key business opportunities in the agro-forestry-fishery sector

Vietnam’s agro-forestry-fishery sector is creating diverse opportunities as it shifts toward higher value, sustainability, and technology-driven growth. Both domestic and foreign investors can tap into subsectors aligned with strong demand and government priorities.

High-value fruits and vegetables remain one of the fastest-growing segments. Vietnam is a leading exporter of durian and is expanding shipments of mango, banana, jackfruit, pomelo, and dragon fruit to China, South Korea, Australia, and the Middle East. Fruit and vegetable exports rose nearly 20% in 2025 to USD 8.56 billion. Opportunities lie in premium farming, VietGAP and GlobalGAP-certified production, post-harvest processing, and branded exports as new market access protocols continue to open.

Aquaculture and seafood processing also offer strong potential. Vietnam is the world’s fourth-largest seafood exporter, with fishery exports exceeding USD 11.3 billion in 2025. Investment opportunities include sustainable shrimp and fish farming, modern processing facilities, cold storage, and ready-to-cook or high-end seafood products that meet international standards. Stronger enforcement against illegal fishing further supports long-term growth.

Wood and forestry products represent another major opportunity, with exports reaching USD 18.5 billion in 2025. Demand remains solid for furniture and processed wood products, particularly from legal and sustainable sources. Investors focusing on certified timber, plantation development, and higher-end furniture design can benefit as Vietnam moves up the value chain under stricter EU and U.S. regulations.

Value-added agro-processing is a key strategic focus. Instead of exporting raw commodities, Vietnam is expanding processed food production such as roasted coffee, rice-based foods, packaged nuts, spices, coconut products, and dairy. Coffee export earnings jumped over 50% in 2025 to USD 8.57 billion, driven by higher prices and processing. Rising urban incomes are also boosting domestic demand for processed foods and animal protein.

Agritech and high-tech farming are emerging as long-term growth drivers. Government-backed initiatives support smart irrigation, precision farming, IoT, biotechnology, and digital farm management. High-tech farms, smart greenhouses, and precision aquaculture systems are expanding, offering opportunities for investors with technology, data, or advanced farming expertise.

Overall, Vietnam’s agro-forestry-fishery sector offers broad and scalable opportunities. Enterprises that bring capital, technology, or value-added capabilities to farming, forestry, or fisheries are well-positioned to benefit from the sector’s modernization and sustained growth.

Already operating or exporting? InCorp Vietnam delivers accounting, tax, and compliance support to keep your business export-ready.

Export policies and international market access

Vietnam’s agro-forestry-fishery exports benefit from an increasingly favorable policy environment, shaped by extensive trade agreements, active market-opening efforts, and stronger alignment with global standards.

Vietnam has one of Asia’s most comprehensive FTA networks, including CPTPP, RCEP, EVFTA, and UKVFTA. These agreements significantly reduce or eliminate tariffs on agro-forestry-fishery products such as coffee, rice, seafood, cashew, and wood products, improving competitiveness in high-value markets like the EU, Japan, Canada, and the UK. As a result, exports to non-traditional markets have risen sharply, supporting diversification beyond China and the U.S.

The government is also actively pursuing new market access protocols. In 2025, several new agreements were signed with China covering fruits such as passion fruit and fresh jackfruit, following the successful durian protocol that drove rapid export growth. Vietnam is expanding access to Australia, New Zealand, the Middle East, and Northeast Asia for fruits, seafood, and wood products. Each new protocol creates immediate export opportunities for compliant producers.

To sustain momentum, authorities have set ambitious export targets, aiming for around USD 74 billion in agro-forestry-fishery exports in 2026. Export promotion programs now focus on emerging markets in the Middle East, South Asia, Africa, and Eastern Europe, alongside national branding initiatives and stronger use of geographical indications. Enterprises are encouraged and supported to obtain certifications, improve packaging, and participate in international trade fairs.

At the same time, technical barriers and compliance requirements are rising. Major markets now demand strict traceability, food safety, and sustainability standards. Vietnam has responded by integrating export standards into domestic regulations, including mandatory traceability systems, registered farm and facility codes, and stricter sanitary controls. New EU rules on deforestation-free supply chains further reinforce the need for compliance, especially for coffee, cocoa, rubber, and wood products.

The government is also investing in logistics and trade facilitation, expanding ports, cold-chain infrastructure, and border-gate efficiency, particularly for trade with China. Digitized customs procedures and regional logistics hubs are expected to reduce costs and delays for exporters, especially for perishable goods.

Finally, Vietnam actively defends market access for its exporters through diplomacy and regulatory reforms. Efforts to resolve anti-dumping risks in wood products and to lift the EU’s IUU fishing “yellow card” demonstrate the government’s willingness to work with industry to remove external trade barriers.

Overall, Vietnam’s export policy framework strongly supports agro-forestry-fishery enterprises. Businesses that leverage FTAs, invest in compliance and traceability, and align with government promotion efforts are well positioned to access a growing range of international markets.

Sustainability and green growth trends

Sustainability has become a defining feature of Vietnam’s agro-forestry-fishery sector in 2026, driven by climate risks, government policy, and market demand. Green and climate-resilient practices are no longer optional, but increasingly central to competitiveness and market access.

Climate change adaptation is now a priority. Extreme weather has caused losses of over VND 98 trillion annually in recent years, pushing the government and industry to adopt climate-smart agriculture. Measures include drought- and flood-resistant crops, improved irrigation, resilient aquaculture systems, and renewable energy use on farms. Projects that enhance resilience, such as integrated rice-shrimp farming or drought-resistant coffee, are increasingly favored by policymakers and green finance programs.

Environmental standards are tightening, especially due to pressure from export markets. Buyers demand deforestation-free supply chains, reduced chemical use, and lower emissions. Vietnam is promoting organic farming, regenerative practices, circular agriculture, and low-emission rice cultivation. Forest cover has increased to over 42%, supported by reforestation programs and sustainable plantation models. These efforts help exporters meet international expectations and reduce future exposure to carbon-related trade measures.

Certification and traceability are now core sustainability tools. Vietnam has rapidly expanded adoption of certifications such as GlobalG.A.P., organic, FSC, ASC, and BAP. Government support includes partial subsidies for certification and a national traceability system linking farms, processors, and exporters. QR-code traceability is becoming standard, enhancing transparency and consumer trust while improving production accountability.

Market demand strongly favors sustainable products. International buyers are willing to pay premiums for certified seafood, low-carbon rice, and sustainable coffee. Domestically, around 80% of consumers are willing to pay more for safe and eco-friendly food. Sustainability is increasingly linked to price stability, long-term contracts, and brand differentiation.

Overall, sustainability is no longer a compliance cost but a growth strategy in Vietnam’s agro-forestry-fishery sector. Enterprises that integrate green practices, certification, and climate resilience into their business models are better positioned to access premium markets, benefit from government incentives, and secure long-term competitiveness as Vietnam accelerates its green transformation.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions on Vietnam agro-forestry-fishery sector

Why did Vietnam’s agro-forestry-fishery sector continue to grow in 2025 despite major challenges?

- Because export demand remained strong, production shifted toward higher-value and sustainable segments, and government policies helped stabilize supply chains.

Which agro-forestry-fishery subsectors performed best in 2025?

- Agriculture remained the largest contributor, aquaculture led growth momentum, and forestry performed well through certified and deep-processed wood products.

What are the main risks for agro-forestry-fishery investors in Vietnam?

- Key risks include climate volatility, rising compliance and certification costs, logistics constraints, and tightening sustainability standards in export markets.

What agro-forestry-fishery opportunities are most promising going forward?

- Value-added processing, sustainable aquaculture, certified forestry, agritech, and green projects aligned with traceability and export standards.