Automation is a crucial part of the corporate world, enhancing productivity as it makes business operations more efficient and digitises many of the processes. By definition, automation refers to automatically manufacturing products with the help of robots and control systems that don’t require human intervention. Like any other country, automation in Vietnam is important for the manufacturing industries as seen in the boom in the robotics market of the country, which is about to reach US$356.70 million in revenue in 2024. As manufacturers scale automation pilots into full production, it is recommended to engage corporate secretarial services to ensure compliance, procurement, tax-incentive claims, and hiring align with local regulatory requirements.

Automation in Vietnam is surging as the projected annual growth rate of the industrial robotics segment including the industrial automation industry is 2.38% in 2024 – 2028. This surge happened because the manufacturing sector adopted robotics solutions at a rapid rate, as seen in the 10% of Vietnamese firms automating their operations between 2019 and 2021.

With the introduction of AI, we have now entered the phase of artificial intelligence automation which is creating a new workforce with specialized skill sets, replacing the old low-skilled jobs with AI-enabled automation. Let’s take a look at how automation in the world, especially in Vietnam is progressing.

Growth of Automation Around the World

To understand the Vietnam automation phenomenon, we must understand how automation is pacing all over the world. Data published by the Robotics and Automation Magazine estimates that the industrial automation industry will grow by 9.3% annually to reach GBP 227.6 billion (US$287.6 billion) by 2030. These statistics, presented by a New York research firm, forecast considerable growth in automation as the valuation in 2023 stood at £122.2 billion (US$154.4 billion). Most of this boom automation is centered around North America which accounts for 35% of it.

In contrast, Fortune Business Insights predicted that the sector will grow by 9.8% annually to reach US$205.86 billion by 2022 and US$395 billion by 2029. However, the COVID-19 downturn hindered growth in all countries causing a 6.5 decline in 2020 in comparison to the previous year.

The driving force of the current uptick in industrial automation is the demand from the manufacturing sector which accounts for 30% of the market share, followed by oil and gas and power generation which stand at 20% and 15%, respectively.

Hence, these sectors, especially manufacturing, mining, and metals, are seeking engineers who are skilled in automation, including the handling of programmable logic controllers (PLCs), robots, distributed control systems (DCSs), and Supervisory Control and Data Acquisition (SCADA) technologies. This coupled with the industrial Internet of Things (IoT), augmented reality (AR), 5G wireless technology, and Industry 4.0 is heralding a new era of automation which is verging towards artificial intelligence automation.

All these advancements in technology mandate heightened cybersecurity systems which have to be integrated with robotics to protect automation, keeping efficiency and accuracy as a priority.

Automation in Vietnam is Growing

Turning to automation in Vietnam, we see a higher level of automation in the country in 2022 than what was planned. This is due to businesses deciding to automate tasks; 75% of companies indulged in automating existing tasks, while 67% automated new tasks by 2025. The three years preceding 2022 saw 10% of domestic firms in Vietnam automating their operational tasks, and over 25% made the move towards automation by the end of that year.

The boom in automation in Vietnam can be attributed to the use of 4.0 technology by the manufacturing sector. Banks are using artificial intelligence automation for enhanced data networks, while companies are using it for data analysis and positioning brands. IoT is being used for research purposes like transportation routes monitoring, and e-ticketing. Some companies are doing better R&D for their smart home products with Internet-controlled software devices.

Automation in Vietnam is growing because of the following factors:

- Clear standards for automation: Since the government is pro-industrialization, it has set clear standards and demands for automation.

- Use of high-technology: Although a traditional market, Vietnam swiftly transitioned into adopting high technology to enhance production, and this increased the demand for automation in the country.

- Cost-effective labor: As the labor costs in Vietnam are lower than in other countries, it promoted the adoption of automation, cutting down production expenses.

- Booming electronics sector: The electronics products market is growing exponentially, especially since Vietnam is a leading exporter in this sector. This caused a surge in automation as companies had to increase production to maintain competitiveness without compromising on quality.

- Financial incentives: The government also incentivizes automation through its policies, making way for increased adoption.

At the beginning of 2020, Vietnam invested approximately 5.7% of its GDP in infrastructure, ranking the country 39th out of 160 nations on the World Bank’s Logistics Performance Index. This creates favourable conditions for the development of the automation sector.

The resulting impact of this adoption of automation is the high 7.02% GDP rate of Vietnam in 2019 which didn’t falter much in the COVID downturn and maintained 6.7% GDP in 2021. Compare this to 2020, when the GDP was 5.7% and the automation industry was just picking up, you will understand how the sector is growing.

The high GDP in 2019 is mostly attributed to the electronic equipment manufacturing sector, which has a 47.2% share in the export market. The industrial automation industry helped in improving the quality of the electronics products in Vietnam during this time along with optimizing it for greater efficiency.

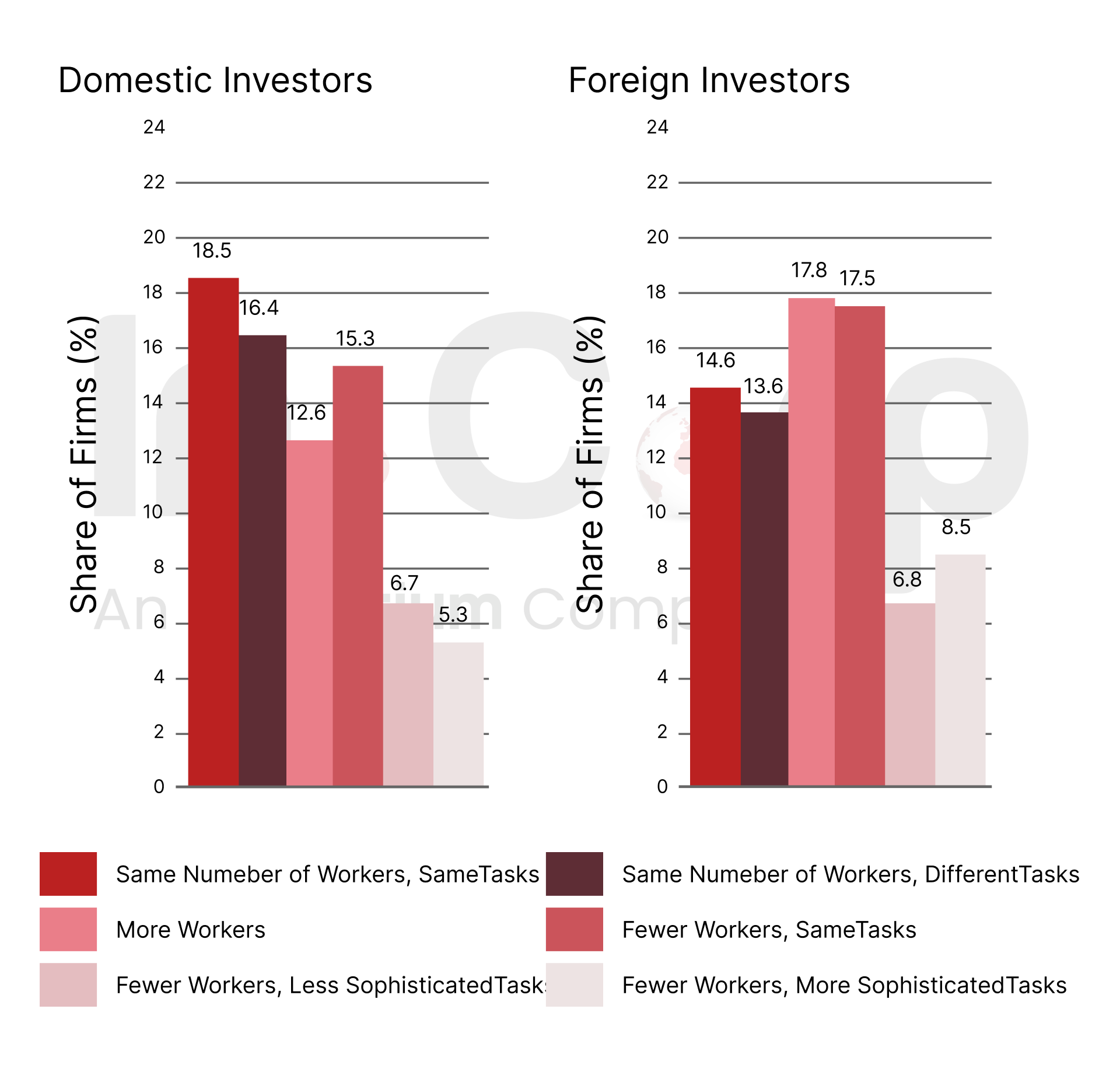

As of 2022, this surge in automation in Vietnamese businesses resulted in 12.6% of companies increasing their workforces, while 27% reduced their workforce and 35% maintained it. Over half of those who reduced their workforce planned to fulfill the same tasks using a smaller number of people because of automation.

Interested in Automation in Vietnam? Check out InCorp Vietnam’s Incorporation Services in Vietnam now!

Bright Future for the Industrial Automation Industry in Vietnam

Different industries in Vietnam are reaping the benefits of artificial intelligence automation technologies, which have enhanced the quality and productivity of companies in these sectors. Let’s take a look at the impact of automation in Vietnam in the following industries.

Automobile Industry

Data from the Ministry of Industry and Trade reveals that a substantial number of automobile companies out of the 40 Vietnamese businesses in the sector are part of the global automobile manufacturing chain. Many of them had to automate tasks, as 65% of the 755 thousand vehicles per year assembly capacity of the global supply chain came from domestic enterprises in 2020.

As the country has been the fastest-growing personal car purchasing nation in the last 10 years leading up to 2020, there were increasing demands for vehicle production to maintain the lead, which led to the use of robots and other automation. Auto factories like Vinfast turned to industrial robots like ABB’s industrial robotic arms, which, when used with Vinfast’s 4.0 technology, led to smart manufacturing synchronising automatic machines, automated robots, and humans remotely controlling the operations. The automotive company lowered the number of damaged products and increased productivity and quality.

Electronics Manufacturing Industry

The labor-intensive manufacturing industry, especially the electronics manufacturers, made a move toward artificial intelligence automation as they employed robots powered by AI systems to lower production costs. The electronics export turnover of Vietnam had a 23.8% annual growth rate in the 2016-2020 period, which increased significantly in the last three years courtesy of foreign direct investments.

Many international electronics firms like LG and Samsung have built their production bases in Vietnam, and many more are trying to establish their presence in the country to meet the demand for smartphones, watches, tablets, and television productions. In 2020, Taiwanese electronics manufacturer Foxconn initiated an automation plan to automate its production line by 30%. At present, the company makes 10,000 Foxbots a year, which replaces human labor. The fact that most of its factories are now fully automated bears testimony to the Vietnam automation boom.

Healthcare & Logistics

Other than manufacturing and automotive, two other industries that are witnessing a surge in automation in Vietnam are healthcare and logistics. While AI-driven diagnostic systems and robots for operations are helping the healthcare sector to deliver personalized treatments in record time, AI systems and robots are improving warehousing, stockpiling, and last-mile deliveries in the logistics industry

The impact of automation is also felt in industries like Textile and Food and Beverages. While the F&B sector has seen an increase in the production of diaries by creating smart warehousing and factories with the help of automated robots and automation of production lines, the garments sector saw companies reducing fuel consumption by using 4.0 technology and automation to make innovative products.

Potential Impact & Preparedness in APAC

One critical reason why automation in Vietnam is booming is the 4.0 industry preparedness in the Asia Pacific (APAC) region as seen in the predominance of industrial robots (64%) in this part of the world. The APAC region also boasts of a high indulgence in AI platforms which is growing at a double in speed in 2019-2024 than in other countries.

Additionally, internet adoption is significantly better in Vietnam than in other APAC countries, which generally lack basic features like KYC process availability in major banks (2 out of 5 usually have it) and individual internet skills of people. Businesses in the Asia Pacific region complain of these issues more than automation, but Vietnam is advanced in this department.

A Deloitte analysis has shed light on how labor markets are reaping the benefit of automation as it helped in eradicating drawbacks like stagnant growth, an ageing population that can’t do manual labor, and a shortage of workforce. So, based on the changing dynamics of work across industries, automation is the key to addressing bottlenecks, and Vietnam is prepared to take advantage of its initial growth in the industrial automation industry.

Worldwide, the COVID-19 pandemic has set the stage for increased automation adoption, which is visible from the fact that nearly 50% of companies are looking to adopt robotic automation in 2025.

Read More: Vietnam’s Economic Growth Projections: Surpassing Southeast Asian Nations by 2036

Implications for the Vietnamese Workforce

Automation in Vietnam is a disruptive force for ageing traditional workers who don’t possess the skills required in the industrial automation industry. Many workers in the garment, food and beverage, and other sectors who used to do menial jobs are facing unemployment. These people lack the fine balance of computer skills, language skills and systematic thinking skills required for jobs now.

While there is a shortage of skilled workers in the F&B and garment industries in Vietnam, training people for employability is a cumbersome process that requires time. Businesses prefer to automate operations instead of reducing production costs.

Read Related: Vietnam’s Workforce: High-Demand Skills and Advice for Business in 2024

Further Challenges Expected in Automation in Vietnam

As with any other country, the challenges will intensify as automation adoption progresses in Vietnam. Challenges like job displacement can be countered with regulations that require companies to train their workers with adequate technological skills including remote controlling of automated production lines.

According to a World Economic Forum estimate, automation will displace 85 million jobs by 2025, but it will also create 97 million new jobs. We need to prepare the workforce to take advantage of this with reskilling opportunities. In the next 6 years, nearly 50% of the global workforce, about 1.1 billion workers, will need reskilling, according to an OECD (Organization for Economic Co-operation and Development) estimate. Countries are generally apprehensive of the upskilling costs, but this investment can boost the GDP by US$6.5 trillion in the coming 6 years, as per the World Economic Forum.

Although job displacement hinders the prospect of automation it can enhance global productivity by 0.8% to reach a 1.4% annual growth rate by 2030, says a McKinsey Global Institute estimate. All we need is to have faith in automation and invest in upskilling people so that the world can enjoy its advantages.

Vietnam is in eighth position in the global automation preparedness list and seventh position in the automation risk list, making it indulge in significant R&D investment (9% of the GDP). However, workers in Vietnam are less utilized compared to other countries in the region. The country has a low internet penetration rate (38%), which is nearly half of Singapore. All these factors necessitate that it should upskill the workforce to benefit from the automation adoption surge.

Growth Opportunities for Automation in Vietnam

Despite the challenges, Vietnam’s automation is likely to grow in the coming years and the government announced several plans to support that. At present, 20 out of 99 high-tech products prioritized by the Ministry of Science and Technology are from the automation field. The ministry is also helping in the development of 107 high-tech products, which include 30 automation products.

More and more vendors from the industrial automation industry are made part of the Main Automation Contractor (MAC) concept which is crucial for the procurement of components of automation and control systems. These vendors are urged to handle and manage the system throughout the whole lifecycle of the project as it would help them in upskilling.

As the industrial production sector across industries like automobiles, machinery, and electronics take up automation to boost their production, the automation market in Vietnam will also grow, ultimately leading to positive economic growth. Hence, automation in Vietnam is expected to find a wider acceptance in industries like chemicals and power generation.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How big is the industrial automation market in Vietnam?

- As of recent estimates, the industrial automation market in Vietnam is valued at approximately USD 2.5 to 3 billion and is growing at a compound annual growth rate (CAGR) of around 10–12%. Growth is driven by strong manufacturing expansion, government support for Industry 4.0, and increasing foreign direct investment in electronics and automotive sectors.

What is Vietnam's stance on AI and automation?

- Vietnam actively supports the development and adoption of AI and automation as part of its national strategy on the Fourth Industrial Revolution. The government has released a National Strategy on AI Development to 2030, aiming to make Vietnam a top 4 AI hub in ASEAN. Authorities encourage foreign and local investment in AI-related sectors, while also addressing potential workforce impacts through education and upskilling initiatives.