Vietnam’s Food & Beverage (F&B) sector, integral to the nation’s consumer market, is currently experiencing a period of significant transformation. Post-pandemic, this sector is not only recovering but also rapidly adapting to new market trends and consumer behaviors. Central to Vietnamese culture and social life, the food & beverage industry is more than a provider of food; it is a creator of experiences and a nurturer of community connections.

As Vietnam progresses toward recovery, the food & beverage industry is at the forefront, adapting to changing consumer preferences, technological innovations, and evolving regulations. This article explores the current trends, challenges, and investment opportunities within Vietnam’s food & beverage market. We will look at how businesses are reshaping their strategies to succeed in the new normal, with a focus on community engagement, sustainability, and innovation.

Investing in Vietnam? Check out Talk to our Company Registration Experts

Food & Beverage Market Overview in Vietnam

According to expert analyses, despite various economic challenges anticipated in 2025, Vietnam’s food & beverage market is set to thrive, experiencing a 9.6% revenue growth. Post-pandemic stabilization will further bolster this sector, leading it toward the remarkable milestone of nearly VND 873 trillion valuation by 2027.

Vietnamese consumers have clearly defined their favorite pastimes, with restaurants, cafes, and shopping malls emerging as the top contenders. In their leisure time, these five destinations receive the most visits, reflecting the lifestyle and preferences of the local population. Dining preferences in Vietnam exhibit an interesting age-based pattern. Fast food and convenience stores hold a strong appeal for the youngest demographic, those aged 18-24. On the other hand, local food establishments and pizza/pasta restaurants find favor among the 25-34 age group.

In 2025, the Vietnam Food Service Market is estimated to be valued at approximately US$24.77 billion, with a promising outlook for the forecast period from 2025 to 2030. During this period, the market is projected to experience a noteworthy Compound Annual Growth Rate (CAGR) of 10.73%, ultimately reaching an impressive US$41.22 billion by 2030.

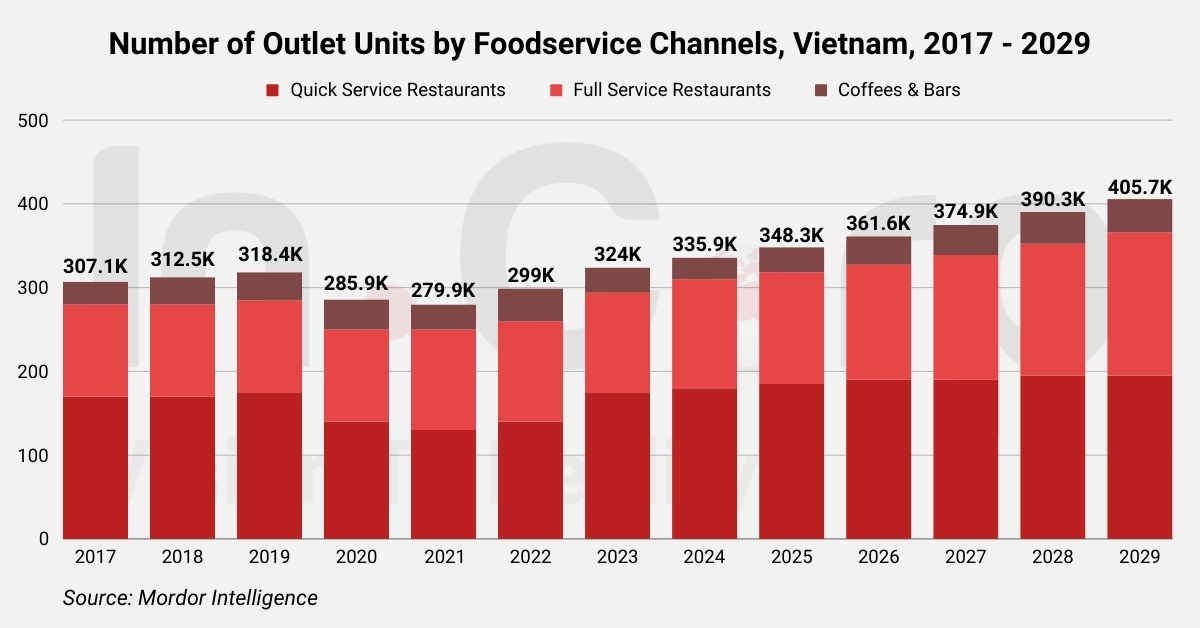

Within the food service landscape, Full Service Restaurants emerge as the dominant segment, reflecting the largest market share. This trend is expected to persist, with full-service restaurants maintaining their prominence. Notably, in 2024, nearly 70% of individuals dined out on weekends, indicating a rising trend in dining out frequency.

Among various outlet types, Independent Outlets emerge as the key contributors to the Vietnam Food Service Market. Asian full-service restaurants within this segment hold a prominent position, primarily due to the widespread utilization of seafood sauces, an integral component of numerous Asian culinary creations, such as “Canh chua cá.”

A noteworthy highlight is the impressive growth of Cloud Kitchens, which has emerged as the fastest-growing foodservice category in the Vietnam Food Service Market. The surge in internet usage, with approximately 73.2% of the population actively engaged online, and 53% of food establishments maintaining an online presence, has significantly propelled the growth of cloud kitchens.

Moreover, Chained Outlets represent the fastest-growing outlet category in the Vietnam Food Service Market. This growth can be attributed to the strong emphasis on consistency and standardized food quality, particularly driven by the concerns of food safety expressed by nearly 90% of the population. The dominance of Quick Service Restaurants (QSRs) within this segment underscores the importance of stringent food safety standards in the industry.

Read More: Ease of Doing Business in Vietnam: Why Do Foreign Investors Choose This Destination?

Investment Opportunities for Food & Beverage Foreign Investors

Potential from Market: Projection from Experts

Industry analysts, including Mordor Intelligence, anticipate robust growth in Vietnam’s food & beverage sector, with an estimated annual expansion rate of 8.65% during 2021-2026. A compound annual growth rate of 4.98% from 2021 to 2025 is expected, leading to a projected market size of US$678 million. By 2025, the predicted consumer base is set to reach a substantial 17.1 million individuals.

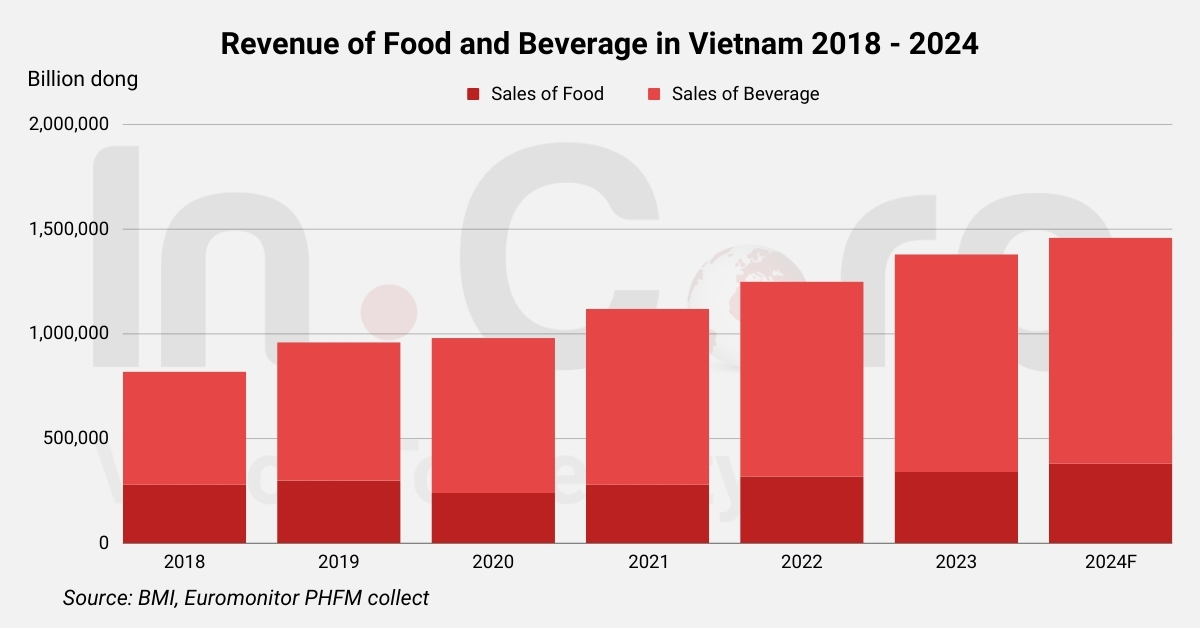

VNDirect, a prominent securities company, predicts a flourishing food & beverage industry in 2022, projecting growth rates between 10-12%. This positive outlook is attributed to the resumption of in-person services and the recovery of domestic consumption. Moreover, market research firm BMI suggests an upward trajectory in Vietnamese households’ spending habits for the years 2022-2025.

Presently, expenditures related to food & beverage represent the most significant portion of consumers’ monthly budgets, accounting for 35%. Projections indicate the emergence of approximately 17 million middle-income households in Vietnam by 2030. Consequently, Vietnam is poised to become the third-largest urban market in Southeast Asia in terms of consumer numbers and the fifth-largest concerning overall spending by 2030, according to Phu Hung Security (2020).

Additionally, Fitch Solutions, a global financial services provider, estimates that spending on essential goods, particularly food and non-alcoholic beverages, as well as housing and utilities, will increase between 8% and 10% YoY in 2022 and 2023. This growth is attributed to a surge in post-pandemic spending. As a result, revenues from non-alcoholic beverages are projected to witness a notable increase, with an impressive annual growth rate of 12.5% in 2020, culminating in a 10.5% increase by 2024.

The food & beverage landscape in Vietnam presents an irresistible opportunity for investors on a global scale. Vietnam stands out as a dynamic market, and with shifting consumer behaviors, increased mobility, rising affluence, and rapid urbanization, it’s poised to secure a position among the top three food & beverage development nations in Asia.

Notably, Vietnam has become a magnet for capital from countries like Korea, Germany, Singapore, and Thailand. As the digital transformation revolutionizes dining experiences, emphasizing safety and security, the demand for top-notch food & beverage products is on the rise. This translates to a plethora of untapped markets waiting for visionary newcomers to explore. By staying ahead of the curve and embracing trends with sustainability and innovation at their core, investors can unlock the immense potential of the Vietnam food & beverage market.

However, investors should approach this promising market with awareness. Striking the right balance between competitive pricing strategies and upholding stringent food safety and hygiene standards is paramount. In the eyes of consumers, these factors are non-negotiable, and businesses that can harmonize them will reap the rewards of this thriving food & beverage industry.

Read Related: Vietnam’s Economic Growth Projections: Surpassing Southeast Asian Nations by 2036

Behaviors of Food & Beverage Customers in Vietnam

The high-income consumers of Vietnam exhibit a proclivity to elevate their spending on food & beverage, as compared to other demographics. A survey reveals intriguing spending thresholds, with Vietnamese consumers being willing to part with VND 40,000-70,000 for a beverage and up to VND 500,000 on special occasions.

What’s equally striking is the commitment to these spending levels. Over 77% of consumers express their intent to maintain or even increase their expenditure on food and drinks throughout 2023. Astonishingly, a substantial 77.16% of diners managed to keep their spending steady, with plans to amplify their culinary indulgences. This unwavering desire to savor delightful culinary experiences remains steadfast, despite economic forecasts painting a challenging landscape for 2023.

Trends for Vietnam’s Food & Beverage Investors in 2025

Cloud Kitchen

A cloud kitchen, often referred to as a delivery-only restaurant, is a dining concept without a physical space for in-person dining. Instead, it relies solely on online orders placed through food aggregation platforms or dedicated online ordering platforms, accessible via websites or mobile apps.

In 2025, the cloud kitchen segment is projected to be the fastest-growing in the foodservice market, with a CAGR of 3.72% during the forecast period. The average order value (AOV) for cloud kitchens reached USD 3.45 in 2022, the highest among foodservice types, indicating strong consumer spending in this segment.

One of the distinguishing features of the cloud kitchen format is its remarkable flexibility. It empowers restaurateurs to introduce multiple brands utilizing the same kitchen infrastructure. This innovation, known as multi-brand cloud kitchens, allows culinary entrepreneurs to leverage existing kitchen resources to operate a variety of distinct brands.

In recent years, Vietnam has witnessed the emergence of the “cloud kitchen” concept, fueled by the proliferation of online food delivery platforms. At first glance, this model held immense promise. However, as time unfolded, the initial enthusiasm began to wane.

Trial ventures by key players like ShopeeFood and GrabFood, alongside independent entrepreneurs, started to fade away. The root cause of this decline lay in the struggle to strike a harmonious balance between costs and profits. Renowned brands grew wary, unwilling to dive headfirst into a model fraught with financial uncertainties. Nonetheless, this setback should be viewed as a stepping stone rather than an impasse. The cloud kitchen model is now undergoing refinement and optimization.

Healthy Eating, Vegetarianism and Veganism

Healthy Eating

Across Southeast Asia, including Vietnam, people are showing a growing interest in healthier eating, especially after the pandemic. They’re willing to spend more on food that’s good for them. This trend has sparked a demand for new kinds of foods and diets like gluten-free and keto. For companies that want to get in on this trend, it’s important to consider Vietnam’s food culture. They must think about how they can offer healthier options that are also suitable for the Vietnamese.

Healthy eating has become a significant trend in Vietnam, especially after the pandemic. The market’s largest segment is bread and cereal products, with a market volume of US$17.47 billion in 2025. However, affordability remains a concern. While healthy diets are becoming more accessible due to rising incomes, they are still unaffordable for approximately 70% of low-income households, where adherence can cost up to almost 70% of their income.

The Vietnamese love their green veggies which do not just include kale and spinach. They not only enjoy snacks that are good for them but also prefer sharing meals with others. But healthy eating isn’t just about the ingredients. People are paying more attention to what’s in their food and where it comes from. They want to know that the fruits and veggies they buy are safe to eat. This is especially true for traditional wet markets.

After the pandemic, more and more people are taking their health seriously. This has led to a rise in brands that offer healthier food options, especially in big cities like Hanoi, Saigon, and Da Nang.

This trend isn’t new, it’s been around for about a decade, with the pandemic being its stimulus. However, many Vietnamese still prefer traditional dishes like hotpot, grilled food, fast food, rice, and pho due to their eating habits. However, there’s a growing number of customers choosing healthier options and thus, this trend is gradually but certainly gaining ground.

Vegetarianism

Vegetarianism is no longer limited to Buddhists; it’s now an integral part of daily life in many countries, including Vietnam. People are increasingly aware of the incredible benefits of vegetarianism, which includes consuming a variety of vegetables, beans, and fruits. It’s seen as a way to maintain good health, cleanse the body and mind, and even manage weight.

But there are many other reasons why people are choosing vegetarian options or reducing their meat intake. Some simply find vegetarian food delicious and appreciate this sustainable eating style. Others do it to avoid consuming animals and protect the environment. Some turn to it when they want to pray or make amends for something.

Vegetarianism is gaining popularity in Vietnam beyond traditional Buddhist practices. In 2021, 87% of Vietnamese consumers had tried plant milk, 46% had tried other dairy alternatives, 49% had tried plant-based meat, and 32% had tried vegan egg substitutes. Health was the primary motivation for 61% of respondents, followed by concern for animals (40%) and the desire to try a food trend.

Restaurants are responding to this trend by offering extensive vegetarian menus, with some buffets boasting nearly a hundred different vegetarian offerings. These dishes come in various culinary styles, including pure Vietnamese, Thai, Indian, and European vegetarian cuisine, showcasing the global appeal of plant-based dining.

The trend of vegetarianism, especially on full moon days, is on the rise. It’s not uncommon to see restaurants serving vegetarian dishes or offering vegetarian buffets bustling with customers these days. Some foreigners living in Vietnam even humorously suggest using the lunar calendar on their phones to plan when to dine out because vegetarian restaurants are so packed on these occasions.

What’s driving this trend is not only the health benefits but also the delightful preparation and presentation of vegetarian dishes. They’re not only delicious but also affordable, often costing just half or even a third of a meat-based meal. This combination of taste, aesthetics, and value is attracting more and more people to savor vegetarian options even on regular weekdays.

In terms of quantity, restaurants often feature extensive vegetarian menus with as many as 30 to 50 dishes. It’s not uncommon to find buffets boasting nearly a hundred different vegetarian offerings. They come in various culinary styles, including pure Vietnamese, Thai, Indian, and European vegetarian cuisine, showcasing the global appeal of plant-based dining.

Veganism

Veganism is not merely a dietary choice but a comprehensive philosophy and way of life. Its fundamental principle is to minimize, to the greatest extent possible and practical, all forms of animal cruelty or exploitation, whether for clothing, food, or any other purpose. This ethos extends beyond the welfare of animals and encompasses the well-being of humans and the environment. In practical terms, veganism entails a commitment to abstain from all products that are entirely or partially derived from animals.

Veganism in Vietnam is experiencing significant growth, driven by concerns about animal welfare, environmental sustainability, and health and wellness. The vegan food market in Vietnam is projected to exhibit a growth rate (CAGR) of 8.1% from 2025 to 2033.

This growth is supported by the increasing availability of nutritious and delicious vegan alternatives, advancements in food technology, and the development of innovative plant-based substitutes that closely mimic the taste and texture of animal products. These innovations make the transition to a vegan diet more accessible and appealing to a broader audience.

In 2021, 10% of Vietnamese respondents reported that they only consume plant-based foods, indicating a significant shift towards veganism in the country.

Veganism continues to surge in popularity, fueled by a growing interest in healthier lifestyles. The trend towards meat-free and dairy-free diets has gained momentum, with endorsements from celebrities, and renowned chefs, and a surge in vegan products at supermarkets.

Sustainability and Quality of Organic Food

Vietnam’s food and beverage industry is experiencing a significant shift towards organic foods, driven by rising disposable incomes, a burgeoning middle class, and a younger generation keen on diverse food options. In 2023, the organic food market in Vietnam reached a value of US$100 million, reflecting a 20% growth since 2020.

This transformation is further fueled by government initiatives promoting food safety and a clean food chain. As of the end of 2023, Vietnam had 495,000 hectares of organic agricultural production, accounting for 4.3% of the country’s total agricultural production area . The government aims to increase this to 2.5–3% of the total agricultural land area by 2030.

Consumer awareness is also on the rise. A 2023 survey by AC Nielsen revealed that 86% of Vietnamese consumers prioritize organic options for their daily meals due to their nutritional value, safety, and minimal environmental impact. Additionally, 24% of respondents consume organic food daily, with another 16% and 21% consuming organic products four to five times a week and two to three times a week, respectively.

Government initiatives promoting food safety and a clean food chain further fuel the demand for organic products. Consumers are growing more conscious of how their environment affects the quality of their food. This heightened environmental awareness is compelling food & beverage establishments to prioritize sustainability. Restaurants are revamping their branding, adopting sustainable sourcing practices for raw materials, and reevaluating their packaging choices. Manufacturers are grappling with similar challenges, focusing on promoting the health benefits of their products in response to the evolving consumer landscape.

Moreover, Vietnam’s rich soil and diverse climate provide an ideal environment for cultivating a wide range of organic produce. As health-consciousness sweeps across the nation, the demand for organic and wholesome food is surging. This appetite for healthier options extends beyond locals to expatriates residing in Vietnam and tourists seeking authentic and nutritious dining experiences.

International enterprises can capitalize on this burgeoning trend by investing in organic farming, the processing of organic goods, and their distribution in Vietnam. By delivering top-tier organic food products free from harmful chemicals, businesses can set themselves apart from competitors and capture the loyalty of health-conscious consumers.

Moreover, the Vietnamese government is proactively fostering the growth of the organic food sector. They offer incentives and support to businesses within this industry, such as tax incentives, low-interest loans, and aid in obtaining product certifications.

Online Food Deliveries

Having a Presence with Online Delivery

Vietnam’s government is spearheading a digital revolution, and the food & beverage sector is fully embracing the change. The year 2022 witnessed a substantial uptick in restaurants adopting digital solutions. It’s not just about managing sales anymore; many brands are now recognizing the pivotal role of technology across various aspects of their operations. This includes customer service, human resource management, purchase value tracking, and more. Crucially, managerial decisions are increasingly data-driven, relying on technology-generated reports and insights.

Recent data from IMARC Group reveals that this market surged to a value of US$597.1 million in 2021. What’s even more impressive is the projected growth, with expectations that it will reach a whopping US$1,555.4 million by 2027. This translates to a remarkable compound growth rate of 16.4% during the years spanning from 2022 to 2027.

Online food delivery platforms bring a world of convenience to the table. They promise effortless ordering, swift deliveries, reduced order mix-ups, and minimal face-to-face interactions. Additionally, enticing discounts and cashback offers have endeared these services to the younger demographic, catapulting them to widespread popularity throughout Vietnam. Among the standout players in this arena are Eat.vn, Foody.vn, Now.vn, and Grab Food.

Non-Presence and Only Online Delivery

In response to stringent social distancing measures in 2021, Vietnamese consumers have ever since flocked to online shopping. Ride-hailing platforms like Grab, GoJek, Bee & Baemin swiftly adapted to deliver not just passengers but also food and parcels. Meanwhile, domestic e-commerce giants such as Shopee, Lazada, Tiki, and Sendo, alongside major supermarket chains like BigC, VinMart, and Lotte Mart, wholeheartedly embraced door-to-door delivery.

For small businesses, this shift marked a financial reprieve, as maintaining physical stores became less burdensome. Small and medium-sized enterprises (SMEs) shifted their focus to expanding promotions, enhancing customer service, and streamlining logistics to bolster revenue. The wealth of data available through online business models enabled companies to personalize offerings in areas like diet, nutrition, and fitness, aligning with the burgeoning trend toward healthy eating.

This change also democratized market entry, making it accessible to virtually anyone capable of setting up an online store. Big brands, too, capitalized on this shift, using e-commerce channels to sell directly to consumers (D2C) through platforms like ShopeeMall and LazMall. These official stores provided enhanced credibility compared to resellers, attracting a larger customer base. Manufacturers and consumer brands no longer rely solely on traditional distribution channels. They now connect directly with their customers through online marketing campaigns, offering more precise feedback, expanded sales, and less time spent negotiating with distributors and intermediaries.

In Vietnam’s dynamic food & beverage market, selling food online has become the norm. However, a significant challenge arises from the high commissions charged by online food ordering platforms, typically ranging from 20% to 25% per order. This substantial cost eats into profits and forces restaurants to rethink their strategies.

Intense competition on food ordering apps, with brands engaging in a relentless “discount race” to secure orders, further threatens profitability. As a result, food & beverage businesses are increasingly seeking balance by diversifying their order sources. They are aiming for an optimal ratio, often around 8/2, meaning 80% of orders come from applications while 20% originate from self-operated systems via hotlines and inboxes. These establishments are also exploring self-delivery options through services like AhaMove and GrabExpress. In the future, this ratio may shift even more in favor of self-operated systems as businesses navigate the evolving landscape of online food sales.

Challenges in Vietnam’s Food & Beverage Industry

While the food & beverage sector in Vietnam offers enticing investment opportunities, it is not without its share of challenges. A recent report highlights several obstacles that businesses face during their recovery and development journeys, with human resources being a prominent concern for 99.1% of surveyed enterprises.

The primary HR challenges are listed down below:

- Many businesses struggle to find qualified personnel and they also face difficulties in retaining them. The lack of professional staff and high labor costs compound this issue.

- Employees in the food & beverage market often need to fulfill multiple roles, which can be demanding and lead to burnout. Clear investment opportunities for career advancement are also lacking.

- Employers tend to offer limited benefits such as social insurance and bonuses like the 13th-month salary, making positions in the industry less attractive.

Moreover, around 16.3% of businesses grapple with work scheduling difficulties, while 10.4% encounter problems in accurately calculating staff salaries. Most businesses still rely on traditional methods for shift management, using tools like Excel, Zalo, or fingerprint attendance machines.

However, approximately 94.7% of these enterprises have recognized their weaknesses and taken steps to modify their production structures. Furthermore, 68.4% of them have adopted modern technology in their production and distribution processes. This strategic move not only creates a competitive edge but also enhances the overall customer shopping experience, especially in times of crisis.

Read More: Top 10 Challenges of Doing Business in Vietnam: Notes and Advice for Foreign Investors

Conclusion

Vietnam’s food & beverage industry is undergoing a significant transformation, driven by shifting consumer preferences, a growing middle class, and digitalization. The food & beverage market in Vietnam is poised for substantial growth, with experts projecting a promising future.

However, the industry faces its share of challenges. Competition is intense, both domestically and internationally. Navigating the dynamic export market, with its changing quality requirements and complex FTAs, poses another set of challenges.

Despite these obstacles, Vietnam’s food & beverage industry offers substantial promise. As consumers seek healthier, more sustainable options, businesses that can adapt, innovate, and embrace modern technology are well-positioned for success in this dynamic and evolving market. With government support and a growing appetite for diverse culinary experiences, the Vietnamese food & beverage industry is on a path of exciting growth and transformation.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly