Electric vehicles in Vietnam are a key part of the country’s commitment to lower its carbon emissions by switching to low-carbon fuel options. Hence, it has built a robust EV ecosystem, which supports customers looking to adopt Vietnam electric cars. The electric vehicle market in Vietnam has been boosted by adequate infrastructure development and policy support from the Vietnamese government, which promotes consumer buy-in.

According to KPMG’s latest EV market survey, 36% of Vietnamese consumers prefer full EVs, while 31% will go for hybrid vehicles. This boom is attributed to the younger generation’s (25-44 age group) aptitude for EV adoption, as they are earning more and looking for advanced features. Vietnam’s participation in large FTA networks, powered by partnerships with other EV markets, has given it access to the knowledge and cutting-edge technology needed for the growth of this sector. The number of electric vehicles in Vietnam is estimated to reach 1 million by 2028 and 3.5 million by 2040 due to lower import tax and registration fees for EVs.

Investing in Electric Vehicle Market in Vietnam? Check out InCorp Vietnam’s Incorporation Services

Additionally, Vietnam’s 2050 carbon neutrality goals and key policies to uplift the energy sector are enhancing EV adoption across the country. In this article, we have discussed EVs in Vietnam, including the market dynamics and major challenges faced by the automobile industry, along with future prospects.

Overview of Electric Vehicles Market in Vietnam

The electric vehicle market in Vietnam is witnessing an unprecedented boom as various businesses like VinFast, regarded as the country’s answer to Tesla, have joined the EV production chain. VinFast’s VF e34 electric car turned out to be the most carbon-neutral vehicle in the country, with monthly sales reaching 2000 cars in 2022.

Vietnam’s EV battery production is also speeding up with the construction of the VinES facility in Ha Tinh’s Vung Ang economic zone in 2021. The company aims to reach 100,000 battery pack production capacity by the end of 2030. This will be further enhanced by the Vietnam Association of Mechanical Industry’s (VAMI) clean fuel vehicle proposal, which seeks to attract businesses towards EV battery production investment. The association has already proposed several ideas, like all Vietnam-registered vehicles to be clean fuel and all vehicles to be electric cars by 2035 as part of the Vietnam Electric Vehicle Industry Development Plan.

Furthermore, EVs in Vietnam got a boost from several other proposals from the EV manufacturers in 2021, including Vingroup’s suggestion of preferential rates on vehicle registration tax and luxury tax for 5 years. Meanwhile, VAMI’s preferential tax suggestion is helping more people opt for electric vehicles in Vietnam in 2021-2030.

Additionally, the Ministry of Finance (MOF) proposed registration tax exemption for EVs for 3 years with a further 50% reduction in registration fees for another 2 years. In 2022, the Vietnamese government aimed to reduce luxury taxes by 5-12% in the next 5 years and adopted a range of policies like subsidies for consumers, preferential treatment of manufacturers, and infrastructure development.

As of 2024, an electric car in Vietnam that is registered for the first time has zero registration fees, while the special consumption tax (SCT) is at 1-3%. The SCT will be 4-11% from March 2027. This is supported by the Prime Minister’s COP26 commitments, where a roadmap for achieving the 2050 net-zero emission goals of the country was outlined in July 2022. Based on that roadmap, 2 out of 5 ministries and 57 out of 63 Vietnamese localities have launched their own action plans, which include green transition in the transport sector.

Read Related: A Guide to Green Energy Growth & Investment Opportunities in Vietnam

Adoption of Electric Vehicles in Vietnam

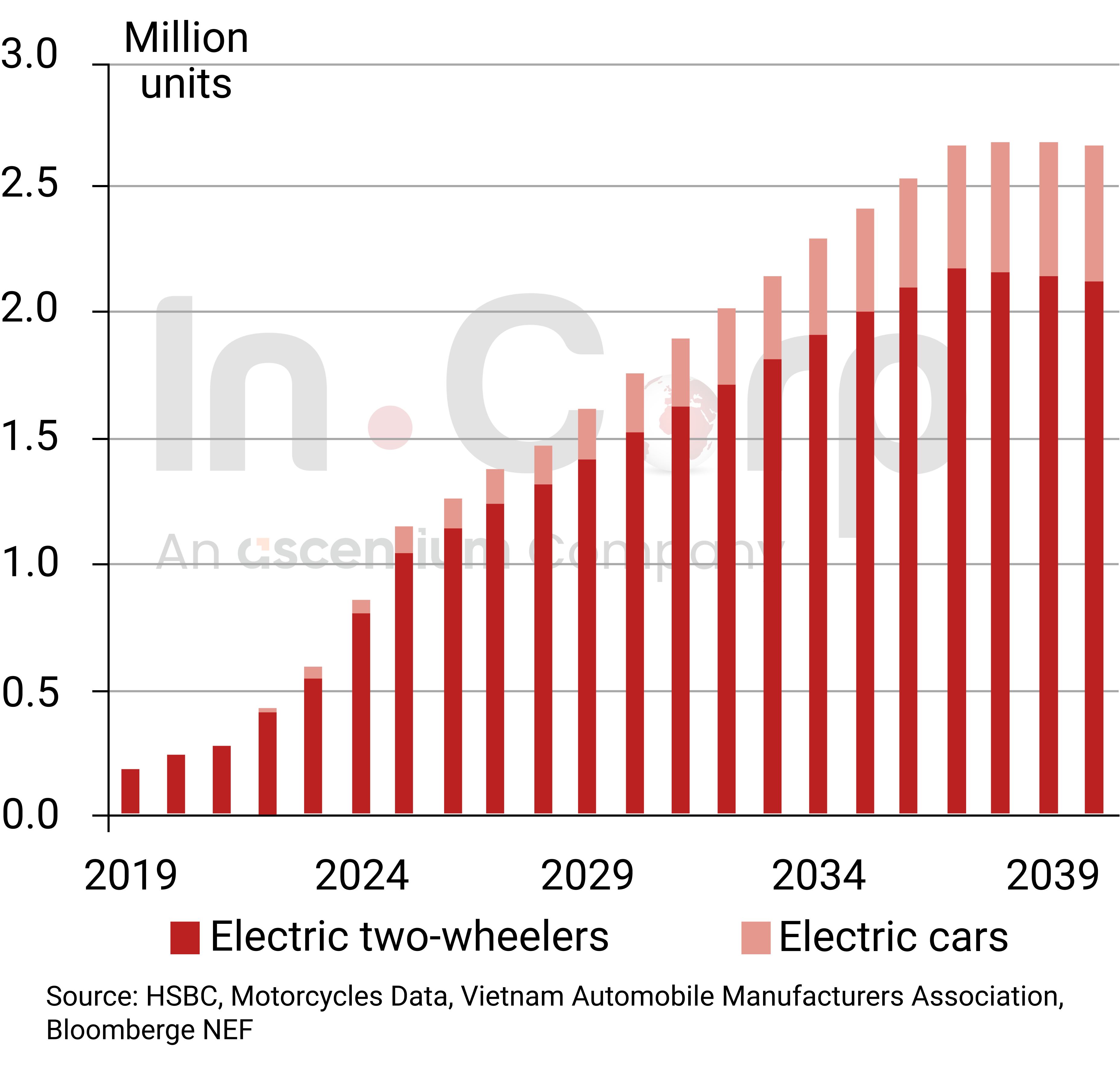

The electric vehicle market in Vietnam is categorised based on the types of chargers, EVs, DC charger power levels, and charger-end consumers. When people speak of EVs in Vietnam, they usually mean the two-wheeler segment, which made up 95% of the overall EV market volume in 2019. This was followed by three-wheelers and four-wheel vehicles. However, new government policies and infrastructural support are slowly driving the adoption of electric cars in Vietnam.

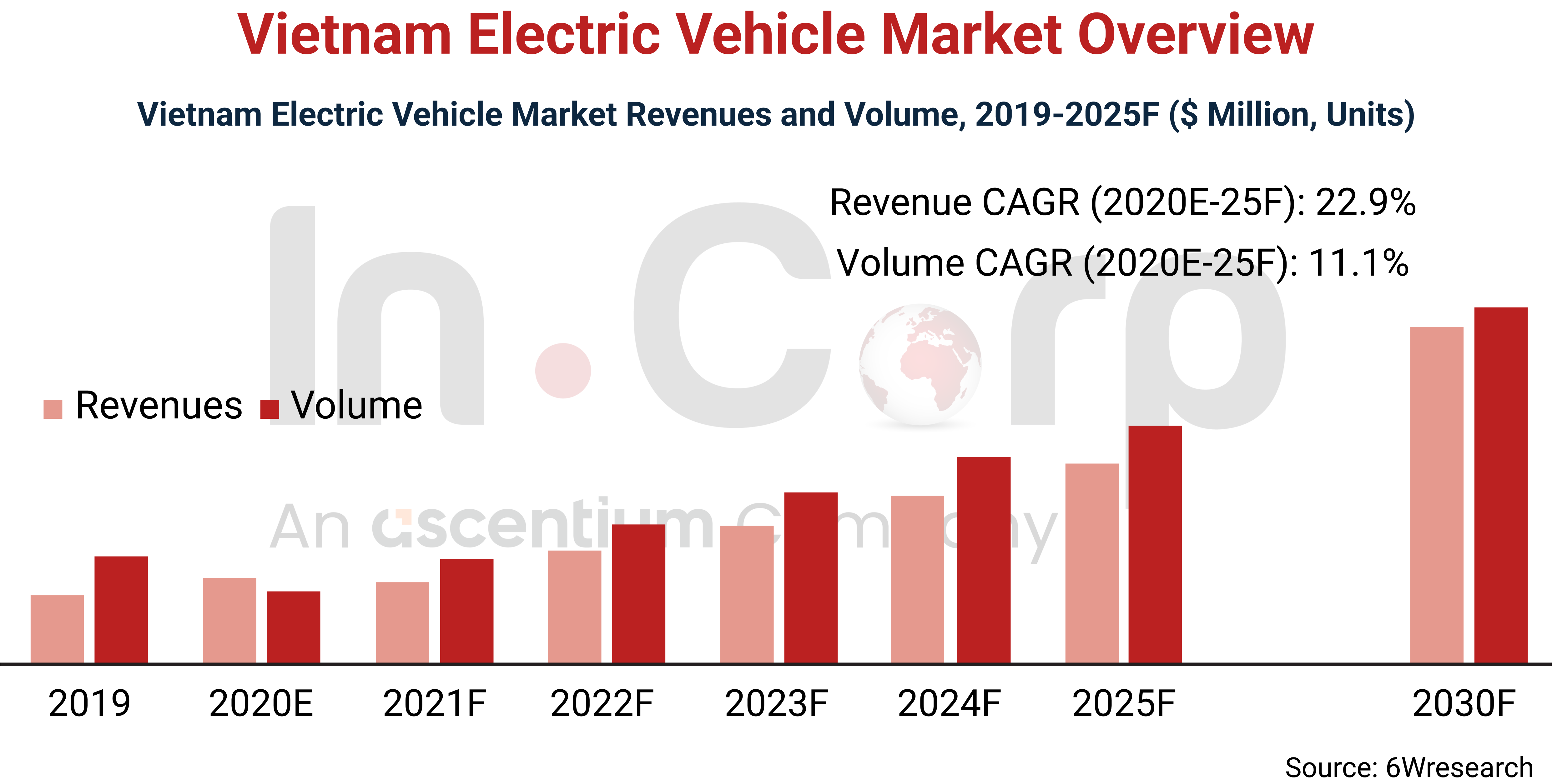

In 2020-2025, the electric buses segment is projected to witness the highest growth rates because of the government’s focus on green and clean public transportation. In this period, the Vietnamese EV market is projected to grow by 22.9%; this could be hampered by the low GDP per capita income of the country.

The deciding factor in EV adoption in Vietnam is the charging infrastructure. While Vinfast’s plans to install charging stations across the country can uplift the Vietnam electric car market, charging facilities will still remain an issue as per a KPMG survey. Fast charging capability, the prevalence of charging stations, and charging costs are top concerns of Vietnamese consumers, according to the survey.

Experts believe government support in taxes, deadlines, and interest rates, along with the easy availability of capital loans and guarantees, can speed up EV adoption in Vietnam in the coming years.

Read More: An Essential Guide of Taxation & Compliance Deadlines in Vietnam

EVs Vietnam’s Major Challenges

For EVs in Vietnam to gain center stage, certain challenges like excessive cost, infrastructure issues, and increasing energy consumption need to be addressed.

- Costs: When it comes to the manufacturing cost of Vietnam electric cars, the government has introduced policies to promote their development over traditional engine vehicles, but they aren’t enough. Although electric cars in Vietnam will be cheaper by 2030, they’re still 9–10% more expensive than diesel and gas vehicles. As of 2020, EV manufacturing costs were 45% higher than internal combustion engine (ICE) vehicles.

- Energy Consumption: With regards to EV power consumption, electric cars and motorbikes will have a considerable share in the rising power demand of the transport sector. While electric cars account for 30% of the total sales in the EV sector, electric motorbikes make up 34% of the sales. Comparing this with the projected 4 billion kWh power demand of the transport sector in 2030, power consumption is a major challenge for EV adoption.

- Infrastructure Issues: Infrastructure also remains a key issue despite recent policies to support EV battery production. The government should further back this up by prioritizing plug-in hybrid electric vehicles, which will eventually lead to battery-operated electric vehicle transitions.

Furthermore, tax schemes to stimulate growth in charging stations are essential for the development of EVs in Vietnam in the first 10 years. The Vietnamese government can later remove these incentives as we approach 2050, but it’s crucial to boost the electric vehicle market in Vietnam at present.

While companies like VinFast, EBOOST, and Charge+ have installed charging stations across the country, there is a considerable infrastructural gap in this sector. Nearly 90% of consumers cited a lack of charging facilities as the primary reason for not switching to electric cars in 2023. VinFast has installed 150,000 charging ports in 3000 charging stations, including 250kW superfast and 30kW and 60kW fast charging stations. This is spread across different types of locations, like gas stations, highway rest points, parking lots, and apartments, but they are still not enough.

Read More: Top 10 Challenges of Doing Business in Vietnam: Notes for Foreign Investors

EVs Vietnam Market: The Way Ahead

The future of EVs in Vietnam looks promising as a range of foreign automobile manufacturers like Tesla, Toyota, Mercedes-Benz, and Volvo are planning to introduce their electric cars to the domestic market. These global automobile giants want to leverage prospects in the electric vehicle market in Vietnam by investing in electric and hybrid car lines.

The Vietnamese automobile industry is estimated to generate 1 million vehicles in the 2030-2040 time period, and a major portion of it will be Vietnam electric cars. This is visible in the recent EV charging station investments of foreign firms like Porsche and Mitsubishi. Statista has further updated the estimation, suggesting that Vietnam will have 1 million electric vehicles by 2028.

According to some experts, VinFast will become a leading EV exporter in ASEAN in the coming years as it is expanding its capacity to 1 million annual production from its current 250,000 capacity. At present, the company is building an EV assembly plant in Vietnam and has recently signed MoUs with Indonesian companies with 600 EVs.

Additionally, the parent company of VinFast chalked out a plan to develop lithium ferrous phosphate (LFP) batteries in partnership with Gotion High-Tech from China. The company’s two lithium-ion factories will soon be operational in Q3 2024 in Ha Tinh province.

Several other Chinese firms have also shown interest in the electric vehicle market in Vietnam recently, including Chery Automobile, declaring that they will set up an EV plant in the country in April 2024. It is a joint venture with the Vietnamese company Geleximco in the Thai Binh province. The US$800 million EV assembly plant will have an annual production capacity of 200,000 vehicles after it is completely set up in Q1 2026.

Read Related: Finding the Right Place to Start Your Business in Vietnam

How Can InCorp Vietnam Help?

As mentioned before, the Vietnamese EV market is on its way to the 3.5 million mark by 2040, which makes it the ideal time to leverage opportunities in electric vehicles in Vietnam. At present, electric cars make up a modest share of the passenger car market of the country. However, this is likely to change in the next few years as the infrastructure develops and more policy changes happen.

InCorp Vietnam can prepare you for that future by providing able assistance to set up your EV business in Vietnam. Our team of legal experts and consultants is there to guide you through all compliance issues, making it a hassle-free experience for companies opening up businesses in Vietnam.

Get in touch with us for a free consultation to understand more about your prospect in the EV market of Vietnam!

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly