The Vietnamese economy has burgeoned into one of the world’s strongest economies thanks to its stable political and influential macroeconomic environment. Since the late 1980s, its Doi Moi reform policy has employed a range of measures to foster its attractiveness to foreign investment and develop a resilient economy. Hence, doing business in Vietnam is a lucrative option for foreign investors planning to expand their operations.

With 16 free trade agreements in place, including the EU-Vietnam Free Trade Agreement (EVFTA), Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), and most recently Regional Comprehensive Economic Partnership (RCEP), the government remains committed to promoting international trade. As part of the country’s goal of embracing Industry 4.0, the government is proactively implementing various initiatives as well and the rollout of a 5G network is also in the pipeline.

Investing in Vietnam? Check out Our InCorp Vietnam’s Incorporation Services

Vietnam’s Economy at a Glance

Combined with global trends and economic reforms that started in 1986, Vietnam emerged from being one of the world’s poorest nations into a middle-income country. Between 2002 and 2021, GDP per capita increased 3.6 times, reaching almost US$ 3,700. Moreover, the poverty rate (US$ 1.90/day) declined from over 32% in 2011 to below 2% in 2022.

GDP growth since the reforms has stayed consistently above 6%, with 2022 ending at over 8%. Through different crises, including COVID-19, the economy has proven resilient due to its solid foundation. Vietnam was one of the few countries that registered positive GDP growth during the pandemic.

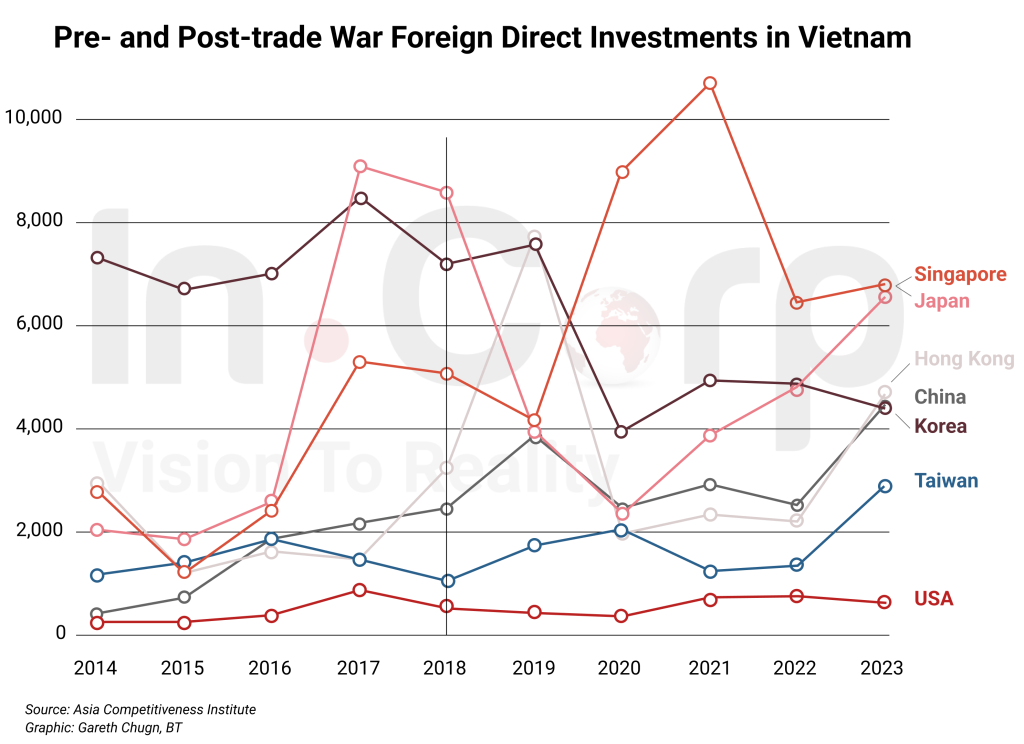

Vietnam will be the second-largest economy in Southeast Asia by 2036, as projected by the Centre for Economics and Business Research’s (CEBR) World Economic League Table 2022. Advantageous trends in the global economy (such as the US-China trade war) have allowed the country to record remarkable economic growth.

The Vietnam Investment Review (VIR) reported that the national government plans to become a high-income nation by the year 2045. Based on the country’s most recent five-year development plan, the economy is projected to expand at an approximate rate of 6.5% every year for the next ten years. And in 2023, Vietnam’s gross domestic product (GDP) growth rate is estimated at 5.05% in 2023, the General Statistics Office (GSO) announced on December 29.

Read more: Vietnam’s Economic Growth Projections: Surpassing Southeast Asian Nations by 2036

Ease of Doing Business in Vietnam

Company Registration Entities in Vietnam

If you’re planning on doing business in Vietnam as a 100% foreign-owned entity, you’ll have four options:

- Limited Liability Company (LLC)

- Representative Office (RO)

- Branch Office (BO)

- Joint-stock Company (JSC)

Read More about Each Entity when Doing Business in Vietnam here!

Tax Incentives in Vietnam

A few incentives offered by the Vietnam government are as follows:

- Preferential Tax Rates: CIT can be paid at rates lower than 20%, with preferential rates of 10%, 15%, and 17%. These reduced rates apply to specific industries and for a limited time.

- Tax Holidays AKA Corporate Tax Reductions: Foreign companies in preferred industries enjoy tax benefits such as CIT exemption for the first 4 years, a 50% tax reduction of the 10% rate for the next 9 years, and a 10% CIT for the following 2 years, with the standard 20% corporate income tax rate applying from the 16th year of operations onwards.

Read more: Tax Incentives in Vietnam: A Comprehensive Guide for Foreign Companies

Vietnam’s Fastest-Growing Industries

Vietnam is considered Southeast Asia’s investment hotspot with its central location, industrialization, and urbanization. Below are some of the industries representing the most lucrative investment opportunities.

High-end and Luxury Hospitality

Vietnam has a growing number of luxury hotel properties, with over 150 properties opened in 2020. The hotel market in Vietnam has shown positive performance in both occupancy and revenue per room. Investment opportunities in this sector are backed by a growing tourism industry and the demand for high-end accommodation.

Manufacturing and Logistics

Vietnam’s Manufacturing and Logistics sectors are appealing due to their strategic location, diverse demographics, and favorable trade agreements. The country’s expanding economy, efforts to establish economic zones and industrial parks, and increasing M&A activity are expected to sustain long-term growth in both industries.

Renewable Energy

Vietnam’s renewable energy sector, particularly solar and wind energy, is rapidly expanding, aiming to triple renewable power generation by 2030. The country also relies on hydroelectricity and biomass, with feed-in tariffs and supportive policies driving the growth of renewable energy, especially solar PV. As part of its green energy transition, Vietnam is moving away from coal and increasing the proportion of renewable sources through Power Development Plans.

Retail Banking & Fintech

Retail banking and fintech sectors present opportunities in Vietnam, driven by the underdeveloped banking system and the potential for a cashless society. With substantial room for growth and increasing consumer demand, both banks and fintech firms have attracted significant attention from global investors, with transaction values exceeding US$11 billion in 2020. Key sub-sectors include digital payments, P2P lending, cryptocurrencies, blockchain, investment tech, and point of sales.

E-commerce

E-commerce is thriving in Vietnam despite challenges like growing competition and limited market research due to slow technology adoption. The industry’s strong growth is fueled by progressive government policies, a growing middle-income class, and a fast-expanding Internet economy. The government’s approval of a national e-commerce development master plan further supports digital transformation in the sector.

Identifying Industrial Zones in Vietnam

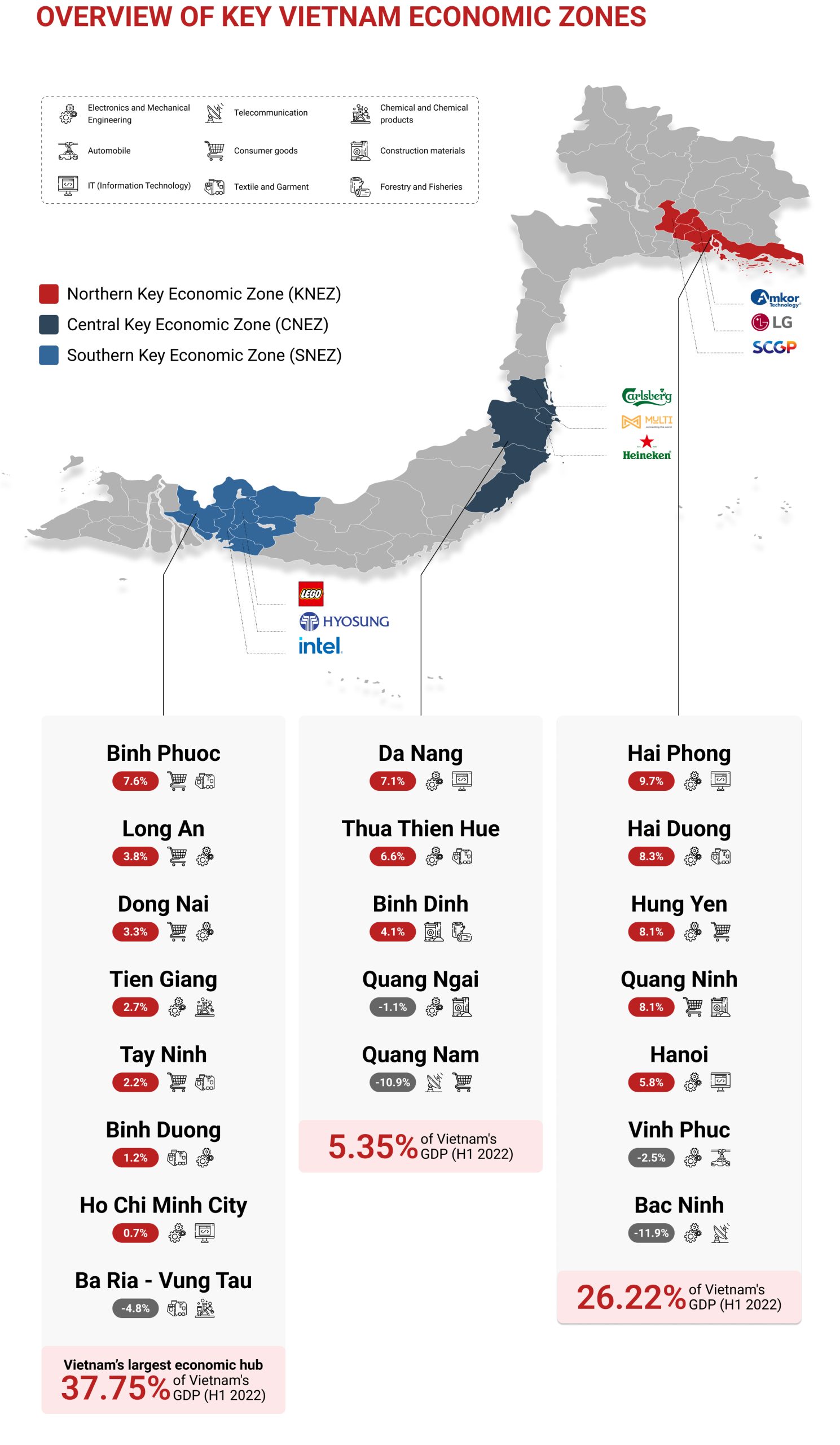

Vietnam has three significant economic zones:

NKEZ (Northern Key Economic Zones)

The NKEZ comprises Hanoi and six provinces: Hai Duong, Bac Ninh, Hung Yen, Vinh Phuc, Hai Phong, and Quang Ninh. Its strengths lie in motorbike manufacturing, electronics, and technologically advanced products. Offering competitive labor costs and proximity to China, this strategically located region is highly sought-after by manufacturers exploring options beyond China.

CKEZ (Central Key Economic Zones)

There are four provinces (namely Thua Thien Hue, Quang Nam, Quang Ngai, and Binh Dinh) and the Da Nang municipality in the CKEZ. There has been significant development in this region in areas such as textile manufacturing, apparel, materials for construction, and the production of wood and paper.

SKEZ (Southern Key Economic Zones)

Ho Chi Minh City and seven southern provinces: Ba Ria – Vung Tau, Binh Duong, Binh Phuoc, Tay Ninh, Dong Nai, Long An, and Tien Giang, constitute the SKEZ. Industries such as textiles, rubber, and plastics are located in this zone. SMEs and other businesses are attracted to this region due to its diverse economy and large pool of resources.

Related: Doing Business in Vietnam’s Free Zones: Some Highlights to Consider

Overview of Vietnam’s Workforce

Vietnam’s economic growth is driven by its impressively young and dynamic workforce, with over 100 million people, 51.6 million employed, and more than 30 million below the age of 35. The country’s competitive labor costs make it a top destination in Southeast Asia for manufacturing and software outsourcing. Despite this, talent and skills deficiencies, especially in advanced linguistic and technological fields, remain a challenge. The government is prioritizing IT training and implementing reforms to enhance technical and vocational programs to meet the labor market’s needs.

Related: High Demand Skills and Recruitment Advice for Foreign Employers

Challenges of Doing Business in Vietnam

Doing business in the Vietnamese market requires foreign investors to dedicate ample time to researching and analyzing risks stemming from various challenges, such as bureaucratic procedures, the fluctuating exchange rate, the Vietnamese language in paperwork, complex taxes, and cash dependency.

Excessive Bureaucratic Procedures

Over the period from 2012 to 2020, more than 57,000 officials faced disciplinary actions under Regulation No. 47-QD/TW (dated 1 November 2011). Among them, 17.4% faced charges of bureaucracy and irresponsibility, such as power abuse, inaccurate reports, and bribery. The Political and Economic Risk Consultancy (PERC) rated Vietnam poorly in Bureaucratic Performance in 2018, considering criteria like corruption levels and policy efficiency.

The Fluctuating Exchange Rate

In late 2022, the USD significantly strengthened due to the U.S. federal government tightening loaning policies to combat inflation, leading to a decline in the value of the Vietnamese dong. To address this, the Vietnamese government has imposed strict regulations on international transactions, particularly outgoing cash flow.

Required Use of The Vietnamese Language in Paperwork

When doing business in Vietnam, all reporting and filing paperwork, including licenses, must be in Vietnamese. Documents in English or other languages need to undergo certified translations at the court in the home country and then be validated by a Vietnamese embassy.

Complex Taxes in Vietnam

Vietnam’s tax system is complex, with multiple tax types, frequent changes, regional variations, and strict transfer pricing rules. Navigating it requires expert guidance, diligent compliance, and awareness of international agreements.

Cash-dependent Economy

A cash-dependent economy relies heavily on physical currency for transactions, with limited electronic or digital payment systems in place. It often indicates a lack of financial infrastructure and can pose challenges in terms of financial inclusion, transparency, and economic development.

Read More: Top 10 Challenges of Doing Business in Vietnam: Notes and Advice for Foreign Investors

Local vs Foreign Companies in Vietnam

Because it will affect the success of your future company, selecting a legal entity in Vietnam is almost as crucial as deciding which industry to engage in.

A Limited Liability Company is the most typical form of corporate organization in Vietnam. Either residents or outsiders may own it entirely. Local LLCs must submit a bank proof of deposit of shared capital and a registered location in Vietnam to the officials to organize.

For foreign-owned LLCs, opening a capital account with a regional bank is required to be approved for a foreign investment license (FIC). Although there is no mandatory minimum capital requirement in Vietnam, generally a sum of US$25,000 (2023 update) is required to effectively do business. Don’t hesitate to contact a consultant to get a detailed estimation for your specific industry.

Read More: FDI and 100% Vietnam Limited Liability Company (LLC): A Comparison Table

Sectors Prohibited for Foreign Investments

According to Decree 31/2021/ND-CP (Appendix I), there are 25 business sectors in Vietnam with restricted entry to the market:

- Trade in products and services on the list of monopolized products and services

- News-gathering efforts by the press in all forms

- Taking or using aquatic life for food

- Security and investigation services

- Court and administrative services, including court evaluation, bailiff, property sale, notary, and official receiver services.

- Services for guest workers

- Investing in the building of cemeteries to pass the facilities and land use rights thereon

- Household trash direct collection

- Services for public surveys

- Services for blasting

- Producing and selling firearms, explosives, and protective clothing

- The import and deconstruction of used seagoing ships

- The use of public post offices

- Trading in products as a merchant

- Temporary purchase of merchandise for re-export.

- Importing, exporting, and selling products that are listed as being prohibited by foreign owners and foreign-invested business groups

- Collection, purchase, and handling of public property at armed force units.

- Manufacturing of military goods or materials, dealing in military goods, weapons, specialty vehicles used only by the military and the police, specialist equipment and its components, and manufacturing of related technology

- Services for representing industrial property and evaluating intellectual property

- Marine-related foundation, administration, maintenance, support, survey, and publishing services

- Electronic marine information services; maritime safety services in water zones, water regions, and publicly accessible channels

- Services involving car examination, testing, and license issuing

- Survey, evaluation, and gathering of natural resources services

- Studying or utilizing novel household animal genetic resources

- Travel services, except international travel services for inbound tourists

Business Restrictions under the WTO Agreement

Vietnam may impose restrictions on or shut down particular industries to foreign investment by its WTO commitments. The following industries are affected by the barriers:

- Courier services

- Advertising services

- Equipment maintenance and repair (except for ships)

- Film production, distribution, and screening

- Travel agents and tour operators

- Services related to manufacturing and mining

- Distribution

- Telecommunication services

- Education

- Electronic games

- Road and rail transport

- Maritime transport, and container handling

- Aircraft repair and maintenance

Conditional Industries

In addition to the aforementioned limitations, Vietnam’s Investment Law specifies the number of industries that are permissible for foreign investment, subject to clearance under certain circumstances.

- Air transportation

- Air and seaport construction and operation

- Exploration, extraction, and refinery of petroleum

- Gambling industry

- Production of cigarette

- Infrastructure development in economic zones

- Golf courses construction

- Other industries include shipping, telecommunications, media, publishing, and the

- Creation of science and technology businesses.

Besides, there are further regulations such as:

- When a project requires over 10,000 people in the highlands or 20,000 people in other areas to relocate (needs clearance from the Prime Minister)

- Projects with investments of more than VND 5 trillion (needs clearance from the Prime Minister)

How to Start a Business in a Fully-Closed Sector?

Even in the restricted sector, there is a secure option to follow the local law when starting a company in Vietnam as a foreigner.

Establish a nominee business in Vietnam by locating a local designer. This kind of business is frequently used by overseas investors because they can still execute all of their rights in a nominee company. A set of agreements that have been notarized and signed through a reputable consultant can ensure a clear division of tasks and obligations.

Restrictions on Property and Land Ownership

In Vietnam, the law allows foreigners who have established legal entities to purchase various types of property, including apartments, villas, and houses, similar to local residents. However, there are restrictions: foreigners cannot own more than 250 properties in one ward or exceed 30% ownership in any single apartment building.

Read More: Property in Vietnam: 7 Key Insights for Foreign Investors to Thrive

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly