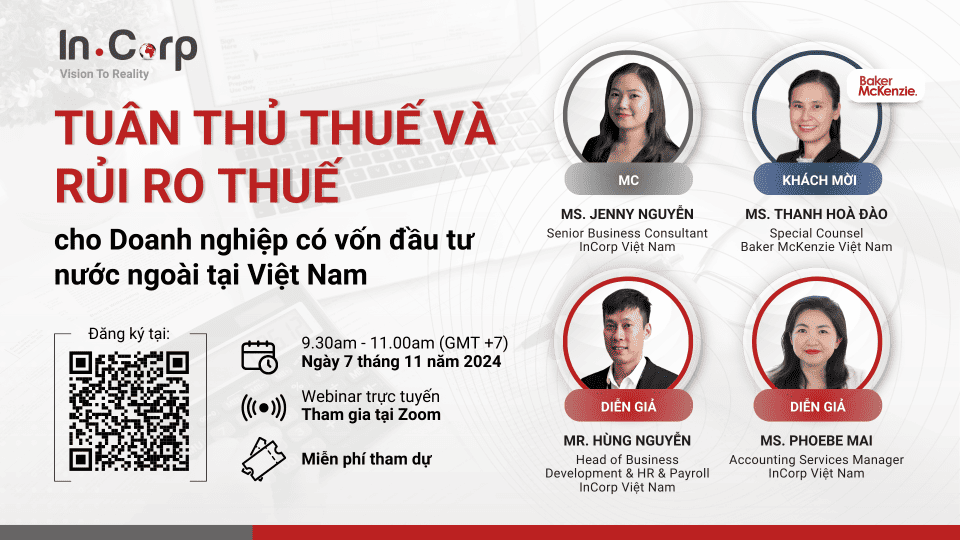

Join us for an insightful webinar designed for foreign individuals and businesses operating in Vietnam, led by InCorp Vietnam’s experts in collaboration with Baker & McKenzie. Gain a comprehensive understanding of Vietnam’s tax landscape, learn about key tax compliance obligations, and discover strategies to mitigate risks.

This webinar is a must-attend for foreign investors, business owners, and expatriates who wish to stay compliant and reduce tax liabilities in Vietnam.

• Overview of tax compliance for foreigners in Vietnam

• Common FDI tax issues

• PIT and CIT obligations for foreigners and businesses

• Work permit and government black list issues

• Strategies for mitigating tax risks

• Recent updates on tax laws and regulations