Vietnam’s accounting and reporting rules have evolved rapidly in recent years. Companies must prepare financial statements that comply with the latest Vietnamese standards and ongoing IFRS integration. In late 2025 the Ministry of Finance issued Circular 99/2025/TT-BTC (effective Jan 1, 2026), replacing the old Corporate Accounting Regime (Circular 200/2014). This new Circular clarifies accounting vouchers, the chart of accounts, and the preparation/presentation of financial statements.

Notably, it renames the Balance Sheet to “Statement of Financial Position” (other names – Income Statement, Cash Flow Statement, Notes – remain) and updates reporting templates. Meanwhile, Vietnam’s IFRS adoption roadmap (Decision 345/QD-BTC 2020 and a 2024 Accounting Law) mandates that larger companies switch from Vietnamese Accounting Standards (VAS) to IFRS by 2026. In short, financial statements in Vietnam must now align with these reforms – incorporating international disclosures and, for some firms, consolidating under IFRS.

Read More: IFRS and VAS in Vietnam: Top 3 Challenges and Opportunities

Financial statements are essential for investors and regulators to gauge a company’s health. By law, annual audited financial statements in Vietnam include four components: the balance sheet (statement of financial position), income statement (profit & loss), cash flow statement, and notes to the statements. These reports show assets, liabilities, equity, revenues, expenses, cash sources/uses, etc., providing transparency into the business. All enterprises (except very small ones) must prepare a yearly financial statement, typically covering either the calendar year or an approved fiscal year (e.g. Apr–Mar, Jul–Jun, Oct–Sep). The Accounting Reference Date (ARD) marks the end of the annual period (commonly Dec 31) – companies fix this date and report up to that day.

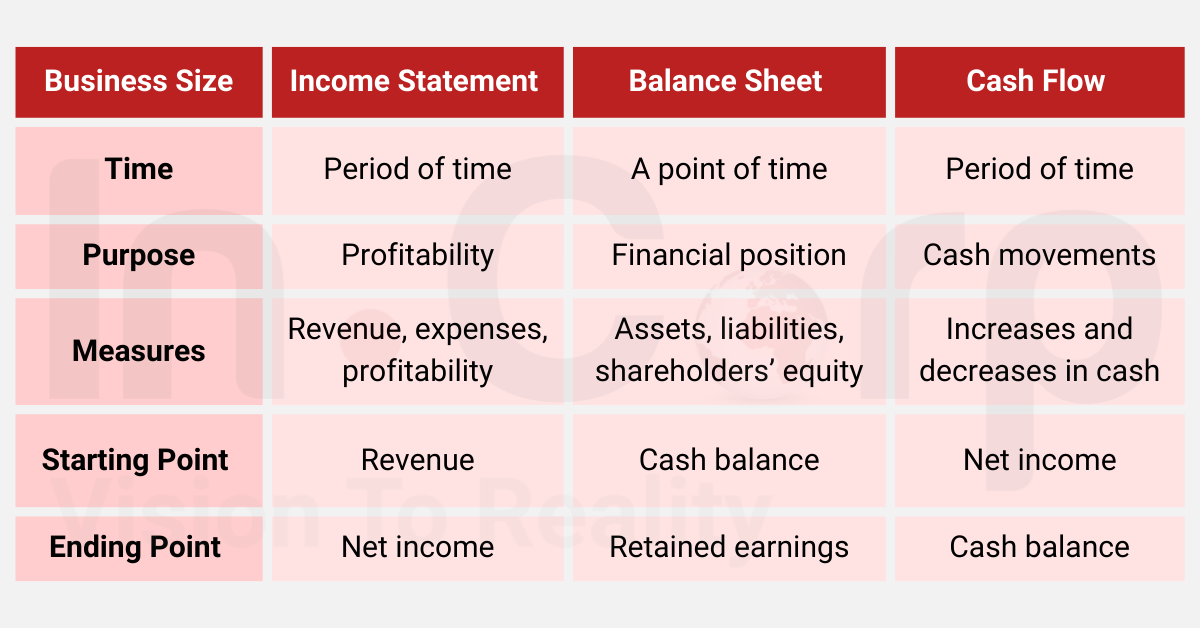

Three Major Financial Statements

Before understanding the analysis of such statements we need to know 3 major types of financial statements – balance sheet, income statement and cash flow statement (CFS).

However, these three major types are only applicable to for-profit organizations, non-profits have a different set. Apart from these, some companies also issue financial status change statements, and profit and loss statements.

Sometimes the schedule of the company also becomes a part of a financial statement. But under no circumstances, do they reveal information about management analysis, directors’ reports and financial fact sheets.

Balance Sheet

A balance sheet shows the net worth of the company as it provides a snapshot view of the finances of the enterprise at any given point in time (marked by the financial statement issue date at the top of the document). The balance sheet displays the assets and liabilities of the company, classified according to current and non-current versions and listed as per their liquidity. (Under Circular 99, the “Balance Sheet” is officially called the Statement of Financial Position, but it performs the same role.)

The balance sheet starts with cash balance and ends with retained earnings. It is governed by the formula:

Assets = Liabilities + Shareholders Equity

In this kind of financial statement, assets and liabilities plus equity are balanced. This includes balancing assets like cash and other equivalents with the same in the liabilities section. At the end of the statement, the ending balance of the concerned period has to be displayed, showing the proper cash flow. It’s connected to the income statement, as the net income is highlighted in the balance sheet after adjustment for dividends.

However, to know how it works, you need to understand the critical features of assets and liabilities including shareholder’s equity

Assets can include:

- Cash equivalent items like deposit certificates and treasury bills

- The amount of money the company owes from customers for its products and services sale

- The inventory of goods like raw materials used for products, unfinished work-in-progress products that the business is likely to sell in the future

- Expenses that are made by the company in advance as there’s a possibility of refund.

- Equipment, factories and properties owned by the business

- Investments, patents, trademarks, goodwill and other intangible assets that offer long-term benefits.

Liabilities can include

- Bills like rent, utility bills, and raw materials expenses that are operating costs

- Wages and taxes paid by the company

- Short-term debt or current liability payable as per the debt agreements

- Dividends payable to the shareholders

- Long-term debt like mortgages and loans due for over a year.

Shareholders’ Equity is the money returned to the stockholders after debts are paid and assets are liquidated. It is measured by subtracting the liabilities from the assets as per the balance sheet formula. The earnings retained by the company are part of this equity and dividends are the net earnings not paid to the shareholders.

Income Statement (Profit & Loss Statement)

This statement shows the company’s performance over the year. It starts with revenue (operating revenues from sales of goods or services, plus any other income like interest or royalties) and subtracts expenses (cost of goods sold, operating expenses, R&D, depreciation, etc.). It also accounts for any gains or losses from one-time events (e.g. sale of an asset, lawsuits). The result is net income (profit or loss) for the period. In formula form:

Net Income = (Revenue + Gains) – (Expenses + Losses)

Revenue can include:

- Operating revenue gained from selling products for wholesalers, distributors, manufacturers or retailers)

- Operating revenue earned from services for those in the service industry

- Non-operating revenue or earnings from other sources like royalties, rental income, displayed advertisement and interest from business capital

Gains include:

- Money made from selling assets like vehicles, equipment, unused land or property, subsidiary company

Expenses include:

- Primary costs are core business activities like the cost of goods sold (COGS), selling, general and administrative expenses (SG&A), R&D and depreciation expenditures. (Sales commissions, transport costs, utilities like electricity bills and wages of the workers are examples of primary costs)

- Secondary costs that are non-core business activities like interest on loans

Losses are one-time expenses that can’t be recovered like expenditures on lawsuits.

This type of financial statement provides details of sales, the work done and the earnings per share (EPS), measuring how the company is turning revenue into earnings. All this is done without cash non-cash discrimination, that is, sales on credit and cash both are counted to determine the revenue. Similar to sales, expenses are also not discriminated against based on cash or credit.

Cash Flow Statement

A cash flow statement (CFS) is a crucial financial statement as it highlights the cash position of the business, informing the investors how the cash is spent, how much of it is invested in growth and how much goes to creditors. All this information is depicted in the following 3 segments in the cash flow statement – cash from financing, cash from operations and cash used in investments. It shows the debts and obligations of the company.

Unlike the balance sheet and the income statement, the CFS starts with net income and ends with cash balance. It complements the other two financial statements and stands for the financial footing of the company as it displays where the cash is coming and going. This kind of financial statement has three components:

- Investing activities like the cash sources and uses from the company’s investments, loans given to vendors, loans received from customers, sale of assets, fixed asset purchases (equipment, property, plant), merger and acquisition-related payments

- Operating activities like cash sources and uses from selling products and services or running the business, cash derived from inventory and depreciation, cash receipts from sales, rent, income tax and interest payments, and the wages of the workers.

- Financing activities like cash from banks and investors, debt issuance, stock repurchases, loans, equity issuance, dividends paid, payments made to shareholders and debt payments.

Each of these statements is prepared using VND and must be presented in Vietnamese language. By regulation, all enterprises must file a financial statement annually (and may optionally prepare interim statements). Small companies can use simplified accounting regimes (Circular 133/2016 as amended) but still submit essentially the same four reports.

Fiscal Year and Reporting Period

Vietnamese companies may adopt either a calendar year or another fiscal period, subject to approval. Common fiscal year options are: Jan 1–Dec 31, Apr 1–Mar 31, Jul 1–Jun 30, or Oct 1–Sep 30. Once chosen, a firm’s Accounting Reference Date (ARD) – the year-end date – is fixed (±7 days flexibility is allowed by law). For example, if a new company is established late in the year, it may combine that short period into the next year’s reporting. For instance, Emerhub notes that a company incorporated after October can skip a separate first-year report and include that period in the next year’s financial statements.

In practice, many businesses use the calendar year. Vietnamese law (Tax Administration Law 2019) requires annual final returns and audited financial statements to be filed by the last day of the third month following year-end. For a December 31 year-end, that means a March 31 deadline.

Filing Deadlines for Financial Statements

- General Deadline: By law, companies must submit their annual financial statements (with tax returns) by the last day of the 3rd month after the accounting period ends. In other words, for a Dec 31 year-end the deadline is typically March 31 of the next year.

- State-owned Enterprises: Per Circular 200/2014 (still guiding many state units), accounting departments of state firms submit annual reports within 30 days after year-end, while central parent corporations have 90 days. (For example, if the year ends Dec 31, the accounting department must file by Jan 30 and the parent by Mar 30.)

- Private Companies and Partnerships: In-house accounting units of private enterprises and partnerships must file annual statements within 30 days after the year-end. Other entities (including subsidiaries) have 90 days unless governed by a parent’s shorter schedule.

- Small & Medium Enterprises (SMEs): SMEs under the simplified accounting regime must prepare annual statements and send them within 90 days of year-end.

In modern practice, many firms simply use the 3-month rule above for taxes and accounting. (PwC confirms that the final corporate tax return and audited statements are due by the end of the third month after year-end.) Note that these deadlines reset based on the chosen accounting period.

Submission and Audit Requirements

Auditing: Most foreign-invested enterprises (FOEs) and certain large companies are required to have their financial statements audited by a licensed independent auditor (a Vietnamese auditing firm) each year. In fact, all FOEs must produce audited financial statements under Vietnamese law. Small domestic companies may not be strictly required to audit if below thresholds, but many still do so for credibility. Independent audits ensure accuracy of the reported financial statements and tax compliance.

Submission Locations: After preparation and (if required) audit, companies must file their financial statements with various government agencies:

- Domestic (Vietnamese) Companies: Submit annual financial statements to the local Tax Department, the General Statistics Office (GSO), and the Department of Planning and Investment (DPI) of their province. If the company has a parent firm or is part of a corporate group, it also submits to its corporate headquarters or holding company. (These rules come from the Enterprise Accounting Law: local state tax, statistics and investment agencies receive the reports.)

- Foreign-Invested Enterprises (FOEs): FOEs must file their audited statements with additional bodies. This typically includes the Department of Corporate Finance (under the Ministry of Finance), the local Tax Department, and the provincial Statistical Office. For FOEs in industrial zones or export processing zones, a provincial EPZ/IZ authority may also require a copy. In practice, upon submission the tax/statistics offices will stamp one copy for confirmation (electronic submissions yield an official e-confirmation).

Listed companies and financial institutions have further obligations: for example, securities firms and public companies must also file statements with the State Securities Commission and stock exchanges.

Documentation: Companies should prepare detailed accounting records to back up their financial statements. Auditors will typically request the general ledger, trial balance, bank statements and reconciliations, fixed asset registers, receivables/payables aging reports, inventory counts, and copies of all tax filings. Maintaining good records simplifies the audit and submission process.

Looking for Accounting Outsourcing in Vietnam? Check out InCorp Vietnam’s Accounting Outsourcing Services in Vietnam

Required Forms and Financial Statement Contents

Under Vietnam’s accounting regulations, the annual financial statements must include the standardized forms approved by the Ministry of Finance. For non-SME companies, these are:

- Form B01-DN: Balance sheet (Statement of Financial Position) – assets, liabilities, equity.

- Form B02-DN: Income statement – revenues, expenses, net profit.

- Form B03-DN: Cash flow statement – cash flows from operating, investing, financing.

- Form B09-DN: Notes to the Financial Statements – explanatory information.

These are specified in Circular 200/2014 (Article 100) and remain in use until the new Circular 99 issues its updated templates. (Circular 99 may revise form numbering or titles, but still requires the equivalent four reports.) Small and medium enterprises following Circular 133/2016 prepare similar statements (often using simplified account codes), but they too typically compile a balance sheet, P/L statement, cash flows and notes.

When filing tax returns, companies attach their audited financial statements to the annual corporate tax finalization forms. Vietnamese law explicitly links tax filings and audited FS: the annual tax return deadline and FS deadline coincide (the end of the 3rd month after year-end). In effect, the completed financial statements are submitted alongside (or as part of) the final tax declarations.

Read Relevant: Must-Know Year-End Deadlines for Foreign Companies in Vietnam

Other Year-End Reporting Requirements

Apart from financial statements, Vietnamese companies must meet several related compliance filings each year (mostly in the first quarter):

- Corporate Income Tax (CIT) Finalization: After making quarterly provisional tax payments during the year, companies finalize their CIT by submitting a final CIT return (Form 03/TNDN) to the tax authorities by March 31 (or 90 days post year-end). This return reconciles the actual tax due using the audited income figures.

- Personal Income Tax (PIT) Finalization: Employers must submit annual PIT settlement reports (Forms 05/QTT series) for employee salaries by March 31.

- Annual Statistical Report: Many businesses (especially foreign-invested ones) must file a statistical report to the GSO or DPI. The deadline is often March 31 of the following year. (This report summarizes revenue, labor, investments and business activities for the year.)

- Other Declarations: These may include social insurance reports, labor reports, and any industry-specific filings.

Note: Business license tax is an annual fee based on charter capital (or revenue for business households). Effective January 1, 2026 this tax is abolished. Thus companies no longer pay the license tax or file related forms. (Until 2025, the license tax was VND 3,000,000 for capital over 10 billion VND and VND 2,000,000 if 10 billion or less.)

Compliance and Penalties

Meeting the financial statement deadline is critical. Late filing of audited financial statements can incur fines. For example, a late submission may be fined from VND 700,000 up to VND 25,000,000 (roughly US$30–US$1,100) depending on the delay. Repeat offenses incur higher penalties. Separately, tax late-filing and payment penalties also apply if tax returns are filed after March 31 – typically interest at 0.03% per day on unpaid tax plus administrative fines.

Staying Compliant

In summary, companies in Vietnam should prepare to comply with financial statement requirements as follows:

- Keep accounting records and adjust them early (VAS or IFRS) to allow timely preparation of the four main statements.

- Obtain an independent audit if required (most foreign-owned or large companies must) and have the auditor issue an opinion.

- Ensure statements are prepared in VND and Vietnamese, using the approved templates (B01-DN, B02-DN, etc.).

- File the audited statements together with the annual tax returns by the end of the third month after year-end (typically Mar 31 for Dec year).

- Submit the statements to the appropriate agencies (tax, statistics, DPI, parent company, etc.) as required.

By staying current with the new Circular 99 rules and the IFRS transition timetable, businesses can ensure their financial statements remain accurate, compliant and useful for investors. Companies often engage professional accounting and audit services to navigate these updates efficiently. Properly prepared financial statements not only satisfy regulators (avoiding fines) but also boost investor confidence by clearly showing the company’s financial position and results.

How can InCorp Vietnam Help

InCorp Vietnam’s dedicated team can help you meet all the compliance requirements of filing a financial statement. We have a team of experienced and certified auditors who can assist you in auditing and preparing financial statements along with tax finalization, ensuring the company upholds the compliance standards of Vietnam and doesn’t face penalties.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What are the 4 types of financial statements?

- The four types of financial statements are: 1. **Balance Sheet** – shows a company’s financial position at a specific point in time, detailing assets, liabilities, and equity. 2. **Income Statement** – summarizes revenues, expenses, and profits over a specific period. 3. **Cash Flow Statement** – reports cash inflows and outflows from operating, investing, and financing activities. 4. **Statement of Changes in Equity** – outlines changes in owners’ equity over a reporting period, including retained earnings and other equity movements.

What are the 5 basic financial statements?

- The five basic financial statements are: 1. **Balance Sheet** – shows a company’s assets, liabilities, and equity at a specific point in time. 2. **Income Statement** – reports revenues, expenses, and profits over a specific period. 3. **Cash Flow Statement** – details cash inflows and outflows from operating, investing, and financing activities. 4. **Statement of Changes in Equity** – shows movements in owners' equity over a period. 5. **Notes to Financial Statements** – provide additional context, explanations, and breakdowns of figures presented in the main statements.

What is a 3 statement financial statement?

- A 3-statement financial model includes the income statement, balance sheet, and cash flow statement. These three core financial statements are interconnected and used together to analyze a company’s financial performance and make forecasts. The income statement shows profitability, the balance sheet shows financial position, and the cash flow statement shows cash movements. This model helps assess the company's health, plan budgets, and support investment or financing decisions.