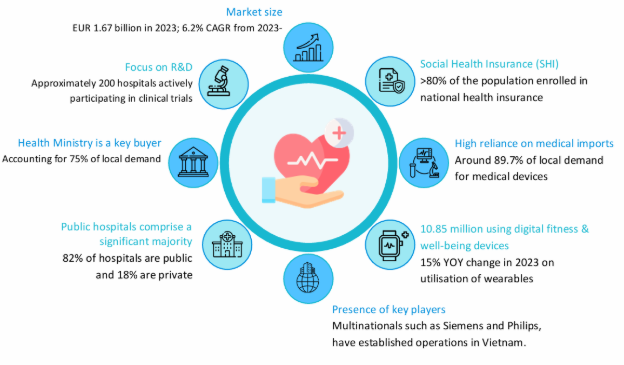

Vietnam is rapidly positioning itself as a rising force in Southeast Asia’s healthcare landscape, driven by strong growth in both its public health system and medical tourism sector. The country operates a hybrid model of public and private healthcare services, with approximately 82% of the population covered under the national health insurance program. This progress is reinforced by the government’s strategic push toward digital transformation, aiming to enhance healthcare quality and accessibility through technology. With increasing investor interest, many healthcare startups and foreign companies are exploring company incorporation in Vietnam to participate in this rapidly evolving medical landscape.

While public hospitals continue to form the backbone of Vietnam’s healthcare infrastructure with over 1,150 public facilities, the private sector is gaining momentum, particularly in urban centers where demand for faster, higher-quality care is on the rise. Of the country’s more than 1,400 hospitals, 250 are privately operated, signaling growing investor interest in advanced healthcare delivery. Private providers are increasingly investing in innovations such as telemedicine, electronic health records (EHRs), and digital diagnostics, offering scalable solutions to meet rising patient expectations and ease the burden on public institutions.

1. Vietnam’s Healthcare Industry Overview

Vietnam has structured a hierarchical healthcare system that extends from regional and rural areas to nationwide. Over the past 3 decades, the country has expanded universal health insurance coverage and reduced healthcare spending. This dedication is apparent in the nation’s focus on preventive medicine and healthcare promotion.

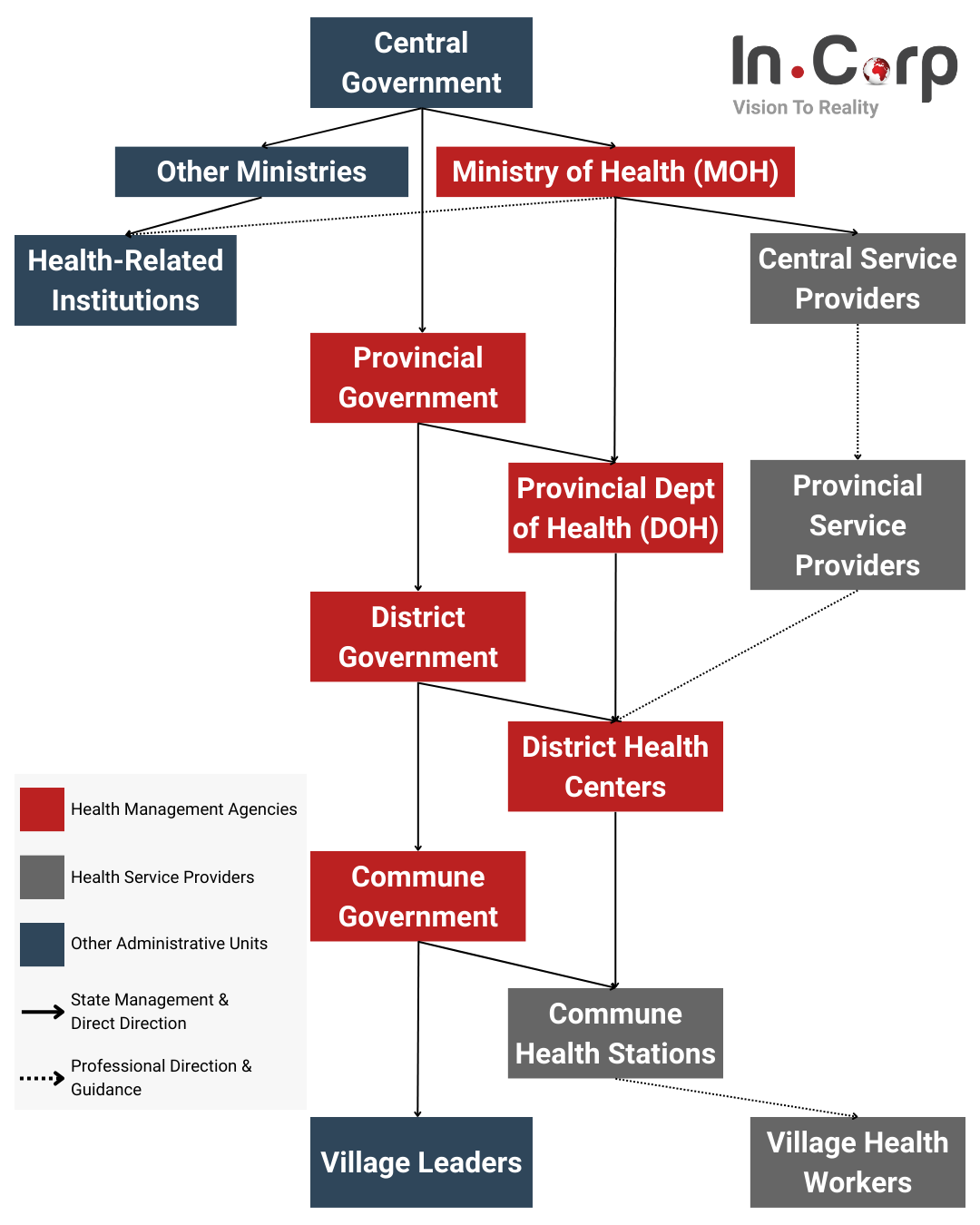

1.1. Healthcare System in Vietnam

The health system operates across four administrative levels: central, provincial, district, and commune. Policy-making typically originates from the central level, with the MOH spearheading evidence-based agendas. Approved policies are executed by the MOH and local authorities, monitored by relevant departments, and overseen by the Social Affairs Committee of the National Assembly.

- National Level: The Ministry of Health (MoH) administers the healthcare sector, managing a network of hospitals, research, and academic institutions, with other ministries operating their hospital systems.

- Provincial Level: Provinces and central-affiliated cities run several hospitals, medical centers, and medical colleges with programs in medicine, nursing, and pharmacy.

- District Level: District health centers provide medical and preventative care services.

- Commune Level: Commune health stations are dedicated to primary healthcare services for local communities

1.2. Healthcare Strategy 2025 – 2030

Vietnam’s 2025–2030 hospital network plan is anchored in a robust legal framework, ensuring transparency, enforceability, and practical implementation. This strategy is designed not only to guide healthcare infrastructure development but also to enable sustainable, innovation-driven growth across the national health system.

1.2.1. Key Legal Foundations

Law on Medical Examination and Treatment (No. 15/2023/QH15) – Effective from January 2024, this pivotal law expands service delivery models (e.g., mobile and telehealth), decentralizes licensing to provincial authorities, and grants public hospitals financial autonomy. It also enforces service price disclosure, professional capacity standards, and ongoing staff training.

- Decree No. 96/2023/NĐ-CP – Clarifies healthcare decentralization, financial mechanisms, and government roles at different administrative levels.

- Resolution No. 20-NQ/TW (2017) – Sets a long-term vision for improving public health through investment diversification and healthcare socialization.

National Digital Transformation Strategy (Decision No. 749/QĐ-TTg/2020) – Lays the foundation for smart hospitals, EHRs, and AI-driven diagnostics.

1.2.2.Core Policy Priorities

- Greater autonomy for hospitals: Enhanced control over finance, human resources, and structure, especially at the provincial and district levels.

- Encouraging private sector involvement: Through PPPs, joint ventures, and equitization, supported by national policy resolutions.

- Enhancing quality of care: Nationwide standards, linked with recruitment and training, backed by Directive 06/CT-BYT.

- Accelerating digital transformation: Broad adoption of IT in operations, patient records, and disease surveillance, with key initiatives like EHR, EMR, and paperless hospitals.

Investing in Vietnam Healthcare Industry? Check out Talk to our Company Registration Experts

2. Key Growth Drivers of Healthcare Industry in Vietnam

- High Demand for Foreign Medical Staff

In Vietnam, there is a growing trend of hiring foreign medical doctors due to disparities in healthcare distribution. Only 30% of the population resides in cities. Most medical professionals are interested in serving the urban areas, which leaves the rural regions underserved. Additionally, government hospital doctors receive low pay and often switch between public and private sectors, hindering skill development.

Despite the demand for physicians, expanding the local workforce is challenging due to lengthy training requirements. Consequently, this country increasingly relies on foreign doctors to address healthcare gaps, emphasizing the importance of balancing local talent development with international expertise.

- Increasing demand for high-quality healthcare services

Vietnam’s healthcare sector is poised for significant expansion, fueled by a population of nearly 100 million and shifting demographics. The country is seeing a marked rise in both its aging population and burgeoning middle class—expected to double from 13% in 2023 to 26% by 2026. This evolution is driving increased demand for quality healthcare services, particularly in general medical care and long-term treatment, as health consciousness grows in the post-pandemic era.

- Expansion of middle-class population

As Vietnam progresses toward upper-middle-income status by 2035, rising disposable incomes are reshaping consumer expectations. More individuals are willing to invest in premium healthcare options, while capacity limitations in public hospitals continue to push demand toward the private sector.

- Government policies supporting private and foreign investments

There are no foreign ownership caps for hospitals and clinics, and investors can benefit from incentives such as tax exemptions, reduced import duties, and preferential land use policies. However, restrictions remain in place for foreign involvement in pharmaceutical distribution, reflecting a cautious but strategic approach to sector liberalization.

3. M&A Investment Opportunities

Vietnam’s healthcare landscape is undergoing rapid transformation, creating attractive opportunities for mergers and acquisitions across several high-growth segments. Investors are showing strong interest in private hospitals, digital health platforms, and pharmaceutical manufacturing, each offering scalable potential amid rising healthcare demand and favorable policy shifts.

Private Hospitals and Specialty Clinics

Private healthcare facilities, especially those specializing in ophthalmology, oncology, and cardiology, are emerging as key M&A targets. While only 23.4% of Vietnam’s hospitals are currently privately owned, government policy aims to expand private hospital bed capacity from 6% today to 15% by 2030 and 25% by 2050. This push reflects a broader strategy to relieve pressure on the public system while expanding access to specialized care.

Digital Health and Telemedicine

Vietnam’s digital health sector is gaining momentum following regulatory reforms that officially authorize telemedicine. Investments in electronic medical records (EMRs), centralized health data systems, and AI-powered diagnostics are accelerating. The digital health market is projected to reach nearly US$906 million in revenue by 2024, with a CAGR of 7.71% through 2028, making it a prime focus for tech-enabled healthcare investors.

Medical Equipment and Pharmaceuticals

Vietnam permits 100% foreign ownership in pharmaceutical manufacturing, positioning it as a regional hub for high-tech medical production. Although foreign participation in pharmaceutical distribution remains restricted, the development of dedicated pharmaceutical industrial zones such as the 338-hectare Le Minh Xuan 2 Industrial Park in Ho Chi Minh City signals a strong commitment to attracting strategic investment in advanced healthcare and life sciences infrastructure.

Check out InCorp Vietnam’s Health Supplement Registration Services in Vietnam

4. Vietnam’s Healthcare Industry Challenges

Below are some factors that are expected to limit the growth of the connected healthcare market in Vietnam.

4.1. Challenges in Workforce Training and Retention

The journey of building and sustaining this healthcare workforce faces hurdles. The training and retention of medical staff pose distinct challenges and opportunities.

- Brain Drain: Skilled healthcare professionals emigrating for better opportunities abroad contribute to talent shortages domestically, impacting care quality.

- Training Opportunities: Ensuring a steady supply of well-trained medical professionals demands an emphasis on education and skill development.

- Motivation and Retention: Sustaining a motivated workforce requires adequate compensation, career advancement opportunities, and a supportive work environment.

4.2. Shortage of International Medical Practitioners

Foreign medical practitioners play a vital role in Vietnam’s healthcare system to enhance the local workforce. These experts bring specialized skills and knowledge that contribute to advanced medical practices and research. Their presence enriches the sector with diversity and expertise. However, collaborations with foreign medical institutions and international organizations facilitate knowledge exchange.

Integrating Local and Foreign Contributors

Foreign doctors bring the necessary skills, but finding the right balance with our local doctors is essential. It is necessary to focus on training and helping doctors grow. This way, Vietnam’s healthcare system can keep improving, and the doctors will better understand the needs of our community.

4.3. Market Restraints

In Vietnam, certain regulatory obstacles, especially regarding data privacy and security, still need to be addressed. This complexity can pose challenges to the implementation of connected healthcare solutions that depend on sensitive patient data.

While knowledge about connected healthcare solutions is growing, a significant portion of the population remains unaware of this technology. This lack of awareness could restrict adoption rates and slow down market expansion.

Even with widespread smartphone use, certain areas in Vietnam may face limited internet access. This limitation can pose challenges in consistently providing connected healthcare services, particularly in rural areas.

Read More: Top 10 Challenges of Doing Business in Vietnam: Notes and Advice for Foreign Investors

How InCorp Can Assist?

InCorp Vietnam provides end-to-end support for healthcare companies navigating Vietnam’s complex regulatory and operational landscape. From business setup and licensing to tax compliance, payroll, and ongoing corporate governance, our team ensures healthcare investors stay compliant with evolving laws. We also offer specialized advisory on import regulations for medical devices, personal income tax (PIT) for expatriates, and HR solutions for clinical and administrative staff. With deep local expertise and a proactive compliance approach, InCorp helps healthcare companies operate efficiently and scale with confidence in Vietnam.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What are the 6 domains of healthcare?

- The six domains of healthcare quality, as defined by the Institute of Medicine (IOM), are: 1) Safety – avoiding harm to patients; 2) Effectiveness – providing evidence-based services; 3) Patient-centeredness – respecting individual patient preferences; 4) Timeliness – reducing waits and delays; 5) Efficiency – avoiding waste of resources; and 6) Equity – providing care without disparities due to personal characteristics. These domains aim to ensure high-quality, consistent, and accessible healthcare for all patients.

What is the health care industry?

- The health care industry comprises businesses and organizations that provide medical services, manufacture medical equipment, and develop pharmaceuticals. It includes sectors such as hospitals, clinics, nursing care, diagnostics, biotechnology, and health insurance, all focused on the diagnosis, treatment, and prevention of illness and injury.

What is Vietnam's healthcare system?

- Vietnam's healthcare system is a mixed public-private system, with the Ministry of Health managing public health services and regulations. Public healthcare is accessible and subsidized, but often faces challenges such as overcrowding and limited resources. Private healthcare services offer higher quality and faster care, but at higher costs. Vietnam also has a social health insurance scheme, which covers a significant portion of the population.