Vietnam’s furniture industry has grown into a global powerhouse, making furniture export a key driver of the economy. In 2024, Vietnam’s wood and wood product exports reached USD 15.7 billion, with furniture accounting for a significant share. As Vietnamese manufacturers ship sofas, tables, and cabinets to markets worldwide (from the US and EU to Asia), mastering export logistics is vital. This guide provides practical insights on all aspects of furniture export logistics – from transportation routes by sea, air, and land, to major ports in Vietnam, packaging best practices, trade compliance essentials, and leveraging trade agreements. With an informative tone, it aims to help Vietnam’s furniture makers plan smooth, cost-effective exports in today’s dynamic trade environment.

Major Transportation Routes for Furniture Export

Vietnamese furniture exporters typically rely on three logistics routes: sea freight, air freight, and land transport. Each option differs in cost, speed, and suitability for bulky goods. Choosing the right route – or combining them – ensures smooth, efficient furniture export operations.

Sea Freight: Primary Mode for Furniture Exports

Sea freight remains the dominant method thanks to low cost and high capacity.

• Cost-effective for bulky cargo:

Ideal for large-volume shipments. FCL (20ft/40ft) helps optimize cost per item, while LCL suits smaller loads though it requires extra consolidation time.

• Global connectivity:

Vietnam’s major ports link to North America, Europe, and Asia via direct or transshipment services. Transit usually takes 4–6 weeks depending on destination.

• Requires longer planning:

Exporters must prepare for longer lead times, peak-season congestion, and schedule containers early for holiday or outdoor-furniture cycles.

• Key considerations:

More handling means stronger packaging is essential. Freight rates and container availability fluctuate, so experienced forwarders and early booking help stabilize costs.

Air Freight: For Urgent or High-Value Shipments

Air cargo is fast but costly, making it suitable only for specific furniture export needs.

• Fastest transit:

Shipments arrive within days for rush orders, hotel projects, or trade-show samples.

• High cost & limited volume:

Air freight is impractical for most bulk furniture, used mainly for premium, fragile, or small items.

• Lower damage risk:

Fewer touchpoints and reliable schedules reduce the chance of breakage.

• Key considerations:

Strict size/weight limits may require disassembly. Strong crates, accurate paperwork, and proper palletizing are essential for smooth clearance.

Land Transportation: Regional and Multimodal Routes

Land transport supports furniture export to nearby markets or as part of a combined logistics plan.

• Cross-border trucking:

Direct routes to China, Laos, and Cambodia offer flexibility and faster delivery within ASEAN, though road conditions and borders can cause delays.

• Rail as an emerging option:

Vietnam’s rail links, including the Hanoi–Europe route (~25 days), provide a middle ground between sea and air for select markets.

• Domestic & multimodal moves:

All exports start with trucking from factory to port. Some exporters combine truck/rail with sea freight for cost and route optimization.

• Key considerations:

Overland routes require customs paperwork at borders and strong cargo insurance. New highways and rail projects continue to expand opportunities for regional shipments.

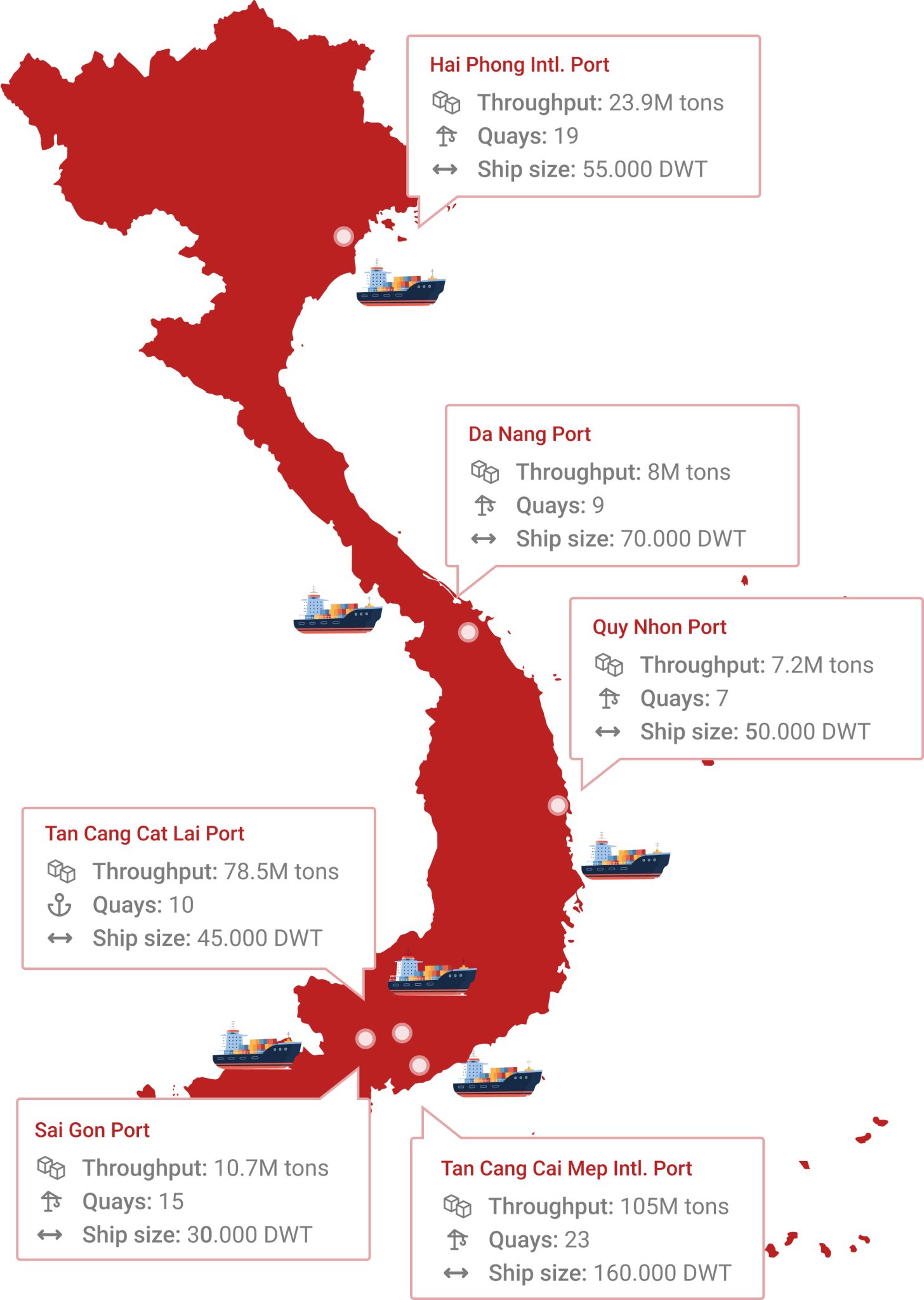

Major Vietnamese Export Ports

Vietnam’s long 3,200 km coastline gives furniture exporters strong access to global shipping routes. Beyond the well-known Hai Phong and Cat Lai, several major and emerging ports play key roles in moving Vietnam’s furniture export volumes efficiently.

Hai Phong Port (Northern Vietnam)

The main gateway for Hanoi and northern industrial zones. With modern terminals like Lach Huyen, Hai Phong supports large vessels and high container throughput. Strong road and rail links make it the primary export point for northern furniture factories.

Cai Lan Port – Quang Ninh

A deep-water Panamax-capable port that complements Hai Phong. It serves Quang Ninh’s industrial base and growing wood-product sector. Ongoing upgrades strengthen capacity and make it a strategic northern alternative for exporters.

Da Nang Port (Central Vietnam)

Central Vietnam’s largest port, serving Quang Nam and Thua Thien–Hue furniture clusters. Its location on the East–West Economic Corridor allows goods to arrive by road from Laos and Thailand. Terminals like Tien Sa ensure consistent container handling for mid-Vietnam exporters.

Quy Nhon Port (Binh Dinh Province)

A key port for the central–south region, especially for wood processing hubs in Binh Dinh. Recent investments have modernized the port, improving efficiency for growing furniture export volumes alongside agricultural and mineral shipments.

Ho Chi Minh City – Cat Lai Terminal

Vietnam’s busiest container port and the main export hub for southern industrial zones (Binh Duong, Dong Nai, HCMC). Cat Lai handles millions of TEUs annually and remains essential for intra-Asia and general export routes, despite size limitations on very large vessels.

Cai Mep – Thi Vai (Ba Ria–Vung Tau)

One of Southeast Asia’s deepest ports, capable of receiving ultra-large container ships. Cai Mep offers direct services to the U.S. and Europe, reducing transit time and avoiding transshipment. It is increasingly preferred for long-haul furniture export shipments and eases congestion from HCMC ports.

Saigon Port (HCMC)

A historic port cluster (e.g., Hiep Phuoc, Saigon Newport) that still handles significant exports. While some traffic shifted to Cat Lai and Cai Mep, Saigon Port supports overflow and specialized cargo, keeping southern logistics flexible.

Other notable ports

Ports such as Nghi Son (Thanh Hoa), Cua Lo (Nghe An), Dung Quat (Quang Ngai), and the developing Van Phong (Khanh Hoa) expand regional capacity and support Vietnam’s growing export network. While not dedicated furniture hubs, they help distribute traffic and reduce pressure on major ports.

Understanding the port options allows furniture exporters to plan better – e.g. using the nearest major port to minimize inland transport, or choosing a port with direct shipping routes to the destination market for faster transit.

Best Practices in Packaging for Furniture Export

Proper packaging is essential because furniture is bulky, heavy, and vulnerable to scratches, dents, and moisture. Following proven packaging standards helps Vietnamese exporters deliver products intact after long-distance transport and multiple handling stages.

Disassemble and cushion parts

Break down items whenever possible (legs, shelves, glass panels). Wrap each piece separately with bubble wrap or foam to prevent abrasion and absorb impact. Use soft paper on delicate wood surfaces before adding thicker cushioning. Individually wrapped components fit more securely into crates or cartons.

Reinforce corners and surfaces

Corners absorb the most shocks, so add cardboard protectors or extra foam. Flat surfaces like tabletops or cabinet sides should have bubble wrap or corrugated board layers to prevent scratches or chips—especially important for wooden furniture and veneers.

Package upholstered items carefully

Cover sofas and chairs with blankets or foam pads, then seal with plastic wrap to block dirt and humidity. Protect protruding parts like armrests with extra padding. Avoid stacking heavy items on top to prevent cushion deformation.

Separate and protect glass components

Remove glass parts and pack them independently. Wrap in multiple layers of bubble wrap, sandwich between rigid boards, and label clearly as FRAGILE. The wooden furniture frame should be padded where glass was removed.

Use sturdy crates or pallets

Place wrapped items into strong export cartons or custom wooden crates. Heavy pieces should be palletized and tightly strapped for easy forklift handling. Use ISPM-15 certified pallets or crates (heat-treated) and include the fumigation certificate in export documents.

Guard against moisture

Sea freight and Vietnam’s humidity require moisture control. Use plastic liners inside crates, silica gel packets, and waterproof outer wrapping. Vapor barriers prevent warping, mold, and rust on metal components during long voyages.

Label clearly and include documentation

Mark packages with “Fragile,” “This Side Up,” and SKUs or order numbers. Add packing lists inside crates or containers for easy customs checks and accurate unloading.

Trade Compliance Essentials for Exporting Furniture

Exporting furniture requires strict adherence to Vietnam’s rules and the destination country’s import standards. Missing documents or misclassified materials can lead to delays, fines, or shipment rejections. Below are the core compliance requirements for Vietnamese furniture export operations.

Export documentation

Prepare the commercial invoice, packing list, sales contract, and bill of lading. These must clearly match in item names, HS codes, quantities, and weights. Any mismatch triggers customs queries.

Customs declarations

Submit an export declaration through Vietnam Customs with accurate HS codes (furniture typically under Chapter 94, such as 9403). Correct classification avoids duty issues and prevents border delays.

Legal timber documentation

Wooden furniture must be backed by proof of legally sourced timber, per Vietnam’s VPA/FLEGT commitments. Keep a full paper trail: supplier invoices, timber origin lists, and import declarations for any imported wood. Customs will check these before clearing wooden furniture.

Fumigation certificate

Wooden furniture and packaging must be pest-free. Obtain a fumigation certificate and use ISPM-15 compliant pallets/crates. Without proper stamping, foreign customs may refuse entry.

Licenses and permissions

Most furniture has no export license requirement, zero export tax, and qualifies for 0% VAT. However, restricted materials like CITES-listed woods still need special permits. Verify wood species to avoid violations.

Certificates of Origin (C/O)

Not mandatory for export itself, but often required for buyers to enjoy tariff reductions under FTAs such as EVFTA and CPTPP. Obtain the correct form (EUR.1, CPTPP, Form B, etc.) from VCCI or MOIT as needed.

Destination-market regulations

Importing countries may require product standards—such as EU emission limits, U.S. flammability rules, or labeling requirements (“Made in Vietnam”). Failing to meet them can result in goods being held abroad. Exporters should be ready to provide wood-origin details for buyers’ compliance with regulations like the U.S. Lacey Act.

FTA rules of origin

If using preferential tariffs, ensure your furniture meets origin criteria (value-add or tariff-shift rules). Maintain detailed manufacturing and material records in case of origin audits.

Customs facilitation programs

Compliant exporters benefit from smoother clearance. Programs like Authorized Economic Operator (AEO) or local Customs–Business partnerships help frequent shippers reduce risks and delays.

Leveraging Trade Agreements (EVFTA, CPTPP, RCEP) in Furniture Export

Vietnam’s integration into global trade agreements has significantly improved the outlook for furniture export by reducing or eliminating tariffs in key markets. Furniture manufacturers should actively leverage the benefits of these agreements while ensuring compliance with their rules:

EVFTA – EU–Vietnam Free Trade Agreement

Since 2020, EVFTA has removed up to 99% of EU tariffs. Most wood furniture duties (previously 2–5%) dropped to 0% immediately or within 5 years, boosting exports to markets like Germany and Spain.

To benefit, exporters must:

• obtain an EUR.1 certificate or use approved exporter status

• comply with EVFTA rules of origin (Vietnam/EU materials or sufficient processing)

• maintain strong timber legality documentation, aligned with VPA/FLEGT requirements

EVFTA offers some of the fastest and deepest tariff cuts, making Vietnamese furniture highly price-competitive in Europe.

CPTPP – Comprehensive and Progressive Agreement for Trans-Pacific Partnership

Connecting Vietnam to Canada, Japan, Australia, Mexico, and others, CPTPP eliminates around 95% of tariffs. Markets like Canada and Australia now allow duty-free entry for Vietnamese wooden furniture, giving exporters a clear edge over non-CPTPP competitors.

To use CPTPP preferences:

• meet origin criteria (regional value content or tariff-shift rules)

• obtain a CPTPP Certificate of Origin or use self-certification where permitted

CPTPP has helped Vietnam diversify beyond the U.S. and expand strongly into Canada, Japan, and Australia.

RCEP – Regional Comprehensive Economic Partnership

Effective from 2022, RCEP offers more gradual tariff reductions but delivers major supply-chain flexibility.

Key benefits include:

• unified rules of origin and regional cumulation, allowing inputs from China, Korea, Japan, etc. while still qualifying for preferential tariffs

• simplified paperwork with a single RCEP C/O form

• improved customs procedures and trade facilitation across the region

Tariff cuts into markets like Japan and Korea expand mid-term opportunities for certain furniture products. RCEP also supports smoother sourcing of fabrics, hardware, and components from the region.

Other FTAs

Vietnam also benefits from:

• ATIGA – 0% tariffs for ASEAN

• UKVFTA – EVFTA-equivalent benefits for the UK

These agreements further reduce duties and support diversified export destinations.

Why FTAs matter for furniture exporters

Leveraging FTAs can remove 5–10% in import taxes in major markets, directly improving margins or enabling more competitive pricing. To maximize benefits, exporters should:

• design supply chains around rules of origin

• maintain accurate material and production records

• stay up to date on FTA requirements and documentation

Strategic use of FTAs not only reduces costs but positions Vietnamese manufacturers as compliant, reliable, and globally competitive partners—opening doors to long-term contracts and premium markets.

Practical Tips for Smooth and Cost-Effective Logistics Planning

To wrap up, here are some practical insights and real-world considerations for Vietnamese furniture exporters to enhance their logistics planning. These tips can help ensure your furniture export operations are both smooth and cost-effective:

Plan ahead and schedule smart

Book shipments early—especially before Lunar New Year or year-end peak seasons—when space is tight and rates rise. Align production timelines with vessel schedules to avoid missing sailings or resorting to costly air freight.

Optimize container utilization

Prioritize FCL shipments for better cost efficiency. For LCL cargo, work with your forwarder to consolidate. Use efficient packing methods or container-loading software to reduce wasted space—every unused cubic meter is a cost.

Select the right Incoterms

Choose terms (FOB, CIF, DAP, etc.) that match your capability. Many exporters use FOB with the buyer’s appointed forwarder. If offering CIF/DDP, ensure you can manage freight competitively and include accurate logistics costs in your pricing.

Choose reliable logistics partners

A reputable forwarder or 3PL can advise on routes, manage customs documents, secure competitive rates, and notify you of disruptions. Prioritize partners with experience handling wooden and bulky furniture.

Invest in cargo insurance

Marine cargo insurance protects against damage, loss, theft, or accidents. Insure at least 110% of invoice value. It’s low cost compared to potential losses and often required by buyers.

Enhance visibility and tracking

Use digital tracking tools from your forwarder to monitor container movement and address delays early. Digitize key documents—e-declarations, e-C/Os, and e-manifests—to speed up customs clearance.

Leverage FTAs

Use EVFTA, CPTPP, RCEP, and other FTAs to reduce import duties for buyers. Plan sourcing to meet rules of origin and always send the correct Certificate of Origin to avoid clearance delays or full-duty charges.

Prepare for compliance checks

Maintain organized records: timber legality documents, fumigation certificates, packing lists, and HS codes. Ensure shipments accurately match declarations to prevent delays during random inspections in Vietnam or destination markets.

Stay agile and informed

Monitor freight rates, regulatory changes, and geopolitical risks. Be ready to reroute, reschedule, or diversify markets when needed. Flexibility helps reduce exposure to sudden tariff changes or port disruptions.

Improve efficiency at origin

Load containers at the factory where possible, keep packing accurate, and prepare customs documents ahead of pickup. Avoid late deliveries or mislabeling, which can cause rolled containers and extra port fees.

Conclusion

Vietnam’s rise as a leading furniture exporting country is no accident – it’s the result of quality products, competitive costs, and increasingly savvy logistics management. By understanding and optimizing each element of furniture export logistics – whether it’s choosing the right transport mode, routing through the best port, packing goods expertly, staying compliant with laws, or leveraging trade deals – manufacturers can enhance their global reach. The road from a Vietnamese factory to an overseas buyer’s showroom can be long and challenging, but with careful planning and the insights outlined above, exporters can navigate it smoothly. In a fast-evolving trade landscape, those who master logistics will deliver not just furniture, but success, to every corner of the world.

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How early should I book space during peak season?

- Ideally 3–4 weeks before vessel departure. Before Lunar New Year or year-end, book even earlier as container space becomes limited and rates spike.

Is FCL always cheaper than LCL for furniture?

- Almost always. Furniture is bulky, so consolidating into full containers reduces per-unit cost and minimizes handling damage. LCL works only for very small or sample shipments.

What Certificate of Origin should I use for tariff savings?

- It depends on your destination: EUR.1 for EVFTA (EU), CPTPP C/O for CPTPP markets, RCEP C/O for regional partners, or Form B where no FTA applies. Always confirm which form your buyer requires.

What are the most common causes of shipment delays?

- Late documentation, missing fumigation certificates, inaccurate HS codes, rolled bookings during peak season, and inefficient origin handling. Preparing paperwork early and coordinating with your forwarder prevents most of these issues.