Vietnam’s import and export industries are vital to its economic engine, contributing significantly to national growth. This article dives into major export sectors like electronics, textiles, and coffee, and crucial imports such as machinery and crude oil. Discover how these industries drive Vietnam’s trade and economic development. As global trade partnerships expand, setting up a foreign company in Vietnam has become an attractive option for businesses looking to engage with the country’s growing export network.

Overview of Import and Export Industries in Vietnam

Vietnam’s foreign trade reached new heights in 2024. According to government sources and analysts, 2024 exports of goods totaled about $405.5 billion, a 14.3% rise over 2023. Imports were roughly $380.8 billion, so Vietnam ran a merchandise trade surplus of ~$24.8 billion. By contrast, 2023 exports were ~$354.7B, so the 2024 jump was record-breaking. Vietnam’s economy remains export-driven: major export industries (electronics, textile, agriculture, etc.) power GDP, while imports supply the raw materials and equipment needed for this output.

Key export sectors include electronics and technology, textiles and garments, agriculture (coffee, fruits, seafood), and wood products. For example, electronics/computers was Vietnam’s top export category in 2024, reflecting investments by Samsung, Intel, Apple and others. The country’s import profile is similarly concentrated in high-tech and industrial goods. Vietnam’s market demand for imports – from consumer items to factory machinery – has grown with its middle class (100+ million people) and manufacturing base. China remains Vietnam’s largest trading partner (bilateral trade ~$204.9B in 2024), underscoring deep linkages. In sum, Vietnam’s strategic location, liberal trade policies, and growing workforce are driving both exports and imports.

Read More: Your Simple Guide to Customs Procedures for Vietnam Import and Export

Leading Export Industries in Vietnam

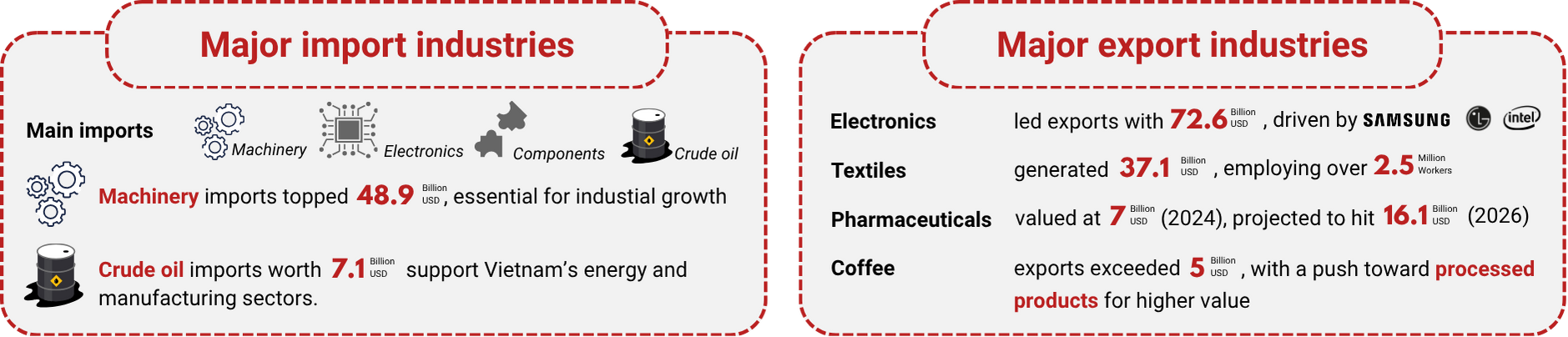

Vietnam’s top export industries, including electronics, textiles, garments, pharmaceuticals, and coffee, form the backbone of its robust economic framework and align with the country’s strategic growth ambitions. Each of these sectors plays a vital role in boosting national GDP and strengthening Vietnam’s position in global markets.

Electronics and Electrical Products

Electronics and electrical products have become Vietnam’s largest export sector, surpassing traditional exports like coffee. In 2023, electronic goods and computers topped Vietnam’s export items, generating US$57.3 billion. This sector’s growth is driven by major global players like Samsung, LG Electronics, and Intel, which have made substantial investments in the electronics sector.

Vietnam’s emphasis on high-value exports, especially in electronics and technology, highlights its changing trade landscape. Excelling in this sector boosts Vietnam’s economic growth and positions it as a key player in the global electronics market.

Read Related: Vietnam’s Electronics Sector: Investment Trends from Chinese Manufacturers

Textiles and Garments

The garment and textile industry remains a backbone of Vietnam’s export economy. With over 2.5 million workers, it is one of the world’s largest garment exporters. In 2024 the sector earned about $44 billion in exports – roughly an 11% increase – buoyed by order shifts from competitors like Bangladesh.

Vietnam is now firmly the world’s second-largest apparel exporter. Its competitive advantage comes from a skilled workforce and modern factories, plus duty-free access to many markets under FTAs. These factors suggest textile exports will remain strong in 2025, potentially surpassing initial targets.

Read Related: Vietnam Clothing Manufacturers: A Premier Destination for Production

Pharmaceuticals

By mid-2024, the total value of Vietnam’s pharmaceutical market clocked US$7 billion. It is projected to reach US$16.1 billion by 2026, reflecting the country’s shift towards high-value exports and its growing importance in the national economy.

Read Related: Vietnam Pharmaceutical Companies: Best Way to Get into Sales and Industry

Coffee

Vietnam is the world’s second-largest coffee exporter, trailing only Brazil. Coffee exports have surged on both volume and price. Notably, in the first 7 months of 2025, Vietnam exported ~1.1 million tons of coffee (≈$6.0 billion), up 65% in value year-on-year. In the 2024–25 crop year (Oct 2024–July 2025), coffee exports were about 1.35 million tons ($7.5B). T

his already exceeded all of 2024’s record $5.62B in coffee exports. By late 2025 Vietnam is on track for $8 billion in coffee export revenue. Higher international prices (due to climate factors elsewhere) and more processing at home (roasting, packaging) have boosted value. The government is encouraging a shift toward selling processed coffee goods to capture greater value, building on Vietnam’s natural advantages (large production volumes and lower costs).

Read More: Vietnam’s Coffee Export Market: Coffee Shop Industry for Investors

Key Import Industries in Vietnam

Vietnam’s import landscape is vital to its economic infrastructure, with key sectors playing pivotal roles:

- Machinery

- Computers

- Electronic components

- Crude oil and petroleum products

These imports are essential for supporting Vietnam’s expanding economy and meeting the demands of its industrial and consumer sectors.

Machinery and Equipment

Machinery, equipment and related tools remain a top import sector. In 2024 Vietnam imported about $48.9 billion of machinery, equipment, and spare parts. These include factory machinery, engines, and industrial tools needed to expand and modernize production. High machinery imports are essential for Vietnam’s industrialization: factories continuously import new equipment for electronics, textiles, auto, and other industries. This underscores Vietnam’s drive to upgrade its manufacturing base. The continued reliance on imported machinery highlights the importance of this category – even as local metalworking and machinery firms develop, Vietnam still buys many high-end machines from abroad.

Computers and Electronic Components

By 2024 Vietnam was importing an electronic products and computer worth $107.1 billion. This category (including semiconductors, chips, cameras, etc.) is the single largest import item. The high demand reflects Vietnam’s role as an electronics assembly hub. Domestic factories (for phones, PCs, TVs, etc.) rely on imported chips and parts. Thus Vietnam’s strategy of attracting tech manufacturing has translated into huge imports of those components.

Crude Oil and Petroleum Products

Vietnam is a net importer of oil and gas. In 2023 the country imported around 11.2 million tons of crude oil. Fuel imports surged in 2024: in the first half of 2024, Vietnam brought in 47.25 million tons of fuels (including crude oil, coal, petroleum) worth $13.88 billion. That was a 29.9% volume jump YOY, partly due to a refinery shutdown that year. Crude oil imports alone in H1 2024 were 6.81m tons (+16.1%). Overall, fuel import value accounted for ~8% of Vietnam’s total imports. In sum, energy needs (for electricity, transport and industry) make Vietnam one of the region’s largest fuel importers. While developing more refining capacity, Vietnam still depends on foreign crude and petroleum products to power growth.

Investing in Vietnam’s Import and Export Industry? Check out InCorp Vietnam’s Company Formation Services

Impact of Free Trade Agreements on Vietnam’s Trade

Free Trade Agreements (FTAs) have been crucial in enhancing Vietnam’s trade by improving market access and reducing costs. In 2024, Vietnam’s participation in 17 FTAs has significantly strengthened its economic ties with key global partners. These agreements have had a profound impact, fostering a more open and competitive trade environment.

The Role of Regional Comprehensive Economic Partnership (RCEP)

The Regional Comprehensive Economic Partnership (RCEP) is the world’s largest trade agreement, aiming to enhance economic integration in the Asia-Pacific region. RCEP offers Vietnam preferential trade terms and reduced tariffs, strengthening its trade dynamics. RCEP provides Vietnam with improved market access to some of the largest consumer markets, facilitating its exports.

The agreement is also expected to attract foreign investments to Vietnam as companies seek to leverage favorable trade terms. This influx of investment will further boost Vietnam’s economic growth and trade potential.

Other Significant FTAs

Other significant FTAs, such as CPTPP, EVFTA, and UKVFTA, have also substantially impacted Vietnam’s trade. In 2023, Vietnam’s exports to CPTPP countries reached approximately US$100 billion. This growth was notably significant with countries like Canada, Mexico, and Peru, with which Vietnam did not have prior free trade agreements. Under the EU-Vietnam Free Trade Agreement (EVFTA), Vietnam’s exports to the EU increased from 35 billion Euros in 2019 to over 48 billion Euros in 2023, marking a substantial rise

The Vietnam-Israel Free Trade Agreement (VIFTA) allows Vietnam to reduce tariffs on 92% of its exported goods, providing access to Israeli and broader Middle Eastern markets. These agreements have enhanced Vietnam’s market access and expanded its export opportunities.

Read More: The Definitive Guide to Vietnam’s 17 Active Free Trade Agreements – FTAs

Domestic Support Industries in Vietnam

Domestic support industries are vital in enhancing Vietnam’s export capabilities. From agriculture to manufacturing support industries, these sectors contribute to the sustainability and growth of the country’s domestic support industries and Vietnam’s export-oriented economy.

Agriculture Economy

In 2024, the agricultural sector contributed 5.36% to Vietnam’s overall economic growth. Agricultural exports are projected to reach approximately US$54-55 billion in 2024, highlighting the sector’s significant economic role in Vietnam’s agriculture economy. The domestic economic sector contributed US$53.4 billion to Vietnam’s export turnover in 2024, reflecting a 20.6% growth.

Agriculture supplies raw materials for key export industries such as textiles and food processing. Notably, agricultural and fisheries exports, especially fruits and vegetables, surged by 66.7% in 2023, demonstrating the sector’s dynamism.

Supporting Industries for Manufacturing

Supporting industries in Vietnam are crucial for the manufacturing sector, providing necessary parts and services to enhance production efficiency. These industries play a vital role in boosting Vietnam’s manufacturing capabilities, making the country a competitive global manufacturing base.

Read More: Setting Up a Manufacturing Company in Vietnam: Industries & Procedure

Vietnam’s Trade Balance and Economic Growth

Vietnam’s trade balance and economic growth are closely linked, with trade surplus trends and economic indicators offering a clear picture of its economic health.

Despite global challenges, Vietnam has shown resilience and growth.

Trade Surplus Trends

Vietnam’s export revenue increased by 15.7% in the first seven months of 2024, reaching approximately US$227 billion. In the first half of 2024, the trade surplus was US$11.63 billion, slightly down from the previous year’s US$13.44 billion.

In the first four months of 2024, Vietnam’s electronics sector experienced significant growth, with exports of computers, electronic products, and components increasing by 34.9% year-over-year, reaching approximately US$21.63 billion.

Despite challenges, such as an 11.8% decline in exports in the first quarter of 2023, there were signs of recovery starting in the second quarter. These trends highlight Vietnam’s ability to adapt and thrive in a competitive global market.

Economic Growth Indicators

Experts anticipate that Vietnam’s total exports could reach US$410 billion in 2024. In the first half of 2024, exports were projected to reach nearly US$190.1 billion, marking a 14.5% increase from the previous year. The predicted rate of domestic consumption growth is 20% per year, underscores Vietnam’s strong consumer demand and economic expansion.

Total retail sales and consumer service revenue for the first three quarters of 2024 reached VND 4.7 trillion (around US$190 million), underscoring the strength of Vietnam’s domestic market. These indicators point to a resilient and growing economy, poised for continued success.

Regulatory and Financial Incentives for Businesses

Regulatory and financial incentives are crucial for attracting foreign investment and fostering economic growth in Vietnam. The government has implemented various reforms to create a more business-friendly environment.

Read More: Maximize Benefits: A Guide to Tax Incentives in Vietnam for Foreign Companies

Streamlining Business Regulations

The Vietnamese government has prioritized simplifying business regulations to create a more attractive environment for foreign investors. Recent initiatives have focused on reducing bureaucratic hurdles, thereby enhancing the investment process for foreign businesses. These efforts aim to improve the ease of doing business, making Vietnam a more competitive destination for international companies.

By streamlining business regulations, Vietnam is positioning itself as a prime market for foreign investment. These changes are designed to foster economic growth and ensure that Vietnam remains a key player in the global economy.

Financial Sector Reforms

The Vietnamese government has made significant strides in reforming its financial sector to improve the business environment. Key reforms include the 2024 Law on Credit Institutions, which introduces stricter regulations on share ownership to prevent undue influence and cross-ownership issues. Additionally, enhanced measures for managing non-performing loans and a focus on early intervention in financial institutions facing distress have been implemented.

These reforms aim to create a more robust financial environment that supports business growth and investor trust. By facilitating investor confidence and reducing bureaucratic hurdles, Vietnam is enhancing its appeal as a destination for multi-billion dollar investments.

Emerging Trends in Vietnam’s Trade

Emerging trends in Vietnam’s trade landscape are reshaping the country’s economic future. From the rise of e-commerce to the shift towards high-value exports, these trends highlight Vietnam’s adaptability and growth potential in the global economy.

E-commerce Boom

Vietnam’s e-commerce market has consistently outpaced regional growth, establishing itself as a leading player in Southeast Asia. In the first half of 2024, e-commerce sales in Vietnam reached nearly US$5.68 billion, marking a substantial year-over-year increase. Social commerce, driven by platforms like TikTok, is becoming a crucial aspect of this growth, reflecting the country’s strong consumer culture and digital engagement.

The e-commerce boom offers significant growth and market access opportunities, positioning Vietnam as an ideal export hub for electronic products and other high-demand goods. This trend is not only boosting domestic consumption but also enhancing Vietnam’s standing in the global trade arena.

Read Related: E-commerce in Vietnam: Surge in Online Shopping Apps and Trends

Shift Towards High-Value Exports

Vietnam is increasingly focusing on exporting high-value products, particularly in technology and pharmaceuticals. The pharmaceutical sector, driven by government initiatives aimed at achieving universal health coverage, is experiencing rapid growth. Additionally, Vietnam, already the second-largest coffee exporter, is shifting towards exporting more processed coffee products to increase value.

This transition towards high-value exports enhances Vietnam’s trade earnings and improves its competitive position in the global market. By focusing on high-value sectors, Vietnam is poised to achieve significant growth and maintain its economic resilience.

Read Related: Vietnam’s Coffee Export Market: Trends in Consumption and the Coffee Shop Industry for Investors

Key Takeaways:

- Vietnam’s total exports reached US$354.67 billion in 2023, with key industries including electronics, textiles, and pharmaceuticals showcasing resilience despite a decline.

- The electronics sector emerged as Vietnam’s largest export industry, generating US$57.34 billion in 2023, driven by investments from global companies like Samsung and LG.

- Vietnam’s trade growth is supported by Free Trade Agreements (FTAs), such as RCEP and EVFTA, improving market access and attracting foreign investments to bolster economic development.

How InCorp can Help?

InCorp Vietnam provides essential support for businesses and investors aiming to navigate Vietnam’s dynamic import and export landscape. With extensive knowledge of local industries and export markets, InCorp Vietnam assists clients in navigating regulatory frameworks, securing necessary licenses, and ensuring full compliance with Vietnam’s trade policies.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What are two synonyms for import?

- Two synonyms for "import" are "bring in" and "ship in." Both terms refer to the act of bringing goods or services into a country from abroad for the purpose of sale or use.

What is import and export?

- Import refers to the process of bringing goods or services into a country from abroad for sale or use. Export is the process of sending goods or services from one country to another for sale or trade. In Vietnam, both activities are regulated by the Ministry of Industry and Trade and require compliance with customs laws, tax regulations, and proper licensing.

What is the meaning of import?

- Import refers to the process of bringing goods or services into a country from abroad for commercial sale or use. In the context of Vietnam, importing involves complying with customs regulations, paying duty and taxes, and obtaining any required permits or licenses depending on the type of goods.