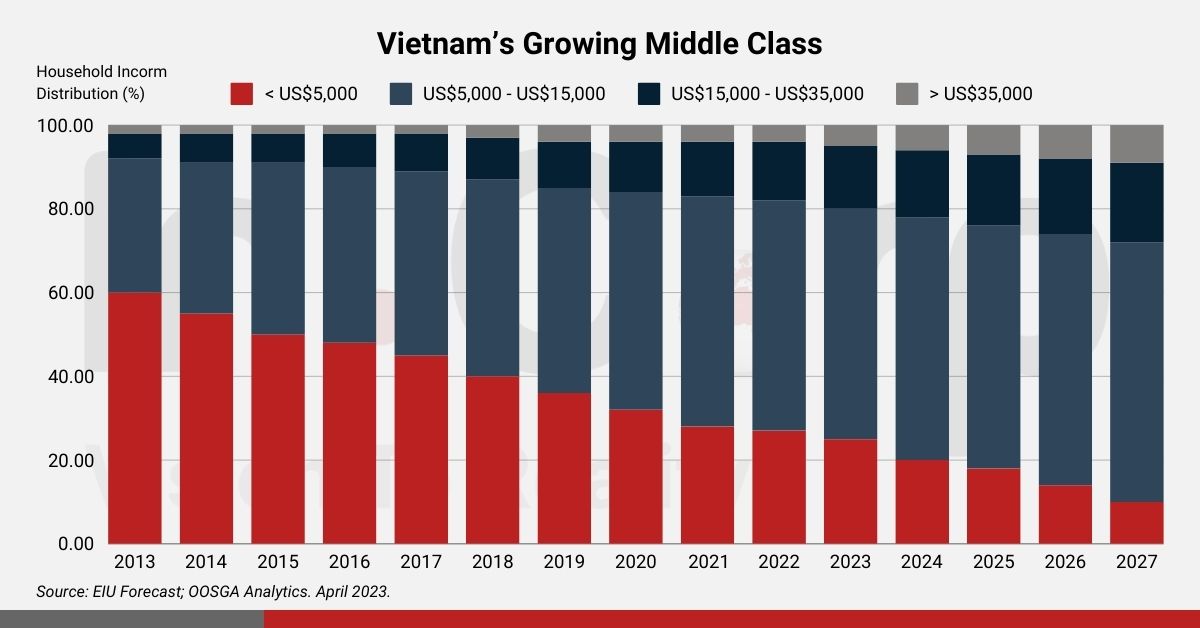

Vietnam offers an enticing market for foreign businesses, with a population now exceeding 99 million and a rapidly expanding consumer base. Projections indicate the country will gain an additional 36 million middle-class consumers by 2030, bringing the total middle-class population to around 56 million. This is a dramatic increase from just about 8 million in 2012. Such growth in affluence, especially in urban centers, is fueling demand for high-quality imported goods.

Vietnamese consumers often perceive imported products as being of higher quality and safer, driving strong preference for foreign brands in categories from healthcare and food to electronics and children’s toys. In this context, businesses eyeing Vietnam’s market have compelling reasons to consider importing in Vietnam as a route to reach these eager consumers. At the same time, navigating Vietnam’s import regulations and compliance requirements can be complex, so partnering with reliable corporate advisory services (such as InCorp Vietnam) is invaluable for a smooth market entry.

Vietnam’s busy container ports reflect the country’s growing import volumes. Many industries depend on imported raw materials and consumer goods to meet demand. As import activities expand, port infrastructure is being upgraded to handle larger volumes.

Situation of Importing in Vietnam

Vietnam’s import values have grown overall despite some year-to-year fluctuations. After reaching a peak of US$32.66 billion in monthly imports in March 2022, imports dipped in 2023 amid global headwinds (total import value for Jan–Aug 2023 fell 15.9% year-on-year). However, activity rebounded in 2024 with total imports for the year at $380.8 billion – a 16.7% increase over 2023. This set a new trade record for Vietnam. Growth has continued into 2025, with import turnover in the first nine months of 2025 up roughly 18% year-on-year. These trends show that Vietnamese industries rely heavily on imported inputs, and consumer demand for foreign products remains robust.

Major Import Categories: Electronics and machinery dominate Vietnam’s imports. In 2024, electronics (including computers and components) accounted for about $107 billion of import value, and machinery and equipment about $49 billion. Other significant import categories include plastics and chemicals (for manufacturing), fabrics and textiles (for the garment sector), fuels (petroleum and LNG), and iron & steel (for construction). Consumer-oriented imports – from smartphones to premium foods and cosmetics – are also rising as the middle class expands. China is Vietnam’s largest import partner (accounting for roughly 28% of total import value), followed by South Korea, and then sources like Japan, Taiwan, Thailand, and the United States. This diversified import portfolio underpins Vietnam’s deep integration into global supply chains.

Interested in importing to Vietnam? Explore InCorp Vietnam’s Legal Advisory Services for expert guidance and advice!

Reasons to Invest in Importing in Vietnam

Vietnam stands out as one of Asia’s most dynamic economies, making importing in Vietnam an attractive proposition for businesses. A combination of rapid economic growth, a youthful tech-savvy population, and integration into global trade networks has created a favorable environment. Here are key reasons why companies are investing in importing to Vietnam:

Free Trade Agreements with Other Countries

Over the past 30 years, Vietnam has embraced foreign direct investment (FDI) to align with the global market and economy. As a member of the World Trade Organization (WTO) and a participant in numerous free trade agreements with various nations, it has actively engaged in international partnerships.

Furthermore, the country’s inclusion in the Trans-Pacific Partnership (TPP) enhances its appeal and potential for transformation. Vietnam has promised to improve its state-owned businesses, allow workers to join groups freely, and follow tougher rules to protect the environment. By doing this, it is set to gain big advantages from being part of the TPP, a group of 12 nations working together.

Vietnam’s integration into the global economy is marked by its membership in various international trade organizations and agreements.

- Joining the World Trade Organization (WTO) in 2007, Vietnam pledged adherence to its agreements, including those concerning Customs Valuation, Technical Barriers to Trade (TBT), and Sanitary and Phytosanitary Measures (SPS).

- The Bilateral Trade Agreement (BTA) with the United States further solidified its commitment to international trade.

- As a member of the Association of Southeast Asian Nations (ASEAN) and the ASEAN Free Trade Area (AFTA), Vietnam collaborates with regional partners to enhance its trade competitiveness. It has also engaged in trade agreements with countries such as China, Japan, Australia, New Zealand, and Chile, extending its reach beyond ASEAN.

- The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP) underscore Vietnam’s dedication to fostering economic cooperation on both regional and global scales.

Read More: Guide to Vietnam’s 16 Active Free Trade Agreements

Thriving Middle Class and Consumer Demand

Vietnam is experiencing one of the fastest middle-class growth rates in the world. Robust economic expansion has lifted millions into the middle class. This group (defined by higher disposable income) now makes up about 13% of the population and is projected to double to 26% by 2026. By 2030, Vietnam’s middle class is forecast to reach 56 million people, accounting for a large share of total consumption. This burgeoning middle class drives over 50% of the nation’s consumer spending and exhibits strong demand for imported goods.

Urban centers like Ho Chi Minh City and Hanoi have especially high purchasing power levels. Vietnamese consumers often favor foreign brands, from luxury fashion and electronics to imported health supplements, due to their perceived quality and status. The rise of modern retail outlets and e-commerce platforms in Vietnam has made it easier for consumers to access imported products, further spurring demand. For importers, this means a ready market hungry for a wide range of goods – if they can deliver quality and authenticity.

Read Related: 9 Reasons to Choose Ho Chi Minh City in Vietnam to Launch Your Business

Strategic Location and Stable Growth

Vietnam’s geographic position and business climate also benefit importers. The country is located close to major manufacturing hubs in Asia, which reduces transit times for goods. Internally, Vietnam’s logistics infrastructure – ports, highways, and industrial parks – has improved, making distribution of imported goods more efficient. Moreover, Vietnam has enjoyed stable GDP growth (around 6–7% annually over the past decade). Rising incomes and urbanization, combined with a young population, ensure that demand for imports will keep growing. These factors give companies importing in Vietnam confidence in the market’s long-term potential.

Importing to Vietnam: What to Import

Vietnamese consumers spend a significant portion of their income on imported goods, and certain product categories show particularly strong potential:

- High-Tech Electronics and Machinery: Items like smartphones, computers, and home electronics are in high demand. Vietnam also imports many electronic components, machinery, and industrial equipment to supply its factories and construction projects.

- Healthcare and Beauty Products: There is strong appetite for imported pharmaceuticals, dietary supplements, baby formula, cosmetics, and personal care items. Middle-class consumers trust international brands in these areas for quality and safety.

- Food and Beverages: While Vietnam is a major food producer, imports of specialty foods are rising. Examples include premium fruits, meats, dairy products, wines, and snack foods that are not produced locally. Urban supermarkets stock a growing variety of imported groceries to cater to changing tastes.

- Fashion and Lifestyle Goods: Branded clothing, footwear, accessories, and luxury goods attract Vietnam’s young and affluent shoppers. Likewise, imports of household appliances, furniture, and décor serve the needs of an expanding urban homeowner class.

As of 2024, the top five import categories by dollar value were: electrical/electronic equipment, machinery, plastics, fabrics, and iron/steel. These reflect Vietnam’s dual needs – importing manufacturing inputs and satisfying consumer preferences. Importers should research market trends and regulations for their specific product niche, as some goods (like medical products or foods) may require additional certification in Vietnam.

Importing in Vietnam: Understanding Restricted Goods

In compliance with Decree No. 187/2013/ND-CP, Vietnam maintains a strict policy regarding importing certain goods for commercial or non-commercial purposes. The list of prohibited items includes the following categories:

- Weapons, explosives, military equipment, and ammunition are strictly forbidden.

- Publications that are banned from circulation and distribution in Vietnam are not allowed to be imported.

- Various items, such as sky lanterns, assorted firecrackers, and equipment that disrupts road speed measuring instruments, are prohibited.

- Second-hand goods, including automotive and electronic items, are prohibited from importation.

- Tobacco products, cigars, and petroleum oils fall under the restricted category.

- Radio equipment and devices emitting radio waves must comply with the Law on Radio Frequencies to be eligible for import.

- Postal stamps that are prohibited from display, exchange, and propagation cannot be imported.

- Cultural products banned from distribution and circulation in Vietnam cannot be imported.

- Waste, scrap, and refrigerating equipment containing C.F.C (chlorofluorocarbon) are prohibited.

- Chemicals listed in Appendix III of the Rotterdam Convention and plant protection agents banned from use in Vietnam cannot be imported.

- Raw materials and products containing amphibole asbestos are also prohibited from importation.

Circular No. 12/2018/TT-BCT issued by the Ministry of Industry and Trade provides a detailed list of used consumer goods, medical devices, and vehicles that are prohibited from import, along with their corresponding HS codes.

Additionally, Circular No. 34/2013/TT-BCT outlines specific goods not allowed to be imported for foreign-invested enterprises. This comprehensive regulatory framework ensures strict control over importing to Vietnam and helps to maintain compliance with national laws and international agreements.

Guidelines for Importing to Vietnam

For companies looking to import products into Vietnam, there are several essential steps and considerations to ensure compliance with legal requirements. Below is a comprehensive guidelines for the process and procedures to be followed:

Establish a Legal Entity or Partner

Foreign investors typically set up a trading company in Vietnam (100% foreign-owned is allowed) to directly handle importing and distribution. Setting up a trading company generally takes 1–3 months and does not require minimum capital by law. The company’s business license should include the right business lines for trading the intended goods, and an additional distribution license may be needed to sell products domestically.

If you do not have a local entity, you can use an Importer of Record (IOR) service. An IOR is a local firm that will import goods on your behalf, taking care of all licenses, customs paperwork, and tax payments. This is an ideal option to test the market or for infrequent shipments without establishing a full company.

Read Related: Setting Up a Logistics Company in Vietnam: 3PL and 4PL Logistics Emerge as Trends

Prepare Documentation and Compliance

Before shipping, ensure all required documents are in order. Key documents include the commercial invoice, packing list, bill of lading, and certificates of origin (to claim FTA tariff benefits). Check if your goods need any special certificate or permit – for example, a phytosanitary certificate for plant products or a quality/health certificate for cosmetics.

Vietnam uses an e-customs system, so importers (or their customs brokers) submit customs declarations electronically via the VNACCS portal. The goods will be classified under the appropriate HS codes and subject to relevant import duties and taxes at this point.

Read More: Importing to Vietnam without Local Presence: Utilizing an Importer of Record (IOR)

Pay Duties and Taxes

When the shipment arrives, import duties must be paid to Customs before goods are cleared. Import duty rates depend on the product’s HS code and origin. Thanks to FTAs, many imports from partner countries enjoy preferential duty rates (often much lower than standard MFN rates). In addition to import duty, imports incur 10% Value-Added Tax (VAT) (temporarily reduced to 8% for many products until end of 2026). Certain goods like alcohol, tobacco, and automobiles also attract a Special Consumption Tax (excise tax). Ensure you calculate these costs and pay them timely to avoid delays.

Customs Clearance

Vietnamese Customs may inspect your shipment’s documents or the goods themselves (depending on a risk-based “green/yellow/red” channel system). If paperwork is accurate and goods meet all requirements, clearance is usually completed within a couple of days (even faster for air shipments) if all paperwork is in order. After clearance, you or your logistics provider can pick up the goods for delivery. Be sure to keep all import records, as Customs can conduct post-clearance audits to verify compliance.

Throughout this process, working with an experienced freight forwarder or customs broker in Vietnam can greatly streamline the steps – invaluable for companies new to importing in Vietnam. These professionals help prepare documentation, classify goods correctly, and liaise with authorities, reducing the risk of errors.

Taxes and Costs on Imports

When importing into Vietnam, businesses should budget for several taxes and fees on top of the product cost:

- Import Tariffs: Applied to nearly all imports, but rates vary. Raw materials and equipment often have lower tariffs, whereas consumer goods can have higher rates. Under Vietnam’s tariff schedule, there are MFN (most-favored-nation) rates and special preferential rates for FTA partners. For example, imports from ASEAN or CPTPP countries might enter at 0–5% duty, while the MFN rate on the same item could be higher.

- Value-Added Tax: The standard VAT on imports is 10%, calculated on CIF value plus duty. However, Vietnam has implemented a 2% VAT reduction (to 8%) for many goods through 2025–2026 to stimulate the economy. VAT on imports is recoverable for businesses that are VAT-registered in Vietnam.

- Special Consumption Tax (SCT): An excise tax on luxury or “sin” goods. Importers of alcohol, tobacco, luxury cars, and certain other items must pay SCT, which can range from 10% to 75% (or more) depending on the product. SCT is calculated on top of the import duty-paid value.

- Other Charges: Additional costs can include environmental protection fees (for example, on plastic bags or petroleum products) and any applicable antidumping or safeguard duties if your product is subject to a trade remedy measure. Port handling fees and customs declaration charges also apply, though these are relatively minor.

It’s important for importers to classify their goods correctly and leverage any applicable FTA benefits to minimize duties. Proper planning of the supply chain (such as timing imports to benefit from tax incentives or using bonded warehouses if available) can help manage the cost impact of taxes when importing in Vietnam.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How To Get An Import License

- To obtain an import license, contact the appropriate government agency in your country, such as the customs or trade authority. Submit the required application form along with supporting documents, including business registration and product details. Approval depends on compliance with regulations and product-specific requirements.

How To Import From Vietnam

- To import from Vietnam, identify reliable suppliers, ensure compliance with both Vietnamese export laws and your country's import regulations, and arrange international shipping and customs clearance. Working with a freight forwarder or customs broker can simplify the process.

How to import goods to Vietnam?

- To import goods into Vietnam, a business must first obtain an import-export license and have a valid business registration with import-export activities listed. The importer must classify goods appropriately, ensure conformity with Vietnamese standards (such as labeling and product compliance), and clear the goods through customs by submitting a customs declaration, commercial invoice, packing list, and any required permits. Import duties, VAT, and other applicable taxes must be paid during clearance. Some goods may be subject to import restrictions, licenses, or quotas depending on their nature.

How To Import Shoes From Vietnam

- To import shoes from Vietnam, identify reliable suppliers or manufacturers, verify their credentials, and negotiate terms. Ensure compliance with your country's import regulations, including tariffs, labeling, and customs documentation. Arrange shipping through a freight forwarder or logistics provider.