Vietnam’s IT industry is rapidly developing and has become a significant business setup hub for global tech entrepreneurs and local startups. Key advancements in communications infrastructure, software, and education technology have positioned Vietnam as a potential major player in the global IT landscape.

Digital technology companies in Vietnam have established themselves as leaders in development, innovation, and research, contributing significantly to the country’s digital transformation. With these impressive strides, Vietnam is poised to impact the global digital technology arena significantly. In this article, we talk about how the recent developments in the IT industry in Vietnam act as catalysts for profitable investment returns.

Interested in Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services

Vietnam’s IT Industry: An Overview

Market Size & Growth: Analyzing the Numbers

The technology sector is a significant aspect of the country’s economy, with estimated revenues of around US$148 billion (2022), representing a 10% year-on-year increase. Vietnam boasts a strong digital technology ecosystem, with over 70,000 firms and exports of the industry estimated at US$136 billion.

| Year | Revenue (US$ Billion) |

| 2022 | 148 |

| 2021 | 136 |

| 2020 | 120 |

| 2019 | 108 |

| 2018 | 103 |

| 2017 | 92 |

| 2016 | 68 |

| 2015 | 42 |

| 2014 | 37 |

| 2000 | 0.3 |

Top IT Companies & Key Players in Vietnam

A Ceremony of Recognition in Hanoi, in 2022 named FPT, Mobifone, VNPT, and Nashtech, among others, as the top 10 information & communication technology (ICT) companies of Vietnam.

Additionally, Vietnam is home to four tech unicorns (startups valued over US$1 billion) recognized worldwide:

- VNG – A Vietnamese technology company that is dominant in the gaming industry. It was founded in 2004 and has since expanded into various other sectors, such as e-commerce, social media, and cloud services.

- Tiki – An e-commerce company founded in 2010 that sells a wide range of products, including books, electronics, and fashion items. It has been growing rapidly, and in 2021, it merged with Sendo, another Vietnamese e-commerce company, to form a larger entity.

- VNPay – A payment technology company founded in 2016 that provides online payment solutions for various industries, including banking, telecommunications, and e-commerce.

- VNLIFE – A technology company that offers various digital products and services, including mobile wallets, eKYC (electronic Know Your Customer) solutions, and digital banking platforms. It was founded in 2007 and has since expanded into other Southeast Asian countries.

Vietnam as an Emerging Tech Hub

Vietnam has rapidly emerged as a tech hub in Southeast Asia, with its digital economy growing at an unprecedented pace. This is largely due to various factors contributing to Vietnam’s tech success, including its large and young population, high smartphone penetration, and a tech-savvy workforce. The government’s support for the tech industry has also been a key factor, with initiatives aimed at fostering innovation, such as the establishment of tech hubs and startup incubators. Additionally, Vietnam’s geographical location has made it an attractive destination for foreign tech companies looking to tap into the Southeast Asian market.

According to a report by Vietnam’s Ministry of Information and Communications, the country’s tech startup landscape has been growing rapidly in recent years, with the number of startups increasing by 38% in 2020 alone. The report also highlighted that Vietnam has seen a significant rise in the number of tech unicorns, as mentioned above.

Furthermore, Vietnam’s startup ecosystem has also been recognized for its potential, with a report by Startup Genome ranking Ho Chi Minh City as the leading startup hub in Southeast Asia. The report noted that the city’s startup ecosystem has seen significant growth in recent years, driven by factors such as the availability of capital and talent. This is further supported by the increase in venture capital investment in Vietnam, with US$741 million raised in 2020, according to Saigon Technology, a leading software development company.

The Landscape of Vietnam’s Information and Communication Technology (ICT) Industry in 2023

ASEAN countries view digital transformation and digital-based economic development as effective measures to advance their cooperation agenda. Vietnam, which was the ASEAN chair last year, moves ahead with a determined mindset of fully digitalizing the ASEAN nations.

The Australian Trade Commission forecasts that the information and communication technology (ICT) industry in Vietnam will experience an average annual growth rate of approximately 8% from 2022 to 2026. Furthermore, with the ongoing flourishing of the digital economy in Vietnam, it is expected that the country’s aggregate GDP could see an additional increase of US$1 trillion by 2025. Vietnam’s emergence as a production hub for IT hardware and services, including software development outsourcing, is driving the rapid expansion of the ICT sector. Furthermore, success in e-commerce growth also assists Vietnam in quickly achieving its objectives and developing its digital economy.

According to the Vietnam Investment Review Central Institute for Economic Management, Vietnam’s GDP would likely increase by US$28.5 billion to US$62.1 billion by 2030, representing a 7-16% sharp rise.

Read More: Vietnam’s ICT Industry: A Dynamic Market for Foreign Investment

Opportunities in Vietnam’s IT Industry

Foreign investors have the opportunity to capitalize on the increasing privatization of state-owned companies in Vietnam, especially in the telecommunications and banking sectors. The country’s software industries, particularly in banking and finance, oil and gas, aviation, and telecoms, offer promising investment prospects for both bespoke solutions and off-the-shelf software and are significant spenders in the industry.

Young & Tech-savvy Population

The digital generation (born between 1992 and 2002) accounts for 21% of the population.

- 53% – Above 29 years of age

- 9% – 25-29 years of age

- 7% – 20-24 years of age

- 5% – 16-19 years of age

Moreover, in 2022, the number of Internet users in Vietnam reached 72.1 million, ranking 13th globally.

IT education in Vietnam is a public system run by the Ministry of Education and Training. In recent years, the Vietnamese government has allowed more flexibility in higher education institutions to boost innovation. Changes such as omitting each institution’s separate entrance exams have improved admission rates.

The Vietnam IT talent pool is expanding in quantity and quality to meet the needs of the Vietnam IT industry. The country produces around 80,000 IT graduates each year, with a high proportion specializing in computer science, information technology, and other related fields. According to Adamo Software, the number of senior developers over 5 years of experience accounts for about 30%, while those with less than 3 years of experience represent 52.5%.

Supportive Policies

Vietnam has adopted a plan to promote national digital transformation, including digital government, society, and economy (contributing up to 30% of the country’s GDP).

The Vietnam National Innovation Center (NIC) is committed to fostering the startup ecosystem, promoting innovation, and innovating the growth model based on scientific and technological advancement.

To accelerate Vietnam’s economic growth, the government has recognized innovation as a crucial objective, and the Ministry of Planning and Investment is leading this initiative. NIC has identified the following key factors for development:

- Creating a policy framework to promote innovation

- Developing human resources to accelerate digital transformation and innovation

- Investing in innovative startups

- Seeking assistance and experiences from Japanese experts in the comprehensive innovation process.

In terms of Corporate Income Tax (CIT) incentives, IT companies in Vietnam are exempt from paying CIT for the first four years, followed by a 50% tax reduction of the 10% rate for the next nine years. After that, the companies will pay a 10% CIT for two years. Standard CIT of 20% is applied from the 16th year of operations.

Rising Cutting-Edge Technologies

- The value of Vietnam’s cloud computing market reached over US$133 million, with 27 dedicated data centers and 270,000 working servers. With the global COVID pandemic pushing digital operations, predictions indicate this market will grow to USD 500 million within five years.

- Vietnam was placed sixth in Southeast Asia on OpenGov’s 2022 Government AI Readiness Index with a score of 53.96, over 20% higher than the global average. Additionally, the AI sector saw US$23 million in venture capital in 2021 alone.

Low Labor Costs

Salaries for professionals in the information technology industry in Vietnam vary significantly, with a minimum wage of VND 4,200,000 and an average maximum salary of VND 22,500,000, which includes bonuses.

According to recent data, monthly wages in Vietnam rose from VND 6.8 million in Q4 2022 to VND 7.0 million in Q1 2023.

IT Outsourcing Boom

The COVID-19 pandemic has greatly impacted our daily lives and work, causing market uncertainties. However, the labor market has also seen positive changes, with employers and employees quickly adapting to new hiring and working models. The IT workforce and digital transformation policies have provided a strong foundation for economic recovery in 2022.

Vietnam was rated one of the two leading IT outsourcing destinations in Southeast Asia by Accelerance’s 2022 Global Software Outsourcing and Rates Guide and the second most prospective in Asia-Pacific for technical skills on the Global Skills Index (2020).

Vietnam’s IT human resources are highly promising, with potential for growth and innovative domestic products. This creates opportunities for software outsourcing and technological value creation. However, strategic investment, development, and orientation are necessary to promote socio-economic goals and ensure the welfare of Vietnamese IT human resources. Businesses, IT talents, and intermediaries can all play a role in talent-driven economic development.

Startup Ecosystem

According to a report published by Google, Temasek Holdings Pte, and Bain & Co, Vietnam has been making waves in the startup world, drawing in US$2.6 billion through 233 private deals in 2021, a significant increase from the US$700 million (140 deals) in 2020.

The country also saw startups doubling in numbers during the pandemic (mid-2022), with some of the world’s biggest investors like Sequoia Capital, Warburg Pincus LLC, and Alibaba Group Holding Ltd. backing them.

Government officials are ambitious, with plans to transform Ho Chi Minh City into a prime destination for tech funding. Recently, city officials have focused on luring foreign investment in high-tech projects while also providing incentives to attract international human resources and companies to set up innovation research centers.

Vietnam is already experiencing some success, with the nation’s first unicorn, gaming developer VNG Corp, anticipated to seek a US listing in the coming months.

Read Related: The Remarkable Rise of the Fintech Industry in Vietnam

Trends in the IT Industry in Vietnam

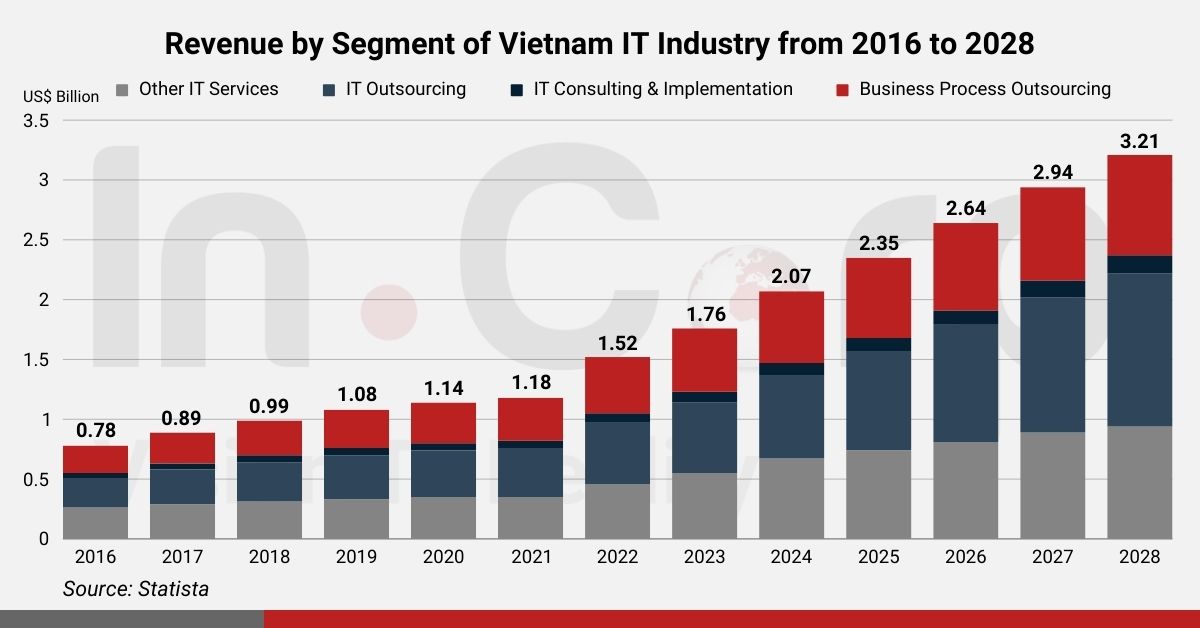

- 2024 projected revenue for the IT Services market: approximately US$2.07 billion.

- Dominant market segment: IT Outsourcing, with a projected volume of US$0.70 billion in 2024.

- Expected annual growth rate (CAGR 2024-2028): 11.51%, resulting in a market size of US$3.20 billion by 2028.

- Projected average spending per employee in the IT Services market for 2024: US$34.90.

Why Invest in Vietnam’s IT Industry?

Vietnam has proven to be a lucrative market for global technological companies looking to expand into various industries. For example, Fujitsu, Japan’s ICT giant, has been implementing its new business strategy in Vietnam. Since it arrived in the country in 1999, Fujitsu has solely sold products to Japanese companies. Furthermore, M-Security Technology Pte Ltd, a subsidiary of M.Tech Singapore, distributes various security solutions in Vietnam for the US-backed IT Blue Coat Group.

Furthermore, Decree No. 108/2006/ND-CP provides a detailed account of the execution of several provisions concerning the Investment Law and the manufacturing of software products and digital content. Within the decision, special incentives to encourage investment are incorporated, encompassing a preferential tax rate of 10% for 15 years, a tax exemption for four years, and a 50% reduction for the following nine years.

Vietnam has emerged as one of Southeast Asia’s most appealing investment markets. The IT industry and its digital economy, in particular, appear to be the most competitive. By 2030, the Ministry of Information and Communications (MIC) hopes to make the country a leading digital destination and economy in Southeast Asia, acknowledging the trial of various innovative digital technologies.

Challenges in Vietnam’s IT Industry

The Make in Vietnam Forum 2022 emphasized the vital role of technology in shaping the future. It further highlighted three pressing issues that require attention: institutional frameworks, the development of human resources, and the need for cutting-edge digital solutions to tackle emerging challenges.

Administrative Procedures

In Vietnam, corrupt practices are quite prevalent, especially in connection to infrastructure projects, customs procedures, and land rights. Those conducting business within the country should brace themselves for potential encounters with corruption, ranging from facilitation payments and bribes to the exchange of lavish gifts in the pursuit of business relationships. Unfortunately, judicial independence is scarce, and corruption continues to plague the court system.

High-profile arrests of individuals in both the public and private sectors have also taken place. However, despite these efforts, Vietnam’s ranking on Transparency International’s 2020 Corruption Perceptions Index is 104th out of 180 countries. Weak prevention and enforcement measures, low salaries in the public sector, and ample opportunities for corrupt practices still exist.

However, The United Nations Development Programme (UNDP), Vietnam Chamber of Commerce (VCCI), Government Inspectorate (GI), and the British Embassy and Consulate General have joined forces to promote business integrity in Vietnam.

Moreover, a UK-funded initiative has incorporated the private sector into Vietnam’s anti-corruption legislation and provided training on codes of conduct. Also, it aims to promote the development of international standards of business integrity within the country’s business community.

Human Resources: Recruitment & Retention

Vietnamese tech talent may not excel in speaking English compared to other ASEAN countries, but they have solid technical skills and are proficient enough to communicate easily. Their main challenge is pronunciation and confidence.

According to JDI Group, recruiting talented individuals in Vietnam is challenging as they are in high demand and seek prompt responses from reputed firms. Offshore recruitment adds complexity to the hiring process, taking months to secure talents. The screening process can extend, resulting in weeks-long delays. The hiring process usually takes at least one month or more and may double or triple if multiple positions need to be filled.

Due to the pandemic, the turnover rate in Vietnam has increased, and the country is experiencing a “brain drain” as employees seek better opportunities in other countries. To combat this problem, companies should focus on employee engagement, create a win-win situation for both the employee and employer, and recognize and invest in talented and competent staff.

Are you interested in Outsourcing IT employees in Vietnam? Our detailed guide for recruiting Vietnamese IT talent can help!

Other Noteworthy Issues

The latter months of 2022 saw a significant rise in the value of the US dollar (USD) due to the US Federal government’s tighter loaning policies to counter inflation. As a result, Vietnam’s currency, the Vietnamese dong, has also been impacted by a decline in its value. To address the situation, the government has introduced strict regulations on international transactions, particularly regarding outgoing cash flow.

When operating a business in Vietnam, all business-related reporting and documentation must be done in the Vietnamese language. If the documents are in languages other than Vietnamese, then they must be translated into Vietnamese through certified translators at the court in the respective country. Post translation, the documents must then be attested by the Vietnam embassy.

Strategies for Successful IT Market Entry in Vietnam

Navigating Regulations and Policies: A Comprehensive Overview

- Stay updated on Vietnamese IT laws and regulations: Foreign companies should stay informed of the latest IT and software development laws in Vietnam by consulting local experts, attending industry events, and reading relevant publications.

- Collaborate with reputable local partners: Working with trustworthy local professionals, such as lawyers, accountants, and consultants, can help foreign companies effectively navigate regulations and avoid potential issues.

- Build strong relationships with local authorities: Establishing connections with entities like the Ministry of Information and Communications and the Department of Information and Communications can facilitate a better understanding of local policies and aid in resolving any arising concerns.

- Safeguard your intellectual property: Intellectual property protection is essential in Vietnam’s growing IT sector; ensure the registration of patents, trademarks, and copyrights to protect your rights and prevent infringement.

- Adhere to data protection and privacy regulations: Foreign companies must comply with Vietnam’s data protection and privacy laws; having well-structured policies and procedures in place can ensure compliance.

By implementing these strategies, foreign IT companies can effectively operate their businesses while adhering to Vietnamese regulations and policies.

Leveraging Collaboration and Knowledge Sharing

To ensure success in the competitive Vietnam market, foreign IT companies should focus on collaboration and knowledge sharing. Implement the following strategies to enhance these aspects:

- Cultivate a collaborative culture by rewarding employees for effective teamwork and facilitating collaborative opportunities on projects.

- Implement communication tools, such as group chats and project management platforms, to streamline information sharing and collaboration.

- Encourage the formation of cross-functional teams, combining people with diverse skill sets and backgrounds for increased creativity and knowledge sharing.

- Develop a knowledge-sharing system, like a wiki or document repository, where employees can exchange their expertise and learn from others.

- Offer training and development opportunities for employees to acquire new skills and knowledge, which they can apply to their work.

- Acknowledge team achievements, learn from failures through post-project assessments, and share insights with the wider team.

- Prioritize diversity and inclusion to promote collaboration and knowledge sharing among employees with diverse perspectives and experiences.

Next Steps for Companies Looking to Enter or Expand into Vietnam’s IT Sector

Companies interested in entering or expanding into Vietnam’s IT sector should always conduct thorough market research, identify target segments, and develop a comprehensive market entry strategy. This may include partnering with local IT companies, leveraging government support programs, and investing in talent development initiatives. By taking these proactive steps and capitalizing on the opportunities presented by Vietnam’s IT industry, companies can position themselves for long-term success in this thriving market.

Conclusion

This comprehensive overview of Vietnam’s IT sector has covered the size, growth, and significance of Southeast Asia’s emerging tech hub, especially in software development. If companies want to join or grow in this market, they can make smart choices by looking at the opportunities (such as the abilities of IT workers in Vietnam), challenges, and support from the government. With a bright future and a good business atmosphere, Vietnam is an attractive place for businesses interested in its booming IT scene.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What is in the IT industry?

- The IT (Information Technology) industry involves businesses and services related to computing, software, hardware, data processing, and telecommunications. It includes areas such as software development, system integration, IT consulting, network infrastructure, cybersecurity, cloud computing, and data analytics. The industry supports both internal company operations and external services across nearly all other sectors.

What is the importance of IT industry?

- The IT industry is crucial for driving innovation, improving business efficiency, and enabling digital transformation across all sectors. It supports economic growth by creating high-value jobs, facilitating global connectivity, and enhancing productivity through technological solutions. Additionally, the IT sector plays a vital role in cybersecurity, data management, and automation.

What is the largest IT company in Vietnam?

- The largest IT company in Vietnam is FPT Corporation. Founded in 1988, FPT operates in various sectors including software development, IT services, telecommunications, and education, and it has a strong international presence with operations in over 25 countries.