Vietnam is primed to unlock the immense potential of its logistics sector by prioritizing high-value service provision, integrated supply chains, and digital transformation. As evidenced by Deputy Prime Minister Le Minh Khai’s approval of Resolution No. 163/NQ-CP in 2023, the country was poised for a logistic revolution.

The rise in compensation levels, coupled with the rapid growth in the retail industry, has rendered an attractive prospect for investment. It has been further expanded by logistics companies in Vietnam’s 3PL and 4PL sectors. Trade agreements such as the ASEAN Economic Community (AEC), the EU-Vietnam Free Trade Agreement (EVFTA), and the Vietnam-Korean Free Trade Agreement (VKFTA) further bolster its position as a logistics powerhouse in the South East region.

Setting up a Logistics Company in Vietnam? Check out InCorp Vietnam’s Company Setup Services

Logistics Industry in Vietnam

This country’s logistics sector presents lucrative investment opportunities amid its robust economic growth. With GDP soaring to 8.02% in 2022, albeit a slight downturn in 2020 due to COVID-19, Vietnam remains a promising market. Its evolution as a manufacturing hub and the burgeoning e-commerce industry underline the critical role of logistics, constituting 4.5% of the GDP.

Forecasts indicate that by 2025, logistics growth will outstrip overall GDP growth. Strategic investments targeting key nodes in the multi-modal transport network can offer early control over vital intersections, potentially averting future bottlenecks.

The exponential growth of e-commerce, as reflected in Vietnam’s estimated US$14 billion market size, underscores the rising importance of last-mile delivery in forwarding and delivery activities. With an anticipated 29% growth rate by 2025, reaching US$52 billion, the country is poised to become a key player in ASEAN e-commerce. However, challenges persist, including infrastructure limitations that impede logistics development.

Moreover, stiff competition among 800 delivery businesses necessitates innovative strategies to reduce delivery times, enhance shipping efficiency, and offer competitive pricing. Overcoming these hurdles will be pivotal for companies aiming to thrive in Vietnam’s dynamic logistics landscape.

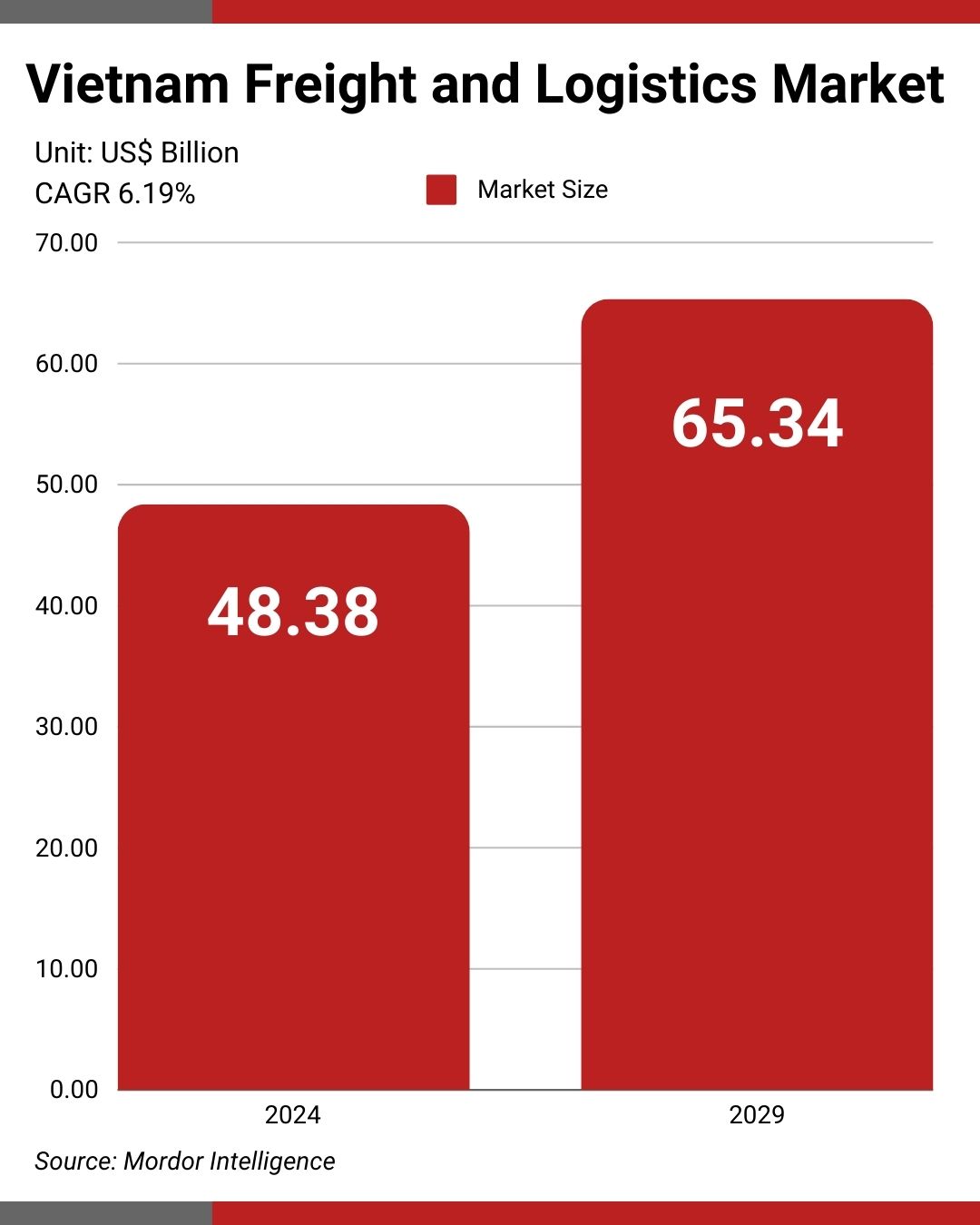

The country’s Freight and Logistics Market is projected to grow significantly, estimated at US$48.38 billion in 2024. Moreover, it is expected to reach US$65.34 billion by 2029, with a CAGR of 6.19% during the forecast period. The sea and inland waterways segment is the fastest-growing mode of transport, with a projected CAGR of 6.47% from 2023 to 2029. Vietnam’s extensive coastline facilitates maritime freight transport, aligning with government aspirations to establish the nation as a naval leader by 2030.

Moreover, within the CEP (Courier, Express, and Parcel) market, the domestic segment holds a prominent position, especially evident in online grocery delivery, highlighting substantial avenues for growth. The wholesale and retail trade industry has the largest share of end users, driven by Vietnam’s surging retail sales in recent years.

Vietnam Logistics Industry’s Infrastructure

The logistics sector is pivotal in Vietnam’s economic progress and has experienced significant growth over time. The government has played a crucial role in fostering this growth by prioritizing infrastructure development, enacting logistics-specific policies, and encouraging public-private partnerships.

Despite these efforts, the logistics industry in this country has encountered several obstacles, such as inadequate infrastructure, elevated logistics expenses, and a shortage of skilled labor. The COVID-19 pandemic worsened these difficulties, causing disruptions in supply chains and logistical operations.

However, the logistics industry is set to maintain its upward momentum, propelled by growing demand for logistical services and ongoing governmental support for sectoral progress.

Read Related: Trade Logistics in Vietnam: Top Megaports and Their Impact from Saigon to Hai Phong

Logistics Trends in Vietnam

Unlike traditional brick-and-mortar stores, e-commerce platforms require a unique range of logistics services that include outbound shipping as well as efficient reverse logistics for handling order returns. The focus on logistics within the online sphere has shifted towards customer-centricity, where factors like delivery speed exert significant influence over purchasing decisions.

Notably, cash on delivery remains the preferred payment and shipping method among Vietnamese online shoppers. As a result, e-commerce enterprises are increasingly seeking comprehensive last-mile delivery solutions that include payment and inventory management, in addition to well-trained delivery personnel. This surge in demand has sparked fierce competition and catalyzed growth within the delivery sector, particularly among express delivery services.

Read Related: E-commerce in Vietnam Evolution: Understanding Market Size, and the Surge in Online Shopping Apps and Trends

Vietnam Freight and Logistics Market Trends

In 2022, the country’s transport and storage sector experienced remarkable growth, with a 17.08% year-on-year increase. This surge was fueled by factors such as the burgeoning manufacturing and export sectors, which have attracted substantial foreign direct investment (FDI).

Notably, the cold chain sector has undergone significant expansion during the 2020-2022 period, which was evident in the 25.2% increase in cold storage facility capacity. This expansion was driven by rising demand for seafood exports, raw food imports, and domestic distribution, particularly to modern retail outlets and food service establishments.

Vietnam’s Oil Industry Trends

In January 2022, Nghi Son, Vietnam’s primary oil refinery, slashed production by 20%, resulting in a surge in fuel prices. This reduction in output had significant repercussions, particularly in the retail sector. In 2022, the retail price of RON 95 gasoline soared to its highest level in eight years, hitting VND 26,287 (US$1.14) per liter, while RON 92 gasoline reached US$1.11 per liter.

The government responded to this price escalation by implementing adjustments, raising fuel prices by VND 1,000 (US$0.04) per liter for gasoline and VND 750 (US$0.03) per liter for oil. Moreover, Vietnam experienced a surge in petroleum product demand in October 2021, prompting an adjustment in fuel prices in line with global market trends. The cost of Brent crude oil increased to US$95.39 per barrel.

Cold Chain Logistics

Vietnam’s cold chain logistics industry is primed for growth, particularly in the food and pharmaceutical sectors. However, challenges such as inadequate infrastructure and a lack of regulatory standards persist. Investment in technology and infrastructure is crucial to address these hurdles.

The country’s cold chain logistics industry has made big strides in the past few years. Vietnam is witnessing a surge in agricultural and aquatic exports, alongside growing consumer interest in imported items such as organic food and products from franchised F&B outlets. Substantial investments have been made in the cold chain market to meet the escalating demand for goods preservation. The southern region, notably dense with seafood enterprises, has emerged as a hotspot for such investments.

However, the high demand has led to elevated rental prices for cold storage facilities, reaching as high as 100% compared to conventional warehouses. Despite progress, challenges persist, including insufficient infrastructure and technology, a shortage of skilled labor, high implementation costs, and limited regulations. Addressing these obstacles requires concerted efforts from both the government and businesses.

Green Logistics Development

The Ministry of Transport plays a pivotal role in overseeing and collaborating on transportation initiatives aimed at seamlessly integrating transport infrastructure with the development goals of the logistics sector. Emphasis is placed on enhancing connectivity between transport modes and optimizing multimodal and cross-border transport to reduce costs and improve service quality.

Simultaneously, the Ministry of Finance reviews tax policies, fees, and service costs to streamline logistics services provision. Collaboration with other ministries aims to promote trade facilitation and simplify customs procedures, aligning with WTO Trade Facilitation Agreement obligations.

Green logistics, aimed at minimizing a company’s environmental impact throughout the supply chain, involves significant changes in logistics operations. Despite initial investment costs, it includes supplier choices, infrastructure optimization, and automation. However, the long-term benefits of implementing green logistics can outweigh these expenditures, fostering sustainable development while maintaining economic activity.

3PL vs 4PL Logistics Trends

When searching for fulfillment providers, you will often encounter the terms ‘3PL’ and ‘4PL’. Now, let’s examine the distinction between these two.

What is 3PL Logistics?

Outsourcing logistics and fulfillment to a 3PL streamlines operations, letting businesses focus on core activities. E-commerce firms opt for 3PL partners to avoid warehouse management, saving time and effort in packing and shipping. As companies expand, 3PL services offer scalability and affordability tailored to specific needs.

Efficient order fulfillment leads to satisfied customers, with 3PL technology ensuring fast delivery and tracking. Moreover, outsourcing saves resources like staff and space, resulting in long-term cost savings despite initial investment.

What is 4PL Logistics?

A 4PL, also known as the control tower model, manages relationships between 3PLs and retailers by providing centralized coordination without owning assets. Outsourcing to a 4PL includes managing and implementing order fulfillment by simplifying platform processes. While offering optimized solutions and customer satisfaction, 4PLs limit control over operations, making them ideal for larger companies seeking streamlined logistics.

What is the Difference Between 3PL and 4PL Logistics?

Below, we have listed some important differences between a 3PL and a 4PL logistics that you must be aware of.

- Order fulfillment: It involves picking, packing, warehousing, and shipping by a 3PL. A 4PL manages the entire supply chain, including transportation and technology, and it works closely with 3PLs to address any issues.

- Communication: This lack of direct contact with customer service at the 3PL level could concern merchants. Contrastingly, a 3PL arrangement allows direct interaction with the customer service team. Direct communication in a 3PL setup facilitates superior customer service compared to the intermediary involvement in a 4PL model.

Regulatory Environment

The Ministries of Industry and Trade, Transport, and Finance, along with relevant agencies, are assigned to monitor international and regional developments. They analyze economic impacts, develop response plans, and coordinate logistics to support production and trade. Ministries, sectors, and local authorities must stay alert, addressing logistics issues promptly to avoid socio-economic disruptions.

Commercial Law 36/2005/QH11 and Decree No. 140/2007/ND-CP define and categorise logistics services in Vietnam. Logistics involve multiple tasks organized by traders, such as goods receipt, transportation, warehousing, and customs procedures. Decree 140 outlines three main categories. It includes the following.

- Principal logistics services encompassing pickup, warehousing, and transportation agency

- Transportation-related services like sea, air, land, and pipeline transport

- Other ancillary services such as technical inspection, postal, and wholesale/retail commercial services.

Commercial Law and Decree 140 govern foreign investment in Vietnamese logistics services – According to Article 234.1 of the Commercial Law, logistics providers must meet legal conditions. Decree 140 further specifies criteria, requiring enterprises to be lawfully established and possess adequate facilities and staff.

Compliance ensures adherence to technical standards and safety criteria, which are essential for efficient and safe logistics operations. These regulations aim to facilitate foreign investment in Vietnam’s logistics sector while upholding quality and safety standards in service provision.

How to Enter Vietnam’s Logistics Market?

For individuals considering the establishment of a logistics company in Vietnam, there are two avenues to explore. It includes the following.

Domestic Invested

Establishing a domestically-invested logistics company in Vietnam is relatively straightforward compared to creating a foreign-invested one. Local investors have the advantage of full ownership using domestic capital and can acquire a business license for designated logistics services from state-level authorities.

The steps for establishing a local logistics company in Vietnam involve several vital procedures:

- Compile and submit requisite documents, such as forms from the Department of Planning and Investment, which may include:

- Enterprise registration form

- Shareholders’ list (if applicable)

- Articles of Association

- Identity cards/passports of shareholders

- Enterprise certificate

- Authorization letter

- The decision of capital contribution

- Publish the company’s establishment details on Vietnam’s National Business Registration Portal, which includes the business certificate information or business line information

- Create a company seal and inform Vietnam’s Business Registration Department with a sample of the seal.

- Apply for specific business licenses for conditional business lines, if required.

Foreign Invested

It includes the following steps:

1. Share information about the investment on the National Investment Information Portal.

2. Within 15 working days of online publication, submit the required documents to the Investment Registration Department. These documents include:

- Copy of passport or identity card

- Copy of establishment certificate or documents proving investors’ legal status

- A written request for project execution permission

- Investment proposal

- Financial statements and commitments

- Land use requirements

- Explanation of technology utilization

- Business cooperation contract

3. Obtain an account from the Investment Registration Department to access Vietnam’s National Foreign Investment Information Portal.

4. Track application progress and outcomes via the portal. Upon approval, the agency will receive a project code.

5. Receive the investment certificate.

6. Publicly announce the business commencement, following steps similar to those for domestic logistics companies.

7. Obtain specific business licenses for conditional business lines as necessary.

Best Practices for Succeeding in the Vietnam Logistics Industry

Expanding business operations in Vietnam requires collaboration with local partners to establish common goals and innovative strategies. Understanding the non-linear decision-making process and environmental considerations is crucial. Additionally, leveraging the expertise of Vietnamese partners is essential.

Logistics firms must actively promote themselves to expand their customer base. Technological advancements, including cloud-based systems, autonomous vehicles, and real-time analytics, are reshaping the logistics landscape, particularly in last-mile delivery.

Advice for New and Expanding Logistics Companies in Vietnam

The logistics sector of Vietnam is on the brink of notable expansion and evolution. It is primed to transition into a high-value service realm, bolstered by government dedication, intricately linked with vital economic sectors. To flourish amidst this dynamic landscape, enterprises must confront obstacles like infrastructure limitations, regulatory complexities, talent shortages, and sustainability concerns.

Embracing cutting-edge technologies and digital innovations enables firms to enhance operational effectiveness and secure a competitive advantage. Furthermore, conducting comprehensive research and exercising prudence before entering the market are crucial to achieving success.

Contact InCorp Vietnam experts to get more advice for your Logistics Company in Vietnam!

Some “Big” 3PL and 4PL Logistics Companies in Vietnam

Below, we have listed some important and “Big” 3PL and 4PL Logistics Companies that are actively contributing to Vietnam’s logistics landscape.

3PL Companies

Gemadept Corporation

Established in 1990, it was among the first three companies to undergo government equitisation in 1993. Over the past thirty years, Gemadept has spearheaded various sectors and currently boasts leading enterprises in port operation and logistics across Vietnam.

With extensive port and logistics networks strategically positioned domestically and internationally, it is one of the most significant contributors to the national budget through corporate income tax.

Indo Trans Logistics Corporation (ITL)

It is a premier provider of integrated logistics solutions, boasting over 300,000 square meters of warehousing space across North and South Vietnam. With a fleet exceeding 300 containers and 250 chassis, ITL offers comprehensive road transport solutions and value-added services throughout its supply chain. Additionally, it is poised to pioneer e-commerce expertise, shaping the future of logistics in Vietnam.

DHL

As part of the US$61 billion DPDHL group, DHL is a global leader in contract logistics. It offers innovative solutions across various sectors, including automotive, consumer goods, energy, and healthcare. With unconventional fulfillment and distribution channels, DHL is well-equipped to address the evolving needs of the global market and provide cutting-edge logistics solutions.

4PL Companies

Wayfindr, a leading 4PL company in Vietnam, leverages extensive industry expertise and cutting-edge technology to offer sustainable logistics solutions. Specializing in facilitating global expansion for businesses, particularly in the booming e-commerce sector, Wayfindr capitalizes on Vietnam’s status as a manufacturing hub.

Global presence is essential in today’s dynamic business landscape, especially across diverse regulatory environments. Wayfindr’s comprehensive logistics platform spans nearly 10 markets, providing businesses with effective solutions tailored to their needs. In an era where traditional networks no longer suffice, this 4PL company in Vietnam ensures seamless logistics operations, catering to the evolving demands of modern businesses.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What is the largest logistics company in Vietnam?

- The largest logistics company in Vietnam is Viettel Post (Viettel Post Joint Stock Corporation). It is a subsidiary of the Viettel Group, a state-owned telecommunications giant, and offers nationwide coverage and various logistics services, including courier, freight forwarding, and warehousing. Other major logistics players in Vietnam include VNPost, GHN (Giao Hàng Nhanh), and Sagawa Vietnam.

Who are the top distributors in Vietnam?

- Top distributors in Vietnam include PetroVietnam (oil and gas), Saigon Trading Group (Satra, FMCG and consumer goods), Phu Thai Group (FMCG), Tan Son Nhat Cargo Services (logistics distribution), and DKSH Vietnam (market expansion services). These companies have established nationwide networks and strong relationships with both local and international brands.

Who is the top logistics company?

- The top logistics company globally is often considered to be DHL Supply Chain & Global Forwarding, a division of Deutsche Post DHL Group, due to its extensive global network and comprehensive logistics services. In Vietnam, leading logistics companies include Gemadept, Saigon Newport Corporation, and Viettel Post, which are recognized for their strong domestic operations and infrastructure.