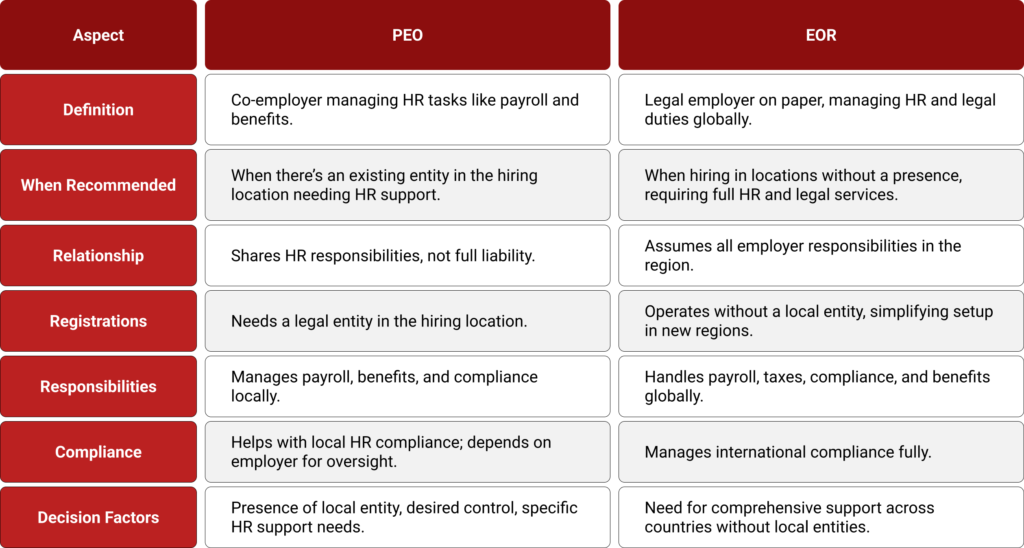

When expanding your workforce internationally, understanding the PEO vs EOR distinction is crucial. While both support HR functions, a Professional Employer Organization (PEO) and an Employer of Record (EOR) operate under very different frameworks. For companies expanding into new regions like Vietnam, efficient HR and payroll services management often plays a vital role in ensuring smooth workforce integration and compliance. Here are four key differences that can significantly impact your business strategy:

1. Nature of the Employment Relationship

A PEO operates as a co-employer, meaning it shares certain responsibilities with your company, primarily in HR functions such as payroll processing, benefits administration, and employee recordkeeping. However, the ultimate legal responsibility remains with your business.

By contrast, an EOR becomes the legal employer of record for your workforce in the target country. The EOR assumes full responsibility for employment contracts, compliance, and obligations to employees in that jurisdiction.

2. Entity Setup and Legal Presence

In the PEO vs EOR comparison, one of the key differences is the requirement for a legal entity. Because a PEO shares employment responsibility, it requires your company to establish a legal entity in the country where you’re hiring. A PEO cannot operate independently on your behalf and hence, you must be registered locally to engage one.

However, an EOR enables you to hire employees in a foreign country without setting up a local entity. For example, if your company is based in the U.S. and wants to hire in France, an EOR can onboard employees legally under its own entity. This saves considerable time, cost, and administrative burden by eliminating the need for local registration.

Investing in Vietnam? Explore our Company Formation – One-Stop Market Entry Services

3. Scope of Responsibilities

Both PEOs and EORs provide operational HR support, including payroll management, tax withholding, benefits administration, and access to HR platforms. They ensure employees are paid accurately and on time, handle statutory deductions, and manage benefits such as health insurance, paid leave, and reimbursements in accordance with local laws.

The key difference lies in accountability:

- A PEO assists with these tasks but works alongside your internal HR team.

- An EOR fully manages these responsibilities under its own legal structure, reducing your direct involvement.

4. Compliance and Risk Management

In the PEO vs EOR discussion, one of the key differences lies in how each model handles compliance. A PEO plays a supportive role in this area by helping businesses stay aligned with local HR and labor requirements. However, since the PEO operates under a co-employment model, your company remains legally responsible for maintaining compliance. This means you must stay up to date with regulatory changes and ensure internal adherence to employment standards.

In contrast, an EOR assumes full legal responsibility for compliance in the country where your employees are based. The EOR continuously monitors local labor laws, manages employment contracts, and ensures that all employment practices from statutory leave policies to benefits and termination procedures are compliant with current legislation.

By acting as the legal employer, the EOR helps mitigate your risk exposure, offering a streamlined and fully compliant solution for managing international talent.

Read Related: Tax Compliance Risks for Foreigners in Vietnam

Key Factors to Consider When to Use PEO vs. EOR

Now that you understand the key differences in the PEO vs EOR comparison, the next step is identifying which model aligns best with your business needs. Choosing between a Professional Employer Organization (PEO) and an Employer of Record (EOR) depends on your expansion goals, existing legal presence, and the level of operational support you require. To help you decide, consider these four essential questions.

1. Where Are You Hiring?

The first consideration is whether you already have or plan to establish a legal entity in the country where you’re hiring.

- If you already have an entity, or intend to set one up, both a PEO and an EOR could work. A PEO can manage HR administration as your co-employer, while an EOR offers a more hands-off, full-service approach.

- If you do not want to establish a legal entity, an EOR is the better solution. An EOR allows you to hire talent in-country without going through the costly and time-consuming process of local company registration. This is particularly helpful for businesses testing new markets or making strategic, low-risk hires abroad.

2. What Level of Employment Support Do You Need?

Next, evaluating the type of support your business needs for international employment is crucial as this will help clarify the key differences in the PEO vs EOR model and guide you toward the most suitable solution for compliance, onboarding, and operational efficiency.

- If your goal is to offload day-to-day HR tasks such as payroll processing, tax filings, and benefits administration, a PEO can be a great operational partner.

- If you’re looking for comprehensive support across HR, legal, and contractual obligations especially across multiple countries then an EOR offers a broader service model. With an EOR, you’re delegating full employment responsibilities to a local expert, minimizing your direct involvement.

3. How Many Employees Do You Plan to Hire?

Your hiring volume can also influence which model is more practical.

- PEOs often require a minimum number of employees in a given market, which makes them a better fit for companies planning to hire at scale. This structure also gives you access to group benefits, health insurance packages, and other employee perks.

- EORs have no minimum headcount requirements, making them ideal if you’re hiring just one or two employees in a new market. However, EORs are typically best suited for early-stage expansion. If your workforce in that region grows significantly, you may eventually need to establish a local entity to maintain long-term operations and cost-efficiency.

Read Related: Understanding Vietnam (SHUI) for Employees

4. How Much Control Do You Want to Retain?

Finally, think about how much control you want over employment decisions and HR policies. This consideration highlights one of the key differences in the PEO vs EOR model, where a PEO allows more direct involvement, while an EOR offers a more hands-off approach by managing these functions on your behalf.

- With a PEO, you retain greater control. As a co-employer, the PEO works alongside your internal team, allowing you to be involved in HR processes, policy decisions, and employee management.

- With an EOR, you’ll need to be comfortable delegating control. Since the EOR is the legal employer, they must ensure all actions comply with local labor laws even if that means delaying or modifying decisions such as contract termination or benefits implementation. While this adds a layer of compliance protection, it also means trusting the EOR to act in your best interest.

Looking for HR Outsourcing in Vietnam? Check out our HR and Payroll Outsourcing for Foreign Businesses

PEO FAQs

- What is the difference between a PEO and a staffing company?

In the PEO vs EOR landscape, it’s also important to understand the key differences between staffing firms and PEOs. Staffing companies lease employees to other businesses and remain the sole employer for those workers. PEOs, on the other hand, don’t supply a workforce, but assume certain responsibilities that make them co-employers with their partner organizations.

- What is the difference between a PEO and HR outsourcing?

In a co-employment relationship, you share certain employer responsibilities with the PEO that cannot be achieved through typical HR outsourcing. For example, a PEO usually provides access to robust health insurance and other perks for employees, while an HR outsourcing firm may simply help administer your existing benefits, HR or payroll.

How InCorp Vietnam Can Support Your HR Compliance

In the context of PEO vs EOR, understanding the key differences is essential for businesses expanding into Vietnam. Navigating Vietnam’s labor laws, payroll regulations, and HR compliance requirements can be challenging especially for growing businesses and foreign investors. Therefore, at InCorp Vietnam, our HR advisory services are designed to help you manage your workforce confidently and in full alignment with local regulations.

- Monthly payroll processing – Accurate salary calculations based on working hours, allowances, bonuses, and deductions

- Personal Income Tax (PIT) compliance – Monthly PIT declarations and annual finalization in line with Vietnamese tax regulations

- Social, health, and unemployment insurance reporting – Timely and accurate contributions in accordance with labor laws

- Payslip preparation and distribution – Secure, confidential delivery of detailed payslips to employees

- Handling statutory filings and labor updates – Stay compliant with evolving labor and tax legislation

With a team of local experts and multilingual consultants, we offer practical guidance, personalized support, and timely execution, helping you and your workforce move forward with peace of mind.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What are the disadvantages of using a PEO?

- The disadvantages of using a PEO (Professional Employer Organization) include reduced control over certain HR functions and company policies, as the PEO becomes the co-employer for compliance and payroll purposes. Additionally, employers may face challenges if the PEO lacks local expertise or if the contract terms are inflexible. PEO services can also be relatively expensive compared to establishing a local entity if long-term operations are planned. Dependency on a third party may create risks if the PEO terminates service or fails to comply with local laws.

What Is The Difference Between A Peo And A Payroll Company

- A PEO (Professional Employer Organization) provides comprehensive HR services, including payroll, benefits, compliance, and employee management, through a co-employment arrangement. A payroll company focuses solely on processing payroll and handling related tax filings without offering broader HR support.

What is the difference between a PPO and a PEO?

- A PPO (Professional Provider Organization) is a type of health insurance plan that offers greater flexibility in choosing healthcare providers, often used in the U.S. insurance context. A PEO (Professional Employer Organization), on the other hand, is a company that partners with businesses to provide outsourced HR services, including payroll, benefits, and compliance. In Vietnam, the relevant concept would be comparable to an Employer of Record (EOR) or labor outsourcing firms rather than a PPO.

What is the difference between a PPO and EOR?

- A Professional Payroll Organization (PPO) handles payroll processing and related services, usually supporting a company's internal HR and employment infrastructure. In contrast, an Employer of Record (EOR) becomes the legal employer of a worker on behalf of a client company, managing compliance, employment contracts, payroll, tax, and benefits—especially useful when hiring in a country without local entity setup.