The personal tax system for foreigners living in Vietnam involves special tax rates, calculations, and procedures. These calculations and procedures can be much more difficult for you to comprehend if you do not have specialized knowledge. Many expats also rely on professional tax accounting services to stay compliant and avoid errors in their filings, especially when dealing with dual taxation or local exemptions. It means that this kind of tax system for expatriates requires expert guidance to navigate. This guide clarifies the intricacies of tax regulations, helping foreigners understand their monthly and yearly tax obligations.

Personal income tax rules in Vietnam apply to both tax residents and non-residents based on their time spent in the country. This article outlines essential regulatory aspects of personal income taxes for expatriates to clarify your tax responsibilities.

What is Personal Income Tax?

The personal income tax is what an individual needs to pay to the Vietnamese Department of Taxation based on the amount of income earned.

Sources of income that are subject to personal income tax in Vietnam include salary and wages, capital investments, capital transfer, franchising income, inheritance, etc.

Who are considered Tax Payers in Vietnam?

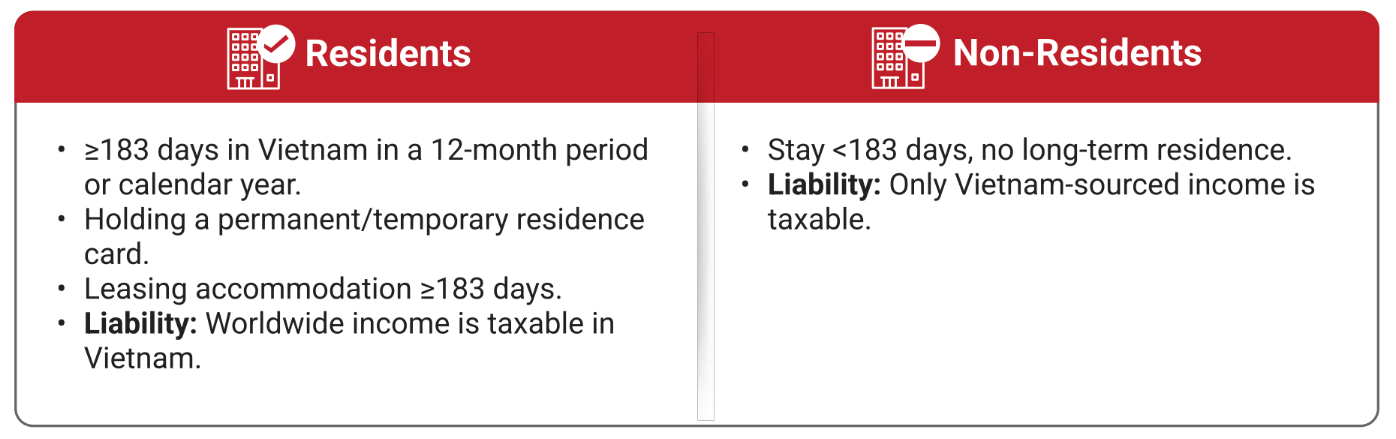

Vietnamese tax residents are taxed on worldwide income, while non-residents pay tax only on Vietnam-sourced income. You are a tax resident (subject to Vietnamese PIT on global income) if you meet any of these conditions:

- Stay in Vietnam 183 days or more in any 12-month period.

- Stay in Vietnam 183 days or more in a calendar year.

- Hold a Vietnam temporary or permanent residence card.

- Lease property in Vietnam for 183 days or more in a tax year.

If none of the above apply, you are a non-resident for PIT purposes. Non-residents (for example, someone on a short-term work contract) pay the flat 20% PIT only on Vietnam-source income. Note that Vietnam has over 80 double-taxation treaties with other countries, which may reduce or eliminate double tax on cross-border income for treaty residents.

Read More: Personal Income Tax (PIT) in Vietnam: Get A Comprehensive Visual Guide

How to Calculate Expat’s Personal Income Tax in Vietnam?

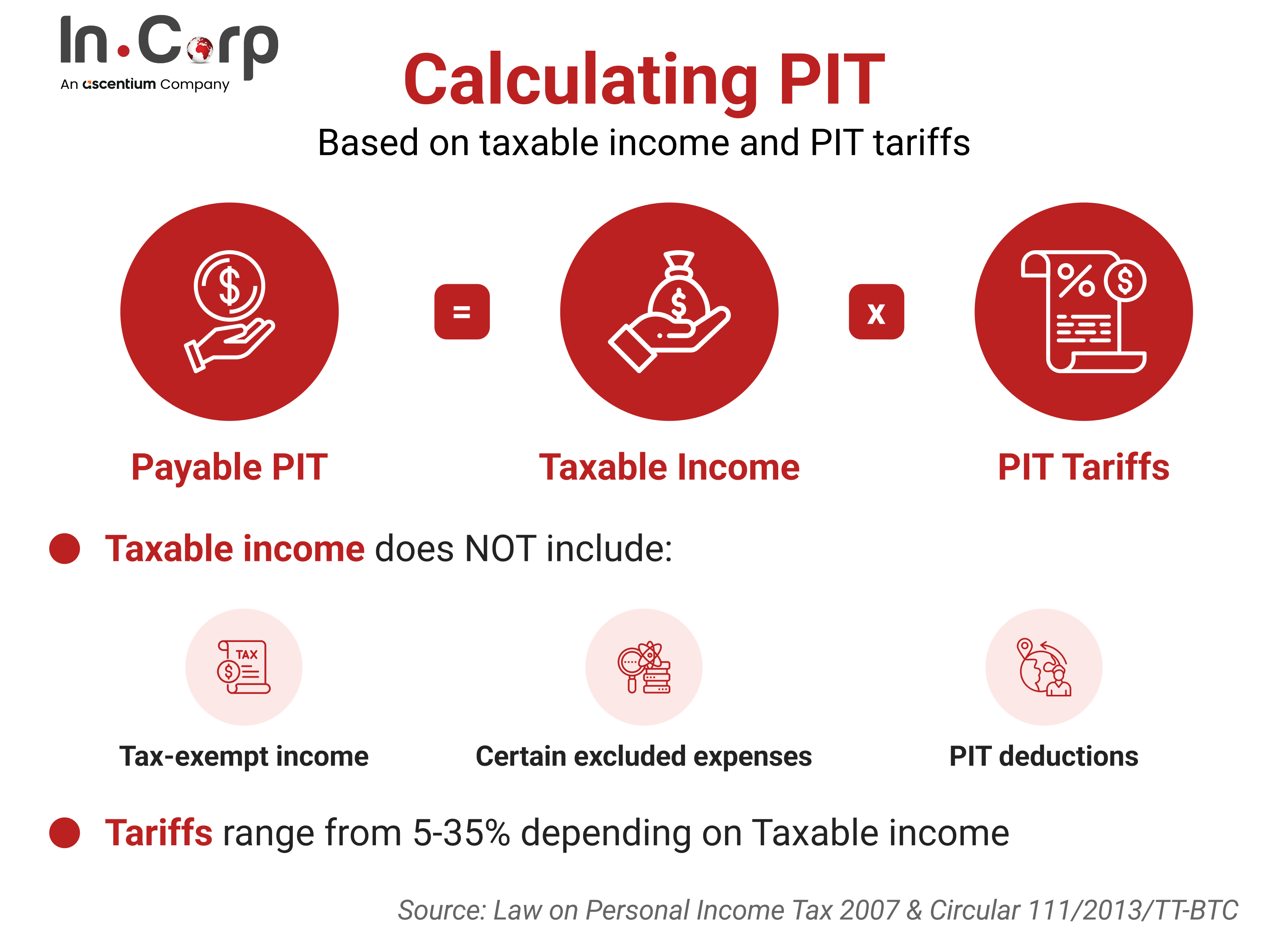

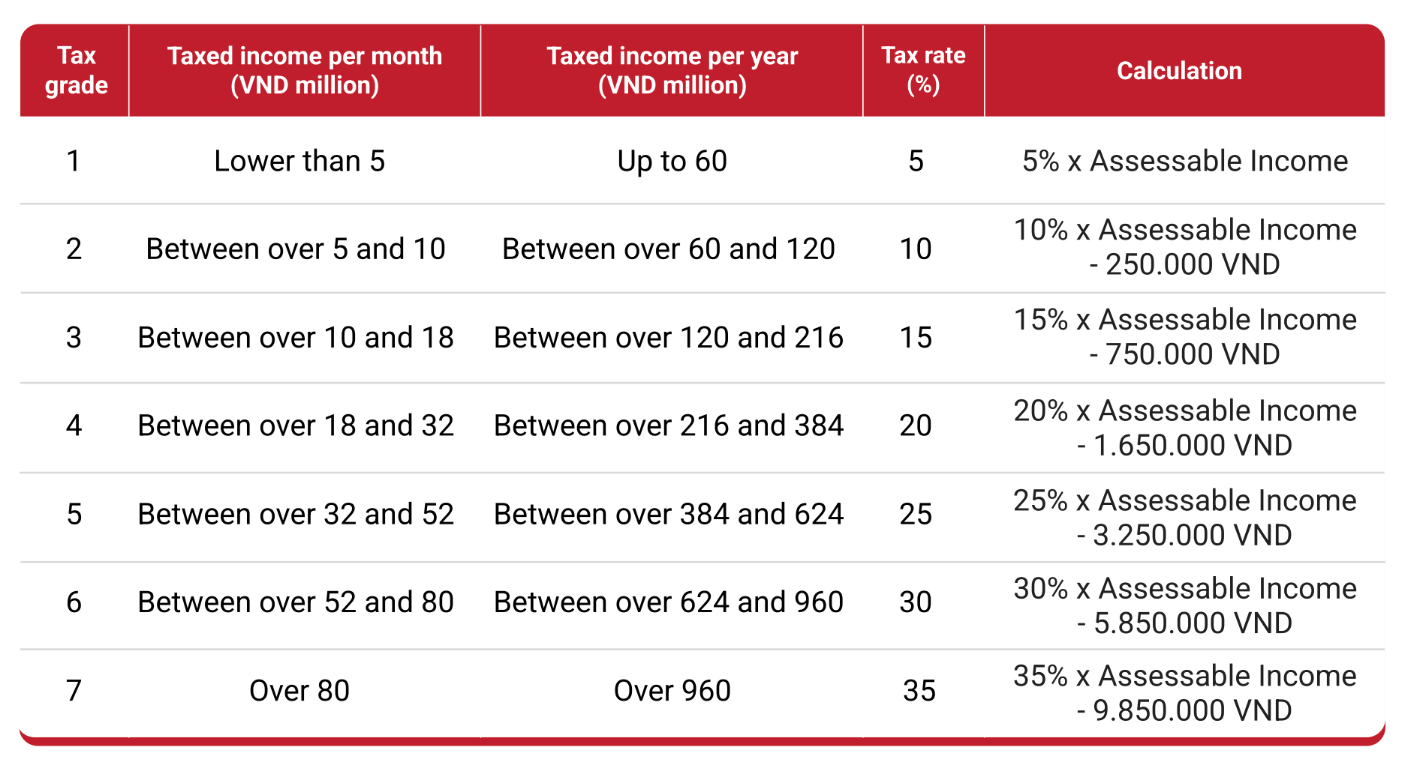

The monthly salary of an ex-pat is also the monthly taxable income in Vietnam. For tax residents, their monthly taxable income is taxed at a progressive rate of 5-35%; for non-tax residents, it is a fixed 20%.

Calculate Your Taxable Income Rate

Find out more about InCorp Vietnam’s Tax Outsourcing Services for Foreign Businesses

To calculate PIT, first total all taxable income (salary, bonuses, allowances, etc.) and subtract allowable deductions. In 2025, every taxpayer automatically receives a personal allowance of VND 11,000,000 per month, plus VND 4,400,000 per month for each qualified dependent. These allowances reduce your taxable income. (From 2026, Vietnam is raising these to 15.5m and 6.2m.) In addition, mandatory contributions to Vietnam’s social insurance, health insurance and unemployment insurance are fully deductible.

Once deductions are applied, tax is calculated on the remaining income at the rates above. For tax residents, use the progressive PIT brackets on the leftover income. Foreigners who are non-residents simply take 20% of their gross Vietnam income.

Monthly tax calculation (residents):

– Subtract personal and dependent allowances and insurance contributions from the monthly gross salary.

– Apply the progressive PIT rates (5%–35%) to the remaining taxable income.

– Compare the calculated tax to the PIT already withheld during the year.

– Pay any additional PIT due (or claim a refund if excess was withheld).

Non-residents simply calculate 20% of each month’s Vietnam income, with no further deductions.

Other Taxable Income (Non-Salary)

Many types of income besides wages are taxable at fixed rates. Important examples include:

- Business or professional income (e.g. consulting, contract work): taxed at 0.5%–5% of turnover, depending on activity. (Small-scale household businesses under VND100m per year may be exempt.)

- Non-bank interest and dividends: 5% of the income.

- Capital gains (asset transfers): 20% of the gain (for example, sale of a private company stake).

- Public share sales: 0.1% of the sales value.

- Real estate sales: 2% of the sales price (regardless of profit).

- Royalties, franchises, copyrights: 5% of the income.

- Prizes, gifts, inheritances (cash or assets): 10% of the amount (except that inheritances/gifts between close relatives are exempt, see below).

Tax residents report these incomes in their annual PIT return at the above rates. Non-residents pay the same rates on Vietnam-source non-salary income (e.g. a foreigner earning dividends from a Vietnamese company).

Tax-Free and Exempt Income

Vietnamese law exempts many income items from PIT altogether. Key tax-free incomes include:

- Family transfers: Inheritances and gifts between close relatives (spouses, parents, children, adoptees) are exempt. Likewise, transfer of a primary residence between family members (one house or land) is tax-free. Notably, transfers of real estate between direct family members incur no PIT.

- Pensions: Payments from the Vietnam Social Insurance Fund (e.g. retirement pensions) are PIT-exempt.

- Personal remittances: Money sent by relatives overseas to support a person in Vietnam is exempt.

- Scholarships and aid: Approved scholarships, foreign government aid or NGO humanitarian contributions are tax-free.

- Night/overtime bonuses: Higher-than-normal pay for night shifts or overtime is not subject to PIT.

- Insurance or compensation: Payouts from personal insurance (life, health, etc.) and certain insurance compensations are not taxable.

In practice, this means routine expat perks are often non-taxable if structured correctly. For example, Vietnam’s regulations explicitly exempt common fringe benefits for expatriates:

- Relocation allowance: A one-time payment to help an expat move to Vietnam is tax-exempt.

- Home-leave airfare: One round-trip ticket per year (to the employee’s home country) paid by the employer is non-taxable.

- Education support: Employer-paid tuition for an expat’s child (kindergarten through high school in Vietnam) is exempt.

- Lunch allowance: Employer-provided (catered) midday meals are exempt up to VND 730,000 per month.

- Uniform allowance: Cash or in-kind support for work uniforms (up to VND 5,000,000) is exempt.

- Training expenses: Fees paid by the employer for a job-related training course are exempt.

These exemptions (from various tax circulars) mean expat benefits like airfare, school fees, training, meals, etc. can often be provided tax-free if done properly.

Deduction for Charitable Donations

Vietnam allows a tax deduction for donations to approved charities, humanitarian causes or educational funds. Contributions in the tax year to qualifying organizations can be deducted from taxable income up to the level of the taxpayer’s total taxable income. (For example, if you earn VND 100m taxable income and donate VND 10m to an approved charity, only VND 90m is taxed.) Keep official receipts and ensure the organization is on the government-approved list. Unused donation deductions cannot be carried forward.

Read Related: Living in Vietnam: 10 Laws Expats Must Know

Deadline for Tax Finalizations

Vietnam uses the calendar year for PIT (Jan 1–Dec 31). Employers withhold PIT monthly and remit it by the 20th of the next month. At year-end, taxpayers must finalize their PIT:

- By March 31: Employers consolidate employees’ annual PIT and submit finalization returns to the tax authority by the last day of the third month after year-end (typically March 31).

- By April 30 (typically): Individuals with multiple jobs or who file on their own must finalize by the last day of the fourth month (April 30). If that date falls on a weekend/holiday, it shifts to the next working day. For example, the 2024 PIT (for income year 2024) had a deadline of May 2, 2025.

In summary, for wage earners: employers file by March 31, and individual self-filers by April 30/early May. Missing the deadline leads to fines and interest on unpaid PIT.

Expatriates: Special Cases

- Leaving Vietnam: Foreign workers ending their contract must settle their PIT before departure. The final return should be filed within 45 days after the exit date. You can file it yourself or authorize your employer to do so.

- Non-resident foreigners: If you did not meet the 183-day residency rule and have no continued income source, you are a non-resident and do not file an annual PIT finalization (unless you want a refund).

- Double tax relief: Vietnamese tax residents get a credit for any foreign tax paid on the same income. In practice, if you’ve paid tax abroad on income that is also taxed here, you can offset it against your Vietnamese PIT. (DTAs may further reduce your overall tax.)

Summary

Vietnam’s personal income tax system for foreigners depends mainly on residency. Tax residents pay 5–35% on their world income, while non-residents pay 20% on Vietnam-sourced income. Standard deductions (personal and family allowances) significantly reduce taxable income, and many common expat allowances can be structured as tax-free. Key deadlines: annual PIT filings are due March 31 (through employer) and April 30/early May (individual). In addition, starting in 2025 Vietnam is replacing individual tax codes with new Personal Identification Numbers (PIN) – but foreign individuals (who are not issued a PIN) continue using their existing tax code for PIT.

Read More: A Full 2024 Tax Calendar: Key Dates & Deadlines for Businesses in Vietnam

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Are There Taxes In Vietnam

- Yes, Vietnam has a tax system that includes personal income tax, corporate income tax, value-added tax (VAT), and other taxes. Tax rates and regulations are governed by the Vietnamese government.

Do Vietnamese Pay Taxes

- Yes, Vietnamese citizens and businesses are required to pay taxes, including personal income tax, corporate income tax, and value-added tax, among others. The tax system is administered by the General Department of Taxation under the Ministry of Finance.

Does Vietnam Have Income Tax

- Yes, Vietnam has a personal income tax system. Residents are taxed on worldwide income, while non-residents are taxed only on Vietnam-sourced income. Tax rates vary based on income levels and residency status.

What is pit Vietnam?

- PIT in Vietnam stands for Personal Income Tax. It is the tax imposed on the income of individuals, including both Vietnamese residents and foreign individuals working or earning income in Vietnam. Residents are taxed on worldwide income, while non-residents are taxed only on Vietnam-sourced income. PIT rates in Vietnam are progressive for employment income, ranging from 5% to 35%.