Vietnam’s January 2025 marks a tremendous turning point in the nation’s development, driven by wise strategic advancements in Agritech and a pervasive surge in foreign investments. Agritech startups are at the forefront of innovation, grappling with challenges yet thriving by leveraging cutting-edge technologies like AI and IoT to revolutionize agricultural practices and bolster high-value exports. Simultaneously, Binh Duong, the affluent industrial hub, is cementing its reputation as a preponderant investment destination with US$1.7 billion poured into transformative projects in early 2025. These milestones underscore Vietnam’s unmistakable commitment to sustainable growth and its capacity to attract diverse global investors into sectors spanning real estate, infrastructure, and technology.

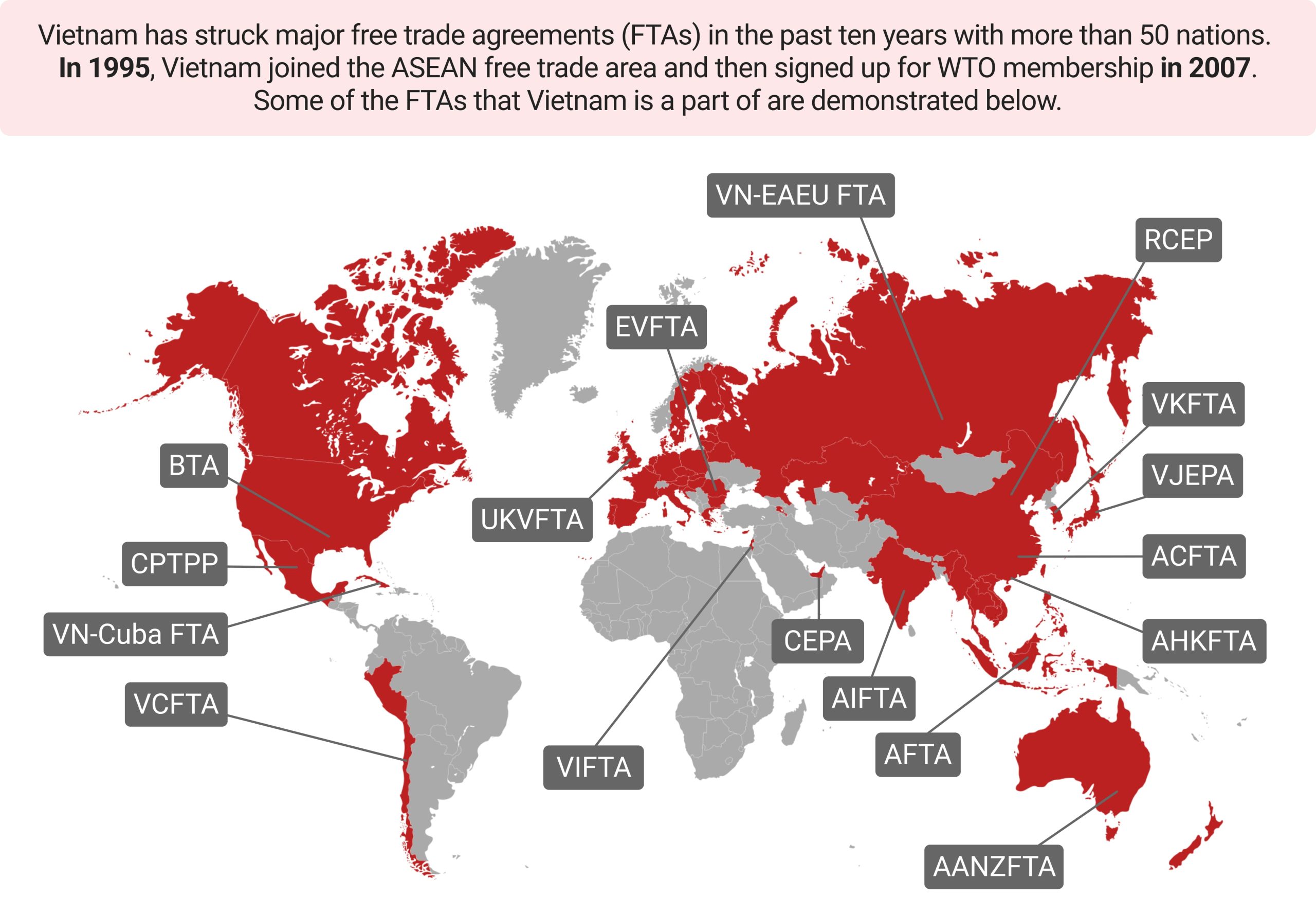

As the country strategically leverages free trade agreements like RCEP and enshrines progressive policies, it continues to foster innovation, streamline administrative bottlenecks, and enhance sleek infrastructure to create an optimal business environment. Vietnam’s progress is not just incremental but a spectacular rise, positioning the nation as a formidable global player in technology, advanced manufacturing, and international trade. These achievements highlight Vietnam’s ability to spur economic resilience while securing a legacy of innovation for the foreseeable future.

Interested in Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services

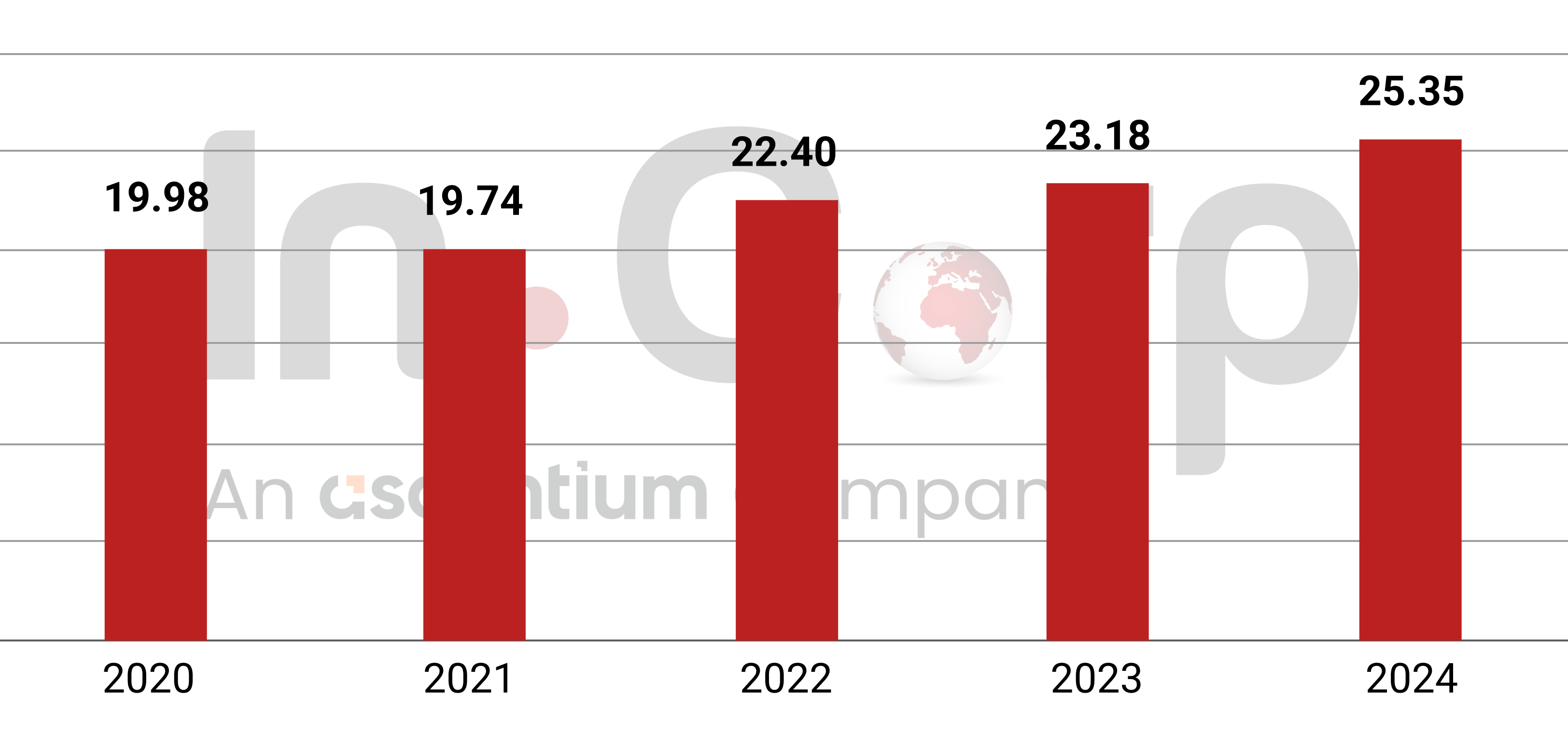

Record US$25.35 Billion FDI Disbursement Achieved

Vietnam’s foreign direct investment (FDI) disbursement reached a record-breaking US$25.35 billion in 2024, reflecting a notable 9.4% increase year-on-year. Total registered FDI exceeded US$38.2 billion, experiencing a slight 3% dip, yet demonstrating resilience. New projects contributed US$19.73 billion, while adjusted capital for ongoing projects saw a spectacular surge of 50.4%, totaling US$13.96 billion. The manufacturing hub and processing sector remained the preponderant force, accounting for nearly US$25.6 billion, or 67% of the total. Real estate followed closely with US$6.31 billion, marking a robust 19% growth. Singapore led as the most affluent investor, with US$10.2 billion (up 31.4%), followed by South Korea at US$7.06 billion (up 37.5%).

Read More: Vietnam FDI: Analysis of Industries, Source Countries, and Geographical Regions

FDI inflows were concentrated in strategic regions like Bac Ninh (US$5.12 billion), Haiphong (US$4.94 billion), and Vietnam’s largest city Ho Chi Minh (US$3.04 billion), with the latter spearheading new projects, adjusted investments, and capital contributions. Although capital contributions and share purchases declined by 48.1%, the unmistakable rise in disbursement underscores Vietnam’s dynamic investment climate. This success is underpinned by sleek infrastructure, forward-thinking administrative reforms, and strategic promotional efforts that continue to attract diverse global stakeholders, cementing the country’s reputation as a regional economic powerhouse.

Read More: Ease of Doing Business in Vietnam: Why Do Foreign Investors Choose This Destination?

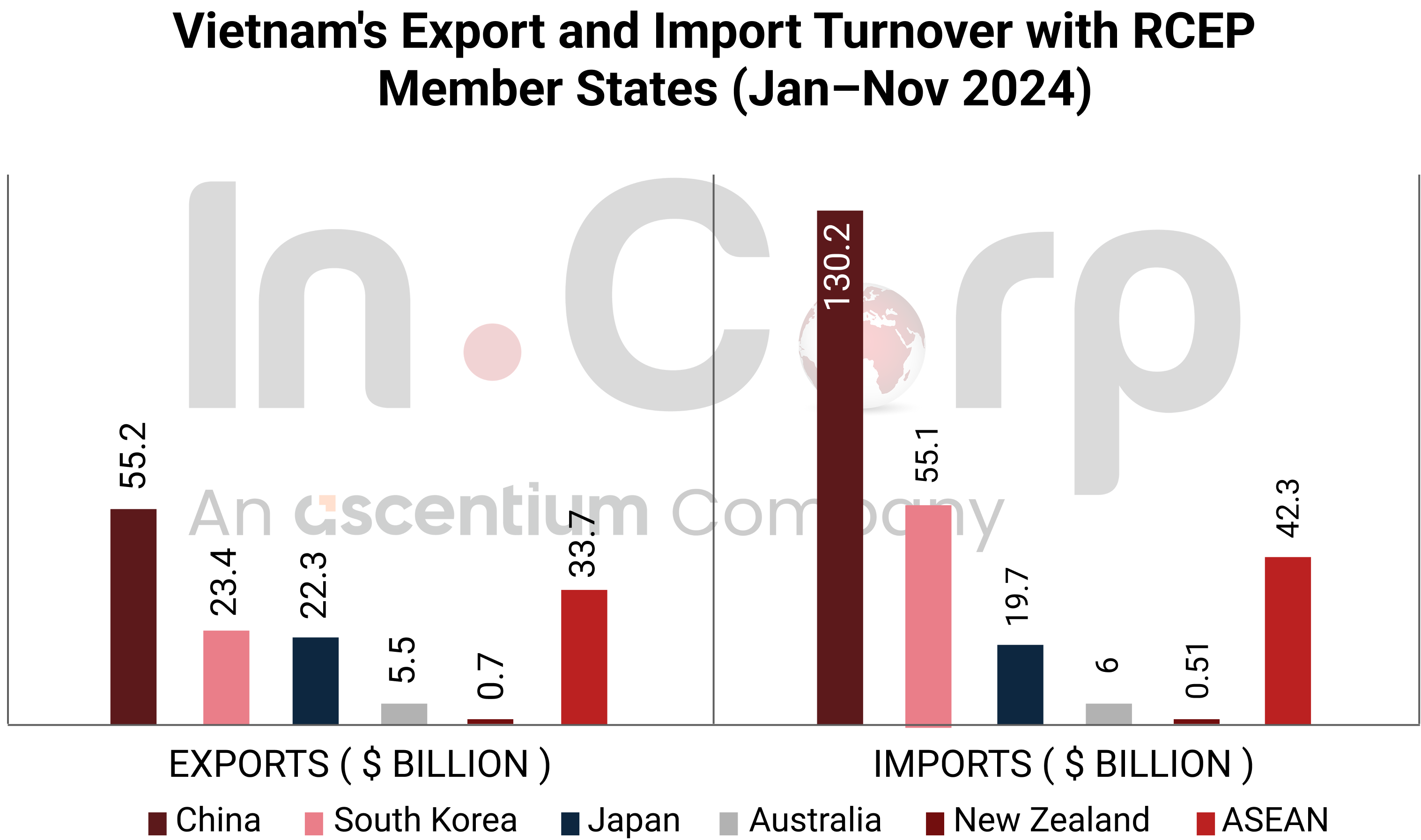

Vietnam Leverages RCEP to Boost Trade

Vietnam’s trade under the Regional Comprehensive Economic Partnership (RCEP) reached an impressive US$394.61 billion in the first 11 months of 2024, comprising 55.1% of its total trade of US$715.55 billion. Exports to RCEP countries totaled US$140.8 billion, representing 38% of Vietnam’s total exports, while imports amounted to US$253.81 billion, contributing 73.4% of overall import value. The RCEP agreement, effective since January 2022, unites 15 nations, including China, Japan, and South Korea, under a single set of rules of origin, significantly lowering costs and streamlining supply chain integration.

The deal bolsters Vietnam’s exports of garments, agricultural goods, and seafood through flexible sourcing and tariff incentives. Enhanced trade partnerships, such as Chile, whose trade turnover with Vietnam reached US$1.57 billion in the first nine months of 2024, further amplify these gains. RCEP members have pledged to eliminate up to 98.3% of tariff lines for Vietnam over 15-20 years. Vietnam has also attracted US$110.1 billion in registered ASEAN investments, led by Singapore with US$82.3 billion. This agreement is poised to elevate Vietnam’s key export sectors—IT, agriculture, and automobiles—while reducing import costs and driving economic efficiency.

Read More: The Definitive Guide to Vietnam’s 17 Active Free Trade Agreements – FTAs

German Businesses Commit to Invest

Despite short-term challenges, German businesses reaffirm their commitment to Vietnam, with notable investments in 2024 from companies such as Ziehl-Abegg, Kärcher, and Pearl Polyurethane Systems. The German Business Association (GBA) expanded to over 400 members, spearheading initiatives like the GBA Business Awards and Green City Forum to strengthen partnerships. German investments are increasingly focused on sustainability, particularly in photovoltaic systems and green technologies. While industrial performance faltered early in 2024, Q4 saw recovery through enhanced collaboration in training, technological upgrades, and stabilized operations.

German firms prioritize decarbonization and supply chain localization to meet evolving global demands. Persistent challenges, such as infrastructure congestion and complex licensing, remain, but Vietnam’s reform-driven governance is fostering better business conditions. As the global economy regains stability, German companies plan further investments in research, local sourcing, and manufacturing, particularly in export and industrial goods. With its reform momentum and appeal for sustainable growth, Vietnam continues to emerge as a compelling destination for long-term strategic partnerships.

Vietnam Advances as Global Semiconductor Hub

Vietnam is solidifying its position as a prominent destination for semiconductor investments, drawing major players like Nvidia, Intel, and Amkor. Nvidia has initiated recruitment for its research centers in Hanoi City and Bac Ninh, while Viettel is allocating US$100 million to build Vietnam’s largest data center. The nation is ambitiously targeting the establishment of 100 chip design enterprises, a small-scale manufacturing facility, and 10 packaging and testing factories by 2030.

Despite logistical hurdles and workforce shortages, Vietnam is intensifying local efforts, with institutions like Hanoi University of Science and Technology advancing specialized training programs. In 2024, semiconductor investments reached US$18.23 billion, marking an 11.5% year-on-year increase. By leveraging its strategic roadmap, Vietnam aims to capitalize on global shifts in the semiconductor supply chain and solidify its role in the industry’s future.

Read More: Unlocking Opportunities and Overcoming Challenges in the Global Semiconductor Industry

Agritech Startups Gain US$70 Million Funding

Vietnam’s Agritech sector is rapidly advancing, with startups like Enfarm and Techcoop attracting substantial investments to expand operations. Enfarm, leveraging AI and IoT for precise crop management, secured seed funding led by Touchstone Partners to enhance its platform and collaborate with OEMs in Vietnam. Meanwhile, Techcoop raised US$70 million in a Series A round, combining US$30 million in equity and US$40 million in debt. With 2024 revenue at US$75 million, Techcoop aims for US$150 million in 2025, prioritizing digital payment systems and high-value export markets like the US, Europe, and Japan.

As Vietnam targets US$100 billion in agricultural exports by 2030, Agritech startups like Rize and Enfarm are tackling challenges such as high input costs and limited data access for smallholder farmers. Rize secured US$14 million to expand into South and Southeast Asia, but the ecosystem remains nascent, with only eight of 80 Agritech companies in Vietnam funded. Experts stress the importance of government-backed certification and acceleration programs to drive technology adoption and foster the sector’s long-term growth.

Read More: Agtech in Vietnam: Driving Modern Solutions for Agricultural Growth

Ho Chi Minh City, Danang Plan Financial Centers

Ho Chi Minh City and Da Nang City are moving forward with plans to establish regional and international financial centers. Ho Chi Minh City has allocated space in Thu Thiem New Urban Area for its financial hub, emphasizing infrastructure development, innovation, and resource mobilization. A local steering committee has been formed to implement the project, with plans to integrate financial services with technology and knowledge hubs. The city is consulting domestic and international experts to ensure the project aligns with global trends.

Danang has reserved over six hectares of land near the sea, with a total area of 50 hectares in Son Tra district, for its financial center. The city is attracting strategic investors to build infrastructure and support the center’s development. Additionally, Danang is preparing policies for immigration, international arbitration, and training human resources domestically and abroad. Both cities aim to create sustainable financial hubs, leveraging their unique geographic advantages and fostering innovation to attract global investors.

Binh Duong Secures US$1.7 Billion Early 2025

Binh Duong province attracted US$1.7 billion in investments in early 2025, comprising 20 domestic projects and three foreign-invested initiatives. Real estate dominated with 16 projects, including the US$158.3 million Quang Phuc 4 residential area and the US$154.1 million Binh My residential area. Infrastructure developments featured the US$45.8 million Ben Cat 2 transformer station and the US$41.6 million expanded Rach Bap industrial park. Foreign investments included Vista Investment’s US$10.5 million project and Farina Food’s US$7.08 million bicycle production initiative.

International corporations continue to prioritize Binh Duong as an investment destination. In late 2024, Manwah Group committed an additional US$50 million, while Japan’s IHI Group expressed interest in high-tech and green projects. Binh Duong surpassed Hanoi as Vietnam’s second-largest FDI recipient, with cumulative foreign investments exceeding US$42.4 billion. Supported by strategic policies, transparent governance, and advanced infrastructure, Binh Duong solidifies its reputation as a thriving industrial hub, attracting both global and domestic investors.

Conclusion

Vietnam’s strategic efforts in January 2025 highlight its resilience and visionary approach to economic progress. From agritech startups revolutionizing agriculture to Binh Duong securing billions in investments, the nation is establishing new standards for growth and sustainability. These achievements reflect Vietnam’s commitment to fostering innovation and embracing global trends to strengthen its economic foundations.

By leveraging international partnerships, forward-thinking policies, and cutting-edge technologies, Vietnam is positioning itself as a regional leader. Its ability to attract both domestic and foreign investments underscores the country’s potential to meet ambitious targets while driving prosperity for diverse stakeholders. These milestones solidify Vietnam’s reputation as a compelling and dynamic destination for long-term economic growth.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly