Entering the Vietnamese market offers immense potential for businesses across industries but before your product can hit the shelves, it must pass through the country’s regulatory gateway. Product registration in Vietnam is a mandatory process that ensures goods meet local safety, quality, and labeling standards. Whether you’re in healthcare, food and beverage, or consumer goods, understanding the registration requirements is key to avoiding costly delays and ensuring smooth market entry. In this guide, we’ll walk you through the essentials of product registration in Vietnam, with a closer look at high-regulation sectors like medical devices, health supplements, and packaged foods.

Investing in Vietnam? Check out InCorp Vietnam’s Product Registration Services

Vietnam’s Regulatory Landscape

The following commonly distributed goods require product registration before they can legally be sold within the Vietnamese consumer market:

- Food and Beverage: Processed and packaged foods, dietary supplements, alcoholic and non-alcoholic beverages

- Cosmetics: Skincare, hair care, personal care products

- Drugs and Pharmaceuticals: Medicine, health supplements, controlled substances

- Medical devices: equipment, tools, software, or chemicals intended for medical use

- Consumer electronics and electrical equipment: Consumer-grade appliances and electronics, IT equipment, AV equipment

Whereas most countries have one Food and Drug Administration (FDA) which monitors most regulated activities, Vietnam has three separate agencies. Each of these regulatory bodies oversees quality control and monitors consumer markets that fall under their jurisdiction:

- Vietnam Food Safety Authority (VFA)

- Drug Administration of Vietnam (DAV)

- Ministry of Health (MOH)

1. Medical Devices in Vietnam

Vietnam’s medical device market is on a strong growth trajectory, with revenues projected to reach US$1.77 billion in 2025, according to Statista. Among various segments, cardiology devices are expected to lead the market, generating an estimated US$292.99 million, making it the largest category.

Looking ahead, the market is forecasted to grow at a compound annual growth rate (CAGR) of 8.62% from 2025 to 2029, reaching approximately US$2.47 billion by the end of the period. This steady expansion is underpinned by increased healthcare spending, rising demand for advanced medical technologies, and ongoing efforts to modernize Vietnam’s healthcare infrastructure—creating strong opportunities for both local and foreign investors.

Key drivers behind this growth include:

- Aging Population: Vietnam’s healthcare system currently supports over 100 million people through a network of more than 1,300 hospitals and medical facilities. As the population ages, demand for healthcare services is expected to increase significantly. The proportion of citizens aged 60 is projected to reach 25% by 2050. This demographic shift signals a growing need for advanced medical care and equipment, especially as older adults represent the segment with the highest healthcare usage and spending potential.

- Rising Living Standards: Improvements in living conditions across both urban and rural areas are contributing to greater health awareness among consumers. As disposable incomes grow, individuals are increasingly willing to invest in quality healthcare products and medical technologies, creating stronger market demand for both diagnostic and treatment-focused devices.

- Supportive Government Policies: The Vietnamese government is actively prioritizing healthcare development through long-term strategies. One notable example is the National Strategy for Developing Vietnam’s Pharmaceutical Industry to 2030, with a Vision to 2045, approved in October 2023. The strategy aims to fulfill 80% of national pharmaceutical demand through domestic production, targeting 70% of market value by 2030.

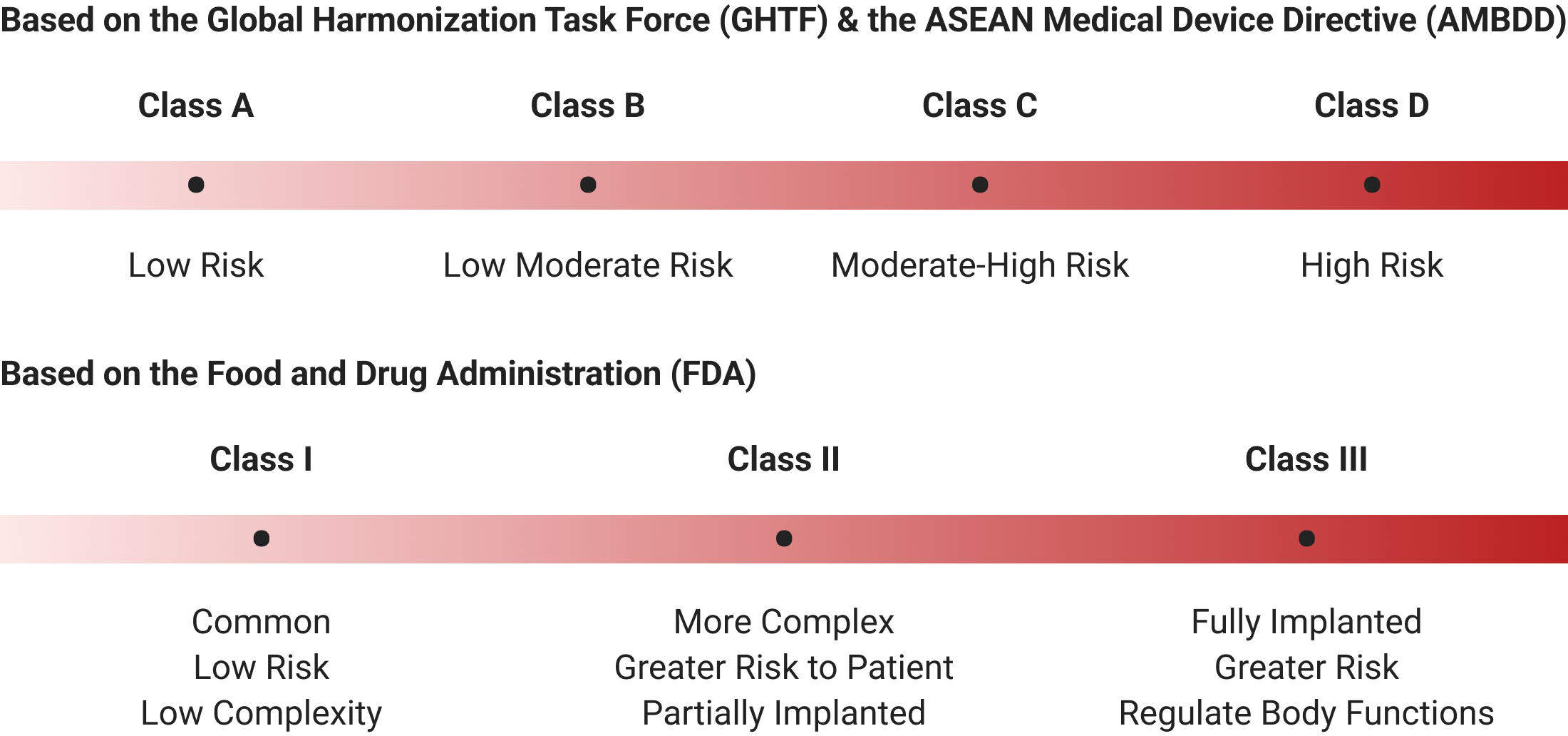

1.1. Device Classification

The classification is based on the perceived levels of potential risks associated with the design and manufacture of medical devices. There are distinct classes:

In the past, the determination of medical device risk classification in Vietnam was reliant on the assessment of a locally certified organization or individual. However, with the advent of new regulations, a significant shift has occurred in the classification process. Under the updated framework, the responsibility for classifying the risk level of a medical device now lies with the Registration Holder, who can include this classification as part of the overall application.

1.2. Registration Process

Foreign companies looking to enter Vietnam’s medical device market have three primary pathways to navigate the regulatory process, each with varying levels of control and commitment.

The first option is to establish a legal entity in Vietnam, which involves obtaining an Establishment License from the local Department of Planning and Investment. This route allows foreign businesses to directly manage product registration and conduct commercial activities within the country, offering full control over operations and long-term market presence.

Alternatively, companies may choose to partner with a local importer or distributor. In this model, the local partner is responsible for registering and commercializing the medical device. This is a practical solution for firms looking to avoid the complexities of setting up a local entity, though it does require a reliable and compliant partner with strong market knowledge.

A third option is to engage an independent third-party service provider that holds the necessary certifications to act on the company’s behalf. This party handles the end-to-end registration process and ensures compliance with Vietnamese regulations, offering a streamlined solution with minimal administrative burden for the foreign company.

Read More: A Comprehensive Overview of Medical Device Compliance in Vietnam

2. Food & Beverage Registration in Vietnam

According to the findings, by the end of 2024, the number of F&B outlets in Vietnam reached 323,010, marking a 1.8% rise compared to the previous year. Despite challenges in consumer spending, the F&B sector’s revenue is projected to reach approximately VND688.8 trillion ($27.3 billion), up 16.6% from 2023.

However, despite the overall industry growth, only 25.5% of the 4,005 surveyed F&B businesses reported stable revenue compared to 2023, with just 14.7% experiencing growth. Facing rising raw material costs, 49.2% of F&B businesses anticipate raising prices in 2025 to offset cost pressures.

Regarding customer behaviour, while overall consumer spending remains stable, purchasing behavior is evolving as consumers increasingly seek high-quality products at accessible price points. Dining out, particularly on weekends, continues to grow in popularity, with nearly 70% of surveyed consumers falling into the “occasional” or “regular” dining-out segments. This trend reflects a shift toward experience-driven consumption, especially in the food and beverage sector.

Among emerging preferences, Matcha beverages have taken the lead, identified by 29.6% of F&B businesses as a standout trend. Its blend of health appeal and premium positioning has made Matcha a key driver of innovation and menu development across cafes and restaurants in Vietnam.

Meanwhile, the previously booming trend of strong-flavored teas, such as oolong and Snowshan, appears to be reaching market saturation. The selection rate for this category dropped to 21.4%, suggesting that consumer interest may be shifting away from traditional premium tea offerings toward more contemporary, health-focused alternatives. For F&B operators, this signals an opportunity to recalibrate offerings to align with evolving tastes and value-conscious preferences.

Source: 2024 Vietnam Food and Beverage Market Report

Read More: Food & Beverage Industry in Vietnam: Market Overview and Investment Opportunities

2.1. Food Labeling

In Vietnam, the labeling of food products is a mandatory aspect of distribution and sale, with certain exceptions for specific types of items. Notably, unpacked raw food, unpacked fresh food, and certain processed foods may be exempt from this requirement. For all other food items, a comprehensive label is essential, incorporating at least the following key information: name of the food; name and address of the producer, importer and assembler; weight and volume; ingredients; the country of origin; instructions on storage and usage; production date & expiration date

2.2. Product Classification

In Vietnam, enterprises and individuals engaged in the production and sale of food possess the option to either self-declare the quality and origin of their products or undergo a formal registration process. Self-declaration signifies a commitment by companies to take full responsibility for the safety and hygiene of their food products. This involves making public announcements on their websites, multimedia platforms, or at their corporate offices, assuring consumers of the safety standards adhered to.

However, certain food items, by their nature, require a more formal declaration process. Companies intending to sell these specific food products must register for Product Declaration with the Ministry of Health before introducing them to the market. Article 6 of Decree 15/2018/ND-CP outlines the distinction between self-declaration and registration for declaration, providing clarity on which food products fall into each category.

| Self-declaration | Registration for declaration |

| * Processed and Prepackaged Food * Food Additives * Food Processing Aids *Food Containers * Packaging Materials in Direct Contact with Food | * Health Supplement or Dietary Supplement * Food for Special Medical Purposes or Medical Food * Food for Special Dietary Uses * Dietary products for children up to 36 months * Mixed food additives with new uses, food additives that are not on the list of allowed additives or are not for the right users, regulated by MOH. |

2.3. Registration process

1. Prepare Required Documents

Businesses must compile a registration dossier, which typically includes:

- Business License – Proof of company registration in Vietnam.

- Certificate of Free Sale (CFS) – Required for imported products, confirming legal sale in the country of origin.

- Product Composition & Labeling – Details of ingredients, nutritional content, and compliance with Vietnamese labeling standards.

- Testing Reports – Laboratory test results to verify compliance with food safety standards.

2. Submit Application to the Relevant Authority

3. Government Review and Evaluation

Authorities will assess the submitted documents and may request additional information or product testing. Approval timelines vary, but it typically takes 3 to 6 months for products requiring government review.

4. Receive Registration Certificate

Once approved, businesses will obtain a Product Declaration Certificate or a Health Certificate, allowing them to legally distribute the product in Vietnam.

3. Health Supplements

Foreign investors find a lucrative opportunity in Vietnam’s expanding healthcare and medical equipment market. The country’s substantial healthcare spending, exceeding US$17 billion in 2019 and constituting 6.6 % of the GDP, underscores its commitment to the sector. Projections from FitchSolutions estimate healthcare expenditure to reach US$23 billion in 2022, with an anticipated annual growth rate of approximately 10.7% from 2019 to 2024. Given the complexity of the process, having a trusted local guide with extensive experience in product registration becomes invaluable.

3.1. Product Classification

Health supplements, also known as dietary or food supplements, play a vital role in enhancing health and boosting immunity. These products, designed to improve well-being, can take various forms, including pills, tablets, capsules, powders, liquids, and granules.

Aligned with their purpose, health supplements typically contain a range of substances, which can be singular or a combination of vitamins, amino acids, minerals, enzymes, fatty acids, probiotics, and other biologically active substances. Moreover, health supplements may include substances derived from minerals, plants, and animals in the form of extracts, concentrates, isolates, or metabolites.

3.2. Registration Process

For producers and distributors aiming to enter the Vietnamese market with health supplements, the registration process involves the submission of either product self-declaration or product declaration registration to the Ministry of Health (MOH). The application dossier should encompass several key documents, ensuring regulatory compliance with legal standards. These documents include:

- Certificate of Free Sale or Health Certificate

- Licenses of a Vietnamese importer consisting of:

- Investment registration certificate (IRC)

- Enterprise registration certificate (ERC)

- Product samples

- Product label

- Certificate of Good Manufacturing Practices (GMP)

Read Related: Navigating Health Supplement Registration Process in Vietnam with Confidence

Conclusion

In the complex realm of product registration in Vietnam, foreign investors face both challenges and opportunities. Understanding and adhering to the regulatory framework is paramount for successful market entry.

As Vietnam’s market continues to evolve, investors can capitalize on the country’s economic growth and burgeoning consumer demands. A strategic and informed approach to product registration ensures not only compliance with regulations but also positions investors to contribute to and benefit from Vietnam’s dynamic marketplace.

In essence, by embracing the intricacies of the application process, foreign investors can pave the way for successful ventures and meaningful contributions to Vietnam’s growing and diverse economy.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How can I register my products?

- To register your products in Vietnam, you must comply with the regulations of the relevant government authority based on your product type. For example, food products require registration with the Vietnam Food Administration (VFA), while cosmetics must be notified through the Drug Administration of Vietnam (DAV). The process typically involves submitting product information, labeling, safety documentation, and test results. Once approved, you receive a registration number or acknowledgment for legal distribution.

What is an example of registration?

- An example of registration is obtaining a Business Registration Certificate (BRC) from the Department of Planning and Investment (DPI) when establishing a company in Vietnam. This process includes submitting necessary documents such as the application form, charter, and investor identification to formally register the company's legal existence.

![The Ultimate Guide to Product Registration in Vietnam [Update in 2025]](https://vietnam.incorp.asia/wp-content/uploads/2024/02/Product-Registration-in-Vietnam-1024x576.png)