In the realm of conducting business within Vietnam, foreign enterprises find themselves standing at the crossroads of a thriving market brimming with opportunities. Vietnam, with its burgeoning economy, investor-friendly policies, and vibrant, youthful workforce, has emerged as a magnet for businesses seeking both growth and venture capital opportunities.

In the ensuing segments of this article, we will delve into the requisites of capital, delve into considerations surrounding business sizes, and unravel the multifaceted role that venture capital plays within Vietnam’s business ecosystem. These insights are poised to be instrumental for foreign entities navigating the captivating yet complex landscape of the Vietnamese business sphere.

Investing in Vietnam? Find out InCorp Vietnam’s Incorporation Services

Minimum Capital Requirements to Set up a Company in Vietnam

One of the intriguing facets of setting up a company in Vietnam is the absence of a mandatory minimum capital threshold. This singular factor gives rise to a broad spectrum of possibilities for aspiring entrepreneurs venturing into Vietnam. As per the stipulations of the Enterprise Law, the charter capital must be fully paid within ninety days, after obtaining the business registration certificate.

When navigating the Vietnamese market, a foreign company typically adheres to a standard paid-up capital of around VND 230 million, which is approximately US$ 10,000. However, for smaller enterprises, a modest capital injection of as low as VND 69 million (equivalent to US$ 3,000) can suffice.

Given the absence of a fixed minimum benchmark, the precise capital requirement hinges on the specific nature of the enterprise in question. Vietnam hosts conditional business sectors that enforce a specific minimum capital criterion. For instance, a fully foreign-owned real estate enterprise is mandated to maintain a minimum capital of VND 20 billion (approximately US$878,499). Similarly, legal capital for mutual insurance organizations must not fall below VND 10 billion (about US$439,000).

Similarly, for a limited liability company, the minimum capital is US$10,000, depending on the area of activity, and the shareholder liability is limited to the capital contribution. As for a joint-stock company, a minimum capital of VND 10 billion (approx. US$439,356) is required if trading on the stock market and the shareholder liability is limited to the capital contribution. On the other hand, for both representative offices and branches, there is no minimum capital requirement and the shareholder liability is unlimited.

The Department of Planning and Investment dictates the minimum capital imperative based on the degree of capital intensity associated with the business domain. For industries and manufacturing entities operating on a larger scale, the requisite capital amount naturally escalates. Nevertheless, the capital requirement can be relatively modest for businesses with minimal investment prerequisites.

Yet, when it comes to ratifying businesses with lower capital amounts during the incorporation process, the discretion largely rests with the Department of Planning and Investment. Therefore, it is prudent to prepare to allocate at least US$10,000. It’s worth noting that certain sectors do impose a minimum capital prerequisite. Such sectors include banking, insurance, and the broader finance industry, including the realm of fintech.

Business Size based on Level of Capital

Establishments with substantial capital and resources constitute large-scale businesses. This abundance enables them to achieve superior economies of scale, leading to enhanced operational efficiency. Substantial resources also make up for a robust market presence, granting an edge during negotiations with both suppliers and customers.

From an economic standpoint, large enterprises contribute significantly to output and employment. Their impact on the economy is amplified when they extend their operations to the financial sector.

For instance, banks grow in significance, upon expansion. Their pivotal role in propelling the economy is exemplified by their function as lending facilitators. Consequently, the failure of a major bank holds the potential to have rippling effects on the entire economy. Hence, governments commonly resort to bailout measures to avert substantial bank collapses. Moreover, the size of a business is often factored in, when stakeholders are making economic decisions concerning a company.

Micro Company in Vietnam

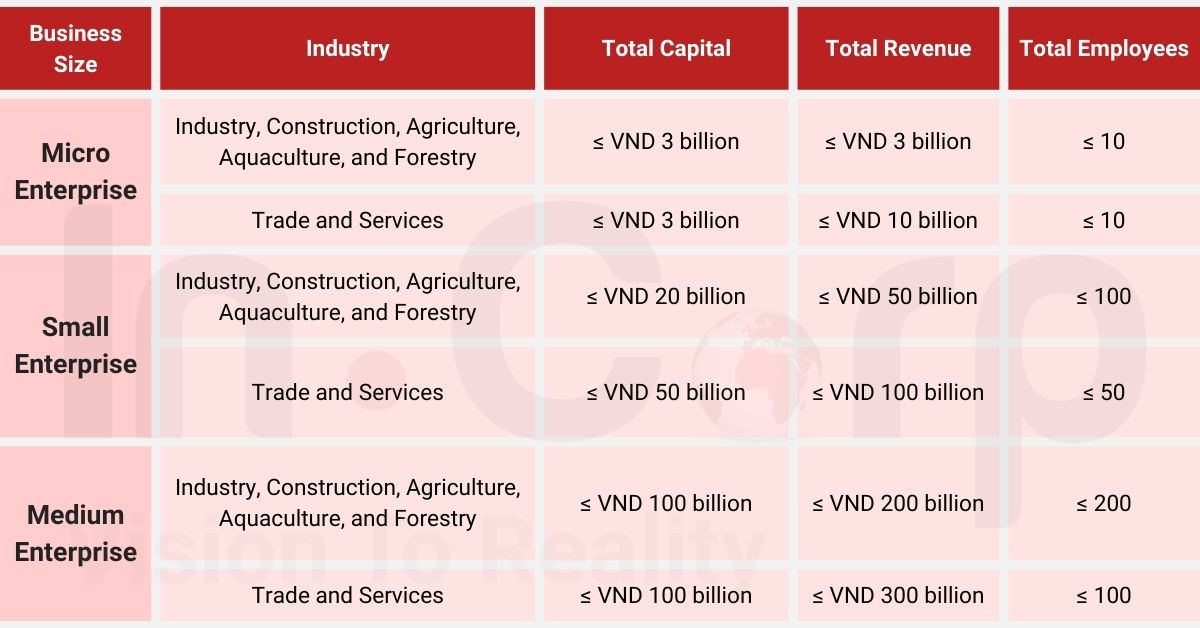

The qualification of a micro company is determined by a set of criteria including the industry of operation, the aggregate count of employees covered by social insurance, total capital, and the revenue recorded in the preceding year.

- Industry, Construction, Agriculture, Aquaculture, and Forestry: the workforce is fewer than 10 employees and the required capital as well as the total revenue do not exceed VND 3 billion;

- Trade and Services: the workforce is fewer than 10 employees and the required capital does not surpass VND 3 billion. But the total revenue is no more than VND 10 billion.

Small Company in Vietnam

The classification of small companies in Vietnam hinges on various factors including business domain, total capital, previous year’s revenue, and the number of employees participating in social insurance.

- Industry, Construction, Agriculture, Aquaculture, and Forestry: the qualification entails having fewer than 100 employees, total capital not exceeding VND 20 billion, and a total revenue within VND 50 billion from the preceding year;

- Trade and Services: meeting the criteria involves having less than 50 employees, total capital not surpassing VND 50 billion, and total revenue of up to VND 100 billion from the previous year.

Medium Company in Vietnam

To qualify as a medium company in Vietnam, specific criteria must be met regarding total capital, the total revenue in the preceding year, and the annual average number of employees participating in social insurance. This designation applies to businesses engaged in agriculture, forestry, industry and construction, and aquaculture.

For a company to be classified as a medium enterprise in Vietnam, it should employ less than 200 individuals, possess total capital not exceeding VND 100 billion, and have a total revenue for the previous year not surpassing VND 200 billion.

The method to calculate the annual average total employees involves dividing the overall count of employees engaged in social insurance by 12 months. In instances where a company has been established for less than 12 months, the employee count is divided by the actual months of operation.

Concerning total capital and total revenue, when a company’s operational span is less than a year, the values are derived from the closest balance sheet of the preceding quarter that corresponds to the time of company registration.

Large Company in Vietnam

The classification of businesses differs between countries and institutions and the metrics for such classification may also differ. For a large company, the categorization is based on metrics, as depicted below:

| The Central Statistics Agency, Indonesia | 100 or more workers |

| The Organization for Economic Cooperation and Development (OECD) | More than 250 employees |

| The European Commission | 250 people or more and have an annual turnover of over €50 million |

| The Small Business Administration (SBA), USA | over US$1 billion in revenue and over 2,000 employees |

However, based on Decree 80/2021/ND-CP in Vietnam, although there are no explicit criteria for categorizing businesses as “large-scale”, it is possible to establish that micro-enterprises, small businesses, and medium-sized enterprises do not fall into the category of large enterprises.

More specifically, in the fields of agriculture, forestry, fisheries, as well as industrial and construction sectors, a business is classified as “large” when it employs an annual average of 201 or more workers who participate in social insurance and records an annual total revenue exceeding VND 200 billion or an annual total capital exceeding VND 100 billion.

In the realm of trade and services, a business is deemed “large” if it employs an annual average of 101 or more workers who participate in social insurance and generates an annual total revenue surpassing VND 300 billion or an annual total capital exceeding VND 100 billion.

Read More: Doing Business in Vietnam: 4 Types of Business Investors Should Know

Venture Capital of Foreign Business in Vietnam

Situation of Venture Capital in Vietnam

Foreign businesses seeking venture capital in Vietnam are entering a dynamic landscape. The country has rapidly emerged as Southeast Asia’s standout startup hub, drawing attention for its vibrant ecosystem and substantial investment potential. This fertile ground for entrepreneurial growth has positioned Vietnam as a prominent destination for investment activity.

Vietnam is also often referred to as the “rising star” of Southeast Asia. The country’s startup ecosystem is the reason behind the rapid growth of entrepreneurial prospects, driving innovation and fostering expansion. Notably, Vietnamese early-stage enterprises witnessed a historic surge in investments from global venture capital firms in 2021, amassing over US$1.4 billion through 165 deals. This trend is set to persist in 2023, accompanied by a projected 6.7% increase in the country’s gross domestic product (GDP).

This favorable environment has attracted not only substantial foreign venture capital but also nurtured the emergence of local investment solution providers. These indigenous stakeholders are equipped to support and finance startups, providing growth opportunities to them. At the same time, these local players also help in the establishment of dedicated funds to propel innovation across pivotal sectors like FinTech, EdTech, and e-commerce.

For those poised to seize the next breakthrough, our comprehensive guide to Vietnam’s leading venture capital firms offers the roadmap to funding and scaling ambitious ideas. These firms are pivotal in driving innovation and fostering high-growth potential for local entrepreneurs in this ever-growing landscape.

The Top Venture Capital Firms in Vietnam

500 Vietnam

Driving the momentum of Vietnam’s startup scene, 500 Vietnam stands as a potent force in the investment landscape. A dedicated arm of 500 Global, it has emerged as one of the foremost venture capitalists in the country, renowned for its adept deployment of resources and funds to cultivate the growth of nascent enterprises. With a prolific track record, 500 Vietnam has become a focal point of support for growing companies.

At the heart of the firm’s strategy lies a keen interest in early-stage startups that specialize in technology-driven distribution models. This focus extends across a diverse spectrum, encompassing domains such as FinTech, HealthTech, media, entertainment, and AgriTech. The firm’s portfolio consists of more than 70 enterprises globally.

ThinkZone Ventures

Emerging from the vibrant city of Hanoi, ThinkZone Ventures stands as a prominent figure in Vietnam’s investment domain. Established through a collaborative effort of esteemed homegrown conglomerates such as IPA Investment Corporation, Phu Thai Holdings, and Stavian Group, ThinkZone Ventures has carved its name into the country’s investment landscape.

ThinkZone Ventures offers financial support and valuable mentorship for nascent startups. The firm’s diverse investment portfolio spans a spectrum of competitive sectors, encompassing retail, advertising, marketing technology, software, and beyond.

Dragon Capital

Dragon Capital began its operations in 1994 with a modest capital of USD 16 million and a team of eight people. It then steadily evolved into Vietnam’s longest-standing independent asset management firm. It specializes in an array of sectors including listed equities, fixed incomes, clean tech, and properties, catering to a global clientele of international sovereign wealth funds, pension funds, and endowments.

A remarkable feat in Vietnam’s financial landscape, Dragon Capital holds the distinction of establishing the nation’s inaugural domestic asset management firm.

Mekong Capital

Mekong Capital, a trailblazer in the Vietnamese venture capital arena, possesses a keen acumen for nurturing growth-stage enterprises. The firm has achieved remarkable success in customer-centric businesses across diverse sectors. These include retail, healthcare, pharmaceuticals, food and beverage, and finance.

Its launch of the Mekong Enterprise Fund IV, propelled Vietnamese companies into accelerated market expansion, providing them with enhanced exposure opportunities.

Patamar Capital

Patamar Capital, a prominent venture capital firm with a Southeast Asia focus, distinguishes itself by cultivating a vibrant network of influential founders and entrepreneurs. The firm’s mission is rooted in unlocking economic potential for marginalized communities by directing investments toward socially conscious enterprises.

The firm is dedicated to fostering equitable opportunities and generating favorable impacts in sectors such as health, education, finance, agriculture, etc. Notably, Patamar Capital has aligned with Golden Gate Ventures in a recent commitment of US$1.5 billion, signifying a robust investment drive to nurture startup innovation and foster growth within the country.

Conclusion

In the dynamic landscape of business in Vietnam, understanding the interplay between business size, capital requirements, and venture capital is paramount for foreign companies seeking to establish themselves here. As businesses vary in size and scope, Vietnam’s criteria for micro, small, and medium enterprises are intricately designed to reflect the diverse sectors they operate in.

Furthermore, the flourishing venture capital scene in Vietnam offers a wealth of opportunities for startups and businesses to secure the necessary funding for growth and innovation. The venture capital firms available in Vietnam not only infuse capital but also provide mentorship and support, elevating startups to new heights of success.

As Vietnam continues to attract global attention, the synergistic interplay of these elements will undoubtedly shape the trajectory of business ventures, fostering innovation, growth, and prosperity in the Vietnamese market.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly