Vietnam has become a key destination for foreign investment, where understanding labor regulations is crucial for success. The New Labor Code, effective since January 2021, introduced significant changes to the previous 2012 framework. A fundamental requirement for businesses in Vietnam, both local and foreign, is the establishment of formal labor contracts, with penalties of up to US$781.71 for non-compliance. These contracts are essential for defining the rights and responsibilities of both employers and employees. Given these strict procedures and frequent updates, many foreign companies rely on local payroll services to manage contracts, timekeeping, social insurance, and PIT filings accurately.

Foreign investors often face challenges with employee terminations in Vietnam due to the country’s labor laws, which prioritize employee protection. These laws require businesses to follow strict procedures when executing terminations to avoid legal issues. The 2021 Labor Code underscores Vietnam’s commitment to enhancing employment regulations while safeguarding workers’ rights. These revisions have impacted HR and payroll practices for foreign companies, establishing a framework that fosters equality and mutual benefits for the government, employees, and employers.

For foreign businesses, mastering these regulations extends beyond mere compliance – it forms an essential element of establishing lasting operations in Vietnam’s market.

Vietnam Labor Code in 2025: Key Updates & Compliance

In 2025, employers and employees in Vietnam must be aware of several updates to the country’s labor laws. These changes affect various aspects of employment, including trade unions, retirement age, contracts, and more.

Key Updates to Vietnam’s Labor Laws:

- Trade Union Law: Vietnam’s New Trade Union Law will take effect on July 1, 2025. It is expected to enhance the rights of foreign workers in Vietnam, especially by allowing them to join trade unions. The revised law consists of 37 articles and stipulates the rights of employees to establish, join, and operate trade unions.

- Retirement Age: The retirement age is gradually increasing to 62 for men by 2028 and 60 for women by 2035.

- Employment Contracts:

- Permitted contract types include fixed-term contracts (up to 36 months) or indefinite-term contracts.

- Contracts for specific tasks and seasonal work are not permitted.

- E-contracts are officially recognized with the same validity as written contracts, provided they are accessible and remain unchanged after execution.

- Overtime: The monthly overtime cap has increased from 30 to 40 hours per employee. In certain cases, an employee may work up to 300 hours of overtime. The normal workweek remains at 48 hours.

- Worker Representation: Employees have the right to establish an independent representative organization, which may or may not be affiliated with the Viet Nam General Confederation of Labour (VGCL).

- Labor Code Coverage: The Labor Code’s coverage has been expanded to include those working without written employment contracts.

- Termination of Employment: Employers can unilaterally terminate an employee who has reached the normal retirement age or is absent for five consecutive workdays without a proper reason.

- Foreign Workers: Foreign workers must be 18+, have professional qualifications and work experience, and be healthy. They must generally hold a work permit unless an exemption applies.

- Disciplinary Actions: Employers should be aware of key aspects such as conditions for applying disciplinary actions.

Read Related: HR Outsourcing in Vietnam: Optimizing Operations for Business Success

Compliance Considerations for Employers:

- Employers must follow the Labor Code provisions, which contain the legal framework for the rights and obligations of employers and employees.

- Ensure compliance with regulations regarding working hours, labor agreements, social insurance, overtime, and termination of employment contracts.

- Review all employment-related documentation, including labor contracts, internal labor rules, codes of conduct, and other internal policies, to ensure they align with the New Labor Code.

- Understand the procedures and regulations for fair and lawful termination of employment contracts.

- Be aware of the legal framework governing labor relations and disputes, primarily the Labor Code, 2019.

- Understand the rights and obligations of employers and employees and the procedures for resolving disputes.

- Prevent gender discrimination and sexual harassment at work. Employers are required to ensure equal pay for work of equal value without discrimination based on sex and provide maternity protection.

- Consult with workers’ representative organizations.

Read Related: Minimum Wage in Vietnam: July 2024 Increase Keeps Vietnam Among the Most Affordable for Business

Overview of Vietnam’s Labor Code

Vietnam continues to refine its labor laws and policies as it strengthens its position in international business. The amended Labor Code, which took effect in January 2021, marks a significant step toward meeting international labor standards—a progress recognized by the International Labor Organization (ILO). This advancement demonstrates Vietnam’s dedication to improving its workforce regulations as it further establishes itself in the global economy.

Companies operating in Vietnam must adhere to the Labor Code, which provides the legal framework for employer-employee relationships. The code governs essential aspects of employment, including working hours, labor agreements, social insurance provisions, overtime regulations, strike procedures, and employment contract termination terms.

Employers must understand several critical requirements when hiring staff in Vietnam. These include establishing and managing employee-employer contracts, implementing severance packages and related payments, and administering bonuses. The code also specifies requirements for allowances and benefits, retirement provisions, and the protection of employees’ data.

The Labor Code in Vietnam goes beyond basic requirements to include provisions that standardize employment practices across all sectors, ensuring protection for both employers and employees while promoting sustainable business practices. For foreign companies operating in Vietnam, understanding and adhering to these regulations is crucial for maintaining compliance and fostering positive employer-employee relationships.

Significant Improvements to the Vietnam Labor Code 2019

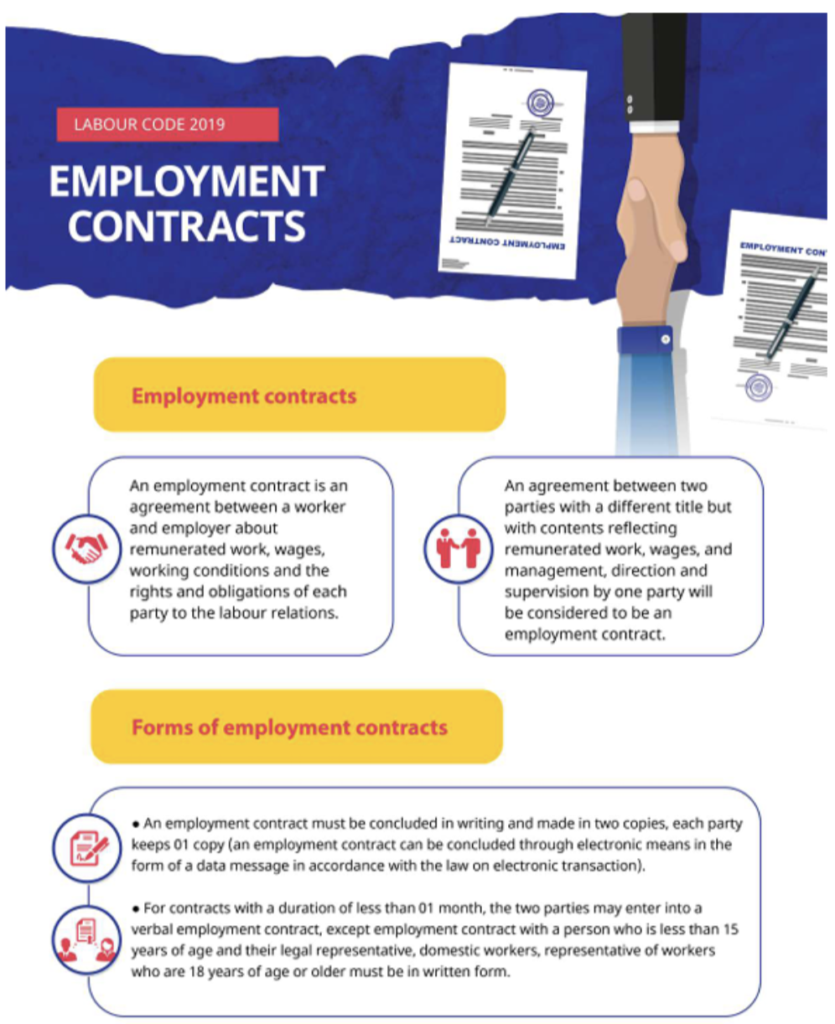

1. Labor Contract Reforms

- Introduction of e-contracts with equal validity to written contracts

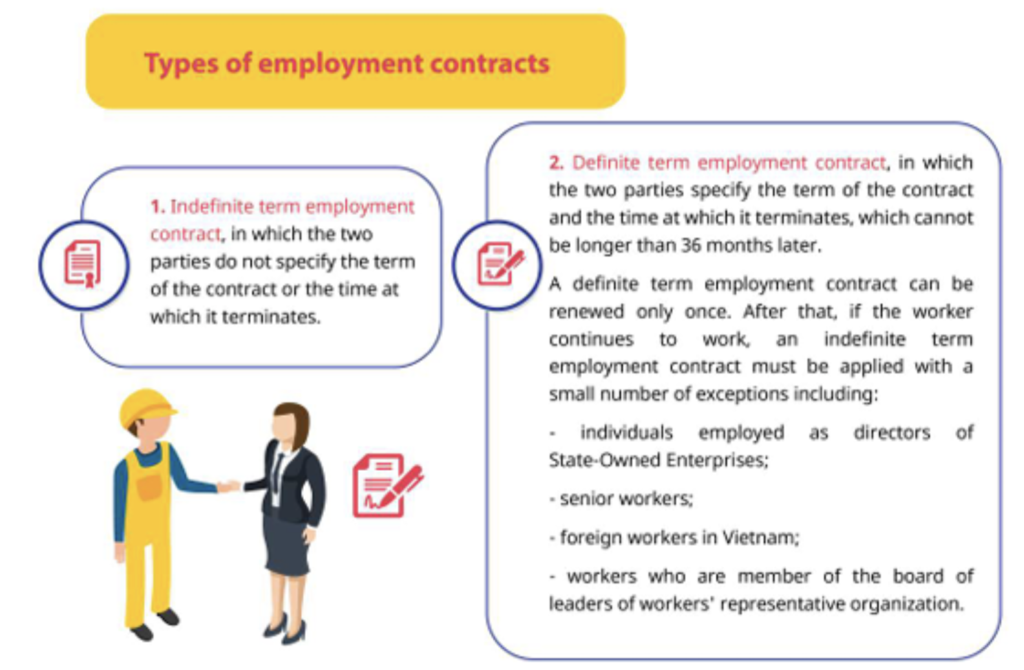

- Simplified contract types to just two categories:

- Definite-term contract (maximum 36 months)

- Indefinite-term contract

- Elimination of seasonal/temporary contracts

- Oral contracts are permitted for terms of less than 1 month

- Recognition of employment agreements under different names if they contain core employment elements

2. Probation Period Guidelines

- No probation for contracts less than 1 month

- Maximum probation periods based on position:

- 180 days for enterprise executives

- 60 days for positions requiring a junior college degree or higher

- 30 days for technical/skilled positions

- 6 working days for other jobs

- Only one probation period is permitted per job position

3. Contract Termination Rights

Employee Termination Rights

- Employees can terminate contracts without cause with proper notice:

- 45 days for indefinite-term contracts

- 30 days for definite-term contracts (12-36 months)

- 3 days for contracts less than one year

- Immediate termination is permitted in cases of mistreatment, sexual harassment, or non-payment

Employer Termination Rights

New grounds for unilateral termination:

- Five consecutive days of unexplained absence

- Employee reaching legal retirement age

- False information provision by employee

- Repeated failure to meet performance criteria

- Extended illness periods:

- 12 consecutive months for indefinite-term contracts

- 6 consecutive months for 12-36 month contracts

- Half the contract duration for contracts under 12 months

4. Working Hours and Overtime

- Standard working week: 48 hours

- Maximum daily working hours: 8 hours

- Overtime limitations:

- 12 hours per day maximum

- 40 hours per month (increased from 30)

- 200 hours per year

- Special exception of 300 hours for specific industries (textile, garments, electronics)

5. Public Holidays

- Increase to 11 days annually (from 10)

- Additional day added to National Independence Holiday

- Holiday breakdown:

- Lunar New Year: 5 days

- Hung Kings’ Death Anniversary: 1 day

- Victory Day: 1 day

- International Labor Day: 1 day

- Independence Day: 2 days

- International New Year’s Day: 1 day

6. Foreign Worker Regulations

- Work permit validity: 2 years

- A one-time extension allowed for 2 additional years

- Maximum total duration: 4 years

- Foreign currency payment permitted for foreign employees

7. Salary and Payment Reforms

- Mandatory payslip provision

- Employer responsibility for bank transfer and account opening costs

- Authorization options for salary collection

- Clear specification of salary components, deductions, and overtime pay

8. Retirement Age Adjustments

- Men: Gradual increase from 60 to 62 by 2028

- Women: Gradual increase from 55 to 60 by 2035

Read More: Vietnam HR & Payroll: Labor Laws, Payroll Processes, and HR Planning For SMEs

Challenges in Implementing Vietnam’s New Labor Code

Regulatory Gaps and Implementation Issues

The implementation of Vietnam’s New Labor Code faces several significant challenges despite the government’s introduction of key decrees. While Decree 145 on employment conditions and Implementation Decree 135 on retirement age have been announced, crucial regulatory components remain absent.

Most notably, there is no established mandate for registering employees’ representative organizations, and comprehensive regulations governing collective bargaining are still pending. These regulatory gaps create substantial obstacles that prevent both employees and employers from fully realizing the benefits intended by the 2019 Labor Code.

Impact on Workplace Relations

The absence of essential implementation decrees has created uncertainty in workplace relations. Without clear guidelines for employee representation and collective bargaining, workers face difficulties in exercising their newly granted rights effectively. This regulatory vacuum affects not only the day-to-day operations of businesses but also the broader goal of improving labor relations in Vietnam. The situation is particularly challenging for organizations attempting to adapt their internal policies to comply with the new code while lacking clear implementation frameworks.

Need for Support Systems

To address these challenges, there is an urgent need for authorities to develop and implement proper legal tools and support systems. These mechanisms should enable workers to proactively engage with the new labor code provisions while ensuring their rights remain protected. Employers require clear guidance on compliance requirements and practical implementation strategies to effectively adapt their operations to the new regulatory environment.

Looking for HR & Payroll support in Vietnam? Explore Payroll Services in Vietnam

Path Forward

The successful implementation of the 2019 Labor Code requires a coordinated effort from regulatory authorities, employers, and worker representatives. This includes developing comprehensive implementation guidelines, establishing clear procedures for collective bargaining, and creating effective mechanisms for protecting workers’ rights. Regular review and updates of supporting regulations will be essential to address emerging challenges and ensure that the labor code achieves its intended objectives of improving working conditions and labor relations in Vietnam.

The Importance of Vietnam’s Labor Code 2019 Compliance

International Alignment and Economic Vision

The Vietnamese government’s introduction of the New Labor Code in 2019 represents a pivotal strategic initiative designed to align the country’s labor practices with international standards. By implementing these comprehensive reforms, Vietnam aims to position itself as a competitive and attractive destination for global trade and investment. The labor code serves as a critical mechanism for the country to meet the sophisticated requirements of international free trade agreements, signaling a commitment to modernizing its regulatory framework and creating a more transparent, equitable workplace environment.

Balanced Protection for Employers and Employees

Compliance with the 2019 Labor Code is not merely a legal obligation but a fundamental aspect of sustainable business operations in Vietnam. The code establishes a delicate balance of protections and responsibilities for both employers and employees, creating a structured framework that promotes fair workplace practices. For businesses, adherence to these regulations is essential not only for legal protection but also for maintaining operational integrity and building trust with workers, stakeholders, and international partners.

Legal and Operational Consequences

Failure to comply with the new labor code can have severe and far-reaching consequences for businesses operating in Vietnam. Non-compliance potentially renders legal protections inaccessible during disputes, leaving organizations vulnerable to significant financial and reputational risks. Moreover, businesses that do not align their practices with the new regulations may face penalties, increased scrutiny from regulatory bodies, and potential limitations in accessing market opportunities.

Strategic Compliance as a Competitive Advantage

Forward-thinking organizations recognize that compliance with the Vietnam Labor Code 2019 extends beyond mere legal adherence. By proactively implementing these regulations, businesses can differentiate themselves as responsible, modern employers. This approach not only mitigates legal risks but also enhances organizational reputation, attracts top talent, and demonstrates a commitment to ethical business practices in an increasingly competitive global marketplace.

Labor Contracts in Vietnam – Compliance & Termination

Labor contracts in Vietnam are critical legal documents that establish the employment relationship between employers and employees. These contracts must comprehensively outline the terms of employment while adhering to Vietnamese labor regulations. Vietnam recognizes two primary contract categories:

Indefinite-Term Contracts: These agreements continue without a predetermined end date, remaining in effect until either party chooses to terminate the employment relationship.

Fixed-Term Contracts: These have a specific duration, with a clearly defined start and end date, automatically expiring once the designated period concludes.

Important Elements in a Labor Contract

Every labor contract in Vietnam must systematically address several key provisions to ensure legal compliance and clarity:

Scope of Work: A detailed description of the employee’s specific duties, responsibilities, and expected job performance. This section provides a clear understanding of the role’s expectations and boundaries.

Working Conditions: Comprehensive details about work schedules, including regular hours, potential overtime, and rest periods. This ensures transparency regarding time commitments and compensation.

Compensation Structure: A precise breakdown of wages, including base salary, potential bonuses, and any additional financial considerations. The contract must explicitly state the payment terms and frequency.

Workplace Location: The specific site or sites where the employee will perform their professional duties. This helps avoid potential misunderstandings about work expectations.

Contract Duration: For fixed-term contracts, the exact start and end dates must be clearly specified. This provides certainty for both employer and employee.

Occupational Safety Provisions: Detailed information about workplace safety standards, hygiene conditions, and protective measures. This demonstrates the employer’s commitment to employee well-being.

Social Insurance Details: Comprehensive information about the state-provided social insurance coverage, including benefits related to sickness, maternity, retirement, and potential death benefits.

Additional Considerations:

While drafting a labor contract in Vietnam, employers should note some unique specifications:

- Temporary contracts are defined as employment agreements lasting less than three months.

- Domestic helpers are an exception and do not require a written contract.

- Contracts must be primarily drafted in Vietnamese, though bilingual versions are permissible.

- Work permit information should be included for foreign employees.

To protect both employer and employee interests, the contract should be:

- Written and easily understood

- Comprehensive in addressing potential workplace scenarios

- Aligned with current Vietnamese labor regulations

- Signed by both parties after a thorough review

Termination & Amendment of Labour Contract

Vietnamese labor law outlines several circumstances that can lead to the termination of a labor contract. These include the contract’s expiration, project completion, mutual agreement, the employee reaching retirement age, the employee’s death or imprisonment, or if the employee is deemed incapable of acting civilly.

Company restructuring, such as acquisitions, mergers, divisions, or consolidations due to economic conditions, can also necessitate layoffs. Both employers and employees have the right to terminate a contract unilaterally, but specific regulations and notice periods apply.

Unilateral Termination and Notice Periods

Unilateral termination requires careful attention, especially for employers seeking to maintain a stable workforce. Both parties must provide advance written notice of termination, with the length of notice varying based on the type of contract.

For indefinite-term contracts, 45 days notice is required; for fixed-term contracts, it is 30 days; and for seasonal or specific job contracts under 12 months, it is 3 days. Employers must ensure all payments, including severance and unemployment benefits, are made within 7 days of the employee’s official unemployment date.

Severance Pay Eligibility and Calculation

Severance pay is a crucial aspect of termination. Employees with at least 12 months of service are typically eligible for severance pay if the termination is not due to disciplinary reasons. The amount is calculated based on the employee’s average salary over the previous six months and their length of service, with the formula being half a month’s salary multiplied by the number of years worked. The calculation of the employee’s wage considers payments from the previous six months, and social insurance payments may be deducted from the severance.

Legal Framework for Contract Termination

The 2019 Labor Code provides a comprehensive framework for contract termination, detailing conditions and procedures. While termination can occur through mutual agreement, expiration, or completion of work, unilateral termination by either party is also permitted under specific conditions. Employers can unilaterally terminate for reasons such as repeated failure to perform work, prolonged illness or injury, economic or force majeure-related reductions in production, or reaching retirement age. Employees can unilaterally terminate for any reason, provided they adhere to the notice periods. Certain situations, like severe mistreatment or danger to health and safety, allow for immediate termination without notice.

Payment and Procedures Upon Termination

Upon termination, employers must pay all outstanding salaries, unused leave, and other owed benefits within 14 working days, though this can be extended up to 30 days in special circumstances. Employers are also responsible for handling social insurance procedures and providing necessary documents to the employee.

Contractual Terms and Amendments

Labor contracts should clearly define termination and amendment conditions. Employers must follow specific procedures, including issuing warning letters and providing advance notice, to avoid wrongful termination claims, which can result in penalties like paying the employee two months’ salary. Any contract amendments must be in writing and signed by both parties.

Social Insurance, Taxes, and Dispute Resolution

Both employers and employees contribute to social insurance, which covers various benefits like sick leave, maternity leave, work accidents, and pensions. Personal income tax is also a statutory requirement, with employers withholding and paying taxes on behalf of employees.

For contracts longer than three months, employers contribute to social insurance allowances. For shorter contracts, the salary covers social insurance, and employees are responsible for payments. Employees with at least 12 months of service are entitled to severance pay, typically within 7 days of termination. Labor dispute resolution mechanisms exist, including labor conciliation councils within companies and the option to take cases to court.

Comparison with International Standards about Labor Law

Vietnam’s increasing integration into the global economy has driven consistent revisions and updates to its labor laws for foreigners, aiming to align with international labor standards. A significant step in this direction was the enactment of an amended Labor Code in January 2021, which has been recognized by the International Labor Organization (ILO) as a move toward greater alignment with these standards.

Impact of Trade Agreements

Global trade agreements, particularly the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the European Union-Vietnam Free Trade Agreement (EVFTA), have exerted considerable influence on the enforcement and compliance of labor laws within Vietnam. These agreements necessitate Vietnam’s adherence to standards established by the ILO.

Read More: The Definitive Guide to Vietnam’s 17 Active Free Trade Agreements – FTAs

Complexities of Enforcement

The influence of these global trade agreements on labor law compliance and enforcement, however, is a multifaceted issue, with diverse perspectives on their actual effectiveness in promoting and safeguarding workers’ rights. Some argue that international labor standards and trade agreements play a crucial role in maintaining a level playing field in the global economy, preventing a decline in labor standards driven by competitive pressures. Conversely, others express concerns regarding the enforcement mechanisms in place and question the overall effectiveness of these agreements in truly protecting the rights of workers.

How Can InCorp Vietnam Assist?

InCorp Vietnam offers comprehensive assistance with labor contracts in Vietnam, from drafting to ensuring compliance. Their labor contract drafting services meticulously detail the rights and responsibilities of both employers and employees. A team of experienced legal experts ensures the delivered contract is reliable, accurate, and effective, helping businesses avoid potential employment issues. Beyond drafting, InCorp Vietnam also provides legal contract review and comprehensive advice, safeguarding client rights before contract execution.

For businesses seeking to ensure labor compliance and alleviate HR burdens, InCorp Vietnam offers expertise in navigating the complexities of the Vietnamese Labor Code. As a leading provider of recruitment, staffing, and HR solutions, InCorp Vietnam’s certified business specialists and legal experts can manage time-consuming and challenging HR tasks, allowing businesses to focus on growth. As a professional legal and business services firm, InCorp Vietnam delivers customized solutions to international and local clients alike. Their agile and expert team of consultants works efficiently and cost-effectively, maintaining high-quality service. Specializing in corporate law, including the Vietnam Labor Code, InCorp Vietnam can handle even the most complex legal issues and business transactions.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What are the labor laws in Vietnam?

- Vietnam's labor laws are governed by the 2019 Labor Code (effective January 1, 2021), which regulates employment contracts, working hours, rest periods, wages, and employee rights. Standard working hours are 8 hours per day and 48 hours per week, with overtime limited to 40 hours per month. Employers must sign written contracts with employees and provide benefits such as social insurance, health insurance, and unemployment insurance. The law also includes provisions on termination procedures, trade union rights, and workplace safety standards.