According to Jack Nguyen, CEO of InCorp Vietnam: ‘Running a business in Vietnam means juggling multiple taxes and stringent filing obligations. For SMEs and startups, the key taxes—VAT, CIT, PIT, SCT, and FCT—each come with strict declaration and payment deadlines, and missing those dates can incur steep tax penalties.

These tax penalties take several forms. First, administrative fines are imposed for late filings or declarations. Second, late payment interest accrues on overdue tax. More seriously, intentional misreporting or tax evasion may trigger penalty multipliers or even criminal charges. Recent regulatory reforms—such as the new VAT Law 48/2024/QH15 (effective July 2025), the new CIT law (effective October 2025), Decree 236/2025 on the global minimum tax, and Decree 122/2025 on tax-debt waivers—further shape the tax penalty landscape for businesses.

Need help with taxation in Vietnam? Explore InCorp Vietnam’s Tax Advisory Services today!

Major Taxes for SMEs and Startups

Vietnamese businesses typically deal with the following taxes:

- Value-Added Tax (VAT): A consumption tax on goods/services. Standard VAT rates are 10% (general), 5% (preferential), and 0% (exported goods/services). Companies with turnover above the registration threshold must register for VAT; businesses below the threshold may voluntarily register to claim input VAT credits.

- Corporate Income Tax (CIT): Tax on company profits (standard rate 20%). SMEs pay provisional CIT each quarter and finalize once per year.

- Personal Income Tax (PIT): Tax on individual income, typically withheld on salaries. Employers withhold PIT from employees’ salaries monthly or quarterly and reconcile annually. Business owners earning income (e.g. dividends, contract income) may also file PIT.

- Special Consumption Tax (SCT): Tax on certain goods deemed “luxury” or harmful (e.g. alcohol, tobacco, vehicles, gasoline). If your business produces or sells these goods, you’ll file monthly/quarterly SCT returns. (If your SME is not in these sectors, SCT may not apply.)

- Foreign Contractor Tax (FCT): A withholding tax on payments to foreign vendors without a Vietnamese entity. It combines VAT (typically 5%) and CIT (5–10%) withholding. For example, if an overseas company provides services to you, you must withhold FCT and remit it to the tax authority.

Each tax has its own filing and payment schedule, but they all must be declared and paid on time to avoid penalties.

Read More: An Essential Guide of Taxation & Compliance Deadlines in Vietnam

Tax Filing & Payment Deadlines in Vietnam (for SMEs & Startups)

Running a business in Vietnam means staying on top of multiple taxes and strict deadlines. Missing dates not only brings disruption—but triggers tax penalties. Below is a clear guide to key taxes, their deadlines, and what risks you face.

1. Value-Added Tax (VAT)

VAT applies to most goods and services consumed in Vietnam. Businesses can choose to file monthly or quarterly, depending on annual revenue and tax authority registration.

- Monthly declaration:

- Deadline: The 20th day of the following month.

- Example: VAT for March must be declared and paid by April 20.

- Quarterly declaration:

- Deadline: The last day of the month following the quarter.

- Example: Q1 VAT (Jan–Mar) must be declared and paid by April 30.

- Annual finalization:

- All VAT taxpayers must submit an annual VAT final return by March 31 of the following year.

- Example: For fiscal year 2024, the final VAT return is due by March 31, 2025.

2. Corporate Income Tax (CIT)

CIT is levied on profits at a standard rate of 20%. SMEs must make quarterly provisional payments and a final annual settlement.

- Quarterly provisional CIT:

- Deadline: The 30th day of the first month of the following quarter.

- Example: For Q1 (Jan–Mar), provisional CIT must be paid by April 30.

- Requirement:

- The total of quarterly provisional payments must be at least 80% of the final annual tax liability.

- If not, the shortfall is subject to late payment interest (0.03% per day) from the due date of the 4th-quarter provisional payment until settlement.

- Annual finalization:

- Deadline: The last day of the 3rd month after the fiscal year-end.

- For calendar-year companies, the deadline is March 31 of the following year.

- Example: For fiscal year 2024, the final CIT return is due by March 31, 2025.

3. Personal Income Tax (PIT)

Employers act as tax agents for employees by withholding PIT on wages. Filing and payment rules depend on whether you report monthly or quarterly.

- Employer PIT withholding returns:

- Monthly: By the 20th of the following month.

- Quarterly: By the last day of the month after the quarter.

- Example: Q1 PIT (Jan–Mar) return is due by April 30.

- Employer annual PIT reconciliation:

- Deadline: March 31 of the following year.

- Covers all salary-related PIT withholdings for the year.

- Individual PIT finalization:

- Deadline: April 30 of the following year (the “last day of the 4th month after year-end”).

- Required if:

- An employee had multiple employers, or

- The employer did not make finalization on their behalf.

4. Special Consumption Tax (SCT)

SCT applies only to specific industries (alcohol, tobacco, automobiles, gasoline, luxury goods). SMEs in these sectors must comply in parallel with VAT deadlines.

- Monthly/Quarterly return:

- Monthly: By the 20th of the following month.

- Quarterly: By the last day of the month after the quarter.

- Annual finalization:

- By March 31 of the following year.

- Temporary extensions (recent):

- In mid-2024, the government issued Decree 81/2025, extending SCT payment deadlines for domestically produced cars. However, for most SMEs, standard VAT-aligned deadlines still apply.

5. Foreign Contractor Tax (FCT) / Withholding Tax (for foreign suppliers)

If your business pays foreign suppliers (goods, services, digital platforms), you may have to withhold taxes (VAT, CIT, PIT) and remit on their behalf.

- Deadlines generally follow VAT withholding deadlines or specific rules under the tax treaties / regulations.

- For example, under new Decree 117/2025/ND-CP, digital platforms must withhold VAT & PIT from July 2025, with first filing by August 20, 2025.

Penalties for Late Filing and Payment

Vietnam’s tax framework imposes a range of tax penalties on businesses and individuals who miss deadlines, file incorrectly, or evade tax. Below is a structured guide to the major categories of tax penalties under Decree 125/2020 (and related laws).

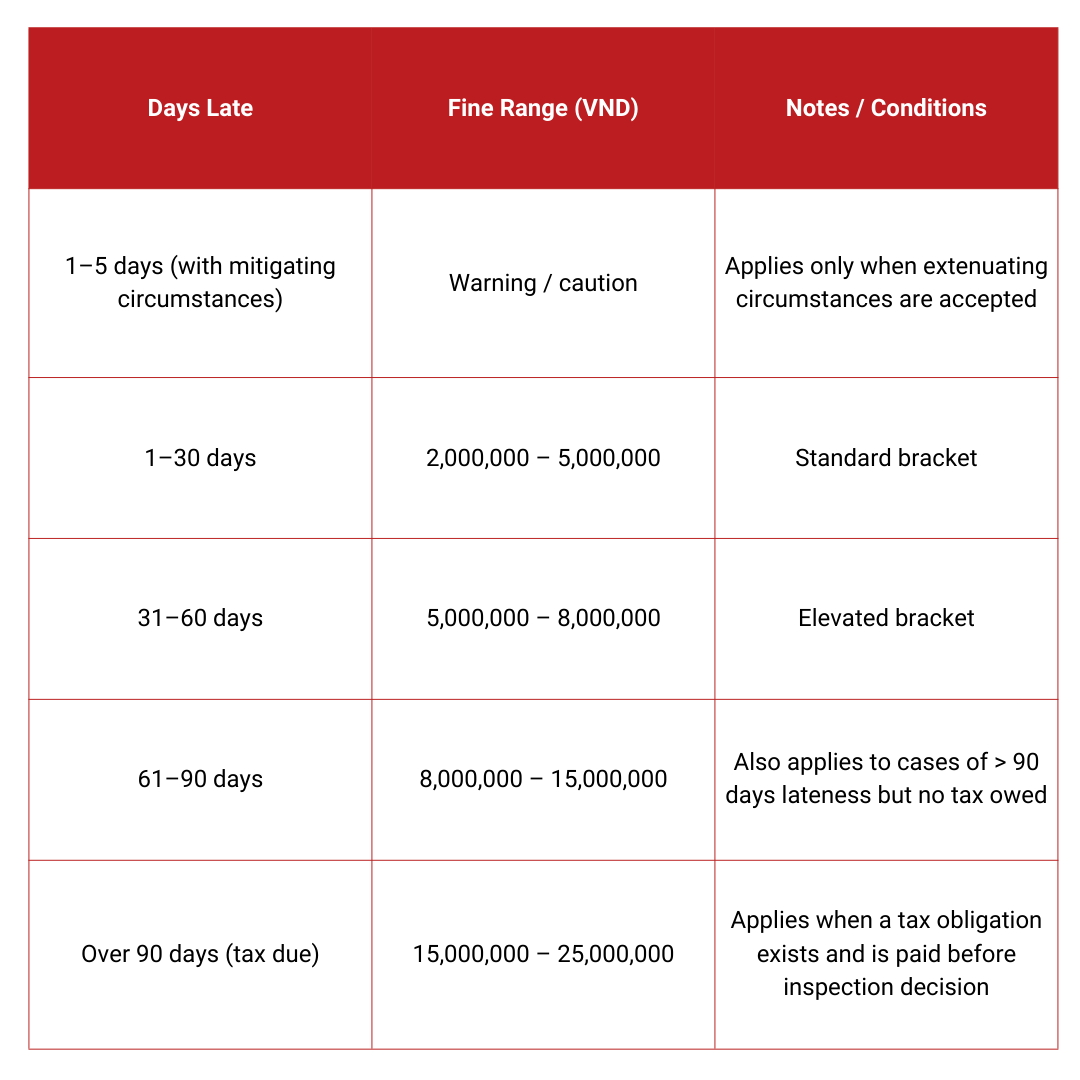

1. Administrative Fines for Late Filings (Declarations & Returns)

- Legal basis: Article 13, Decree 125/2020 (as amended) governs fines for late tax declaration submissions.

- Penalty tiers (for individuals; legal entities typically pay double)

- Key caveats & caps:

- Fines are administrative, separate from tax owed, and are imposed per violation. Legal entities often face double the fine for the same infraction. Decree 125 caps fines for serious procedural violations: up to VND 200 million for organizations and VND 100 million for individuals.

- Cases involving “large-scale violations” (e.g. tax amount ≥ VND 100 million or goods/services value ≥ VND 500 million or ≥10 invoices) may attract harsher treatment.

2. Interest on Late Tax Payment

- Rate: 0.03% per day on the overdue tax amount.

- Calculation period: From the day after the due date through to the day before the tax is paid (continuous, including weekends/holidays)

- Example: A VAT shortfall of VND 100 million paid 150 days late incurs interest = 100,000,000 × 0.0003 × 150 = VND 4.5 million.

- Applicability: This interest applies across various tax types (VAT, CIT, PIT, etc.) under the Law on Tax Administration.

3. Penalties for Late Payment of Fines

- If the administrative fine itself is not paid by its deadline, an additional surcharge is imposed: 0.05% per day on the unpaid fine amount.

- This surcharge accrues from the day after the due date of the fine until the day before actual payment, counting all calendar days.

4. Misreporting, Under-Declaration & Tax Evasion

When non-compliance is deliberate or fraudulent, tax penalties escalate sharply.

- Administrative penalties under Decree 125, Article 17:

- Fines ranging from 1× to 3× the amount of tax evaded, depending on aggravating or mitigating circumstances.In many audits, a 20% penalty is applied for under-declared tax in non-fraud cases.

- If the statute of limitations has passed, the taxpayer may be exempt from the evasion fine but must still pay the tax plus interest.

- Criminal liability (Penal Code, Article 200):

- Serious tax evasion cases may be prosecuted criminally — with tax penalties in the form of heavy fines, imprisonment, business suspensions, or bans.

- Companies evading ≥ VND 200 million (or individuals ≥ VND 100 million under certain conditions) are at risk of criminal charges.

5. Other Violations: Withholding, Invoicing & Recordkeeping

- Illegal / fake invoices: Under Article 28 of Decree 125, fines range between VND 20 million and VND 50 million for using illegal or fake invoices.

- Failure to issue invoices: Proposed amendments in 2025 may raise fines to VND 80 million depending on violation severity.

- Withholding failures: If you fail to withhold required taxes (e.g. payments to foreign contractors), you may incur tax penalties equal to the full amount, plus interest and fines.

- Bookkeeping, mis-records, noncompliance with e-invoice rules: These may lead to disallowance of deductions, forced adjustments, or additional tax penalties.

In sum, even innocent mistakes can be costly. Administrative fines (on the order of millions of VND) and interest charges (0.03%/day) pile up quickly for any late filing or payment. More importantly, deliberate under-reporting risks huge fines or criminal charges. SMEs should therefore prioritize on-time, accurate filings.

Read Related: Vietnam Business Accounting & Taxation: Principles of Taxation, Problems & Solutions, and Accounting Department Setup

Practical Tips for SME and Startup Compliance

To minimize the risk of tax penalties, SMEs and startups in Vietnam should take proactive, disciplined approaches to tax compliance:

Maintain accurate records and invoices.

- Keep all VAT invoices, receipts, contracts, and accounting books carefully organized.

- For each transaction, ensure you have valid VAT invoices or receipts (especially for non-cash payments) so you can support input tax credits.

- Double-check that your sales invoices correctly state quantities, unit prices, VAT rates, buyer tax codes, and customer details. Errors or omissions may invalidate deductions, prompt audits, or trigger tax penalties.

- With expanded e-invoice mandates under Decree 70/2025, precise invoice data is increasingly enforced—poor invoice practices can attract tax penalties.

File and pay on time – use electronic systems.

- Register for Vietnam’s official eTax portal (GDT) and file returns / make payments via the e-system. Electronic timestamps and audit trails help guard against disputes and delayed evidence.

- For foreign suppliers or cross-border contracts, the eTaxVN platform supports tax registration, declarations, and payments.

- Set firm reminders well before due dates (e.g. 20th or 30th), and avoid last-minute submissions.

- Use bank transfers or e-payment so there is verifiable proof of payment. Missing or weak proof can increase your exposure to tax penalties in case of disputes.

Apply for extensions if eligible.

- In special situations—such as force majeure, natural disasters, or industry relief programs—you may obtain deferred deadlines. For example, Decree 82/2025/ND-CP allows some sectors to defer VAT, CIT, or PIT payments.

- Submit a Request for Tax Payment Extension (in the prescribed form) along with or by the original return deadline (or by any alternate cutoff given).During the extension period, no late-payment interest is charged for the deferred amount (if eligible). However, missing the extended deadline still incurs tax penalties and interest.

- Always confirm whether your business meets the criteria, and comply strictly with extension request rules.

Use professional advice when needed.

- As your operations grow (e.g. foreign investment, intercompany transactions, R&D, incentives), the risk of complex errors increases—so does the risk of tax penalties.

- A qualified tax advisor or accountant can help you align with transfer pricing rules, claim incentives properly, apply foreign contractor withholding rules, and avoid pitfalls that incur tax penalties.

- Getting expert help early often costs less than the tax penalties from avoidable mistakes.

Monitor Law & Regulatory Changes

- Assign someone (a founder, head of finance, or external consultant) to regularly monitor new tax laws, decrees, circulars, and legal updates via GDT, Ministry of Finance, or tax advisories.

- Examples to watch: extension decrees (e.g. Decree 82/2025, Decree 81/2025), e-invoice rules (Decree 70/2025), and new VAT law adjustments.

- Attend tax seminars, webinars, or subscribe to newsletters so you catch changes early and can adapt before tax penalties hit.

Claim Deductions & Incentives with Caution

- Only claim tax incentives (e.g. CIT holidays, R&D expense boosts, PIT dependent deductions) when fully eligible—and always retain supporting documentation.

- Include all allowable deductible expenses (within legal caps). Under-claiming might cost you tax savings; over-claiming or presenting weak documentation can invite tax penalties or audit disallowances.

- Focus on substance: ensure your activities genuinely meet incentive requirements in form and practice, not just on paper.

By building good tax habits – prompt filings, diligent bookkeeping, and awareness of rules – an SME can minimize risks. Remember, consistent compliance not only avoids fines but also builds credibility with tax authorities and investors.

How Can InCorp Help?

At InCorp Vietnam, we act as your compliance partner to help prevent costly tax penalties. We provide end-to-end tax compliance and advisory services: from setting up your e-invoice system, managing accurate bookkeeping, preparing and reviewing filings (VAT, CIT, PIT, FCT), applying extensions when eligible, to handling disputes with tax authorities. We constantly monitor legal changes, apply the latest regulations in your filings, and double-check your documents to catch discrepancies before submission. With our support, you can reduce your exposure to tax penalties, focus on growing your business, and operate with confidence under Vietnam’s evolving tax regime.

Conclusion

Vietnam’s tax system is detailed and carries stiff penalties for non-compliance. SMEs and startups must juggle multiple tax types, regular deadlines, and evolving laws. The key to avoiding penalties is timely and accurate filings: submit VAT, PIT, CIT, SCT, and FCT returns by their respective due dates, and pay the reported taxes on time. Late filings can trigger fines of millions of VND and accruing interest, while misreporting risks far higher penalties. Recent law changes – such as the new VAT and CIT laws, Decrees 236/2025 and 122/2025 – underscore the need to stay updated.

Ultimately, treat tax compliance as an ongoing part of operations. Use electronic filing systems, maintain clear records, and don’t hesitate to seek advice. By doing so, Vietnamese SMEs and startups can focus on growth while keeping tax liabilities in check.