Information Communication Technology (ICT) is one of the most important industries for foreign investors to consider doing business in Vietnam. The government recognizes Vietnam’s ICT industry as a pivotal sector with the potential to drive both economic and societal progress. It encourages government agencies at all tiers to adopt advanced ICT solutions to enhance efficiency and elevate governance services.

Notably, Vietnam’s administration has endorsed the National Digital Transformation Program, spanning from 2025 with a vision extending to 2030, aimed at bolstering the expansion of the ICT market. Meanwhile, pivotal sectors like aviation, banking, energy, healthcare, broadcasting, telecommunications, and urban infrastructure are adopting advanced ICT solutions for efficiency and sustainable growth.

Investing in the Vietnam ICT Industry? Find Out InCorp Vietnam’s Incorporation Services

Overlook Vietnam’s ICT Industry: From 2023

With an estimated value of US$7.7 billion in 2021, Vietnam’s ICT Industry is anticipated to expand at an average annual rate of around 8% from 2022 to 2026. This growth can be attributed to the increasing adoption of ICT solutions by both the public and private sectors.

Furthermore, the government sanctioned the National Digital Transformation Program, fostering ICT market growth. Simultaneously, the private sector, notably aviation, energy, and banking, eagerly adopts advanced ICT solutions for efficiency and sustainable progress.

While Vietnamese suppliers are still emerging in the ICT sector, there remains a significant demand for imported ICT hardware, software, and services. The software market sees major players from the United States, Germany, China, Russia, Israel, and Vietnam. The variety of suppliers underscores Vietnam’s competitive ICT market, fostering collaborations and partnerships between local and global entities.

In recognition of their exceptional innovation and implementation of customer solutions based on Microsoft technology, Softline Vietnam was honored with the prestigious 2022 Microsoft Partner of the Year Award in June 2022. Further, Viettel Group, a prominent player in the industry, made headlines in May 2022 through its partnership with Qualcomm Technologies Inc. This strategic alliance focuses on the development of a next-generation 5G Radio Unit (RU).

In 2023, the information and communications sector in Vietnam achieved a revenue exceeding VND3.7 quadrillion (approximately US$154 billion), marking a 1.49 percent increase compared to the previous year, according to data from the Ministry of Information and Communications. The sector’s contribution to Vietnam’s GDP exceeded VND887.3 trillion (around US$36.9 billion), reflecting a year-on-year growth of 1.34 percent. The total number of employees in the sector surpassed 1.76 million, a 2.72 percent increase from the year 2022.

Vietnam ICT Industry: A Diverse Segmentation

The Vietnam ICT market is segmented based on type, including hardware, software, IT services, and telecommunication services. Under the hardware category, specific subcategories such as network switches, routers, WLAN, servers, storage, and others contribute to the overall market. Furthermore, the industry verticals play a crucial role in shaping the ICT market, with key sectors including banking, financial services and insurance (BFSI), IT, and telecom, among others.

Leading Sub-sectors of the Vietnam ICT Industry

- Telecommunications

As of February 2021, Vietnam had approximately 125 million mobile phone subscribers, indicating a penetration rate of 129%. It is estimated that telecommunications service firms will invest up to US$2.5 billion in deploying and commercializing 5G technology between 2020 and 2025.

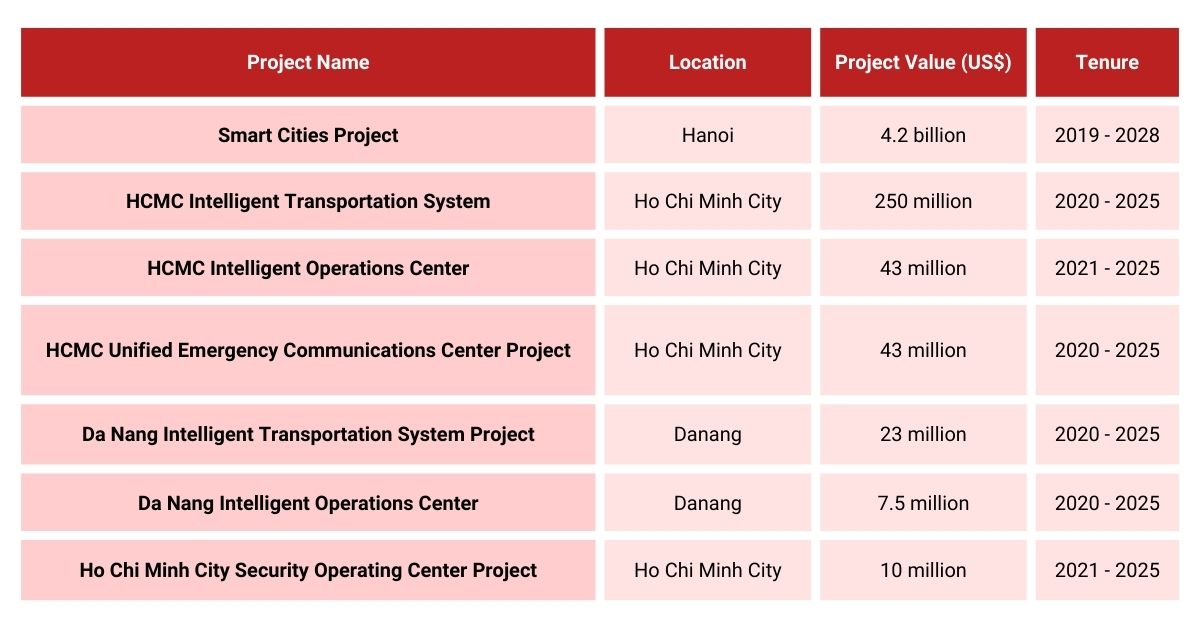

- Smart Cities

The push for smart cities stems from the country’s rapid urbanization rate, which has exceeded 30% per year over the past decade. The Vietnam Urban Development Association reported a total of 819 cities in the country as of 2019, with an estimated 50% of the population projected to live in urban areas by 2040.

- Cybersecurity

Ken Research’s report projects that Vietnam’s cybersecurity market will amass a total revenue of US$215 million by 2023 and an estimated annual growth rate of around 15% in 2022 and 2023. The country’s digital economy is expected to surpass US$43 billion by 2025, as estimated by the World Bank.

To enhance cybersecurity in the public and private sector, the Vietnamese Government issued Decree 14 in June 2019. This decree mandates government agencies to implement cybersecurity measures and allocate a minimum of 10% of their annual IT expenditure between 2020 and 2025 towards cybersecurity solutions and initiatives.

Six Blooming IT Industries in Vietnam in 2024 – 2025

- Artificial Intelligence

Vietnam’s artificial intelligence (AI) industry holds immense potential, despite still being in its early stages. To encourage foreign direct investment (FDI), the Vietnamese government recently passed a resolution, aiming to increase the number of enterprises operating in the advanced technology industry to 50%, by 2025.

- E-Commerce

Vietnam’s e-commerce, set to be 3rd in the region by 2025, centers in Ho Chi Minh City and Hanoi, contributing 70% of total sales.

- Cloud Computing

Cloud computing is vital for interconnected businesses, offering fast data analysis and processing in evolving environments.

- Fintech

Robocash Group predicts Vietnam’s Fintech to hit US$18 billion by 2024, fueled by youth, growing middle class, and internet reliance. Vietnam boasts of more than 100 businesses and brands offering a range of fintech services. These include wealth management, blockchain technology, and digital payments.

- Education Technology (EdTech)

The EdTech market in Vietnam is witnessing positive responses from consumers. Parents have especially shifted their perspectives on the use of technology in education.

- Software Outsourcing

Vietnam has experienced significant growth in the field of software outsourcing over the past decade. A report by BetterCloud suggests that 73% of businesses in Vietnam use software outsourcing services. Capturing approximately 21% of the market, Vietnam has emerged as a major global market player.

Four Types of IT Service Services Firms in Vietnam

- State-Oriented IT Services Firms Producing for the Local Market

The Financing and Promoting Technology Corporation (FPT) is a significant former state-owned enterprise (SOE) in Vietnam, recognized as one of the largest and most influential. FPT operates through its seven member companies, spanning four key industries: technology, communications, retail, distribution, and education.

- Locally Owned IT Services Firms Producing for the Export Market

TMA Solutions, a prominent IT services company in Vietnam, has expanded its operations globally, establishing sales offices in Canada, the United States, Australia, and Ireland.

- Global IT Services Firms Producing for the Local Market

Unlike most global IT services firms operating in Vietnam, IBM stands out as an exception by actively serving the local market. It has its operations in Hanoi and Ho Chi Minh City.

- Foreign-Owned IT Services Firms Producing for Export

Export-oriented, foreign-owned IT services firms operating in Vietnam often serve as multinational affiliates that leverage the country as a base for providing software outsourcing and ICT-enabled services such as business process outsourcing (BPO) to clients worldwide.

Emerging Growth in Vietnam’s ICT Market: Data Analysis

In line with the cooperative agenda of ASEAN countries, Vietnam is spearheading digital transformation and the development of a digital-based economy. As the former chair of ASEAN, Vietnam is committed to fully digitalizing the member nations and driving their collective progress.

As per the Australian Trade Commission, Vietnam’s ICT industry experienced an annual growth rate of 7% until 2018. With the flourishing digital economy, Vietnam has the potential to witness an impressive increase of US$1 trillion in its aggregate GDP by 2025. By 2030, it is estimated that Vietnam’s GDP could rise between US$28.5 billion to US$62.1 billion.

According to the Vietnam Report, the accumulated revenue of the industry by the end of March 2023 was estimated at VND 845.6 trillion (US$35.9 billion), representing a 3% decrease year-on-year. Similarly, the export turnover of hardware electronics amounted to approximately US$26.6 billion, reflecting a 9.5% decline compared to the previous year.

Despite the plunge, the Vietnam Report’s survey in March indicated that the ICT sector held the highest growth potential among seven industries, with a promising rate of 63% over the next two to three years. This suggests that despite the current challenges, the ICT industry holds a lot of potential for future growth in Vietnam.

Vietnam ICT Market Trends in 2024

- The Vietnamese ICT market is expected to demonstrate a compound annual growth rate (CAGR) of 7.8% in the coming years.

- The Vietnamese government has identified ICT as a priority industry and has implemented various initiatives to promote its development.

- The e-Conomy Southeast Asia Report 2021 predicted that Vietnam’s digital economy would reach US$50 billion by 2025, presenting lucrative growth opportunities for the ICT market. Moreover, World Bank data indicates that Vietnam’s digital economy is growing at a rate of 10% annually and has the potential to surpass US$200 billion by 2045.

- To position Vietnam as an innovation and artificial intelligence (AI) hub in ASEAN and the world, the government has formulated a national strategy for AI research and development applications until 2030.

- The COVID-19 pandemic accelerated digital transformation, with an increased demand for remote work and a higher demand for online content consumption. This has resulted in a surge in internet penetration and data consumption, creating a need for robust infrastructure.

Market Leaders and Latest News

Some of the prominent Vietnam ICT Market Leaders are Microsoft, Qualcomm, IBM, Dell Technologies, and Cisco Systems. Below is the latest news regarding the ICT industry in Vietnam:

- The Viettel Group, in October 2022, rolled out the Viettel Cloud Ecosystem, solidifying its spot as Vietnam’s largest cloud computing service provider.

- K-One agreed with the Vietnam Distribution Joint Stock Company to buckle up for a joint venture, indicating the company’s intention to expand its cloud computing business in Vietnam.

- In August 2022, Amazon Web Services (AWS) introduced new edge networking services in Hanoi and Ho Chi Minh City, to enlarge its presence in Vietnam.

According to HanoiTimes, Vietnam ambitiously aims to have 80,000 digital technology enterprises by 2025. The goal is to have 100,000 digital technology enterprises by 2030, indicating the long-term vision for sustained growth and innovation in the sector. By 2025, it is projected that the tech industry will contribute between 6% and 6.5% to the country’s gross domestic product (GDP).

As per the Vietnam Report JSC, the top 10 most renowned ICT companies are as follows:

- Viettel Military Industry and Telecoms Group (Viettel)

- FPT Corporation

- Việt Nam Posts and Telecommunications Group (VNPT)

- MobiFone Telecoms Corporation (MobiFone)

- CMC Corporation (CMC)

- Telecommunication Services Corporations (VNPT-Vinaphone)

- Việt Nam Technology & Telecommunication JSC

- Hanel Communications JSC

- Việt Nam Maritime Communication and Electronics Single Member Limited

- Tiến Phát Technology Corporation.

Opportunities for Foreigners in Vietnam’s ICT Industry

Vietnam’s ICT sector offers promising prospects for foreign firms, especially from the US, owing to their advanced tech, cost-effectiveness, and strong customer support.

To further support the engagement of U.S. companies in Vietnam’s ICT market, the U.S. Commercial Service, in collaboration with renowned U.S. ICT companies, has organized smart city conferences. These conferences serve as platforms for introducing smart city technologies and solutions to Vietnamese authorities and municipalities. Simultaneously, they educate stakeholders on the benefits of implementing smart technology in infrastructure planning, management, and public service delivery.

The key project opportunities are specified below:

Vietnam Report released a report in June 2023 revealing the challenges Vietnam faces in the cybersecurity landscape. Challenges include talent retention, policy gaps for technology, intense industry competition, and limited capital access.

Data from Kaspersky, a cybersecurity firm, revealed that Vietnam, in 2022, experienced a 33.8% decline in the number of ascertained and intercepted online attacks. With a total of 41,989,163 cases, Vietnam ranked 49th globally, a dip of 17 positions relative to 2020. The successes stem from robust enforcement of cyber regulations and multifaceted security measures’ implementation at the state level.

Why Consider Investing in Vietnam’s ICT Industry?

Vietnam has become an attractive market for global technological companies seeking expansion in various industries. Fujitsu, a prominent Japanese ICT giant, has been effectuating its new business strategy in Vietnam since 1999, primarily catering to Japanese companies.

To further encourage investment, Vietnam has enacted provisions outlined in Decree No. 108/2006/ND-CP, which detail the execution of the Investment Law and the production of software and digital content. These provisions include incentives, such as a preferential tax rate of 10% for 15 years, a tax exemption for four years, and a 50% reduction for the following nine years. Vietnam’s Ministry of Communications targets becoming a premier digital destination in Southeast Asia by 2030, focusing on pioneering digital innovations.

Overall, Vietnam’s favorable investment environment, supported by specific provisions and incentives, makes it an attractive destination for global technological companies. Vietnam strives to lead the regional ICT industry and boost its investment appeal through digital advancement.

Read Related: The Developing IT Industry in Vietnam: Update 2023

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How To Grow Ict Business

- To grow an ICT business, focus on identifying market needs, investing in innovation, and building a skilled team. Leverage digital marketing, strategic partnerships, and scalable technologies to expand reach and efficiency. Continuously adapt to emerging trends and customer feedback.

What Is The Ict Industry

- The ICT (Information and Communication Technology) industry encompasses businesses and services related to computing, telecommunications, and data management. It includes sectors such as software development, hardware manufacturing, internet services, and digital communication.