Vietnam is one of Southeast Asia’s fastest-growing economies, attracting strong interest from local and international investors. The tech sector is booming, and the country’s massive unserved and underserved middle class presents significant opportunities. According to Allied Market Research, Vietnam’s wealth management market is projected to grow at 31.6% annually from 2020 to 2030. While Australia currently manages around 20% of Asia-Pacific’s wealth, Vietnam is rapidly closing the gap.

Despite this growth, challenges remain. A key hurdle is the disparate pricing and fee structures across the Asia-Pacific, creating confusion for both providers and clients. However, Vietnam’s financial infrastructure is evolving, with FinTech companies driving necessary change for the country’s wealth-building individuals and families. As more people seek guidance in asset management and financial planning, the demand for wealth management services is rising. Though well-established globally, wealth management remains in its early stages in Vietnam, offering immense potential for development.

Unsure how to start your company in Vietnam? Speak with an InCorp Vietnam expert today!

What is Wealth Management?

Wealth management is the strategic art of managing assets, offering tailored financial services for individuals and businesses with substantial wealth. This comprehensive financial approach includes investment management, tax planning, estate and trust planning, and real estate strategies, all designed to protect and grow your assets.

A wealth manager serves as your trusted financial advisor, overseeing all aspects of your financial life so you don’t need multiple experts. They create a personalized financial roadmap, whether your goal is retirement planning, legacy protection, or market-driven investments.

Wealth management services can be comprehensive, handling entire portfolios worth US$10 million or more, or specialized, focusing on complex investments like international asset management. Many wealth managers collaborate with attorneys, accountants, and financial experts to offer holistic advice on tax strategies, estate planning, and business acquisitions. Some also provide banking services and philanthropic guidance, ensuring every aspect of your wealth is efficiently managed.

Vietnam’s Wealth Management Market with High-Net-Worth Individuals

Once a hermit nation, Vietnam is currently emerging as a major player in Southeast Asian wealth management. The country’s economic growth momentum is undeniable, with a talented population of over 100 million. Vietnam is poised to become a shining example of effective asset management in the region.

Today, Vietnam is at a critical inflection point. Regulatory reforms are transforming the financial landscape, while a new generation of ultra-high-net-worth individuals (UNHWIs) is emerging.

Recently, HUBBIS panel members commented on the Vietnamese wealth management market. In their event article, they said the asset management market in Vietnam needs optimism and practicality. The lack of standards, the limited range of products, and poor customer experience are just a few of the many challenges that require thoughtful solutions to develop and grow the market successfully.

Read Related: The Remarkable Rise of Vietnam’s Fintech Industry: A Guide for Investors

Vietnam’s “Super-rich” Class on the Rise: UHNWIs and Millionaires Drive Wealth Management Growth

Vietnam is experiencing a remarkable rise in wealth. The Knight Frank Wealth Report 2022 advises that there are expected to be over 1,500 individuals with assets of US$30 million in Vietnam. Over the last 20 years, Vietnam has seen significant social mobility, and its super-rich, wealthy and middle classes have grown.

The number of Vietnamese millionaires is expected to increase by 32% between 2020 and 2025 and ultra-high-net-worth individuals by 31%. Vietnam is currently home to 19,500 millionaires and this is expected to increase by 25% by 2025, ranking sixth in ASEAN for both super-millionaires and billionaires.

Vietnam’s largest city Ho Chi Minh has seen rapid wealth growth and ranks ninth globally for the growth of millionaires. Ho Chi Minh’s net worth is growing and now has 7,700 millionaires, an increase of 84% since 2010. There are now 15 individuals with US$100 million and three billionaires in the city. Ho Chi Minh City ranks 67th in the Wealth-X report of the 97 cities ranked by wealth.

The city’s wealth growth is driven by the services, textile, technology, electronics, telecoms, chemical, and tourism sectors. When measured by millionaire growth, Ho Chi Minh City is only surpassed by Hangzhou in China (105%), Austin, USA (102%), and Shenzhen, China (98%). New York has the most millionaires (3,40,000) while Tokyo has the second-largest number (2,90,300) and the Bay Area, also known as the San Francisco Nexus of Innovation, has 2,85,000.

Read More: Key City Business Centers in Vietnam: Opportunities for Multinational Corporations

Understanding Asset Management: Key Roles and Services for Wealth

Asset managers are individuals or teams that have specialized knowledge and experience to handle investment portfolios on behalf of their clients. They are hired to think about the complex financial problems their clients may face and provide thoughtful and effective solutions.

Along with other financial professionals, such as accountants, asset managers can provide comprehensive financial advice to their clients. Several Wealth Management services are particularly valuable:

In addition to individual wealth management, many companies offer asset management services to other businesses. This management style helps people who have a lot of assets to maintain. If you have cash, saving deposits, and investments, then proper management and safe distribution are important so that the existing assets grow in value.

Whether you need a wealth manager or not depends on your situation, goals, and comfort level.

- If you are clear on your goals and are comfortable managing the liability, you may not need professional advice.

- If you are wealthy and don’t have time to manage the liability, consider hiring a mentor.

- If you are not wealthy, you may want to consider asset management software such as GSOFT, Faceworks, Hinet, or MISA AMIS.

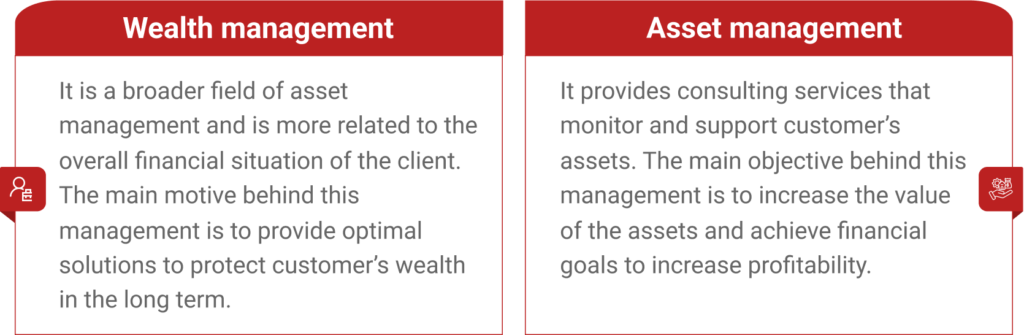

Comparison of Wealth Management and Asset Management

Wealth management and Asset Management are two terms that are often used interchangeably but to the contrary are completely different fields altogether. Both fields provide valuable consulting, support, and guidance from experienced professionals which ultimately results in achieving financial goals and protection of assets. But the difference between them is as follows:

How to Manage Fees For Wealth Management?

Managing wealth is a very difficult subject but everyone needs to know about the management of their wealth. Consultants are there who help monitor wealth and help to get maximum profit and secure the future. But how do we pay them for their services?

The fee structure depends on the service provider. If you are taking the services of a company, then you have to follow their fee structure. If you are taking the services of an individual then the fee structure is decided by both parties.

The fee structure is usually 0.25% to 1% of the total assets. You should ask about the fee structure before taking their services.

Also, most wealth management companies have a minimum asset requirement for their clients. For example, Fidelity is a private wealth management company that provides its services to clients who have invested at least US$2 million in Fidelity Wealth Services and have total investable assets of US$10 million. If you want a personal advisor, then you need to have at least US$250,000 in your account. You should know about these requirements if you want to manage your wealth.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How Many Millionaires Are In Vietnam

- As of 2023, Vietnam has approximately 19,400 millionaires, according to global wealth reports. This number is expected to grow in the coming years due to the country's rapid economic development.

How much money is needed for wealth management?

- The amount of money needed for wealth management varies depending on the provider and services offered. Many traditional wealth management firms require a minimum of $250,000 to $1 million in investable assets, while some digital or hybrid services may accept clients with as little as $50,000 or less.

Is Vietnam A Wealthy Country

- Vietnam is considered a developing country with a growing economy, but it is not classified as wealthy. Its GDP per capita remains relatively low compared to developed nations, though it has seen significant economic progress in recent decades.

What is the 72 rule in wealth management?

- The Rule of 72 is a simple formula used in wealth management to estimate how long it will take for an investment to double at a fixed annual rate of return. By dividing 72 by the annual interest rate (e.g., 72 ÷ 6% = 12 years), investors can quickly approximate the doubling time of their money.