Vietnam’s March 2025 marks a pivotal chapter in the nation’s economic evolution, fueled by surging foreign direct investment (FDI) and ambitious strides in the semiconductor sector. From breakthrough training programs to multi-billion-dollar industrial projects, the country is rapidly positioning itself as a key player in high-tech manufacturing and digital infrastructure.

Regional hubs like the city of Ho Chi Minh, coastal city of Da Nang, Hai Phong, and Quang Nam are seeing record inflows of capital, while landmark developments in fintech, AI, and logistics underscore Vietnam’s growing appeal to global investors. These strategic moves reflect not only economic resilience but also a long-term vision to lead the region in innovation, connectivity, and industrial excellence.

Interested in Investing in Vietnam? Check out InCorp Vietnam’s Incorporation Services

FDI Fuels Economic Growth Momentum in 2025

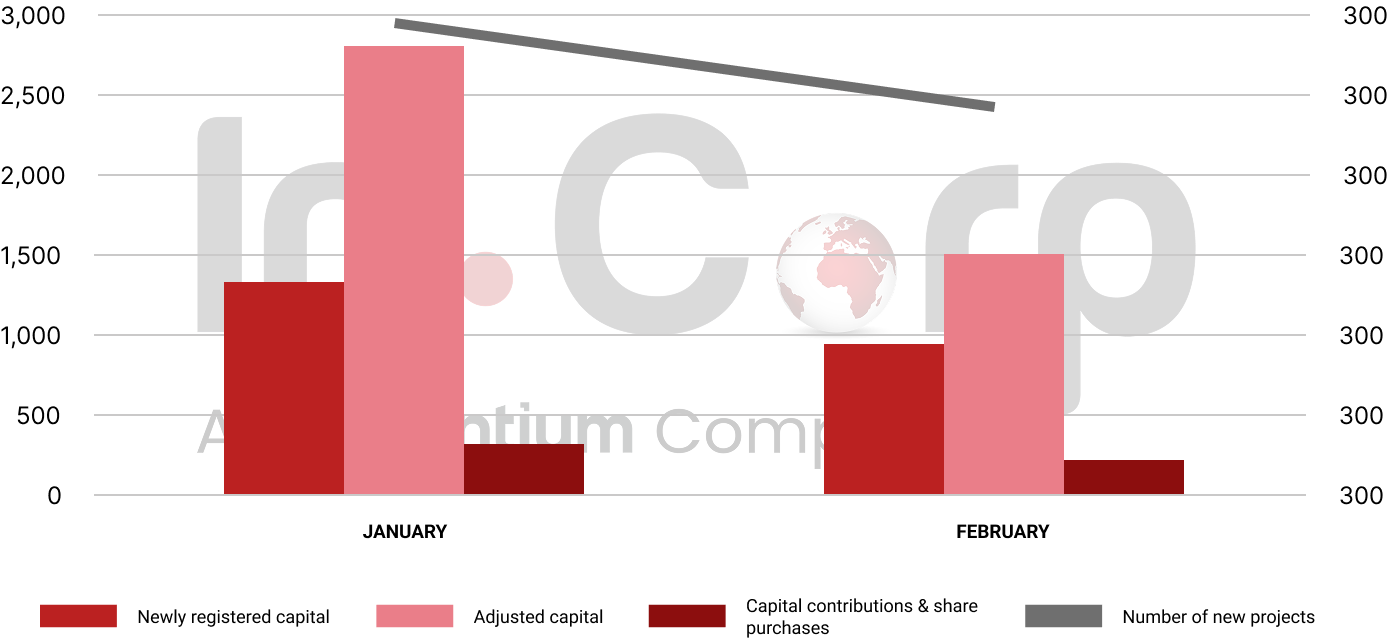

Vietnam secured US$38.23 billion in foreign direct investment (FDI) in 2024, positioning itself among the top 15 developing countries for FDI inflows. FDI disbursements reached a record US$25.35 billion, driving economic growth. In early 2025, FDI inflows rose 35.5% to over US$6.9 billion, with the manufacturing sector leading at US$4.72 billion.

To sustain this momentum, Vietnam is focusing on high-tech industries like semiconductors and AI, aiming for US$150-200 billion in FDI by 2025. South Korea and Singapore were the top investors, while regions like Bac Ninh, Dong Nai, and Capital of Vietnam Hanoi saw significant inflows, further boosting the country’s economic growth and export performance.

Read More: Vietnam FDI: Analysis of Industries, Source Countries, and Geographical Regions

First Solar Cuts Production in Vietnam, Malaysia

First Solar, a leading American solar technology company, will reduce its production by 1GW in 2025 across its Vietnam and Malaysia facilities. This decision is influenced by multiple factors, including the European Union’s shift to Chinese solar modules priced near or below manufacturing costs and limited market access to India for Southeast Asian solar products. Additionally, the uncertain US policy landscape following the 2024 election is contributing to the adjustment.

Despite a decline in global module pricing, First Solar’s US market remains relatively stable, supported by demand for domestically produced modules and the US tariffs on Chinese and Taiwanese imports. First Solar’s factory in Vietnam, located in Ho Chi Minh City, has an annual capacity of 9.13 million solar modules, and the company plans to reach 25GW of global manufacturing capacity by 2026, reaffirming its commitment to sustainable growth.

Read More: Opportunities and Challenges in the Rooftop Solar Market in Vietnam

Education Powers Vietnam’s Semiconductor Sector Growth

Vietnam is ramping up efforts to become a global semiconductor hub by training 50,000–100,000 skilled workers by 2030. The government is launching training centers focused on semiconductors, AI, and biotechnology, in partnership with universities and businesses. These initiatives aim to fix labor mismatches, enhance productivity, and support Vietnam’s ambition to become a high-income economy by 2045 through improved human capital and innovation-driven development.

At AISC 2025 in Hanoi, Vietnam reaffirmed this ambition with the debut of SemiKong—an open-source AI model for chip production, co-developed by Aitomatic, Tokyo Electron, and FPT Software. The event featured advanced topics like AI-driven IC design and scalable chip manufacturing. Backed by government policy and international partnerships, Vietnam seeks to integrate deeply into global semiconductor value chains, strengthen domestic innovation, and attract high-tech investment through strategic collaboration and ecosystem development.

Read More: Unlocking Opportunities and Overcoming Challenges in the Global Semiconductor Industry

Fintech Investment in Vietnam Surges with AI

Vietnam’s fintech market is projected to reach US$20 billion in 2025 and US$50 billion by 2030, growing at 20.2% annually. In 2024, Payoneer expanded operations, focusing on AI-powered cross-border payments, while 1982 Ventures backed startups like Fundiin and Infina, targeting digital payments and financial inclusion.

Unicorn MoMo now serves one-third of Vietnam’s population and plans an IPO abroad in 2025. From 2013–2023, Vietnam saw US$1 billion in payment fintech investments and US$495 million in financial services. A Swiss US$5 million grant is also supporting fintech growth. AI is expected to transform e-commerce, marketing, and operations, accelerating the sector’s role in driving Vietnam’s digital economy.

Read More: The Remarkable Rise of Vietnam’s Fintech Industry: A Guide for Fintech Vietnam Investors

Ho Chi Minh City Unveils US$4 Billion River Development

Ho Chi Minh City is rolling out a comprehensive plan to develop the Saigon River corridor into a vibrant economic zone. This includes a US$4 billion upgrade to Can Gio Port, which aims to handle 10% of Vietnam’s import-export volume—90% via international transshipment. A new metro line connecting the city center to Can Gio Island is also planned to support the city’s target of 8.5–9.0% annual GDP growth through 2030.

In parallel, the city will establish an international financial center in Thu Thiem, spanning 9.2 hectares across 11 plots. Backed by a 29-member steering committee, this project aims to enhance regional financial connectivity. In early 2025, the city attracted US$365.8 million in FDI—a year-on-year increase of 87.1%—alongside growth in retail, tourism, and public transport. However, business registrations declined 37.6%, indicating challenges that require improved investment mechanisms and clearer policy frameworks.

Read More: Launching Your Company in Ho Chi Minh City: 9 Reasons to Do It

Danang Promotes Investment Opportunities in Singapore

Danang held the 2025 Investment Forum in Singapore, showcasing its potential as a key financial hub in Southeast Asia. The event highlighted Danang’s two key development drivers: the Danang International Financial Centre and the Danang Free Trade Zone, attracting global investors.

The city is aiming to establish Vietnam’s first regional financial center, strategically positioned at key trade routes. With a strong regulatory framework and significant infrastructure investments, Danang seeks to attract financial institutions, asset managers, and fintech firms to expand into ASEAN, further strengthening economic ties with Singapore.

Quang Nam Attracts Over US$1.56B in Investments

Quang Nam province secured over US$1.56 billion in investments across multiple industrial parks in March 2025. Six projects received investment certificates, including ventures from South Korean, Chinese, Spanish, and Vietnamese companies. Key investments include Thaco Auto’s US$11.5 million R&D center and a US$282.4 million dredging project.

Additionally, the province signed research agreements for further investments, such as a US$23.5 million infrastructure project and over US$1 billion for the Hoiana Resort & Golf Phase 2. The province continues to enhance its investment environment, attracting global players like Kärcher, with significant industrial and infrastructure developments underway.

Read More: Competitive Advantages of Doing Business for Foreigners in Quang Nam Province, Vietnam

1,000-Ha Free Trade Area Under Development in Hai Phong

Hai Phong is finalizing plans for a 1,000-ha free trade area within its southern coastal economic zone, set to open in early 2025. This area is part of a 20,000-ha zone designed to attract multinational companies, with an estimated investment of US$8 billion by 2030.

The development aims to boost regional connectivity, create 400,000 jobs, and house 500,000 people by 2040. The zone is expected to generate US$40 billion in investments and US$70 billion in trade value, further strengthening Hai Phong’s position as a strategic northern port city and economic gateway.

Read Related: Trade Logistics in Vietnam: Top Megaports and Their Impact from Saigon to Hai Phong

Conclusion

Vietnam’s economic momentum in March 2025 is no coincidence—it’s the result of deliberate policy, strategic sector focus, and expanding global partnerships. With semiconductor investments rising, FDI at record levels, and regional cities transforming into financial and industrial powerhouses, the country is laying a strong foundation for sustained, high-value growth. As Vietnam leverages its talent, technology, and trade connectivity, it is poised to solidify its status as a dynamic economic force in Asia and beyond.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly