As businesses expand and adapt to modern work environments, tax regulations have become increasingly complex. Companies must navigate evolving tax policies while managing various financial aspects, from employee benefits to cross-border transactions. This complexity highlights the growing need for business tax advisory services to ensure compliance and optimize tax strategies.

Today, businesses require comprehensive business tax advisory, covering everything from tax compliance issues to international tax advisory services. With ever-changing regulations, expert guidance is essential to avoid Vietnam penalties and maintain compliance. In this blog, you’ll learn everything about business tax advisory in Vietnam and how to tackle international tax compliance challenges effectively.

Need help with taxation in Vietnam? Explore InCorp Vietnam’s Tax Advisory Services today!

Vietnam Penalties and Fines for Tax-relates Violation

Vietnam’s tax law sets out strict schedules for submitting returns and paying taxes. Corporate taxpayers must generally file and pay monthly VAT by the 20th of the following month, and make quarterly CIT installments by the end of the first month after the quarter. Annual final declarations for CIT, PIT and other obligations are due by March 31 of the following year. In special cases, such as short-term contracts, taxes may be due “ad hoc” within 10 days of the transaction.

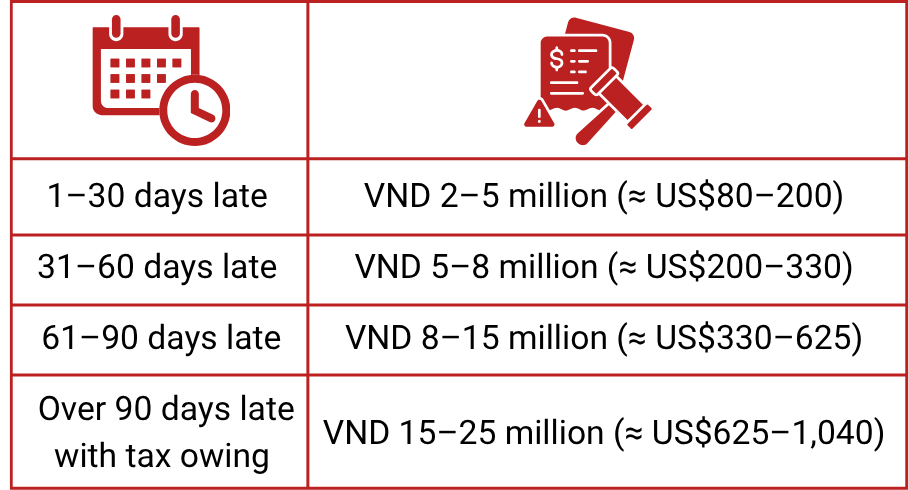

Missing these deadlines brings two consequences: an administrative fine and daily interest on the unpaid tax. Under Decree 125/2020 (Art. 13), late-filing penalties scale with the number of days overdue:

For companies, these fines are doubled compared to individual taxpayers. On top of that, late payments accrue interest at 0.03% per day. For example, leaving VND 100 million unpaid for 100 days adds roughly VND 3 million in interest.

Reporting Schedule

In practice, most SMEs follow this routine: monthly VAT by the 20th, quarterly VAT/CIT by the end of the first month after quarter-end, and annual finalizations by March 31. These are the deadlines you should plan around in your compliance calendar.

However, for 2025 only, the government introduced special deadline extensions under Decree 82/2025 (April 3, 2025) to ease cash flow pressures. Specifically:

- Monthly VAT for February through June 2025 has been deferred into Q4 2025:

- Feb due Sept 20

- Mar & Apr due Oct 20

- May due Nov 20

- Jun due Dec 20

- Quarterly VAT deadlines have also shifted: Q1 is due Oct 31, and Q2 is due Dec 31.

- Provisional CIT payments for Q1 and Q2 are extended by five months.

- PIT and land rental tax payments are pushed back to December 2025.

These extensions are exceptional measures and should not be expected in future years. Normally, businesses must meet the regular deadlines to avoid penalties and interest.

Foreign contractors and cross-border issues.

Vietnam also penalizes failure to comply with withholding obligations. For example, if a domestic payer (including banks) fails to deduct foreign contractor tax from payments to a foreign party, the tax authority can order the bank to pay the tax from the account, and fine the bank an amount equal to the tax not remitted. Decree 125/2020 (Art.24) also imposes fines on misusing e-invoices for foreign-supplier goods or trading invoices in the VAT system. Overall, any cross-border sale or digital service must follow Vietnam’s VAT and tax rules, or risk fines and extra tax assessments.

Read More: An Essential Guide of Taxation & Compliance Deadlines in Vietnam

Vietnam Penalties and Fines For Invoice-related Violations

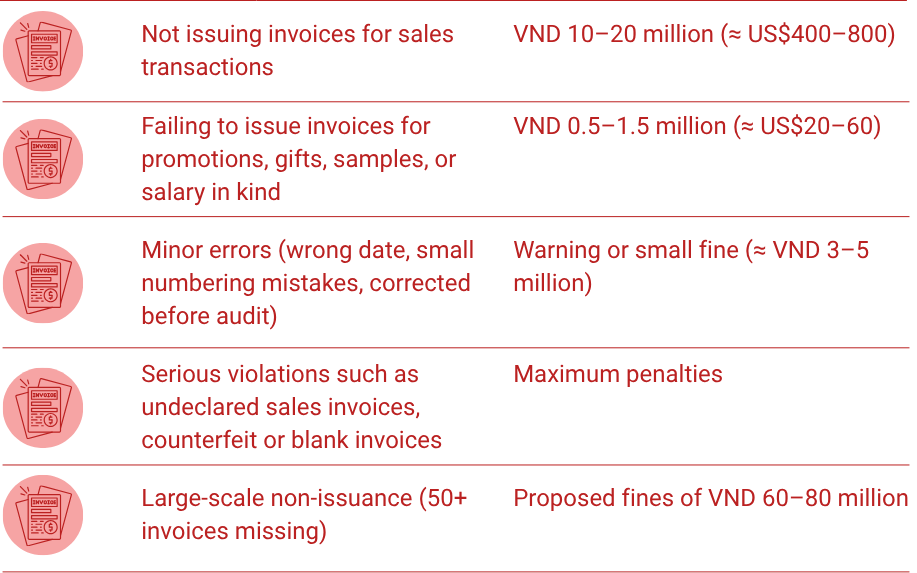

Vietnam imposes a range of fines for invoice errors or omissions. The severity depends on the type of violation:

Since July 1, 2022, e-invoicing has been mandatory for all companies, household businesses, and individuals under tax declaration. This system gives tax authorities real-time access to invoice data, making violations easier to detect.

Recent updates under Decree 70/2025 and Circular 32/2025 have further tightened rules:

- Sellers may now authorize any qualified provider (not only affiliated firms) to issue e-invoices on their behalf.

- E-commerce platforms must report invoices they generate for small sellers.

- Invoice sequencing, buyer tax codes, and accurate content are strictly monitored.

Quick Tip: SMEs should use compliant e-invoicing software and train staff on correct invoice issuance. Even small errors—like missing a buyer’s tax code—can void an invoice. Having a tax advisor review your e-invoice system helps prevent costly fines.

Some Solutions for International Tax Compliance Issues

Globalizing operations and digital trade create additional compliance challenges. To avoid violations, businesses should leverage technology and strong internal controls:

Globalizing operations and digital trade create additional compliance challenges. To avoid violations, businesses should leverage technology and strong internal controls:

- Adopt automated tax software. Modern expense and billing systems can automatically track invoices, classify transactions, and ensure that every sale is invoiced correctly. Automated tools can issue e-invoices in real time and immediately notify the finance team of any anomalies. For instance, an AI-powered system can flag if a transaction lacks a valid tax code or if multiple sales to one customer are missed. Using a reputable e-invoicing platform (or the General Department of Taxation’s public service portal) helps ensure your invoices meet the new technical standards.

- Maintain diligent record-keeping. Whether working remotely or internationally, keep detailed invoices and contracts. Regularly reconcile your sales and purchases against issued invoices. This is especially important for cross‑border sales: under the new VAT law, exports require thorough documentation (bill of lading, export contracts, etc.) to qualify for 0% VAT. For small business owners, periodic internal audits by an advisor can catch missing invoices or tax declarations early.

- Train your team and advisers. Run internal tax workshops or engage an external expert to review your compliance calendar. Ensure that everyone understands the filing schedule (monthly VAT by the 20th, CIT by quarter/annual, etc.) and e-invoice protocols (e.g. timestamping, voiding wrong invoices correctly). For companies operating internationally, seek guidance on Vietnam’s transfer pricing, withholding tax rules, and any new e-commerce taxes (e.g. digital platform withholding).

- Plan for changes. With Vietnam overhauling its tax laws in 2025, businesses should proactively adjust. For example, the upcoming Corporate Income Tax (CIT) Law creates new tiers for small companies. Knowing that a company with revenue under VND 3 billion will pay 15% CIT (instead of 20%) from late 2025, you might adjust pricing or investment plans. A tax advisor can help you model these changes and apply any transitional provisions.

- Monitor global tax trends. Vietnam is aligning with international tax rules (e.g. the OECD Base Erosion rules and digital service taxes). If you have multinational ties, watch for Vietnam’s implementation of global minimum tax (Pillar Two) and any treaty changes. Keeping advisors who follow both Vietnamese law and global tax developments ensures you won’t be caught off-guard.

Services Provided as a Part of Business Tax Advisory in Vietnam

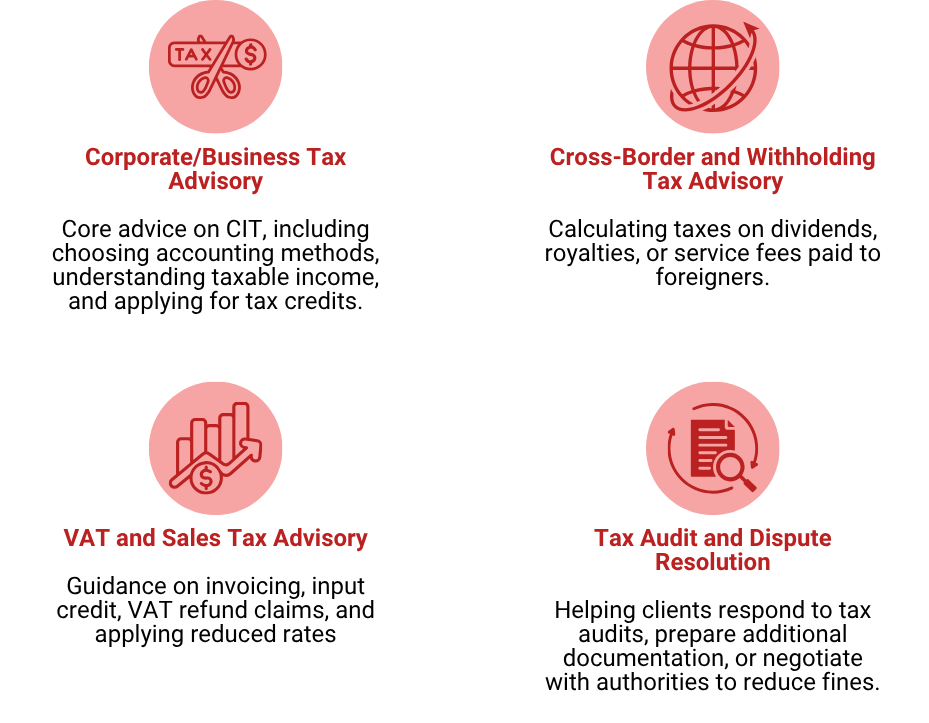

A full-service tax advisor in Vietnam goes beyond mere tax return preparation. Key services for SMEs and startups include:

- Tax compliance support. Ensuring timely VAT, CIT, PIT filings, and e-invoice submissions. Advising on proper tax deductions and credits under Vietnamese law (e.g. allowable expenses, investment incentives).

- Strategic tax planning. Forecasting tax liabilities under different scenarios (new business lines, cross-border transactions) and recommending structures (such as holding company setups) to optimize tax outcomes.

- Transfer pricing documentation. Preparing compliant transfer pricing studies if your business trades with related foreign parties, as required by Vietnam’s tight transfer pricing regulations.

- Withholding tax management. Calculating and withholding correct taxes for salaries, dividends, royalties, and payments to foreign contractors (including the new regime taxing e-commerce incomes).

- Mergers & Acquisitions (M&A) advisory. Analyzing tax implications of business acquisitions, joint ventures or restructurings – for example, advising on how to conduct due diligence to avoid hidden VAT/CIT liabilities.

- Tax audit representation. Assisting during tax audits or investigations by explaining transactions to the tax officers and negotiating penalties if any issues arise.

- Payroll tax services. Setting up payroll systems to handle PIT and social insurance for employees correctly, including registration with tax authorities and liaison on tax deductions.

- Tax incentives and grants. Identifying and applying for government incentives (such as CIT holidays or reduced rates for high-tech zones), which Vietnam offers for target industries.

- Training and updates. Providing seminars or updates to your finance team whenever the law changes. For example, after the new VAT law and e-invoice rules took effect in 2025, many advisers offered workshops on the changes.

Each of these areas addresses specific tax compliance needs. For example, VAT advisory ensures you charge, collect, and recover VAT correctly under the 2025 VAT Law. Corporate tax advisory helps you apply the right CIT rate (now 20% standard, with special 15% and 17% rates for small businesses). International tax advisory helps companies design transactions (like foreign sales or services) to minimize double taxation and comply with Vietnam’s expanding definitions of a taxable presence.

Need help with taxation in Vietnam? Explore InCorp Vietnam’s Tax Advisory Services here!

What Are the Different Kinds of Business Tax Advisory Areas?

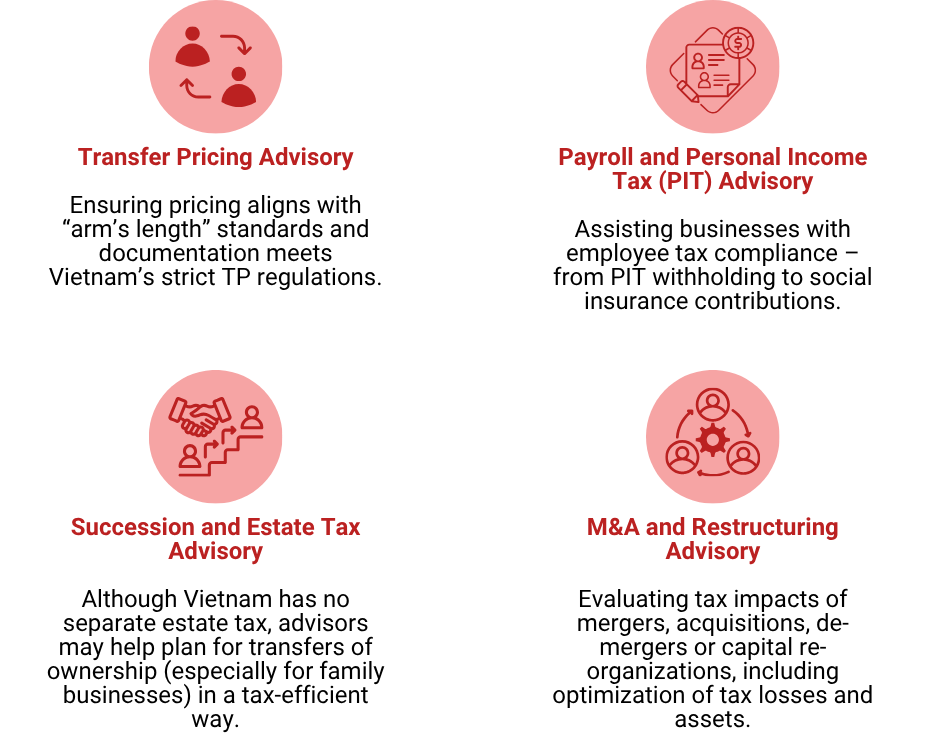

Tax advisory services cover many specialties. Among them:

By dividing tax advisory into these categories, firms can provide specialized expertise. Many tax advisors in Vietnam hold certifications in international areas (like international taxation or transfer pricing), ensuring they understand both local law and how it interacts with global tax systems.

What Advantages Can You Gain from Using Business Tax Advisory Services in Vietnam?

Hiring a professional tax advisor can save your business time and money in the long run. Some key advantages include:

- Up-to-date Compliance: Vietnam’s tax laws change frequently (as seen with new VAT and CIT laws in 2025). Advisors track legal updates and inform you how to implement them. This ensures you meet all requirements (e.g. e‑invoice mandates, new CIT rates) without having to decipher dense legal texts yourself.

- Penalty Avoidance: A good advisor helps you structure transactions and filing schedules to avoid mistakes that trigger fines. For example, they will ensure your invoices include all required information and are submitted on time to avoid the penalties described above.

- Tax Savings and Incentives: Experts can identify deductions or incentives you might miss. Under the new tax regime, certain R&D expenses or “green” investments are deductible, and small enterprises can pay lower CIT rates. An advisor calculates how these apply to your business, potentially saving significant tax.

- Risk Management: By monitoring changes like the new provisions for foreign e-commerce incomes and automatic exchanges (BEPS/Pillar 2), advisors help you anticipate cross-border tax issues. For instance, understanding how Vietnam now treats foreign digital income is crucial for SMEs selling online abroad.

- Strategic Focus: Delegating tax work to specialists lets you focus on core business activities. Instead of wrestling with monthly VAT forms, you can rely on an advisor to handle it correctly. This is especially helpful for startups with limited accounting staff.

- Audit Preparedness: With the complex Vietnam tax environment, companies face regular audits. A tax advisor can prepare your books and walk you through documentation in advance. If an audit happens, having an advisor means having an advocate to interact with tax officers, which often leads to lower penalties or quicker resolutions.

- Customized Advice: Advisors tailor their guidance to your business model and size. An e‑commerce SME, for example, will get different advice (about platform withholding tax, export VAT, etc.) than a local manufacturer (who might focus on import duties and domestic VAT).

- International Expertise: If you have foreign investors or cross-border operations, specialized advisors understand treaties and how to avoid double taxation. Vietnam’s laws for foreign contractors and investors can be confusing (with rules on Permanent Establishment and Limited Withholding Taxes), so expert help is invaluable.

In short, expert tax advice ensures you aren’t leaving money on the table and aren’t blindsided by new rules. In Vietnam’s strict system, the cost of non-compliance can be high; an advisor keeps you on the right side of the law so you can concentrate on growing your business.

Read Related: Vietnam Business Accounting & Taxation: Principles of Taxation, Problems & Solutions, and Accounting Department Setup

How InCorp Vietnam can Assist?

Vietnam’s tax laws can be complex and time-consuming for businesses to navigate. At InCorp Vietnam, our business tax advisory services help companies stay compliant and avoid costly Vietnam penalties. With years of experience, we assist businesses in managing their taxes efficiently and in full compliance with local regulations.

Our team evaluates your current tax situation, identifying any tax compliance issues or risks. We then implement effective tax management systems to ensure alignment with Vietnam’s tax laws. Additionally, for companies operating across borders, we provide international tax advisory services, ensuring compliance with both local and global tax regulations. With our expertise, your business stays up to date and free from tax-related complications.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What is a tax advisory?

- A tax advisory is a professional service that provides guidance on tax-related matters to individuals or businesses. It involves advising on tax planning, compliance with tax laws, optimizing tax efficiency, and managing tax risks. Tax advisors help clients understand and fulfill their tax obligations while minimizing liabilities within legal frameworks.

What is the business tax in Vietnam?

- In Vietnam, businesses are subject to several types of taxes, with Corporate Income Tax (CIT) being the primary one. The standard CIT rate is 20%, though certain sectors like oil and gas may face higher rates. In addition, businesses may also be liable for Value-Added Tax (VAT) at 10% (or 5%/0% for specific goods and services), and other taxes such as Foreign Contractor Tax, Personal Income Tax (for employees), and licensing fees. Tax obligations vary depending on the business structure, sector, and activities.

What is the difference between tax advisory and tax consulting?

- Tax advisory and tax consulting are closely related and often used interchangeably, but there is a subtle difference. Tax advisory typically refers to ongoing strategic guidance to help clients optimize their tax positions and comply with regulations. Tax consulting is more project-specific and focuses on solving particular tax issues, such as restructuring, transaction planning, or responding to audits. In practice, both services may overlap depending on the client's needs.