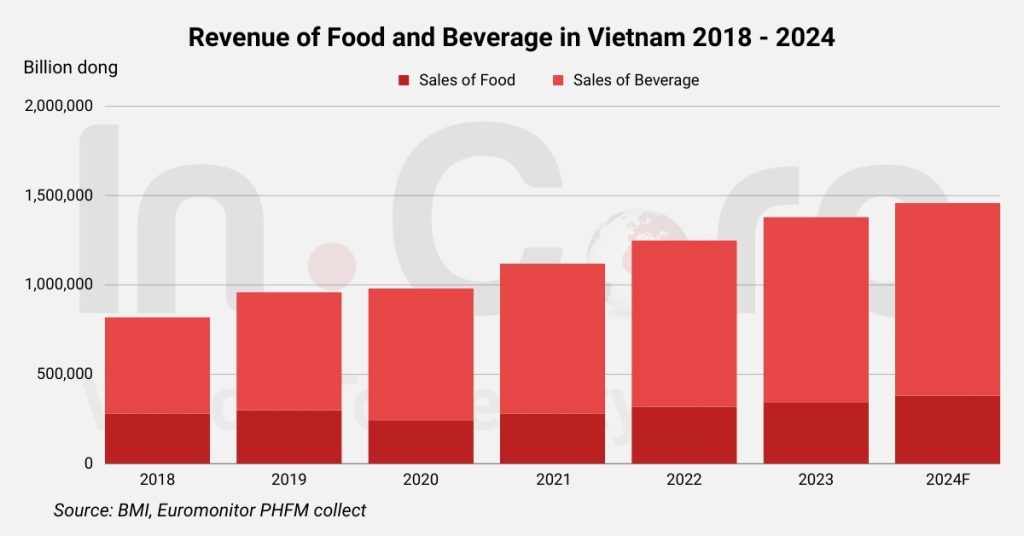

The FnB industry in Vietnam is a rapidly growing sector driven by rising incomes, urbanization, and tourism. It is widely regarded as “a hotbed of opportunity”, but success requires careful navigation of Vietnamese laws. This advisory covers all major legal and compliance topics for foreign investors. We explain market entry procedures, entity structures, licensing steps, food safety rules, labeling standards, land use, labor and tax obligations, IP and branding, ownership limits, recent reforms, and government incentives. Each section offers practical tips and cites authoritative sources to guide investors entering Vietnam’s food & beverage industry.

Market Entry and Company Formation

Foreign investors planning to enter the FnB industry in Vietnam must follow Vietnam’s Investment Law and Enterprise Law. In practice, investors first obtain an Investment Registration Certificate (IRC), then an Enterprise Registration Certificate (ERC), and finally any sector-specific licenses. An IRC (issued by the provincial DPI or EZ management board) formally approves the investment plan.

Once the IRC is secured, an investor applies for the ERC to legally incorporate the company. The ERC (from the Department of Planning and Investment or Finance) is the main business license and is typically valid indefinitely. Planning ahead is crucial: simple projects may take 1–2 months for IRC/ERC, whereas sensitive sectors (like large food factories or foreign franchising deals) can require additional ministry approvals.

In addition, foreign food businesses need industry permits. For a restaurant or packaged food, authorities normally require a Certificate of Food Safety Conditions (CFSC) from the health department as well as other clearances (fire safety, sanitation, signage, employee health checks, etc.). Obtaining these typically involves inspections and compliance with technical standards.

For example, every food & beverage outlet must get a Food Safety Certificate and related permits before opening. In practice, some common steps for restaurants or food factories include: (1) passing an official food safety/hygiene inspection; (2) meeting building, water, and waste standards; (3) obtaining a fire safety approval from the fire department; and (4) registering employee health check certificates with the health authority. Investors should budget 2–6 weeks for these industry licenses after getting ERC.

Foreign investors may also enter Vietnam via acquisitions or share purchases in existing companies. Under the 2020 Investment Law, foreign capital can be contributed to or acquired in any Vietnamese enterprise (LLC, JSC, partnership, etc.) so long as market access conditions are met. Major transfers (for example increasing foreign ownership over 50% or investing in sensitive land areas) require pre-transaction registration with investment authorities. In all cases, changes in shareholders/members must be updated in the company’s business registration documents.

Investing in Vietnam? Check out Talk to our Company Registration Consultants

Business Registration and Licensing

Foreign investors should be prepared for a multi-step registration process. First secure the IRC (if foreign ownership >50% or if project is FDI); then obtain the ERC. Only after the ERC can the company legally engage in business and apply for operational permits. For food & beverage enterprises, the ERC must list the correct business lines (e.g. cuisine services, food manufacturing codes, wholesale, etc.), as some activities (like processing certain foods) might require special approvals. It is wise to include all likely business lines on the registration to avoid amendments later.

Beyond IRC/ERC, sector-specific permits are critical. As noted, a Food Safety Certificate is mandatory. For restaurants and food factories, this typically involves an inspection by the Vietnamese Food Administration (VFA) or local health department, checking sanitation, equipment, and labeling compliance.

Other typical permits include:

– Fire Safety Approval: Issued by the fire department after facility inspection.

– Environmental/Sanitation Inspection: Local environment or health officials inspect waste disposal, kitchen conditions, etc.

– Signboard/Advertising Permit: Required for outdoor signage of the restaurant/shop.

– Liquor License: If selling alcohol, a separate license is needed from police authorities.

– Import/Export Certificates: Food processors need an import license for raw materials and a certificate (or CCD) for each exported food product. Notably, all imported processed foods must be registered with the VFA to obtain a Certificate of Conformity Declaration (CCD) before import.

Failure to obtain these licenses can result in fines or shutdown. In practice, foreign investors often engage local counsel or consultants to handle this licensing. As one industry guide warns, “multiple licenses and permits” are required and regulations change frequently. For example, Vietnam recently introduced new e-licensing portals for food registration, but also tightened enforcement of labeling rules. A key tip: start early on licensing, allow extra time for government reviews, and maintain updated checklists. Proper preparation – including translations of documents and understanding inspection criteria – will streamline the process.

Read More: Food and Beverage Industry in Vietnam: Market Overview and Investment Opportunities

Food Safety Regulations

Compliance with Vietnam’s stringent food safety laws is non-negotiable in the FnB industry in Vietnam. The primary law is the Law on Food Safety, enforced by the Ministry of Health (MOH) through the Vietnam Food Administration (VFA). Both manufacturers and restaurants must follow MOH regulations on hygiene, allowable additives, labeling, and recalls. Producers must often implement food safety systems like HACCP or ISO 22000. Indeed, LTS Law advises foreign food companies to adopt HACCP plans and possibly ISO certification to control safety risks and meet consumer expectations.

Vietnam’s food safety standards cover raw ingredients, processing, storage, and distribution. Key points include:

- Ingredient and Additive Rules: Vietnam has strict lists of permitted additives and maximum residue limits for pesticides, heavy metals, etc. For example, colorants and preservatives must match MOH guidelines. Non-compliance can lead to denied import or product seizure.

- Production Permit: Food factories need a Production License from the MOH or its local branches, confirming the facility meets Good Manufacturing Practices (GMP). Restaurants may need a similar production quality license if doing any in-house processing.

- Regular Inspections: Health inspectors visit businesses to check compliance. Inspections may be random or scheduled, and reports must be maintained. Being proactive (self-audits, staff training) is advisable.

- Food Recalls and Liability: Vietnam holds companies responsible for foodborne illness. A recall plan and insurance are prudent, even though formal recall rules are evolving.

For labeling, Vietnam requires detailed Vietnamese-language labels on all FnB products sold domestically. Labels must list product name, ingredients, weight, expiration date, manufacturer information, and nutrition facts in Vietnamese. If health claims or nutrition content claims are made, they must match Vietnamese regulations. Imported pre-packaged foods often need to meet additional local testing or registration requirements. Failure to label properly can halt product imports or lead to market removal.

Practical tip: Engage a local food safety consultant and budget for labeling translation/certification. Many foreign brands underestimate Vietnam’s labeling rules, so plan to hire Vietnamese translators and register products before launch. Also, maintain good record-keeping of testing results and safety manuals, as regulators increasingly require documentation in audits.

Foreign Ownership Limits and Local Partners

For the FnB industry in Vietnam, most segments are fully open to foreign ownership. According to Vietnam’s WTO commitments and investment laws, the restaurant and catering sector is classified as “committed” to 100% foreign investment. In practice, this means you can own 100% of a Vietnamese company operating restaurants, cafes, bakeries, or packaged food production (unless other sector rules apply). A legal note: even though some FnB businesses don’t require a local partner, the company must still be incorporated as a Vietnamese legal entity (LLC/JSC).

There are few specific foreign ownership caps in FnB:

- Distribution: Owning a distribution company (importer or wholesaler) is also generally allowed 100%, except on goods under state monopoly. Most food items (rice, sugar, etc.) are open, but note that “cane and beet sugar” and some staples were once restricted. Always check the latest negative list.

- Retail and Franchising: Retail sale of food and drink (e.g. grocery or self-service) is open, but setting up multiple outlets might trigger local market regulations or require zoning permissions. Also, foreign franchises (e.g. a U.S. donut chain) must register with MOIT for the franchise and follow bilateral FTA commitments. No law forces a local partner for franchising.

- Certain Sub-sectors: If you process food from forests or aquatic products, MARD can require local registration. Some packaged water, pharmaceuticals, or “traditional medicine” (herbal) might have foreign limit due to health regulations. But standard FnB lines (coffee, soft drinks, snacks, dairy) have no equity limits.

- Location Restrictions: Note that a restaurant’s location often requires local approval. Many provinces require a statement from the People’s Committee for new restaurants (especially in tourist areas or downtown). Land can be zoned only for specific uses. So even with 100% ownership, you may need local government sign-off on site selection.

If a local partner is desired (for distribution network or local know-how), note that a Joint Venture in FnB is typically still structured as an LLC or JSC. The investment law now treats foreign and domestic investors equally on access, so choosing a Vietnamese partner is largely a strategic choice, not a legal requirement.

In summary, foreigners can fully own FnB ventures in Vietnam. Care must be taken to comply with any conditions (such as approval of locations, or specific sub-license requirements), but equity caps are generally not an obstacle. For example, the legal advisory notes that foreign investors are “not limited in capital ratio” for food service businesses.

Practical Tips, Challenges and Solutions

Practical Tips:

- Engage Locals Early: Hire a reputable local law or consultancy firm when planning entry. Vietnamese regulatory practices (including required documents and timeline) can differ greatly from Western norms. Local partners can also navigate provincial requirements (zoning, signage permits) that are often not well-publicized.

- Build Quality Systems: Establish robust food safety and quality systems (HACCP, ISO 9001/22000) from day one. This not only smooths licensing and exports, but builds consumer trust in a competitive market. Frequent training of staff and strong kitchen protocols help avoid violations.

- Protect Your Brand: Don’t skimp on IP. Register trademarks and branding in Vietnam before launching. Many entrepreneurs delay this and later find knock-offs. Also register any unique product designs or logos. Use clear labeling to stand out; Vietnamese consumers gravitate toward brands with Vietnamese packaging.

- Plan for Labor: Understand turnover is high in F&B. Budget for staff turnover costs (recruiting, training). Structure compensation (salaries + incentives) attractively to retain quality servers and chefs. Implement clear workplace rules to avoid labor disputes, especially in a multicultural workplace.

- Comply with Regulations: Continuously monitor food safety, employment, and tax compliance. Use digital accounting software to issue proper invoices and calculate taxes. Many foreign businesses fall afoul of Vietnamese invoice rules inadvertently. Conduct periodic compliance audits with a local accountant.

- Work with Distributors (if needed): If exporting Vietnamese FnB abroad, partner with experienced importers in target markets. Similarly, if importing inputs, use licensed importers with customs expertise.

Common Challenges:

- Regulatory Complexity: As highlighted, multiple ministries (Health, Industry, Agriculture) overlap in FnB regulations. This can lead to bureaucracy and delays. Solution: Maintain a centralized compliance calendar, assign a staff member or consultant to each regulatory area (food, labor, environment).

- Infrastructure Gaps: Outside major cities, cold-chain logistics and water treatment can be uneven. For production, ensure backup plans (e.g. generators, extra water storage). Urban restaurant investors must factor in long lead times for restaurant fit-out (permits for kitchen exhaust, plumbing can be lengthy).

- Competition: The Vietnamese market has strong local FnB players and international franchises. New entrants must compete on either price or unique value (authentic recipes, health orientation, brand experience). Solution: Conduct careful market research, adapt your menu to local tastes, and consider strategic locations (e.g. emerging neighborhoods). A local marketing expert can tailor branding for Vietnamese consumers.

- Language and Culture: Minor details (dates, ingredient names) on packaging or contracts can be misunderstood without quality translation. Ensure contracts are bilingual where needed. Hire local managers or liaisons with language skills. Training foreign managers in Vietnamese business culture (e.g. indirect communication) is advisable.

By anticipating these issues and leveraging the cited legal guidelines, foreign investors can navigate Vietnam’s regulatory environment. The FnB industry in Vietnam can be rewarding, but success hinges on meticulous compliance and local engagement. For example, a foreign café chain expanded successfully only after partnering with a Vietnamese hospitality expert to handle HR and local marketing nuances. Another tip: attend government and industry seminars (e.g. MOH/VFA food conferences) to stay updated on policy changes.

Conclusion

Vietnam’s food and beverage industry in Vietnam offers dynamic growth and attractive opportunities for foreign investors. However, entering the market requires detailed preparation: obtaining the proper licenses (IRC, ERC, food safety permits), choosing the right company structure (LLC/JSC), and rigorously following food, labor and tax laws. Understanding local nuances—like mandatory Vietnamese labeling, environmental regulations, and high excise taxes on alcohol—is key. Investors should leverage available incentives (tax holidays, duty exemptions, land rent breaks) and stay current with recent reforms (new tax rates and labor rules).