Vietnam social insurance is becoming increasingly critical for business owners and employers to master as the economy continues to grow. This complexity is particularly evident in Vietnam’s employee insurance system, which includes various types of insurance collectively known as SHUI – including social insurance (SI), health insurance (HI), unemployment insurance (UI).

Understanding and effectively managing SHUI is essential for ensuring compliance with Vietnamese regulations and for providing adequate protection for employees. This article aims to demystify the components of Vietnam’s employee insurance system, offering valuable insights for businesses navigating the fast-evolving landscape.

Check out InCorp Vietnam services to see how we help your business with Employee Insurance (SHUI)!

Obligations Related to Payroll in Vietnam

Social Insurance Contributions

According to the Law on Social Insurance No. 41/2024/QH15 (2024 Social Insurance Law), effective July 1, 2025, the compulsory insurance payments are as listed below:

| Insurance Type | Employee Contribution | Employer Contribution | Minimum Cap (**) | Maximum Cap (**) |

| Health Insurance | 1.5% | 3% | Statutory pay rate: 2.340.000 | 20 times the statutory pay rate 20 x 2.340.000 = 46.800.000 |

| Social Insurance | 8% | 17.5% | Statutory pay rate: 2.340.000 | 20 times the statutory pay rate 20 x 2.340.000 = 46.800.000 |

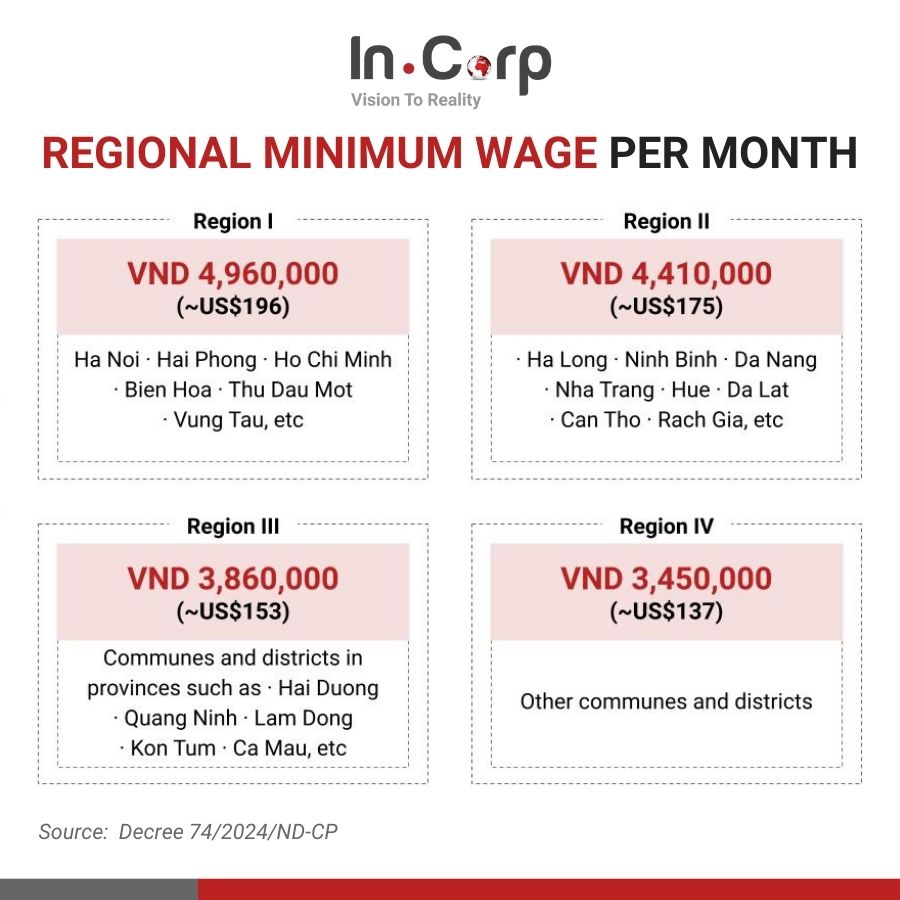

| Unemployment Insurance (*) | 1% | 1% | Minimum regional wage Region 1: 4.960.000 Region 2: 4.410.000 Region 3: 3.860.000 Region 4: 3.450.000 | 20 times the minimum regional wage Region 1: 99,200,000 Region 2: 88,200,000 Region 3: 77,200,000 Region 4: 69,000,000 |

*Unemployment insurance applies exclusively to local Vietnamese employees.

**The minimum/maximum cap refers to the lowest/highest amount on which the percentage will

be calculated.

Minimum Wage for Payroll in Vietnam

As of July 2023, the minimum wage in Vietnam’s urban areas (HCMC, City of Hanoi, Danang) is VND 4,680,000. Decree 38/2022/ND-CP regulates the current minimum wage across Vietnam’s regions, from most urban (Region I) to generally rural (Region IV).

What does social insurance cover?

Social insurance provides employees with various benefits, such as sick leave, maternity leave, compensation for work-related injuries or occupational illnesses, retirement pensions, and death benefits. Health insurance enables employees to access medical check-ups and both inpatient and outpatient care at approved healthcare facilities.

Unemployment insurance, which replaces traditional severance pay, offers financial support based on the duration of contributions made by both the employee and their former employer. The monthly unemployment benefit equals 60% of the employee’s average salary during their final six months of work

Trade Union Funds

According to Article 23, Decision 1908/QĐ-TLĐ and the updated Trade Union Law 2024 effective July 1, 2025, the contributions to trade union funds are as follows:

- Employer Contribution: Companies are required to contribute 2% of the total payroll for both Vietnamese and foreign employees to the trade union fund. This contribution is fully paid by the employer.

- Employee Contribution: If a company has established an in-house Trade Union Board, employees (both Vietnamese and foreign) are required to contribute 1% of their salary, capped at a maximum of VND 180,000 per month.

The 2024 Trade Union Law also grants foreign employees with labor contracts of 12 months or longer the right to join grassroots trade unions, enhancing their participation in workplace representation.

Personal Income Tax

According to the Law on Personal Income Tax 2007, personal income tax rates are as listed below:

– From 5 to 35% for local employees and foreign tax residents, depending on the income level

– 20% for foreign non-tax residents (staying in Vietnam less than 183 days/year or not having e regular residence in Vietnam)

Download InCorp Vietnam’s Tax Guide to explore more Personal Incom Tax in Vietnam

Vietnam Social Insurance for Foreign Employees

Under the Law on Social Insurance No. 41/2024/QH15, which takes effect on July 1, 2025, foreign nationals working in Vietnam are required to participate in compulsory social insurance if they meet the following conditions:

- They are employed by organizations in Vietnam under a labor contract with a term of at least 12 months.

- They hold a valid work permit, relevant practical license, or certificate.

Read Related: Vietnam’s Work Permit and Temporary Residence Card for Foreigners

This mandatory participation extends the social insurance benefits to foreign employees, allowing them to enjoy the same protections as Vietnamese workers, including:

- Maternity leave

- Sick leave

- Occupational diseases and accidents compensation

- Retirement pensions

- Death benefits

- One-time pension payment upon exiting Vietnam

Nonetheless, compulsory social insurance is only applicable to foreign employees in Vietnam when they meet the following conditions:

– A minimum of 12 months of foreign employment contract

– They have a work permit, relevant practical license, or certificate

Read Related: HR Outsourcing in Vietnam: Optimizing Operations for Business Success

Foreign staff is not eligible for mandatory social insurance in the following situations:

– Foreigners come from an overseas office due to an internal transfer.

– They have more than one employer in Vietnam. The social insurance is only applicable to their first employment, and each of the foreigner’s employer is responsible for labor accident and occupational diseases insurance at 0.5%

– They are in their retirement age, which is 56 for women and 60 for men. According to Decree 135/2020/ND-CP on Retirement Age, the statutory retirement age will become 60 for women from 2035 and 62 for men from 2028.

Read Related: Vietnam’s Workforce: High Demand Skills and Advice for Business in 2024

Paid and Unpaid Leaves for Employees in Vietnam

Regulated mainly by the Labor Code 2019 and enhanced by the Labor Law 2025

Employers in Vietnam must provide the following paid leaves according to the latest laws:

- Annual Leave: Minimum 12 days; 14–16 days for hazardous jobs; +1 day per 5 years after 5 years. Pro-rated if less than 12 months worked.

- Public Holidays: 11 days/year; substitute rest if holiday falls on day off; foreign employees get 1 extra day for their national holiday; work on holidays paid at 300% wage minimum.

- Maternity & Paternity Leave: 6 months maternity leave; 5–10 days prenatal checkup; 5 days paternity leave (7 days for C-section/multiple births).

- Sick Leave: 30–60 days paid sick leave/year based on social insurance contributions.

- Marriage & Bereavement Leave: 3 days for employee’s marriage; 1 day for child’s or parent’s marriage; 3 days for death of parent, spouse, or child; 1 day for grandparent or sibling.

- Unpaid Leave: Allowed with employer consent; up to 5 days unpaid emergency leave/year protected by law (Labor Law 2025).

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

[incorp_content_bottom]

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How much is social insurance in Vietnam?

- In Vietnam, social insurance contributions are shared between the employer and the employee. As of 2024, employers contribute 17.5% of the employee’s gross salary (comprising 17% for social, health, and unemployment insurance and 0.5% for occupational accident insurance), while employees contribute 10.5% (8% for social insurance, 1.5% for health insurance, and 1% for unemployment insurance). These rates apply to Vietnamese employees; foreign employees are subject to slightly different rates, including a 8% employee contribution and 17.5% employer contribution (with certain exemptions depending on the contract and nationality). Social insurance contributions are capped at 20 times the basic salary for calculation purposes.

How Much Tax Do You Pay In Vietnam

- In Vietnam, personal income tax rates range from 5% to 35% based on a progressive scale. Corporate income tax is generally 20%. Tax rates may vary depending on residency status and income type.

Is health insurance free in Vietnam?

- No, health insurance in Vietnam is not completely free. Vietnamese citizens are required to participate in the compulsory health insurance program, which is partially subsidized by the government, especially for low-income groups, students, and the elderly. Employees and employers contribute to health insurance as part of the mandatory social insurance system, while foreigners working in Vietnam may also be required to contribute depending on their work permit and contract terms.

Is social insurance mandatory in Vietnam?

- Yes, social insurance is mandatory in Vietnam for both local and foreign employees who have a labor contract of at least one year. Employers and employees are required to contribute to social insurance, health insurance, and unemployment insurance according to prescribed rates set by the government.