Starting a business in Vietnam as a foreigner often involves navigating regulatory restrictions. A nominee shareholder arrangement offers a practical solution, enabling a local nominee (registered owner) to hold company assets and manage operations on behalf of the foreign investor (beneficial owner) while ensuring compliance with local laws. Before proceeding with such arrangements, foreign investors are recommended to engage company formation consultants to establish a recognized legal entity under Vietnamese investment regulations.

This arrangement allows foreign investors to access restricted sectors, maintain anonymity, or operate in industries requiring special permits. With the nominee handling administrative tasks, the foreign investor retains full control over resources and strategic decisions.

This article explores the benefits and processes of nominee shareholder arrangements, highlighting their value for foreign investors in Vietnam.

What is a Nominee Shareholder in Vietnam?

A nominee shareholder in Vietnam is a local individual or entity whose name is registered as a company’s shareholder on behalf of a foreign investor. While the nominee appears on licences and corporate records, they do not contribute capital or benefit economically. The foreign investor, as the beneficial owner, provides the funding, controls the business, and receives the profits.

This structure arose due to Vietnam’s foreign ownership restrictions in certain sectors. Under WTO commitments and investment laws, industries such as telecommunications, film production, banking, and some service sectors are subject to foreign ownership caps or local shareholding requirements. These rules often prevent foreign investors from holding full ownership directly.

By appointing a nominee shareholder, a foreign investor can access restricted sectors while formally complying with local regulations. The nominee holds shares and licences on paper, while control and economic benefits remain with the foreign investor through private arrangements.

Vietnamese law does not officially recognize nominee shareholders, placing them in a legal gray area. Although commonly used in practice, nominee structures carry legal and enforceability risks and should be approached with caution and proper advisory support.

Is It Legal and Safe to Use a Nominee Shareholder in Vietnam?

Nominee shareholder arrangements sit in a legal gray area in Vietnam. While commonly used in practice, they are not explicitly recognized under Vietnamese law. If examined by courts or authorities, a nominee structure may be treated as a “disguised investment” or sham transaction, exposing foreign investors to significant legal risk. It is therefore essential to understand the legal context before using a nominee.

Vietnamese law does not protect the rights of a foreign beneficial owner in a nominee setup. Legally, the person whose name appears on official records is considered the true owner. Private agreements stating that shares are held on behalf of a foreign investor are not registered and have no guaranteed legal effect. In disputes, courts have often declared nominee arrangements invalid under the Civil Code as sham transactions. In addition, the Law on Investment 2020 allows authorities to terminate projects if a nominee is used to bypass foreign ownership restrictions. In short, if discovered, the business may be forced to shut down.

Nominee arrangements are not expressly criminalized, and many companies operate without immediate issues. However, they are legally fragile. If problems arise such as disputes with the nominee, regulatory reviews, or attempts to enforce private agreements, the foreign investor may have little legal protection. The structure relies heavily on trust rather than enforceable ownership rights.

Despite these risks, nominee arrangements can be managed more safely with proper precautions. Careful due diligence is critical when selecting a nominee. The nominee should be a trusted individual or a reputable professional firm with a clear track record. Engaging qualified legal or corporate advisors is strongly recommended. Advisors can help structure supporting documents, arrange powers of attorney, prepare share transfer mechanisms, and ensure the foreign investor retains practical control over management and finances. In some cases, the foreign investor can still be appointed as director or legal representative, allowing day-to-day operational control.

Vietnam is also moving toward greater ownership transparency. From 1 July 2025, companies must declare their ultimate beneficial owners to authorities, including individuals who own or control 25 percent or more of the company. While nominee arrangements are not publicly disclosed, beneficial ownership must be reported to regulators. Anonymity is therefore limited, and failure to comply may result in penalties.

In practice, nominee arrangements can work if used cautiously and only where necessary. Foreign investors should avoid nominees where direct investment is legally possible, choose nominees carefully, use well-structured agreements, retain operational control, and comply with disclosure rules. While risky, a nominee can still be a workable solution when properly planned, though alternative legal structures should always be considered first.

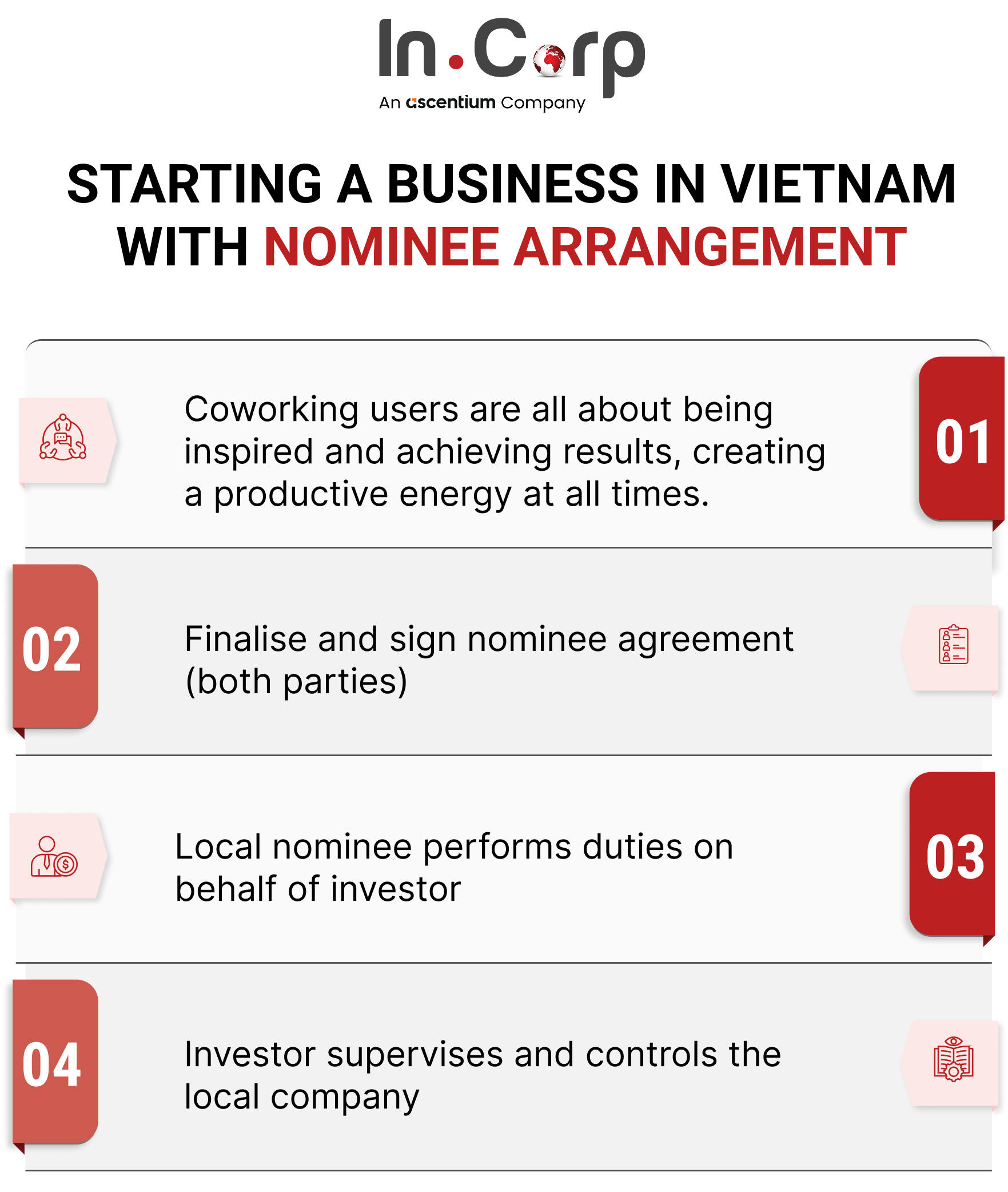

Nominee Arrangement Process in Vietnam

A nominee arrangement is among the simplest methods for establishing a company in Vietnam. Below is a concise overview of the requirements and steps involved:

- Capital Contribution: The foreign investor, referred to as the beneficial owner, must provide capital contributions to set up a local company under the name of the local nominee (the registered owner). The nominee can be either a Vietnamese individual or entity.

- Finalizing the Agreement: Both parties should formalize the nominee agreement through a professional consultant to ensure legal compliance and clarity in roles.

- Nominee Responsibilities: The registered owner assumes responsibility for tasks such as daily operations, administration, procurement, legal issues, communications, and financial arrangements. These tasks are carried out under the strict instruction, direction, and supervision of the beneficial owner.

- Beneficial Owner Control: Despite the nominee’s operational role, the beneficial owner retains full control of the company, including strategic decision-making.

For conditional business lines, specific foreign capital ownership limits apply, such as 51%-49% or 99%-1%. In such cases, the investor and nominee shareholder collaborate to form a joint venture company in compliance with Vietnamese regulations.

Setting up a business in Vietnam? Check out InCorp Vietnam’s Incorporation Services in Vietnam

Benefits of Using a Nominee Shareholder in Vietnam

A registered owner in a nominee company acts as the nominee shareholder. While officially listed as a shareholder under the company, the nominee shareholder is an unrelated third party who does not own the shares or exercise real control over the company. This role is distinct from the nominee director, or beneficial owner, who retains full control and ownership of the company’s assets.

Nominee structures offer numerous benefits for foreign investors navigating Vietnam’s business environment. These structures simplify the process of establishing a business, particularly in sectors restricted for foreign investment. They shield the beneficial owner’s identity, providing anonymity and diverting competitors’ attention. This privacy helps protect foreign investors’ rights while ensuring their control over the company.

Additionally, nominee arrangements streamline registration and compliance tasks, such as opening bank accounts and handling legal obligations, reducing technical and legal complexities. They also allow foreign investors to access Vietnam’s tax benefits, as nominee companies qualify as local entities under Vietnamese law. By simplifying investments and securing legal and financial advantages, nominee structures have become a globally adopted strategy, widely applied in Vietnam to facilitate foreign participation in restricted or conditional business sectors.

Advice for Using a Local Nominee in Vietnam

While nominee structures can be useful, they involve material risks that foreign investors must clearly understand and actively manage.

Lack of legal enforceability.

Vietnamese courts generally recognize only the registered shareholder as the legal owner. Private nominee agreements may be declared invalid if viewed as disguising foreign investment in restricted sectors. If a dispute arises, the foreign investor may have limited legal protection.

Precaution: Choose a nominee you trust deeply and document the relationship carefully. While documents may not be fully enforceable, clear records of capital contributions, written acknowledgments, and ongoing evidence of control can help deter disputes and support negotiation if issues arise.

Risk of asset misuse or loss of control.

Because the nominee is the legal owner, they could theoretically sell assets, borrow in the company’s name, or exclude the foreign investor from decisions.

Precaution: Retain practical control wherever possible. This includes appointing the foreign investor as director or legal representative, requiring joint signatures for bank accounts, limiting key decisions in the company charter, and closely monitoring financial and corporate records.

Unreliable nominee service providers.

Some nominee providers lack professionalism or disappear after setup, leaving investors exposed.

Precaution: Work only with reputable advisors or firms with a proven track record. Avoid unusually cheap services and always have documents reviewed by independent legal counsel.

Compliance and operational risks.

If the nominee is careless or unsuitable, missed filings or personal issues may affect the company’s licensing and credibility.

Precaution: Select nominees with clean records and stable backgrounds. Ensure compliance work is handled by professional accountants or advisors, not left solely to the nominee.

Tax risks.

Dividends or profit flows to nominees may trigger personal tax exposure or raise questions when funds are transferred to the foreign investor.

Precaution: Plan financial flows carefully with tax advisors. Common approaches include reinvestment, formal loan structures, or other compliant mechanisms to reduce tax leakage.

Exit and transfer risks.

Transferring shares back to the foreign investor or selling the business later requires the nominee’s cooperation.

Precaution: Clearly define exit obligations in advance and maintain a strong working relationship with the nominee to avoid leverage issues later.

Overall, nominee arrangements rely heavily on trust and operational control rather than legal ownership. They require disciplined risk management and professional guidance.

Alternatives to nominee shareholder arrangements

Because nominee structures involve legal risk, they should be a last resort. In many cases, foreign investors can use safer and fully compliant alternatives.

First, check whether the sector is actually open to foreign investment or allows high foreign ownership. Many industries in Vietnam now permit 100 percent or near-full foreign ownership, making nominees unnecessary if investors research current rules carefully.

Second, consider a genuine joint venture with a Vietnamese partner where ownership is capped. Although this means sharing equity, strong shareholder agreements can still provide management control and veto rights, and a real partner offers more legal certainty than a nominee.

Third, the business model can sometimes be restructured into an open or related sector, such as providing services or management to a restricted industry rather than investing directly in it.

Other options include Business Cooperation Contracts, where foreign and local parties share profits without forming a new entity, or investing indirectly through local funds that comply with ownership rules.

Overall, legal advisors generally recommend exploring these alternatives first, as they reduce uncertainty and compliance risk compared to nominee shareholder arrangements.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Is a CEO a shareholder?

- A CEO can be a shareholder, but it is not a requirement. In Vietnam, the CEO (commonly referred to as the General Director) is an executive position responsible for managing daily operations and may or may not hold ownership shares in the company.

What does it mean to be a shareholder?

- A shareholder is an individual or legal entity that owns shares in a company, giving them partial ownership. Shareholders may have rights such as voting on key company matters, receiving dividends, and accessing certain company information depending on the type and class of shares held.

What Is A Nominee Arrangement

- A nominee arrangement is a legal agreement where one party (the nominee) holds assets or securities on behalf of another (the beneficial owner). It is commonly used for confidentiality, administrative convenience, or regulatory compliance.

What Is A Nominee Company

- A nominee company is a legal entity that holds assets, such as shares or property, on behalf of another party, typically for confidentiality or administrative convenience. The beneficial owner retains full control and rights over the assets.