Vietnam, listed as Southeast Asia’s sixth most significant market, boasts one of the world’s fastest-growing economies. Its strategic business location and skilled workforce make it an exciting place to start a business, especially in Vietnam’s retail market.

Vietnam’s burgeoning economy, characterized by streamlined business operations, recorded a gross domestic product (GDP) growth rate of approximately 5.05 percent in 2023, as the General Statistics Office (GSO) reported on December 29. This growth has positioned the country as a compelling destination for global investors searching for opportunities. This article outlines the crucial steps for retail and wholesale business in Vietnam.

Interested in Retail & Wholesale Industry in Vietnam? Check out InCorp Vietnam’s Company Registration Services

Overview Retail & Wholesale Industry in Vietnam

In 2022, Central Retail, the Vietnam division, made up 25% of the conglomerate’s overall sales, establishing it as the market’s largest international retailer. It entered the country’s retail market in 2016 by acquiring the local supermarket network BigC. In 2023, Central Retail again invested US$173.1 million in the market. In 2023, Olivier Langlet, CEO of Central Retail Vietnam, anticipated a 6.7% GDP growth, marking it the fastest-growing Southeast Asian market.

Aeon, a Japanese corporation, also intends to expand its presence in Vietnam by launching 100 supermarkets by 2025. This will be approximately 10 times the number of stores it had in the country in October 2021. Additionally, the company aims to establish 16 malls nationwide in the upcoming years.

Retail and Wholesale Market in Vietnam

Despite the global repercussions of the COVID-19 crisis, Vietnam’s effective pandemic management facilitated the recovery of retail sales of consumer goods and services in 2020. The growth rate, while slightly lower than in 2021 at 12.7%, signaled a positive trajectory amidst the global retail market’s significant revenue decline during the pandemic.

Numerous international enterprises are eyeing Vietnam’s flourishing retail industry, currently valued at US$142 billion, with projections to soar to US$350 billion by 2025. This optimism is further buoyed by the country’s rank among the top three Southeast Asian countries for the highest growth in online retail sales, which reached US$13 billion in 2023, marking a 16% increase from 2020.

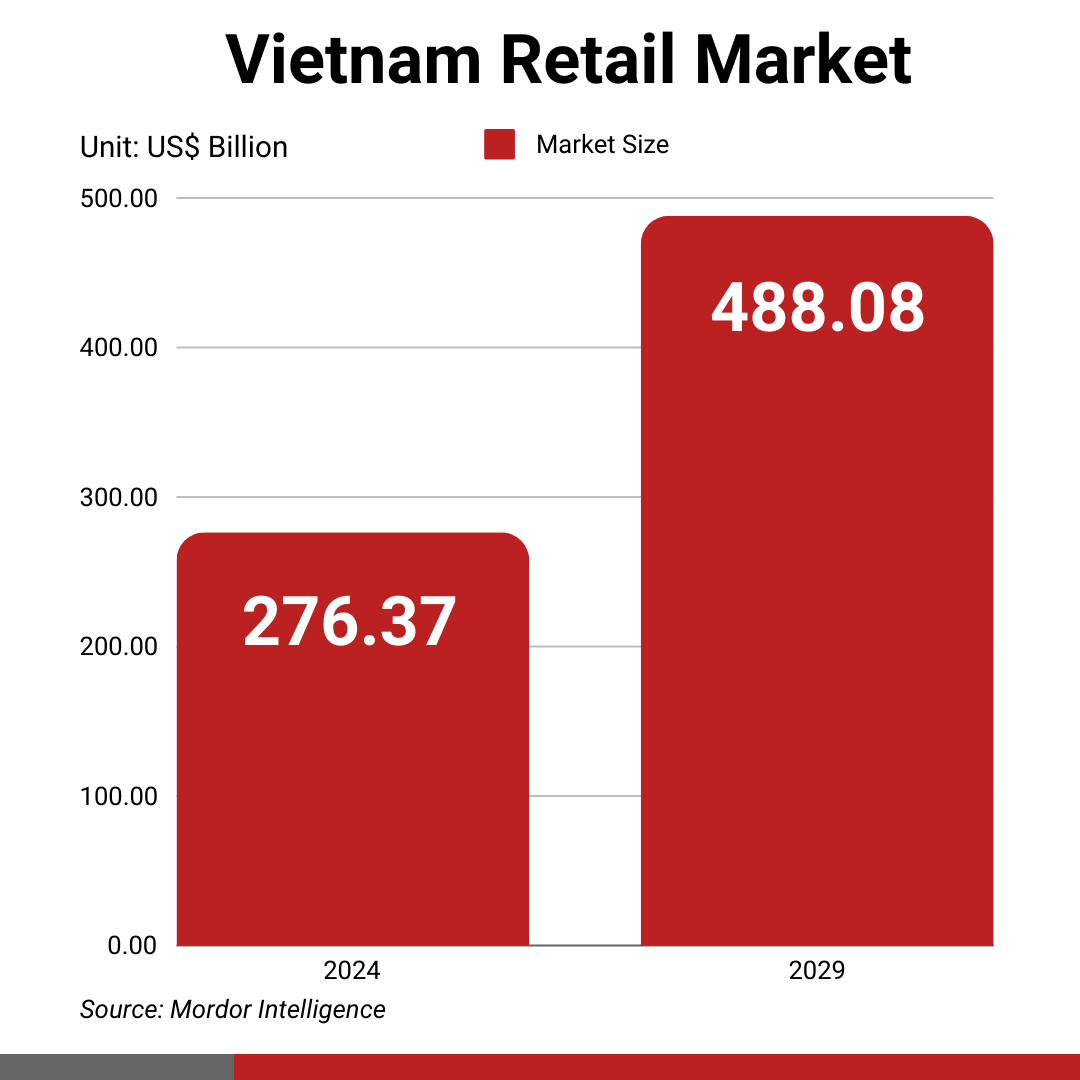

Looking ahead, the Vietnam Retail Market is currently estimated to be worth US$276.37 billion in 2024. It is expected to achieve a robust Compound Annual Growth Rate (CAGR) of 12.05% during the forecast period spanning from 2024 to 2029, potentially reaching US$488.08 billion by the end of the forecast period. This growth trajectory underscores the vibrant potential of Vietnam’s retail sector for the coming years.

The retail industry boasts a vast consumer base valued at US$30.3 trillion, encompassing businesses that directly sell goods and services to consumers. It significantly contributes to the global economy, generating annual sales and revenue. Continuously evolving with emerging technologies and changing consumer preferences, the industry spans various sectors, like:

- Department stores

- Grocery outlets

- Specialty shops

- Discount stores

- Online platforms.

In 2023, total sales from stores and businesses in Vietnam were predicted to hit around VND 4,859 trillion. The accommodation and food service industry followed, with about VND 674 trillion in sales. Overall, the combined sales of consumer goods and services were anticipated to surpass VND 6,231 trillion during the same year.

“Wholesale” involves purchasing large quantities from producers or wholesalers and then selling them to merchants, businesses, or government entities. This differs significantly from retail, which focuses on selling products directly to individual consumers. According to market research firm Technavio, Vietnam’s retail market is projected to grow at an 11.4% CAGR by 2027 (starting from 2022), with an expected increase of US$163.49 billion. Some important factors, such as the demand for convenience foods and the expansion of retail outlets, will drive it.

Upcoming Retail Trends in Vietnam

Numerous retailers have planned to broaden sales avenues through online platforms like Facebook, Zalo, e-commerce platforms, and TikTok Shop. In the F&B sector, restaurant and cafe owners have predominantly opted to diversify their business products (40.9%). Among the selected sales channels for expansion, social networks are the most favored (33.3%).

Read Related: Food & Beverage Industry in Vietnam: Market Overview and Investment Opportunities

Convenience Food Products

The surge in Vietnam’s retail market is propelled by a rising demand for convenient food products, mainly processed and ready-to-eat options. With an uptick in working women and hectic daily routines, there’s a shift from traditional home-cooked meals to time-efficient alternatives like processed meat and poultry.

The increased participation of both genders in the workforce has reduced time for household chores, boosting the preference for convenient food and dining out. This trend is anticipated to fuel the demand for nutritionally rich convenience meat and poultry, driving further growth in Vietnam’s retail market.

Continuous Urbanisation

Ongoing urbanization drives the demand for modern retail channels, particularly convenience stores, and swift e-commerce adoption among younger people. This shift is reshaping the retail landscape, focusing on online sales as distribution channels evolve to meet changing customer preferences.

Despite a lower urbanization rate than neighboring Southeast Asian countries, Vietnam presents high growth potential. Its expected CAGR of 3% will outpace its regional counterparts. The trajectory suggests rapid urbanization, with an anticipated 55% urban population by 2030.

Rapid Growth in Consumer Spending

Vietnam anticipates a rapid rise in disposable income per capita, forecasted to reach US$3,062 by 2023. The actual household spending surged by 8.3%, which was US$121.3 billion in 2021, up from US$112.1 billion in 2019. Private consumption constituted over 67% of the GDP, marking the second-highest rate in the region after the Philippines (73.8%), surpassing Malaysia and Indonesia (57.0% and 57.3% respectively).

Dominance of the Offline Retail Market

In Vietnam, physical retail channels remain dominant despite the surge in online retail. The offline sector is poised for substantial market share growth, driven by the proliferation of brick-and-mortar stores, commercial centers, and supermarkets. These provide daily essentials and household items, like groceries, snacks, personal care products, etc.

Projected Challenges in the Retail Industry of Vietnam

The country’s retail sector confronts formidable challenges. A nascent supply chain system poses hurdles for retailers, leading to delays, heightened costs, and reduced profits. Additionally, the logistics and transportation infrastructure, still developing, grapples with traffic congestion, limited storage, and inefficiencies. It results in longer lead times and reduced profitability for retailers.

Mounting inflation, exacerbated by global uncertainties, strains the economy and affects the retail industry. Wary of economic instability, consumers opt for cost-cutting measures, prioritizing savings over luxury spending.

Escalating unemployment, spurred by high-interest rates and reduced consumer purchasing power, hits export-driven sectors like textiles, footwear, and aquaculture. These multifaceted challenges underscore the need for comprehensive strategies to sustain and fortify Vietnam’s retail landscape.

Read More: Top 10 Challenges of Doing Business in Vietnam: Notes and Advice for Foreign Investors

Global Giants Tapping Into Vietnam’s Opportunities

The retail landscape in Vietnam is witnessing dynamic shifts with the entry and expansion of major international brands, mainly from Japan and Thailand. MUJI, renowned for its lifestyle products, leather goods, and office furniture, has extended its reach in Vietnam’s Capital City and in the city of Ho Chi Minh to encompass 11 stores. Similarly, Uniqlo, another prominent Japanese brand, inaugurated its 19th outlet in Hanoi, which marked the fourth new store in the first half of 2023.

Central Retail

Since its establishment in 2012, Central Retail has experienced steady growth in Vietnam. With a target of achieving 100 billion baht in sales by 2026, Central Retail is poised to double its presence in Vietnam. It aims for 710 stores across 55 provinces, a move that solidifies its position in the retail market. The company anticipates a substantial revenue surge by increasing the number of hypermarkets to over 70, offering diverse products and services.

Central Retail’s investment plan of US$1.45 billion (VND 34 trillion) from 2023 to 2027 demonstrates its dedication to Vietnam’s market. The focus lies on essential foods, price stabilization, and restructuring electronic stores to become a premier multi-channel food retailer and the second-largest investor in shopping centers by 2027.

Lotte

Following its exit from China, it strategically expands its business footprint in Vietnam. With 270 Lotteria restaurants and 15 Lotte Mart stores, the conglomerate is actively developing extensive shopping complexes and residential projects in Hanoi and Ho Chi Minh City.

The forthcoming Eco Smart City in Ho Chi Minh City, featuring diverse amenities, reflects Lotte’s substantial investment in Vietnam. Furthermore, the impending completion of Lotte Mall Hanoi in 2023 underscores the group’s dedication to enhancing retail infrastructure in the capital.

Notably, Lotte Group recognizes Vietnam’s thriving retail sector, leveraging the country’s visa-free entry policy to foster executive engagement and explore business prospects. Beyond retail and real estate, Lotte’s venture capital initiatives to nurture Korean startups in Vietnam demonstrate its commitment to bolstering its startup ecosystem.

Aeon

Asia’s largest retailer, Aeon, intends to triple its mall count in Vietnam by 2025. The goal is to operate 16 malls, nearly three times the current number. With about 200 stores already, including six malls in Ho Chi Minh City and Hanoi, it eyes expansion to Hue with a new mall in 2024. AEON Vietnam’s CEO emphasizes flexibility, tailoring store sizes and specialties to suit diverse shopping behaviors nationwide. Medium-sized supermarkets, around 5,000 sqm, are favored amid cautious spending trends among the working class.

Apart from these, THISO International Commerce and Services Corporation (THISO), a subsidiary of THACO Group, finalized the acquisition of Emart Inc.’s business in Vietnam. Besides, domestic retailers like Vingroup’s Vincom Retail system and WinMart chains have expanded significantly. Despite fierce competition, experts are confident in Vietnamese retail’s prospects due to consumer understanding, digital transformation, and adept human resource management.

Setting Up a Retail or Wholesale Business in Vietnam

The Vietnam Retail Market trends are categorized by below categories:

- Product Category (including Food, Beverage and Tobacco Products, Personal Care and Household, Apparel, Footwear, and Accessories, Furniture, Toys, and Hobby, Industrial and Automotive Electronics and Household Appliances, Other Products)

- Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Department Stores, E-Commerce, and Other Distribution Channels).

Types of Retail Business

The North American Industry Classification System (NAICS) divides retail businesses into two categories. It includes the following:

- Store Retailers: Operate from physical locations

- Non-Store Retailers: Conduct business primarily through online or remote channels

How to Set up a Retail Business?

Companies aiming to penetrate Vietnam’s retail market have multiple entry options, including mergers and acquisitions (M&A) for swift market access or franchising. Establishing a retail or wholesale company allows for a 100% foreign-owned venture, aligning with Vietnamese Company Law.

However, the timeline for setup varies, contingent upon factors like documentation completeness and the business model’s complexity. Additional licenses or permits may be necessary based on the products or services offered.

Typically, the establishment process takes around one month, involving steps like

- Acquiring an investment license

- Obtaining a business registration certificate

- Securing trading licenses for retail operations

- Product registration, if required

Establishing a Retail or Wholesale Company? Check out InCorp Vietnam’s Business Setup Services

Retail Industry Standards in Vietnam

Several methods can help to enhance retail chain operations, such as:

- Firstly, adhering to the 5S principle streamlines store displays, emphasizing organization and cleanliness. This Japanese standard categorizes products by use and implements regular cleaning and maintenance. These are:

- Seiri (Sort)

- Seiton (Set in order)

- Seiso (Shine)

- Seiketsu (Standardize)

- Shitsuke (Sustain)

- Secondly, regular inspections by managers ensure operational efficiency, covering shelf organization, cleanliness, and employee conduct. Utilizing checklists enhances the inspection process.

- Thirdly, personalized customer experiences foster loyalty and revenue growth by addressing customers by name and catering to their preferences.

- Utilizing management software streamlines retail operations, aiding in sales tracking, resource management, and accounting.

Standards for Promoting Quality

For retail store owners, prioritizing quality ensures customer satisfaction and fosters repeat business. Eight essential standards should be upheld to enhance retail operations:

- Customer Service: It includes prompt assistance and polite interactions, which are crucial to having a positive experience with the customers

- Cleanliness: Regularly maintaining a clean and organized store environment is imperative to maintaining a neat and organized product display.

- Product Quality: This involves guaranteeing that all items are appropriately packaged and labeled and comply with safety standards and regulations.

- Inventory Management: This entails performing routine inventory inspections and adjusting orders as required.

- Pricing: This involves visibly displaying prices and providing equitable discounts and promotions.

- Staff Training: Equipping staff with knowledge and skills enhances service.

- Compliance: Adherence to laws and regulations ensures safety and legality.

- Security: Providing a safe environment inspires confidence in customers and staff alike.

ISO Standards

It plays a crucial role in the retail industry’s success. Below are some critical ISO standards you must remember for your retail business in this country.

- ISO 9001 – Ensuring Quality Management: It enables retailers to establish robust quality management processes, improve customer satisfaction, and achieve continuous enhancement.

- ISO 14001 – Promoting Environments Sustainability: It offers a framework for Environmental Management Systems (EMS), allowing retailers to identify and address environmental impacts.

- ISO 45001 – Prioritising Workplace Safety: This standard helps retailers identify and address workplace hazards, prevent accidents, and ensure legal compliance. It enhances employee well-being, reduces absenteeism, and fosters a safer shopping environment, fostering customer trust.

- ISO 27001 – Protecting Information Security: It provides a framework for Information Security Management Systems (ISMS), enabling retailers to establish strong information security practices.

7 Retail Expansion Strategies for Foreign Businesses to Try

There are several strategies to expand your business, including the following:

Adding New Store Locations

When considering expanding your retail business, opening a new store is often the primary strategy that comes to mind. This traditional method ensures your products and services are easily accessible. However, it requires a thorough analysis of financial and logistical requirements such as bills, taxes, and wages.

Chain retail stores, for instance, utilize uniform multi-retail store POS systems to streamline operations and employee training. Therefore, before proceeding, carefully evaluate the expenses and logistics of acquiring a new retail location.

Read More: Choosing the Ideal Business Location in Vietnam: The First Step of Success

New Sales Channels

Expanding a retail business today extends beyond physical locations to leveraging available technology. Creating an online retail store offers numerous advantages: it’s cost-effective and more accessible to implement than opening a new physical location.

Expansion to Other Markets

Retail businesses often target specific market segments, like gender or lifestyle. Expanding into related segments can be an intelligent strategy. For instance, a store selling women’s shoes might expand to offer men’s shoes, leveraging existing clientele to reach new customers. Prior analysis ensures alignment with the new market’s demands.

Expansion of Product Line

Expanding your product range can enhance your retail business’s competitiveness. By seizing market opportunities within your customer segment, you can offer additional services or products that complement your main offerings. When implemented thoughtfully, this strategy allows small businesses to capitalize on customer needs that are aligned with their brand and market segment.

Contribute to Other Businesses

Partnering with established businesses is an effective retail expansion strategy, tapping into existing customer bases ready for your products. It has benefits include cost savings, revenue growth, and simplified marketing due to the partner’s infrastructure. Choose partnerships that enhance your business vision and offer added value to customers.

Utilise Digital Marketplaces

Expanding your retail business through digital marketplaces offers exposure to large client bases seeking widely requested products. Platforms like Amazon, AliExpress, eBay, and Jumia provide opportunities for increased sales, though commission fees apply. Listing your products on these platforms is the first step toward broader business expansion and visibility to potential customers.

Increase Customer Loyalty

Improving customer experience is key to expanding and fostering loyalty in your retail business. Implementing a customer loyalty system rewards purchases with redeemable points, encouraging repeat business and brand affinity. Strategies such as giveaways, community involvement, and improved customer support can strengthen connections, emphasizing your brand’s human side and fostering business growth.

Looking to effectively expand in the retail market? Check out InCorp Vietnam’s Market Research & Analysis Services

Ready to Enter the Vietnam Market?

InCorp can help you fulfill your entrepreneurial ambitions by aiding in establishing a retail or wholesale company in Vietnam. After completing the registration process, you can proceed with essential steps such as

- Contributing capital

- Hiring employees

- Opening a bank account

- Registering products

- Applying for a retail trading license.

These procedures are crucial for successfully establishing and operating your business in Vietnam.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

What are the three types of retail?

- The three main types of retail are store-based retailing, non-store retailing, and service retailing. Store-based retail involves physical locations like supermarkets and department stores; non-store retail includes e-commerce, mail-order, and vending machines; and service retailing covers businesses offering services directly to consumers, such as salons or repair shops.