Introduction

Vietnam’s tax identification number system is fundamental to doing business in the country. A tax identification number (TIN) – often simply called a tax code – is a unique numeric identifier assigned to every taxpayer in Vietnam, including both individuals and organizations. This number defines a taxpayer’s obligations and is used by authorities to track tax compliance. Vietnam has been continuously refining its tax regulations to improve compliance efficiency, reduce burdens, and offer investment incentives. For businesses, especially small and medium-sized enterprises (SMEs), understanding the tax identification number is critical for operating legally and taking advantage of Vietnam’s business-friendly tax policies.

Recent regulatory updates in 2025 have made the tax identification number even more central. Circular 86/2024/TT-BTC, effective February 6, 2025, introduced significant changes – most notably, the use of citizen identification numbers as personal tax codes. This change is part of Vietnam’s move toward digital tax management and aims to streamline tax registration for individuals.

What is a Tax Identification Number in Vietnam?

In Vietnam, a tax identification number (TIN) is a series of numbers assigned to taxpayers by the tax authorities to uniquely identify them and define their tax responsibilities. It is commonly referred to as a tax code or mã số thuế (MST) in Vietnamese. The concept applies to all types of taxpayers – including companies, other organizations, and individuals – ensuring each has a unique code under which all tax obligations are recorded. The TIN is uniformly administered across the country as Vietnam’s tax system is centrally managed (there are no state or provincial tax codes). This means once you have a tax identification number, it is recognized nationwide for all tax filings and payments.

In Vietnam, a tax identification number (TIN), commonly called a tax code or mã số thuế (MST), is a unique number assigned by tax authorities to identify taxpayers and manage their tax obligations. It applies to all taxpayers, including companies, organizations, and individuals, and is recognized nationwide under Vietnam’s centrally administered tax system.

Structure and formats depend on the taxpayer type.

- A 10-digit TIN is issued to businesses and organizations as their primary tax code.

- A 13-digit TIN consists of a 10-digit parent code plus a 3-digit suffix and is used for branches, representative offices, or dependent units.

- For individuals, the 12-digit citizen identification number now serves as the tax code under current regulations.

Regardless of format, the TIN links the taxpayer to all tax filings, payments, and obligations. It is required for corporate income tax, value-added tax, personal income tax, VAT invoices, and other tax-related transactions.

Legal basis: Tax registration in Vietnam is governed by the Tax Administration Law (Law No. 38/2019/QH14), which requires all individuals and businesses with tax obligations to register and obtain a tax identification number (TIN). In practice, obtaining a tax code is a mandatory step when setting up business operations in Vietnam and is essential for identifying tax liabilities and ensuring compliance. Almost all taxpayers are required to have a TIN, including businesses and individuals filing taxes with tax or customs authorities, with only limited exceptions. In short, anyone conducting business or earning taxable income in Vietnam will be assigned a tax identification number.

Why TINs Matter for Businesses (Especially SMEs)

Having a valid tax identification number is more than just a formality – it is proof that your business is registered with the tax authorities and is crucial for legal compliance. For any company, including small and medium-sized enterprises (SMEs) in Vietnam, the TIN enables you to perform essential activities

First, it is required for filing and paying taxes. All tax declarations and payments, including corporate income tax and VAT, must state the company’s TIN. Without it, a business cannot legally meet its tax obligations.

Second, a TIN is mandatory for issuing invoices. VAT invoices must show the tax codes of both the seller and buyer. Clients, suppliers, and partners often request a TIN as proof that the business is legitimate and properly registered.

Third, a TIN is needed for banking and contracts. Vietnamese banks usually require a tax code to open corporate accounts, and many commercial contracts, especially with large or foreign partners, require a TIN to verify legal status.

Fourth, a TIN allows businesses to access tax incentives. Vietnam offers preferential tax rates and incentives for certain sectors and locations, but only businesses registered in the tax system with a valid TIN can benefit from these policies.

Finally, proper TIN registration helps ensure compliance and avoid penalties. Operating without a TIN, or using an incorrect one, can result in fines, back taxes, and difficulties in working with partners and authorities.

From an advisory perspective, SMEs should treat TIN registration and management as a core compliance priority. It keeps the business in good legal standing, supports transparent governance, and connects the company to Vietnam’s electronic tax system. In practice, a TIN is the key tool for operating smoothly within Vietnam’s tax framework and benefiting from its pro-business reforms.

Key Update in 2025: Personal ID Numbers as Tax Codes

In 2025, Vietnam overhauled its tax registration rules with the introduction of Circular 86/2024/TT-BTC (“Circular 86”), which took effect on February 6, 2025. This new circular replaces the earlier Circular 105/2020/TT-BTC and updates many aspects of tax code issuance and management. The most significant change is the adoption of personal identification numbers (from the national ID system) as tax identification numbers for individuals. This reform has wide-ranging implications for individuals and businesses alike:

Under Circular 86, Vietnamese individuals who are subject to personal income tax or registered as dependents will use their 12-digit citizen ID number as their tax code. This means the tax authority will no longer issue separate personal tax codes for Vietnamese nationals. The citizen ID number printed on the chip-based ID card now serves as the TIN for all personal tax filings.

The same approach applies to business households and sole proprietors. The legal representative or owner’s personal ID number is used as the tax code for the household or individual business, simplifying tax registration for micro and family-run enterprises.

There are exceptions to this rule. Foreigners and other individuals who do not have a Vietnamese citizen ID will continue to be issued a standard 10-digit TIN. Enterprises and organizations are also unaffected and will continue to use their existing 10-digit tax codes.

Timeline and transition: Although Circular 86 took effect in February 2025, the full application of personal ID numbers as tax codes applies from 1 July 2025. Personal tax codes previously issued remain valid until 30 June 2025. From July onward, citizen ID numbers officially replace old personal TINs. This change supports the principle under the Tax Administration Law that each individual has only one tax code.

Eliminating duplicate tax codes: A key benefit of the reform is the elimination of duplicate personal tax identification numbers. From July 2025, the tax authority will automatically consolidate any existing personal TINs into a single personal identification number, without requiring individuals to submit cancellation requests.

Business implications: Employers and HR teams should update payroll systems and employee records to use the 12-digit citizen ID number as the tax identifier. Existing documents and invoices issued using old tax codes remain valid, but all tax reporting after the transition date should use the new personal ID-based tax code to ensure compliance.

Overall, the 2025 update modernizes Vietnam’s tax registration system by integrating it with the national ID database. For most taxpayers and businesses, the change simplifies compliance, but timely updates to internal systems are essential to ensure every individual and business uses the correct tax identification number under the new rules.

Read More: Personal Income Tax (PIT) in Vietnam: Get A Comprehensive Visual Guide

Tax Identification Number Structure and Classification

For companies and other organizations, Vietnam’s tax identification numbers follow a specific structure defined by the General Department of Taxation. Understanding the format can be helpful, especially if your business expands or if you work with branch offices or foreign contractors.

Standard structure: Under Circular 86, a tax identification number issued by tax authorities consists of a sequence of digits with a possible extension, following this pattern:

N1N2 N3N4N5N6N7N8N9 N10 – N11N12N13

• N1N2: Province or city code where the tax code is registered, indicating the issuing tax authority.

• N3–N9: A seven-digit serial number unique to the taxpayer within that province.

• N10: A check digit used to verify the accuracy of the code.

• N11–N13: A three-digit suffix used for dependent units such as branches or representative offices. This extension appears after a hyphen.

Example:

A company registered in Ho Chi Minh City may receive a 10-digit TIN such as 0312345678. If it later opens a branch, the branch may use 0312345678-001, where “001” identifies the first dependent unit. Additional branches would use “-002”, “-003”, and so on. The first 10 digits always identify the parent company.

10-digit vs 13-digit TIN:

Independent legal entities, such as companies or subsidiaries, are issued their own 10-digit TINs. Dependent units that are not separate legal entities, such as branches or representative offices, use a 13-digit TIN consisting of the parent company’s code plus a suffix. Businesses must correctly classify each unit to apply the correct tax code.

Personal tax codes:

Vietnamese individuals now use their 12-digit citizen ID number as their tax code. Foreigners or individuals without a citizen ID continue to receive a TIN from the tax authority, usually a 10-digit number. Organizations and individuals each have one primary tax identification number recognized nationwide.

How to Register for a Tax Identification Number

Obtaining a tax identification number in Vietnam is a standard part of starting a business or commencing any income-generating activity. The process is generally straightforward, but it involves some paperwork and adherence to deadlines. Below we outline how different types of taxpayers can register and what documents are needed.

Obtaining a tax identification number is a mandatory step when starting a business or earning taxable income in Vietnam. While procedures differ by taxpayer type, the process is generally straightforward and time-bound.

Business entities (companies and organizations)

For most enterprises, tax registration is integrated into the business registration process. Vietnam applies a single-window system, meaning that when a company registers with the Department of Planning and Investment, its information is automatically shared with the tax authority. The tax identification number is usually issued at the same time as the Enterprise Registration Certificate and, in many cases, the business registration number also serves as the TIN.

Organizations that are not required to obtain an Enterprise Registration Certificate, such as non-profits or project offices, must apply directly to the local tax authority by submitting a tax registration dossier.

Household businesses and individuals conducting business

Household businesses and sole traders are also required to register for tax. Under Circular 86, the owner’s citizen ID number functions as the tax code. Registration is often handled together with the household business license, but a tax registration form may still be required to declare business details. Where registration is not automatic, tax registration must be completed within 10 working days of receiving the household business certificate.

Employees and personal income taxpayers

Employees usually do not apply for a TIN themselves. Employers are responsible for declaring employees’ tax identification details to the tax authority. From 2025, this means registering the employee’s 12-digit citizen ID number as the tax code.

Foreign employees without a Vietnamese citizen ID must still apply for a 10-digit personal TIN, typically through their employer or via the tax authority’s online system.

Foreign contractors and overseas suppliers

Foreign contractors who directly declare and pay tax in Vietnam must register for a TIN. Circular 86 allows foreign contractors and overseas digital service providers to register online through the General Department of Taxation’s electronic portals. This enables tax registration, declaration, and payment without a physical presence in Vietnam.

If a foreign contractor does not register, the Vietnamese payer is generally responsible for withholding and paying taxes on their behalf.

Required documents and forms

Required documents depend on the taxpayer type but typically include:

• A tax registration form appropriate to the taxpayer category, as prescribed under Circular 86.

• Business establishment documents, such as the Enterprise Registration Certificate or investment license.

• Identification documents, including citizen ID cards for Vietnamese individuals or passports for foreigners.

• Authorizations if the application is submitted by an agent.

Most applications can now be submitted electronically via the tax authority’s e-tax portal.

Deadlines and processing time

Tax registration must generally be completed within 10 working days from the date a taxable activity begins or a relevant license is issued, unless registration is handled automatically.

Once a complete application is submitted, the tax authority is required to issue the tax identification number within 3 working days. If information is incomplete or incorrect, the tax office will notify the applicant within 2 working days for correction.

After issuance, taxpayers should verify all registered details and promptly notify the tax authority of any changes. Proper and timely TIN registration is essential to ensure ongoing tax compliance in Vietnam.

Find out more about InCorp Vietnam’s Tax Outsourcing Services for Foreign Businesses

How InCorp Vietnam can Assist?

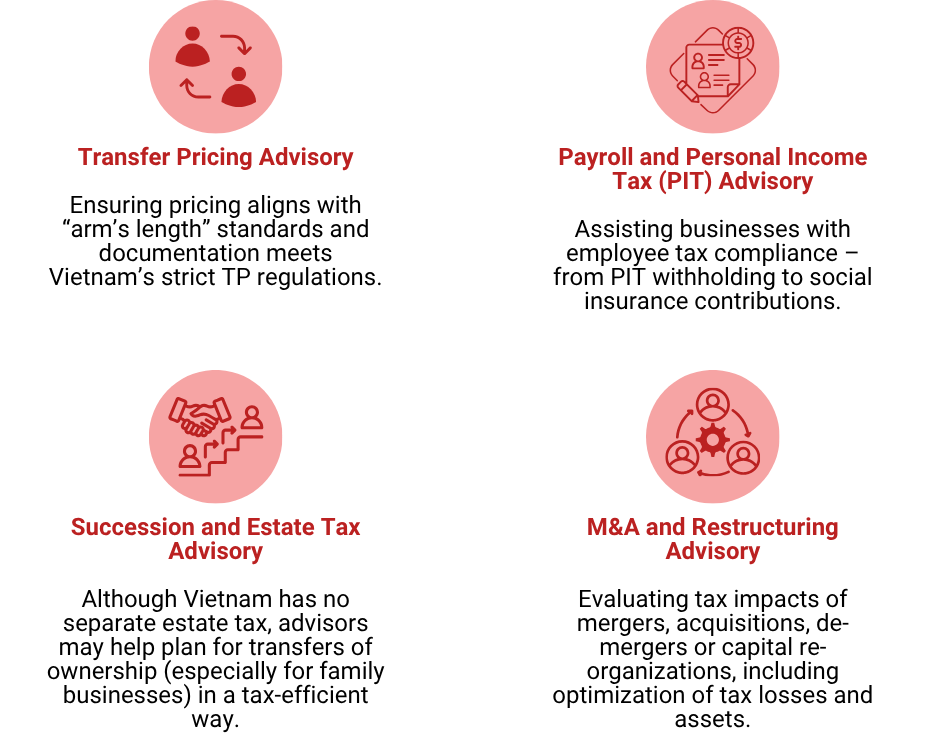

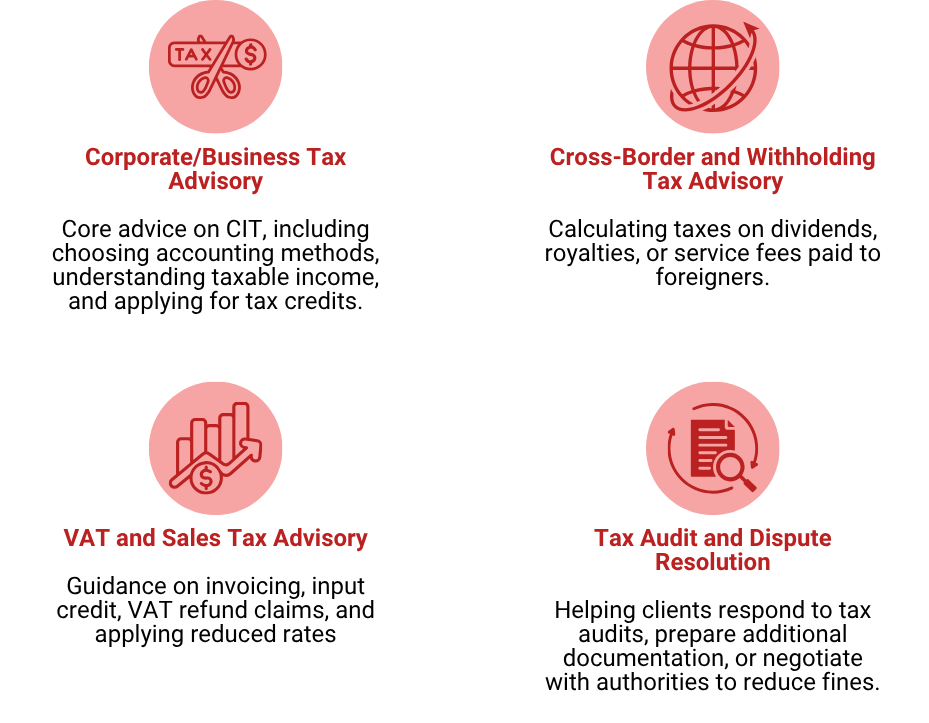

Vietnam’s tax laws can be complex and time-consuming for businesses to navigate. At InCorp Vietnam, our business tax advisory services help companies stay compliant and avoid costly Vietnam penalties. With years of experience, we assist businesses in managing their taxes efficiently and in full compliance with local regulations.

Our team evaluates your current tax situation, identifying any tax compliance issues or risks. We then implement effective tax management systems to ensure alignment with Vietnam’s tax laws. Additionally, for companies operating across borders, we provide international tax advisory services, ensuring compliance with both local and global tax regulations. With our expertise, your business stays up to date and free from tax-related complications.