Vietnam strides into 2024 with remarkable economic growth and FDI allure, positioning itself as a beacon of progress in ASEAN and beyond. The nation has already attracted US$4.29 billion in FDI in the early months, a testament to its dynamic economic environment and strategic focus on high-tech and sustainable development. This robust growth highlights Vietnam’s attractiveness as an investment hub and underscores its leadership in ASEAN, with a projected 6% growth rate surpassing regional counterparts.

Cities like Hanoi and Can Tho rise as investment hubs with skilled workforces. Strategic partnerships with the UK, Israel, and UAE boost Vietnam’s economy. Global giants like Samsung drive innovation in auto, and energy sectors, shaping Vietnam’s industrial evolution towards sustained growth.

Interested in Doing Business in Vietnam? Check out InCorp Vietnam’s Incorporation Services now!

Vietnam Attracts US$4.29B FDI Early 2024

Vietnam attracted US$4.29 billion in FDI in the first two months of 2024, a 38.6% increase from the previous year. This includes US$3.6 billion in newly registered capital across 405 projects, showing a significant year-on-year growth. Additionally, US$2.8 billion was disbursed, marking a 9.8% increase from 2023, indicating strong investor confidence and an expanding economic landscape.

The investment spanned 16 industries, with processing and manufacturing leading at US$2.54 billion, 59.1% of the total. Real estate followed with US$1.41 billion, a substantial increase from the previous year. Singapore and Hong Kong were the top investors, contributing significantly to the total FDI, highlighting Vietnam’s appeal as a dynamic and growing investment destination.

Vietnam is projected to lead ASEAN growth in 2024 with a 6% increase, outpacing its 5.02% growth in 2023. FocusEconomics highlights Vietnam’s economic acceleration due to surging tourist arrivals and a global uptick in electronics demand. The country’s industrial production and exports have seen significant growth in early 2024, with electronics and mobile phone exports rising by 34% and 4.1%, respectively. Strategic sectors and investment climate improvements drive Vietnam’s strong regional investment appeal.

Read More: Vietnam’s FDI: Analysis of Industries, Source Countries, and Geographical Regions

Hanoi Leads in 2024 Foreign Investment

Hanoi leads Vietnam’s foreign investment in early 2024, securing US$914.4 million, including US$869.8 million in 27 new projects. This marks a 24.4-fold increase over the same period in 2023, with significant contributions from a US$662 million Singaporean project in urban development.

The city’s strategic focus on high-tech and quality infrastructure has attracted substantial foreign investment, positioning Hanoi as a top destination for FDI. Efforts to improve the business environment and human resources are set to draw more large-scale foreign projects, enhancing Vietnam’s economic growth and development.

Read More: Hanoi Incorporation Guide: Opportunities, Requirements, and How-To Steps

Quang Nam’s Energy Transformation Era

Quang Nam province is gearing up for a transformative decade with plans to develop a central gas power center in Chu Lai Open Economic Zone, aiming to harness energy from the Blue Whale mine for four power plants with a total capacity of 3,000MW. This initiative is part of a broader strategy to emphasize industrial development, with the Blue Whale gas-to-power project chain expected to generate 23-25 billion kWh of electricity annually, contributing US$15-18 billion in state budget revenue from 2023 to 2044.

Quang Nam’s commitment to renewable energy and new energy sources aligns with national goals, aiming for renewable energy to constitute about 40% of the total primary energy supply by 2030. This focus on sustainable and renewable energy sources underscores the province’s ambition to be at the forefront of Vietnam’s green energy transition. THACO Auto, a pioneer in Quang Nam’s automobile industry, has significantly contributed to the province’s development, with investments in various sectors including automobiles, agriculture, and mechanics.

Read Related: Vietnam’s Industrial Zones: A Key Player in Global Manufacturing

Can Tho Draws Japanese Investment

Focused on securing Japanese investment, Can Tho proudly presents its six fully operational industrial parks, backed by a highly skilled workforce molded by eight universities and 63 vocational institutions. The city’s meticulously crafted strategic policies are designed to draw investments into sectors marked by high technology and digital transformation, significantly boosting its attractiveness to international investors.

Standing as the Mekong Delta region’s premier hub for skilled labor, Can Tho is the academic home to roughly 8,400 students every year. These students engage in comprehensive studies across critical and future-focused fields, including information technology, electronics, telecommunications, e-commerce, and the burgeoning digital economy. This robust educational ecosystem ensures the annual introduction of 1,700 graduates equipped with digital skills into the local workforce, positioning Can Tho as a key player in Vietnam’s journey toward technological advancement and innovation-driven economic growth.

Read Related: Understand the Fundamentals of Japan & Vietnam’s Trade Under the VJEPA

UK-Vietnam Trade Pact Proves Its Worth

The UK-Vietnam Free Trade Agreement (UKVFTA) has significantly boosted bilateral trade, with trade in goods reaching US$5.92 billion in the first 10 months of 2023, including US$5.27 billion in exports from Vietnam to the UK. This agreement, alongside the UK’s accession to the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP), has laid a strong foundation for an increasingly dynamic economic partnership, emphasizing sectors like technology, finance, and green energy.

The UK’s commitment to Vietnam’s green transition is highlighted by the Just Energy Transition Partnership, aiming to mobilize over US$15 billion for renewable energy projects. This focus on sustainability, coupled with initiatives to promote digitalization and innovation, positions the UK-Vietnam relationship as a model for future trade and investment, promising continued growth and collaboration in 2024 and beyond.

Israel’s Free Trade Strengthens Existing Ties

The Vietnam-Israel Free Trade Agreement (VIFTA), set for ratification in early 2024, is poised to significantly enhance trade and investment between the two nations. This agreement, which will eliminate duties on at least 86% of Vietnamese products and 93% of Israeli products, aims to bolster bilateral ties in key areas such as investment, services, digital transformation, and technology. The MoIT is finalizing the ratification dossier, with both countries expected to submit it for governmental approval soon, marking a new chapter in their economic cooperation.

Bilateral trade between Vietnam and Israel has shown robust growth, rising from US$1.2 billion in 2019 to approximately US$2.2 billion in 2022. With the VIFTA’s implementation, trade is expected to reach US$3 billion by 2025. Currently, Israel has 42 valid projects in Vietnam, with a registered capital of US$151.5 million. The agreement is anticipated to open up new opportunities in sectors like agriculture, footwear, and electronics, further strengthening the economic partnership between Vietnam and Israel.

Read More: The Guide to Vietnam’s 16 Active Free Trade Agreements (Updated August 2023)

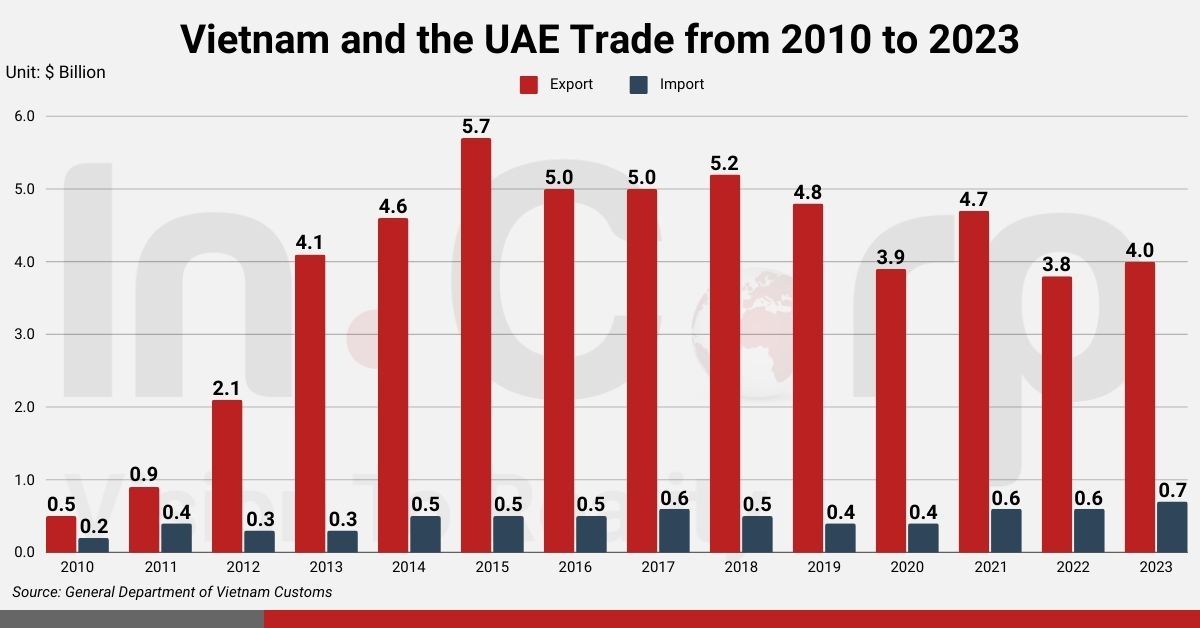

Vietnam & UAE Trade Set to Surge

Vietnam and the UAE are on the brink of finalizing the Comprehensive Economic Partnership Agreement (CEPA), slated for signing in mid-2024, a pivotal step set to bolster trade and investment between the two nations. Representing Vietnam’s first free trade agreement with a Middle Eastern partner, the CEPA holds the promise of significantly amplifying bilateral relations, leveraging the UAE’s pivotal role as a crucial transshipment and financial center.

The robust trade ties between Vietnam and the UAE have been steadily growing, with bilateral trade reaching nearly US$4.7 billion in 2023, marking a 5.9% year-on-year increase, wherein Vietnam’s exports surpassed US$4 billion. With the CEPA on the horizon, projections indicate a further upsurge in trade, expected to soar to US$5 billion annually. This landmark agreement underscores a commitment to deepening cooperation across key sectors, particularly in oil, gas, and energy, while also paving the way for collaborative ventures in Vietnam’s burgeoning Halal food industry and energy sector, thus propelling the nation’s development trajectory forward.

Victory Giant Tech Invests US$800M

Victory Giant Technology plans to invest US$800 million in a high-precision printed circuit boards factory in Bac Ninh’s Vietnam-Singapore Industrial Park (VSIP) Bac Ninh 2. The project, covering 10 hectares, is set to start production in mid-2025, aiming to position Bac Ninh as a leader in Vietnam’s electronics manufacturing industry.

This investment by the Chinese firm, specializing in electronics components for sectors like aerospace and automotive, will significantly enhance Bac Ninh’s industrial capabilities. The local government is committed to supporting the project, ensuring a conducive environment for its timely operation, and reinforcing Bac Ninh’s status in the global electronics market.

Read Related: Finding the Right Place to Start Your Business in Vietnam

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly