As a country known for its rapid economic growth, strategic geographical location, and favorable investment climate, Vietnam has become an attractive hub for foreign investors. When doing business in Vietnam, it is crucial to understand not only its diverse entity types but also the role of investors in business, as they provide essential capital, strategic guidance, network expansion, and risk mitigation.

Investing in Vietnam? See InCorp’s Company Formation Services for Foreign Entities

This article explores the important things that investors need to understand about the four main types of business when thinking about doing business in this active Southeast Asian country. Understanding the different types of business entities and the role of investors in business is important because it helps you make smart investment choices and take advantage of all the great business opportunities that Vietnam has.

Types of Business Based on Legal Structure

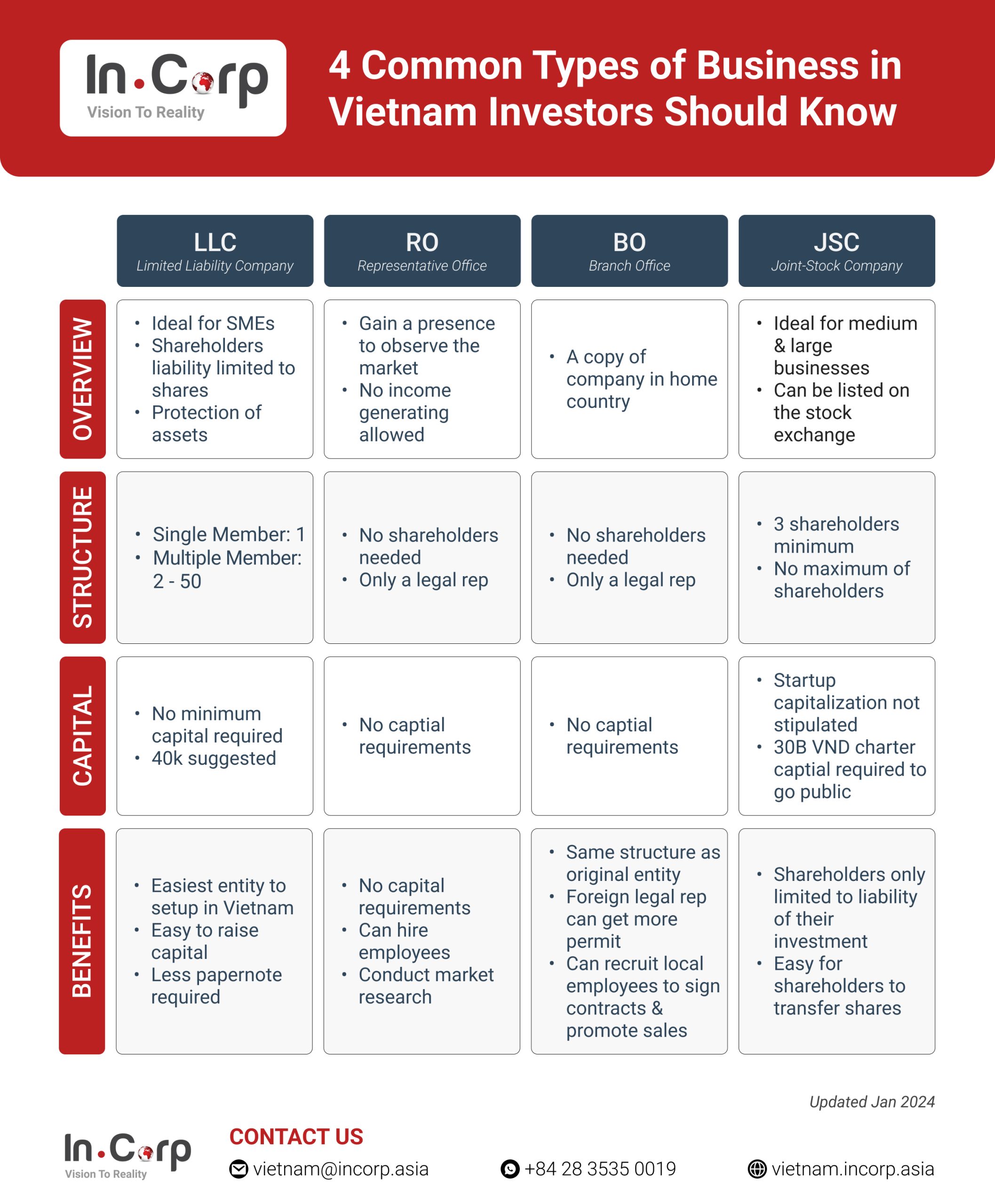

Limited Liability Company

In Vietnam, a Limited Liability Company (LLC) is a legal entity registered under the Vietnam Companies Act, comprising one to 50 members, whether it’s a single-member or multi-member LLC. It is a business structure that is designed to protect company owners and their assets from personal financial responsibility against the losses of the company and its debt obligations. As the name implies, the key advantage of an LLC is that members are only liable for debts and obligations up to the maximum capital they contribute. Each member’s capital contribution is regarded as equity, often referred to as charter capital.

The simplified organizational structure of an LLC facilitates easier management of business activities. Moreover, the legal framework controls purchases and transfers of ownership or membership units between members. This makes hostile takeovers more challenging. In case of legal disputes or setbacks in business setbacks, the company itself assumes liability, safeguarding its partners or shareholders from personal financial risk.

Foreign individuals and companies can have partial or full ownership of an LLC in Vietnam. However, there are some exceptions such as advertising, logistics, and tourism, which have restrictions on foreign ownership. To meet licensing requirements, foreign-owned LLCs must appoint a legal representative residing in Vietnam. Shareholders are obligated to complete their capital contributions within 90 days of receiving the company’s business registration certificate.

However, there are drawbacks to this business entity. For instance, raising capital when needed can be challenging. This is because LLCs cannot issue shares. In the case of a single-member LLC, withdrawing capital requires careful handling to avoid personal liability towards the company’s debts. This means that capital is transferred to another individual or entity, to mitigate potential risks.

Read More: Limited Liability Company (LLC) in Vietnam: The Last Guide You’ll Ever Need

The management framework of an LLC typically comprises the members’ council, the chairman of the members’ council, the general director, and a controller. In cases where the LLC has more than 11 members, a board of supervisors is established instead of a single controller to oversee the company’s operations and compliance.

Joint Stock Company

The concept of joint-stock companies originated from the need to infuse capital into projects, too capital-intensive for an individual or even a government to fund alone. A joint-stock company allows multiple individuals or entities to invest in it by purchasing its shares, corresponding to which its ownership is also decided. Shareholders, in turn, anticipate sharing in the company’s profits and potentially benefiting from its success.

A straightforward way to define a joint-stock company is as a business organization collectively owned by its shareholders. Each shareholder possesses a specific portion of the company’s ownership, which is symbolized by their shares in the company. Establishing a joint stock company in Vietnam involves a more intricate process compared to an LLC. Under Vietnamese law, only a joint stock company can issue shares. Such a company is, however, mandatorily required to have a minimum of three shareholders. This is without any upper limit.

The governance structure of a joint-stock company encompasses various components. This includes the Board of Management, the Chairman of the Board of Management, the General Director, a Board of Supervisors and timely holding a General Meeting of Shareholders. The presence of a Board of Supervisors is typically required when the joint-stock company has more than 11 individual shareholders, or if a corporate shareholder holds over 50% of its shares.

Read More: Seamlessly Navigate Joint-Stock Company Formation in Vietnam

Similar to an LLC, the liability of shareholders in a joint stock company is limited to the capital they have invested in the company. Moreover, such a company can raise further capital, when necessary, upon issuance of additional shares. Nevertheless, this structure also poses challenges. With no restrictions on the number of shareholders, conflicts among various groups within the company are likely. Notably, a joint-stock company in Vietnam can be either fully owned by foreign entities or structured as a joint venture involving both foreign and domestic investors.

Representative Office

Establishing a business presence in Vietnam is notably simpler for companies with a minimum of five years of international operation. These companies have the business investment option to establish a representative office in Vietnam, as outlined by the Vietnam Law on Commerce. While a representative office can be fully owned by foreign entities, it’s important to note that it cannot partake in commercial or production-related activities within Vietnam.

The primary functions of a representative office are limited to promoting its parent company’s business interests and conducting market research within the country. To fulfill its requirements, the representative office must have a resident representative present in Vietnam.

Due to its constraints on the types of activities it can undertake, a representative office is best suited for foreign firms aiming to maintain a presence in Vietnam. It may not be suitable, however, for companies engaged in manufacturing, trade, or retail activities.

Therefore, foreign companies with established business relationships or investment projects in Vietnam have the business investment option to apply for the establishment of representative offices in the country. It’s essential to understand that a representative office does not possess independent legal status and is strictly prohibited from engaging in direct revenue-generating activities. This means it cannot execute contracts, receive funds, buy or sell goods, or offer services for profit.

Nonetheless, a representative office is permitted to perform several key functions:

- It can act as a liaison office to monitor and assess the local business environment.

- It can actively search for potential trade or investment opportunities and partners within Vietnam.

- It can oversee and assist in the execution of contracts between its head office and its Vietnamese partners.

- It can represent its head office in supervising and directing the implementation of projects based in Vietnam.

In essence, representative offices serve as a valuable means for foreign companies to provide a wide range of support services to their overseas head offices. This form of presence is particularly common among foreign firms in the initial stages of their Vietnam market entry strategy.

Read More: Effortlessly Establishment of a Representative Office in Vietnam

Branch Office

A branch office, while functioning independently in business transactions, remains legally and organizationally connected to the head office. It is not considered a distinct legal entity separate from the head office. Instead, it operates as an integral part of the head office’s enterprise and is subject to the laws governing the head office. Despite this internal dependence, the branch office conducts its business transactions autonomously.

In a more specific context, a Branch Office (BO) represents a direct expansion of an established legal entity within a corporate group into a new country. This expansion typically involves the registration or formal qualification of a foreign entity in the target country. Branch Offices are primarily established to conduct revenue-generating activities and operate production facilities within the host country.

The setup of a branch office is often dependent upon geographical considerations. In densely populated urban areas, it’s common to find multiple branch offices nearby. This scenario is particularly prevalent in service-oriented industries like restaurant chains, banks, and retailers. In contrast, in less densely populated rural areas, branch offices are typically spaced farther apart.

Some branch offices may have only one representative, while others may employ several individuals. The term “pop-up” describes a temporary office or store that operates for a very short duration, sometimes appearing one week and disappearing the next. Examples include pop-up Halloween costume stores.

The concept of the “pop-up” shop is quite common in retail and event-driven commerce, providing businesses with a flexible way to meet customer demand. Looking ahead, financial service providers might also adopt a pop-up model to swiftly establish temporary branch locations in response to the dynamic needs of an on-demand marketplace.

Read More: Comprehensive Guide for Setting Up a Branch Office in Vietnam

A branch office exhibits the following key characteristics:

- It has a distinct physical location separate from the head office.

- The branch should be organized in a way that allows it to engage independently in business transactions. It should be capable of functioning even if the head office ceases to exist, often achieved through separate accounting.

- The branch conducts business that is typically aligned with the overall company’s activities, although not necessarily identical. It engages in core business activities rather than auxiliary or executive functions.

- The branch possesses a degree of autonomy, including its management, decision-making authority, and allocated business assets from the head office. The branch’s financial transactions are accounted for separately in the head office’s balance sheet.

- A branch office is created through an actual establishment process, usually requiring registration in the commercial register of the head office. The branch office’s name can be the same as the head office’s or different, but if different, it must include a reference to being a branch.

Still considering these types of businesses? Check out the full Comparison Table between Company Types Based on Legal Structure

Types of Business Based on Organizational Structure

An organizational structure defines a framework within an organization, setting out the specific roles, responsibilities, and rules that govern how it operates. This structure is essential for directing various activities towards the achievement of organizational goals.

It also shapes the flow of information across different levels of the company. For instance, in a centralized structure, decision-making is primarily top-down, with higher levels dictating policies. Conversely, a decentralized structure spreads decision-making across different levels, promoting autonomy. Implementing such a structure is crucial for maintaining efficiency and ensuring a focused approach to organizational operations.

Functional Structure – Bureaucratic Organizational Structure

Four prevalent organizational structures are adopted in practical business scenarios. The most widespread among these is the functional, or bureaucratic, organizational structure. This approach segments a company according to the specific expertise of its workforce. It’s commonly seen in small-to-medium-sized businesses. Organizing the company into distinct departments, such as marketing, sales, and operations, exemplifies the application of a bureaucratic organizational structure. This method facilitates a specialized and efficient workflow, aligning tasks with the skills and expertise of various teams within the organization.

Divisional or Multidivisional Structure

The second form, widely adopted by large-scale organizations with multiple business operations, is known as the divisional or multidivisional (M-Form) structure. This approach organizes a company’s leadership according to the specific products, projects, or subsidiaries they oversee. A prime example of this model is Johnson & Johnson. Given its extensive range of products and business lines, the company is organized in such a way that each business unit functions almost as an independent entity, complete with its president.

Additionally, this structure often includes geographical divisions. For instance, a multinational corporation might have separate divisions for different regions, like a North American Division and a European Division, to cater to specific geographic needs and markets.

Flat (Flatarchy) Structure

Flatarchy, commonly referred to as a horizontal structure, is a modern organizational model gaining popularity among startups. This structure minimizes hierarchical levels and chains of command, granting substantial autonomy to employees. Firms adopting this structure are characterized by rapid implementation capabilities.

Matrix Structure

This reporting structure allows companies to work effectively in complex situations by having employees report to more than one boss simultaneously, combining functional and project-based parts. The functional side is a traditional hierarchy, while the project side involves cross-functional teams collaborating on specific tasks. This setup promotes knowledge and skill sharing, enhancing problem-solving and innovation, but can also cause role confusion and conflicting priorities. Effective communication and coordination are crucial. Companies often use a matrix structure to stay agile and collaborative in rapidly changing or complex projects.

Circular Structure

Circular organizational structures are designed with a hierarchical framework, yet uniquely arranged in a circular format. At the core of this structure are the senior management and higher-level employees, symbolizing the central hub of decision-making and strategic planning. Surrounding this core, like expanding concentric circles, are the layers of lower-level employees and staff. This configuration aims to foster an environment of open communication and collaborative interaction across various levels of the organization, promoting a more integrated approach to business processes and decision-making.

Network Structure

In a network organizational structure, the central office is typically small, focusing on core functions while outsourcing key tasks to contractors and third-party vendors. This model includes geographically dispersed satellite offices, each responsible for specific operations. The structure emphasizes efficiency and specialization by leveraging external expertise and resources, allowing the organization to adapt quickly to market changes and technological advancements.

Types of Business Based on Capital Amount

Micro Company in Vietnam

The type of operating field, the total number of employees taking part in social insurance, and the total capital and previous year’s revenue are the criteria that a micro company shall meet to be qualified as a micro company:

- Industry and construction, agriculture, aquaculture, and forestry: less than ten employees, no more than VDN 3 billion capital, and no more than VND 3 billion of total revenue in the previous year

- Trade and services: less than ten employees, no more than VDN 3 billion capital, and no more than VND 10 billion of total revenue in the previous year

Small Company in Vietnam

Just like a micro company, the criteria utilized for companies to meet the small company status are also based on the business field, the total capital, and previous year’s revenue, and the total number of employees taking part in social insurance:

- Industry and construction, agriculture, aquaculture, and forestry: less than 100 employees, no more than VDN 20 billion capital, and no more than VND 50 billion of total revenue in the previous year

- Trade and services: less than 50 employees, no more than VDN 50 billion capital, and no more than VND 100 billion of total revenue in the previous year

Medium Company in Vietnam

For a business to be legally known as a medium company in Vietnam, it has to fulfill the following criteria in terms of the total capital, the previous year’s total revenue, and the total annual average number of employees participating in social insurance.

- A medium company in Vietnam has to be involved in the following business fields: industry and construction, agriculture, forestry, and aquaculture.

- Medium companies in Vietnam must have less than 200 employees, no more than VND 100 billion of total capital, and no greater than VND 200 billion of total revenue in the previous year.

Here is the calculation for the annual average of total employees: the total number of employees taking part in social insurance divided by 12 (months). However, if a company has been established for less than 12 months, the total number of employees shall be divided by operating months.

As for the total capital and total revenue, if a company has only operated for less than a year, the amounts are based on the previous quarter’s balance sheet nearest to the time when the company was registered.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

Can An Llc Have Investors

- Yes, an LLC can have investors, typically in the form of members who contribute capital in exchange for ownership interests. These members can be individuals or entities. The terms of investment are usually outlined in the LLC's operating agreement.

How many types of business list?

- In Vietnam, there are several types of business structures, with the most common being: 1. Sole Proprietorship 2. Limited Liability Company (LLC) – can be single-member or multi-member 3. Joint Stock Company (JSC) 4. Partnership These structures differ in terms of ownership, liability, and capital requirements.

What Are The 3 Types Of Shareholders

- The three types of shareholders are individual shareholders, institutional shareholders, and corporate shareholders. Individual shareholders are private investors, institutional shareholders include entities like mutual funds and pension funds, and corporate shareholders are other companies that own shares.

Why Might A Joint Stock Company Be Suitable For Small Industries Aiming For Growth

- A joint stock company allows small industries to raise capital by issuing shares to investors, facilitating expansion. It also provides limited liability, which reduces personal financial risk for owners and attracts more investment.