As per the “Vietnam Cosmetics Market 2023” report from the global market research firm Mintel, the country’s beauty market witnessed an average yearly growth rate of 15-20%. The mass-market cosmetics segment dominated the market by holding a substantial 75% share. Simultaneously, there was notable growth in the premium cosmetics segment, which accounted for 25% of the market.

Investing in the Vietnam Cosmetics Market? Check out InCorp Vietnam’s Company Setup Services

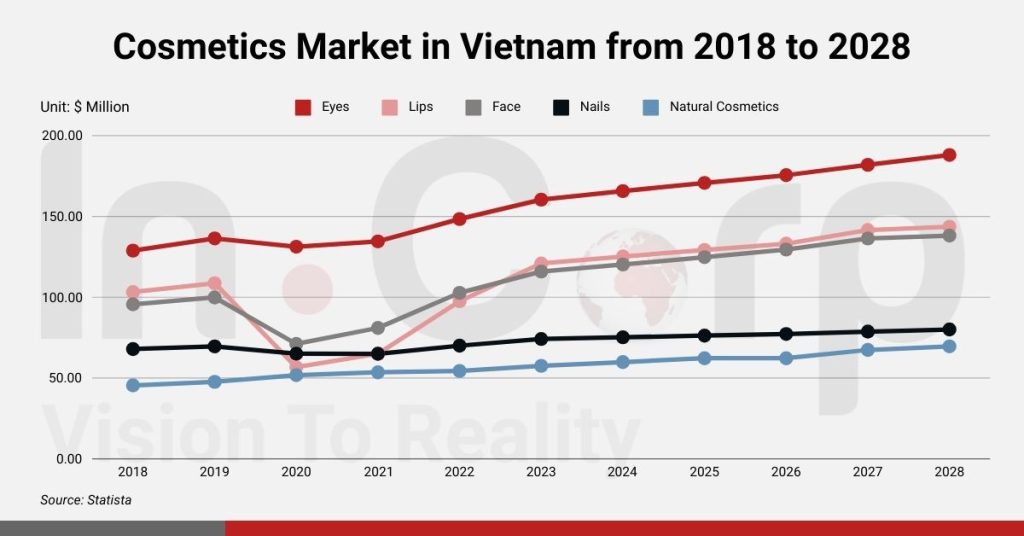

Vietnam’s Cosmetics Market Size and Recent Numbers

The country’s rapidly expanding middle-class population drives demand for luxury goods, specifically cosmetics and personal care items. In 2021, the nation’s beauty and personal care market value reached US$2.3 billion and was projected to rise to US$2.45 billion by the end of 2022. The forecast reveals yield revenues of US$8.6 billion by 2025, with a compound annual growth rate (CAGR) of 8.6%.

As appearance became more important, consumers started spending more on beauty and skincare services (spas, dermatology clinics). According to Kantar Worldpanel’s Insight Handbook 2021 report, beauty products such as lipstick contributed to the largest segment of the cosmetics market in this country. Statistics revealed that approximately 30% of Vietnamese women use lipstick daily, followed by cleansers, sunscreens, and face masks.

Market Size

As reported by Mintel, the country’s cosmetics market saw a turnover of VND 51,000 billion (approximately US$2.3 billion) in 2022. Skincare products emerged as the most sought-after category, with over 60% of consumers incorporating them into their daily routines. Concurrently, Statista’s research revealed a notable surge in cosmetics stores nationwide, which marked an increase from 87% in 2021 to 124% in 2022.

Despite this growth, Nielsen’s findings indicated that Vietnamese consumers’ expenditure on cosmetics remains relatively modest. Interestingly, makeup took precedence over skincare, with women typically allocating between VND 300,000 to VND 500,000 to cosmetics brands. The expansion of e-commerce platforms significantly influenced consumer behavior. Notably, personal care product sales surged by 63% in 2022 compared to 2018. The skincare and makeup brands also experienced substantial increases of 55% and 25%, respectively.

However, local cosmetic businesses faced stiff competition, which held just a 10% market share. Most operated their businesses within the low-end segment and focused on exporting to neighboring markets.

The overwhelming majority (90%) of Vietnamese cosmetic companies acted as distribution agents for foreign manufacturers, with international brands dominating commercial centers nationwide. Despite these challenges, domestic players continued to strive to regain market share in the country’s cosmetics market.

Outlook For Vietnam Cosmetic Market for 2023-2024

Vietnam Industry Research and Consultancy (VIRAC) had projected that the country’s cosmetics and personal care market would grow in 2023. The anticipated return of consumers’ disposable income to pre-pandemic levels drove this momentum, signaling a potential increase in spending on cosmetics.

Additionally, the pervasive influence of social media platforms is reshaping consumer trends within the cosmetics industry. In 2022, the cosmetics industry experienced significant growth worldwide, reaching a market value exceeding US$500 billion, as reported by Euromonitor International. This represented a 4.8% increase from 2021.

The cosmetics industry is a key contributor to the country’s economy. The Vietnam Personal Care Association (VHPA) reported a total production value of approximately US$2.4 billion in 2021. This upward trajectory is expected to persist in the coming years, highlighting the industry’s significant role in the economic landscape.

K-Beauty Products is Prevailing over the Vietnam Beauty Trends

South Korean beauty brands have solidified their dominance in Vietnam’s cosmetic market, mirroring their success across Asia. K-beauty products enjoy exceptional popularity, particularly in this country, compared to global markets. In 2022, South Korea maintained its status as Vietnam’s primary cosmetics import partner, with the import value of South Korean cosmetics nearing US$330 million.

Japanese and European brands also have a presence in Vietnamese skincare products. Local brands like Cocoon, M.O.I Cosmetics, and Lemonade are carving out their niche with affordable yet quality offerings. Social media, particularly influenced by Korean pop culture, has profoundly impacted Vietnamese beauty trends, which is shaping the makeup habits of younger people.

Key Rules and Regulations For Cosmetics Registration in Vietnam

As Vietnam’s cosmetics retail sector experiences rapid growth, regulatory authorities are facing increased pressure to ensure product quality, consumer safety, and environmental compliance. Between 2012 and 2022, the Drug Administration Department significantly ramped up post-market surveillance, conducting inspections of 309 domestic and imported cosmetics manufacturers. These efforts led to the recall of over 3,310 products and the withdrawal of 519 items deemed substandard or non-compliant.

To strengthen regulatory oversight and keep pace with industry expansion, the Drug Administration Department under the Ministry of Health is drafting a comprehensive decree, scheduled for consultation and release by 2025. This new framework aims to bring Vietnam’s regulations in closer alignment with international best practices and the ASEAN Cosmetics Regulatory Scheme.

The upcoming decree is expected to introduce three key policy pillars:

- Enhanced Pre-Market Controls: Regulations around product declarations will be tightened, with greater scrutiny of documentation relating to product claims, functionality, and overseas manufacturing. The objective is to elevate product standards and ensure alignment with global safety benchmarks.

- Stronger Post-Market Surveillance: In response to technological advancements and evolving consumer expectations, the government will enhance post-market monitoring using digital tools. Plans include building a national cosmetics database, digitizing regulatory procedures through e-government platforms, and expanding legal authority for regulatory agencies to improve enforcement capabilities, balancing business facilitation with consumer protection.

- Elevating Domestic Product Standards: To support the local cosmetics industry, the decree will introduce measures to strengthen manufacturing practices in accordance with ASEAN Cosmetic Good Manufacturing Practice (CGMP) standards.

- This includes improving traceability, refining product recall protocols – especially for online sales – and introducing a national cosmetic identification code to ensure authenticity and transparency.

These regulatory developments reflect Vietnam’s strategic push to formalize and modernize its fast-growing cosmetics sector, making it more competitive, consumer-focused, and globally aligned. Businesses looking to enter or expand in this market must prepare for a more structured compliance environment – one that rewards transparency, quality, and innovation.

What Makes the Vietnamese Cosmetics Market So Attractive?

Vietnam emerges as one of the world’s most promising “emerging economies”, undergoing significant transformations. With a burgeoning middle class and improving living standards, the consumers here exhibit a robust appetite for luxury goods.

In 2022, the National Economics University of Vietnam conducted a study across Hanoi City and Saigon. It surveyed approximately 800 urban consumers, who revealed a notable predilection towards status-based consumption and offered promising prospects for foreign luxury brands. The study also reported that the top 20% of earners contributed 45.39% of the country’s total income by spending on cosmetic brands.

The consumers’ perception of luxury items has shifted, seeing them as a symbol of success and happiness. Urban customers prefer foreign brands more due to their perceived symbolic value, often seen as elevating one’s status.

Despite this, consumers in emerging economies remain price-sensitive, which poses challenges for luxury brands. Local products stand a chance if they enhance the country’s image, visibility, and quality. Particularly, when consumers feel a sense of pride and identification with their country, they are more inclined to choose local options.

The Vietnamese skincare products market has become a business hub and offers many opportunities.

Rapid Business Growth

The growth trajectory of Vietnam’s cosmetics market stands out as a notable aspect. With an average annual growth rate ranging between 15% and 20%, this market exhibits robust momentum and evident growth prospects. Several factors notably propel this growth, which include:

- Economic expansion and rising individual incomes have translated into increased expenditures on personal care items and services, including cosmetics.

- Growing aspirations among citizens to enhance their appearance and elevate their quality of life have led to heightened attention to skincare, haircare, makeup, and other personal grooming products.

- The expansion of cosmetic distribution channels has played a pivotal role in stimulating market expansion. Cosmetics are retailed through diverse channels such as brick-and-mortar stores, shopping malls, supermarkets, and e-commerce platforms. The distribution avenues have facilitated consumer access to cosmetic offerings, contributing further to market growth.

Abundant Material Sources at Affordable Prices

Moreover, Vietnam benefits from abundant sources of raw materials and competitive production costs. As an agricultural nation, it possesses a rich array of crops and herbs that are useful in the cosmetics sector.

These raw materials are not only cost-effective but also of superior quality, catering to the requirements of cosmetics enterprises. Some commonly utilized cosmetic ingredients encompass:

- Fruits and Vegetables: Oranges, lemons, pomelos, aloe vera, cucumbers, tomatoes, and more.

- Plants: Turmeric, green tea, chrysanthemum, roses, aloe vera, among others.

- Seeds and Vegetable Oils: Coconut oil, olive oil, cashew oil, grape seed oil, and others.

These ingredients serve as vital components in the formulation of skincare, haircare, makeup, and various personal care products. These abundant and cost-effective sources present a significant advantage for the country’s cosmetics industry.

Demand for Vegan Cosmetics

Vietnam has witnessed a surge in the popularity of vegan cosmetics, emerging as one of the world’s fastest-growing markets. According to Nielsen’s report, it boasts a remarkable annual growth rate of 30%. This trend is fueled by various factors, notably the escalating concerns among Vietnamese consumers regarding health and environmental issues.

With a preference for cruelty-free and eco-friendly products devoid of animal-derived ingredients, the demand for vegan beauty items has soared. Additionally, the proliferation of vegan cosmetic brands has democratized access to such products, aligning with the growing inclination towards green and sustainable living. Supported by government policies, Vietnam’s cosmetics industry, particularly the vegan segment, continues to thrive.

Availability of Foreign Cosmetics Brands

The Vietnamese cosmetics market is expanding significantly and offering lucrative prospects for international cosmetics brands. Here are key opportunities they can capitalize on in Vietnam:

- Robust market growth: The market is witnessing substantial growth, indicating a promising trajectory for new entrants.

- Trust in foreign brands: The citizens exhibit confidence in international cosmetics brands, representing a favorable market penetration environment.

- Increasing demand for quality: Vietnamese consumers have a growing emphasis on high-quality and reliable cosmetic products.

- Diverse product offerings: It features a diverse cosmetics market, spanning from essential skincare to premium and organic lines, presenting ample opportunities for foreign brands to cater to varied skincare needs.

Read More: Ease of Doing Business in Vietnam: Why Do Foreign Investors Choose This Destination?

Obstacles in the Vietnam Cosmetics Market

The Vietnamese cosmetics market demonstrates robust growth, but it grapples with various challenges:

- Market Instability: Intense competition between domestic and foreign brands leads to volatile trends, pricing, and product quality, necessitating agile business strategies.

- Price Sensitivity: Consumers prioritize price comparison, urging businesses to control costs and enhance product quality to remain competitive.

Additional challenges include fake products, a shortage of skilled workforce, and undefined market regulations that require businesses to address these hurdles strategically. Understanding and addressing these challenges is vital for sustained success in the country’s cosmetics industry.

Read More: Top 10 Issues Businesses Encounter in Vietnam

Luxury Market Outlook: Different Sectors

Vietnamese female consumers prioritize purchasing authentic and quality cosmetics despite significant customs duties acting as a deterrent. The store’s ground floors primarily showcase cosmetics and perfume brands. Whitening creams and lotions dominate the beauty care sector, with Lancôme introducing luxury products that challenge traditional beauty norms. Moreover, the growing demand for anti-ageing creams and conditioning products reflects evolving consumer preferences in the cosmetics market.

Luxury cosmetics brands in Vietnam face a significant challenge from many smuggled, unregulated counterfeit, and mislabeled products. Targeted at low-income individuals with an average annual cosmetics expenditure of USD 3, these products threatened the market. In 2006, Vietnamese consumers spent USD 82 million on beauty and skincare items, potentially 60% of sales attributed to illegal imports.

In anticipation of future market potential, foreign brands are intensifying their advertising efforts. Moreover, enhanced marketing and distribution initiatives empower local manufacturers to compete with established international counterparts, aiming to expand their market presence.

The Future of the Vietnam Cosmetics Market

The country’s tech-savvy populace has fueled the rapid expansion of e-commerce. Cosmetics notably rank among the top online shopping categories, especially in urban areas. The internet’s evolution facilitates convenient product searches and purchases in online mode.

Brands are adapting to this trend, offering virtual try-on services using augmented reality, which is enhancing the online shopping experience. With ongoing digital innovations, e-commerce is poised to surpass traditional retail outlets as the preferred avenue for beauty products.

- Choices of the Customer: Affordable alternatives can alter consumer preferences. To adapt, businesses should offer quality products and services that cater to budget-conscious customers.

- Increase in Online Consumption: The online beauty and cosmetics shopping trend is expected to surge by 2024. Businesses must enhance online marketing for superior customer experiences and retention.

- Increase Customer Experience: Personalized online shopping experiences will be critical. Businesses must invest in understanding customer needs to offer tailored products and services.

- Redesign Advertising Campaigns: Businesses must enhance online ad campaigns amid competition. Utilizing data and analytics ensures investments in effective campaigns for customer attraction.

- Microneedling: Once popular at spas, microneedling faces setbacks related to COVID-19. Despite closures, research explores its potential for at-home use and adapting to changing circumstances.

- All Ages Skin Care Product: Shifting gender norms in skincare presents challenges, yet brands are adapting, offering more products for men. With Generation Z’s influence, Vietnam’s cosmetics industry must embrace gender-neutral marketing strategies.

- AI and Machine Learning revolutionize the cosmetic industry by tailoring experiences for each customer. Advancements in computer science will enhance personalization trends in cosmetics, making them more widespread and impactful.

Top Cosmetics Brands in Vietnam

Women’s demand for beauty and healthcare products has increased in recent years. Here is a list of the top beauty brands in this country.

- Estee Lauder: Established in 1946, it is a brand within the Estee Lauder Group (USA). This brand maintains a robust distribution network across Vietnam, ensuring its presence in all major commercial centers.

- Obagi: This cosmetic brand, based in the United States, was established in 1988 by dermatologist Zein Obagi. This skincare line encompasses cosmetics and pharmaceuticals to address skin issues and nurture healthier, more radiant skin.

- Shu Uemura: Established by Shu Uemura, the first successful Asian makeup artist in the West, this is a Japanese cosmetics brand. It offers a diverse range of products beyond cosmetics. Besides crafting cosmetic collections with stunning designs, the brand collaborates with renowned designers.

- Dior: It is a cosmetics line under the renowned French brand Christian Dior. In Vietnam, the beauty brand operates five stores located in the cities below.

- Takashimaya (Ho Chi Minh City)

- Ho Chi Minh City

- Trang Tien Plaza (Hanoi)

- Vincom Dong Khoi Shopping Center

- Parkson Thai Ha (Hanoi)

- Parkson Saigon Tourist.

- Cocoon: It is a cosmetics brand owned by Nature Story Cosmetics Company Limited, founded in 2013. It is widely recognized as a vegan brand, sourced entirely from nature and wholly manufactured in Vietnam. The brand has effectively connected with customers by promoting environmental protection messages, ensuring products are free from toxic substances, and abstaining from animal testing.

- Thai Duong: Established in 2000, this cosmetics brand is a pioneer in crafting skincare products derived from nature. It is well-known for its gentle and skin-safe formulations. Thai Duong is the first entity in Vietnam to establish a factory that is compliant with CGMP (Cosmetic Group Manufacturing Product) ASEAN standards for cosmetics production.

- Emmié: Established in 2015, Happy Skin Vietnam Joint Stock Company owns this brand, which has its roots in the beauty community. It aims to inform and guide cosmetic consumption in the country. With 8 years of experience, Emmié has effectively introduced a range of product lines to customers, encompassing facial cleansers, massage machines, steamers, exfoliators, and skincare creams.

- Laco: Established in 2017, this natural cosmetic brand prides itself on its products crafted by a pharmaceutical factory employing state-of-the-art German technology. Endorsed by the Department of Health, their products boast licenses and have obtained a quality management system certificate meeting international standards.

- Lemonade: The cosmetics and beauty brand Lemonade made its market debut in 2018 with a mission to provide simple makeup solutions for Vietnamese women. Its entry has enlivened the country’s cosmetics market, contributing to the growing popularity of domestic cosmetic brands among consumers.

- M.O.I: Established in 2017 by singer Ho Ngoc Ha and CEO Lam Thanh Kim, this Cosmetics brand offers products sourced from Korea and certified to meet quality standards in both Korean and Vietnamese markets. Within the year 2023, it has emerged as the sole Vietnamese company among the top cosmetic firms, commanding the highest market share in the country.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly

Learn the Right Setup for Business

Expansion in the Vietnam

Frequently Asked Questions

How big is the cosmetics market in Vietnam?

- As of recent data, the cosmetics market in Vietnam is valued at approximately USD 2.3 billion and has been growing steadily at around 5–10% annually. The market is driven by a young population, increased disposable income, and rising beauty awareness, with both international and domestic brands competing actively.

Is Vietnam good for skincare?

- Yes, Vietnam has a growing skincare market with increasing consumer interest in beauty and wellness. The country offers a variety of natural ingredients, such as herbs and rice extracts, which are commonly used in both local and imported skincare products. Additionally, the rising demand for quality skincare has attracted international brands and encouraged domestic production.

Where To Buy Cosmetics In Vietnam

- You can buy cosmetics in Vietnam at major shopping malls, beauty stores like Guardian and Watsons, and local markets. Online platforms such as Lazada, Tiki, and Shopee also offer a wide selection. International brands often have official stores in cities like Hanoi and Ho Chi Minh City.